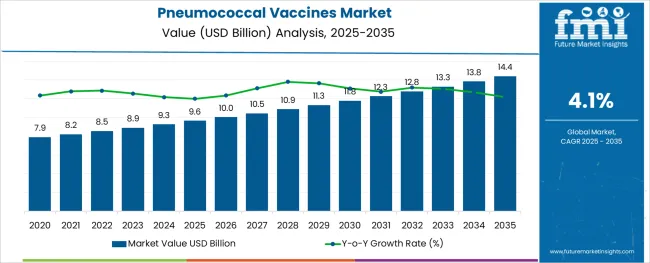

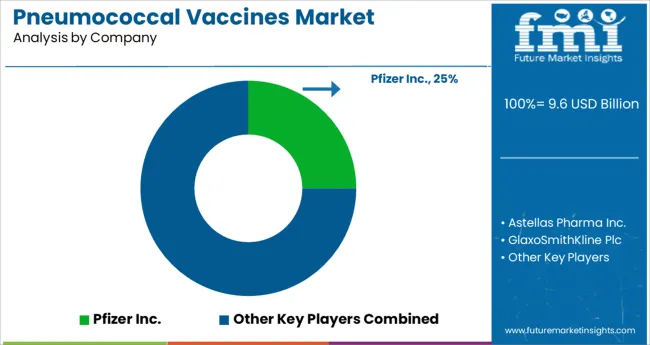

The Pneumococcal Vaccines Market is estimated to be valued at USD 9.6 billion in 2025 and is projected to reach USD 14.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Product Type, Distribution Channel, and Sector and region. By Product Type, the market is divided into Prevenar-13, Synflorix, PCV 13 (Pipeline), V114 (Merck), PCV-20 (Pfizer), PCV-10 (SII), and PPSV-23. In terms of Distribution Channel, the market is classified into Wholesaler (Pharmacy channel), Specialized Companies, Public Authorities, and Others. Based on Sector, the market is segmented into Public and Private. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

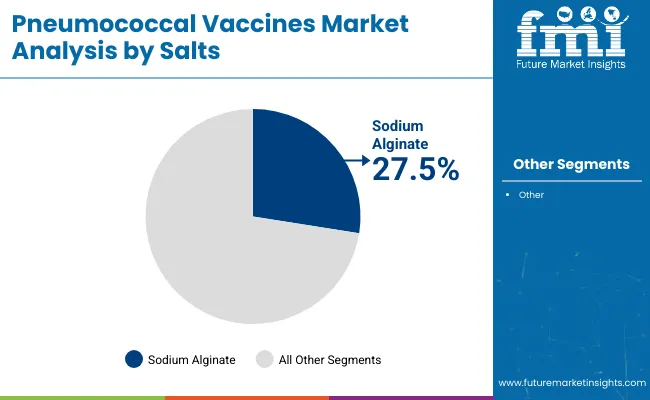

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

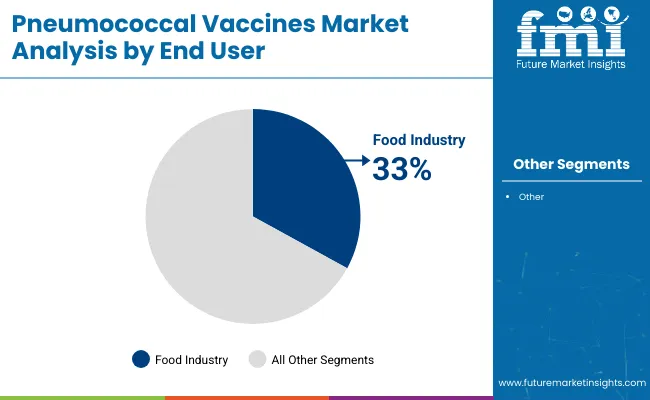

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

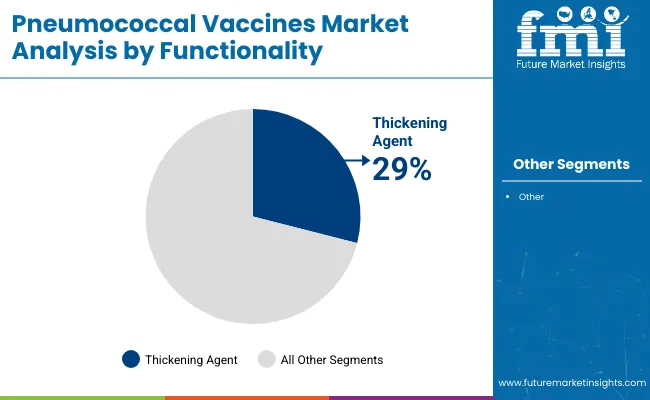

When analyzed by functionality, thickening agents are forecast to account for 29.0% of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

Although the market is estimated to have favorable growth through the forecast period, it is identified that certain factors prevailing in the market are likely to curb the demand for pneumococcal vaccines in the forthcoming years.

It is witnessed that the manufacturing or production process of pneumococcal vaccines requires a longer timeline, which acts as a key restraining element in the market expansion.

Additionally, there is a very high cost associated with the development of pneumococcal vaccines. Therefore, it is expected that the aforementioned factors are likely to hinder the propulsion of industry through the forecast period.

The industry players are diversifying their product portfolios with the launch of protein-based vaccines. The introduction of protein-based vaccines is creating several growth opportunities in the market to further expand and upscale the prominence of pneumococcal vaccines.

Protein-based vaccines have inexpensive production procedures that further aid the market’s prominence. Additionally, these products have logistical and protocol advantages, along with the inclusion of stability at a broad range of temperatures.

These vaccines are identified to narrow the immunization gaps that prevail among the middle-class and abundant populace across developing economies. Therefore, it is estimated that the pneumococcal vaccines market is likely to accrue significant shares through the forecast period.

It is identified that the pneumococcal vaccines market is witnessing an unprecedented surge in the recent few years. There has been an approximate rise of USD 0.4 Billion from the base year to the current.

This growth in market valuation can be highly attributed to the rising number of young children under 2 to 5 years possessing a high risk of pneumococcal diseases.

The rising geriatric population has also made a significant contribution to the industry growth of pneumococcal vaccines. Severe complications and contagiousness of diseases in old adults have fostered the growth of the pneumococcal vaccines market during the period 2020 to 2025.

The market advanced at a moderate pace of 3.2% CAGR and accounted for a market value of USD 8.5 Billion in the base year. It is identified that the rise in the number of diabetes patients, smokers, heavy drinkers, and individuals having chronic health conditions, who are vulnerable to ailments and infections owing to their weak immune systems is estimated to further fuel demand through the foreseen years.

Additionally, a key factor making a significant contribution to the market growth is the introduction of the Pneumococcal Conjugate Vaccine (PCV) by government agencies across emerging countries in infant routine immunization. This factor is expected to further trail growth through the projection period.

| Historical CAGR (2020 to 2025) | 3.2% |

|---|---|

| Market Value in 2025 | USD 8.5 Billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

|---|---|

| Market Value in 2025 | USD 8.9 Million |

Prevenar-13 - By Product Type

It is identified that the Prevenar-13 segment by product type category is likely to trail at a significant rate through the forecast period. In the base year, this segment was advancing forward at a CAGR of 3.2% and is likely to hold dominant shares in the pneumococcal vaccines market through 2035.

This segment is projected to account for a revenue share of USD 9,500 Millionin 2025. The growing prominence of Prevenar 13 can be attributed to the inclusion of thirteen pneumococcus and serotypes. The hospital sector is giving this vaccine to patients due to the presence of serotypes 6A and 19A.

The Centers for Disease Control and Prevention (CDC) has also made recommendations for Prevenar-13 for adults, who are above the age of 65 years. Therefore, this segment is likely to accrue significant shares of the market through 2035.

Public Authorities - By Distribution Channel

After an in-depth analysis of the market, it is witnessed that the public authorities segment by distribution channel category is likely to hold dominant shares in the pneumococcal vaccines market. In 2025, this segment trailed at a CAGR of 6.8% and is likely to move forward at a notable pace, registering a CAGR of 5% during the period 2025 to 2035.

Public health agencies and community clinics are accounting for the largest market share owing to the large number of vaccine purchases made by organizations such as GAVI, WHO, UNICEF, and others. These organizations make bulk purchases of pneumonia vaccines and distribute them across diver geographies for social causes.

The hospital segment is also estimated to have grown at a significant rate and is projected to surpass a market valuation of USD 12,400 Million by the end of 2025.

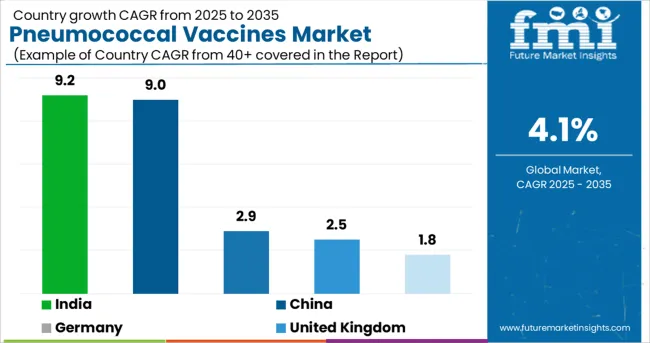

| Region | North America |

|---|---|

| Country | United States of America |

| CAGR (2025 to 2035) | 1.8% |

| Region | Europe |

|---|---|

| Country | United Kingdom |

| CAGR (2025 to 2035) | 2.5% |

| Region | Europe |

|---|---|

| Country | Germany |

| CAGR (2025 to 2035) | 2.9% |

| Region | Asia Pacific |

|---|---|

| Country | China |

| CAGR (2025 to 2035) | 9.0% |

| Region | Asia Pacific |

|---|---|

| Country | India |

| CAGR (2025 to 2035) | 9.2% |

| Country | United States of America |

|---|---|

| Statistics | The USA is estimated to hold the highest share of the pneumococcal vaccines market through the projection period. The pneumococcal vaccines industry in the USA is advancing at a CAGR of 1.8%. the market is estimated to surpass a valuation of USD 14.4 Billion by the end of 2035. Approximate Growth in Market Value: USD 825.6 Million Historical CAGR: 0.4% |

| Growth Propellants | A well-established healthcare infrastructure across the North American region serving a large number of patients is estimated to foster the growth of the pneumococcal market in the upcoming years. It is identified that the 5-7% mortality rate in the USA is due to pneumococcal diseases. The rapid growth in the geriatric population is also a key factor fueling the market expansion of pneumococcal vaccines. |

| Country | Germany |

|---|---|

| Statistics | Germany is likely to hold a significant share of the pneumococcal vaccines market in the European region. The pneumococcal vaccines industry in the UK is advancing at a CAGR of 2.9%. The market is estimated to surpass a valuation of USD 191.9 Million by the end of 2035. Approximate Growth in Market Value: USD 47.2 Million Historical CAGR: 2.1% |

| Growth Propellants | The high prevalence and invasion of pneumonia across the people of Europe which accounted for approximately 15.08% of 1,00,000 people is a key cause fueling the market size of pneumococcal vaccines in Germany. A growing number of research and development activities and clinical trials aided by government advances in the country is reshaping the industry landscape in 2025. |

| Country | China |

|---|---|

| Statistics | The pneumococcal vaccines market in China is estimated to move forward at a substantial rate, slating a CAGR of 9.0% through the forecast period. The market is estimated to surpass a valuation of USD 2.9 Billion by the end of 2035. Approximate Growth in Market Value: USD 1.7 Billion Historical CAGR: 35.3% |

| Growth Propellants | The medical healthcare sector across China is witnessing a rise in investment from government authorities. Medical institutes across China are heavily using pneumococcal vaccines for treating diseases like meningitis, blood-stream infection, and more. Therefore, it is estimated to emerge as one of the most significant and remunerative markets in the pneumococcal vaccine landscape. |

The new entrants in the pneumococcal vaccines market are leveraging advancements in technology to launch new products and gain a competitive advantage. These firms are continually investing in research and development activities to keep themselves in tandem with the changing consumer preferences and end-use industry demands.

Efforts are being made to strengthen their foothold in the market and aid the further progression of the pneumococcal vaccines market.

Affinivax - This firm is a clinical-stage biopharmaceutical organization, who are having a next-generation technology platform for vaccines known as the multiple antigen presentation systems. This firm is likely to penetrate the market and be in tandem with the demand from the hospital sector through the forecast period.

GPN Vaccine - This is an Australian start-up firm that is offering vaccines for pneumonia. The startup sterilizes its proprietary, engineered, and avirulent strain of S. pneumonia with gamma rays to produce Gamma-PNTM, a whole-cell vaccine. The vaccine induces broad-spectrum immunity against the antigens of the pneumococcus bacterium and is effective against different pathogenic pneumococcal strains.

The pneumococcal vaccines market is highly fragmented and the key manufacturers are deploying several organic and inorganic growth strategies to compete with the existing players in the market.

The biggies are heavily investing in research and development activities to leverage advancements to the attributes of pneumococcal vaccines. They are making attempts for treating the chronic diseases prevailing amongst the geriatric population and others in an effective manner.

Activirosomes is developing vaccines for viral infections. The company is leveraging active virosome technology for the generation of non-replicating derivates of measles and some other comprehensive viruses. The virosome-based vaccines are carrying only the viral genes that are necessary for eliciting an immune response.

Recent Developments

The global pneumococcal vaccines market is estimated to be valued at USD 9.6 billion in 2025.

It is projected to reach USD 14.4 billion by 2035.

The market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types are prevenar-13, synflorix, pcv 13 (pipeline), v114 (merck), pcv-20 (pfizer), pcv-10 (sii) and ppsv-23.

wholesaler (pharmacy channel) segment is expected to dominate with a 42.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pneumococcal Testing Market Size and Share Forecast Outlook 2025 to 2035

Vaccines Market Insights - Trends, Growth & Forecast 2025 to 2035

Cat Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Fish Vaccines Market

Live Vaccines Market

Nasal vaccines Market

Travel Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Dengue Vaccines Analysis by Product Type by Product, By Age Group and by Distribution Channel through 2035

Varicella Vaccines Market Insights - Growth, Trends & Forecast 2024 to 2034

Veterinary Vaccines Market Analysis - Size, Share, and Forecast 2025 to 2035

Attenuated Vaccines Market Analysis - Size, Share & Forecast 2024 to 2034

Aquaculture Vaccines Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Recombinant Vaccines Market Analysis – Trends & Future Outlook 2018-2028

Anti-Infective Vaccines Market Growth – Trends & Forecast 2025 to 2035

The Companion Animal Vaccines Market is segmented by product, indication and end user from 2025 to 2035

Chile Aquaculture Vaccines Market Insights – Size, Demand & Forecast 2025-2035

China Aquaculture Vaccines Market Outlook – Growth & Forecast 2025-2035

Seasonal Influenza Vaccines Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Norway Aquaculture Vaccines Market Insights – Size, Demand & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA