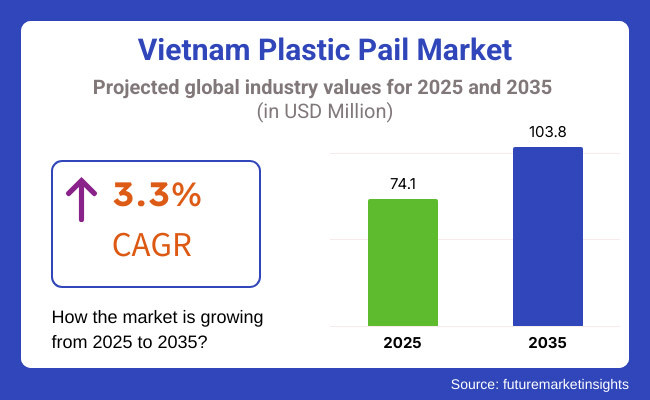

The Vietnam plastic pail industry is projected to be valued at USD 74.1 million in 2025 and is anticipated to reach USD 103.8 million by 2035, registering a CAGR of 3.3% during the forecast period. The increasing demand for sustainable packaging, rapid industrialization, and rising awareness regarding the benefits of plastic packaging is the key factors driving the industry.

A move to green materials such as bioplastics and recycled plastics is propelling the growth. Moreover, increasing trading activities and the rising need for bottled pharmaceutical containers are opening new doors for makers in Vietnam. This growth is propelled by the increasing need for sustainable packaging, heightened industrialization, and cleaner alternative materials like bioplastics.

The rising trade activities and increasing demand in sectors such as chemicals, pharmaceuticals, and food packaging also play a contributory role in propelling the demand for plastic pails in Vietnam. During this time, industrial and commercial sites are increasingly using plastic pails as airtight storage containers due to their ruggedness, lightweight, and lower cost compared to other storage units.

This trend is driving the growth of the plastic pails market. Despite the challenges posed by environmental concerns regarding plastic usage and waste management, which may restrict demand, manufacturers are still forecasted to build up sustainable solutions for recyclable and biodegradable plastic stuff. With Vietnam's industrial growth and urbanization process, the plastic pail market will continue to be a potential development field for domestic and foreign enterprises.

Explore FMI!

Book a free demo

The Vietnamese plastic pails market from 2020 to 2024 was in a phase of stabilization, and end-use sectors, including food, beverages, chemicals, and personal care directly drive it. Manufacturers have come to rely on high-density polyethylene (HDPE), a recyclable material with multiple applications, to meet environmental requirements and enhance the quality of the base material.

This growth comes from fast industry expansion and a focus on organic packaging solutions. There is a significant increase in the use of eco-friendly materials like bioplastics and recycled plastics. As demand for pails rises across industries, innovative designs will emerge, such as square-based pails that improve space efficiency.

Growing trade activities and economic development will bring new opportunities for manufacturers in Vietnam. From 2025 to 2035, the industries anticipate faster, leaner, and more economical Industries anticipate the emergence of faster, leaner, and more cost-effective production technologies to meet future challenges and comply with environmental regulations.

Policies that influence eco-friendly packaging alternatives will further aid this transition toward sustainable materials. Additionally, storage solutions in agriculture and pharmaceuticals require less fragile and more innovative storage solutions, which lead to mini-storage products. Designs of pails would be more customizable, fulfilling the varied needs of various sectors, like tamper-proof and stackable designs, which would offer better acceptance for industry products.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand for sustainable packaging | Fluctuating raw material prices |

| Increasing industrialization | Stringent environmental regulations |

| Adoption of bioplastics and recycled plastic | High production costs |

| Expansion in chemicals and food sectors | Competition from alternative packaging |

| Advancements in pail design | Recycling challenges |

| Key Drivers | Impact Level |

|---|---|

| Growing demand for sustainable packaging | High |

| Increasing industrialization | High |

| Adoption of bioplastics and recycled plastic | High |

| Expansion in chemicals and food sectors | Medium |

| Advancements in pail design | Medium |

| Key Restraint | Impact Level |

|---|---|

| Fluctuating raw material prices | High |

| Stringent environmental regulations | High |

| High production costs | Medium |

| Competition from alternative packaging | Medium |

| Recycling challenges | Low |

High-density polyethylene (HDPE) will continue to be the most commonly used material because of its high strength, chemical resistance, and recyclability. However, as sustainability becomes increasingly important, the use of bioplastics and recycled plastics will increase.

As manufacturers increasingly focus on reducing ecological footprints while maintaining performance standards, plastic pails remain a cost-effective solution for sectors seeking both protection and social responsibility. However, with the increasing eco-consciousness, companies will soon use sustainably sourced resins and advanced plastic formulations that leave lower carbon footprints.

The balancing act is still environmental responsibility versus performance, making sure that these materials can hold their own against industry standards for strength, longevity, and cost-effectiveness.

The variety of pail sizes will continue to depend on market demands, which will be a decisive factor for every vendor to consider when developing products. Small-capacity pails will continue to prevail for personal care and household products, where convenience and ease of use are critical. Simultaneously, industrial and agricultural industries will shift toward large-capacity pails for bulk storage.

Businesses are developing improved and more efficient pails that facilitate space utilization, better handling, easier storage, and transport for both small and large businesses. Conversely, high-capacity pails (10 liters, 20 liters, 25 liters, etc.) will remain in high demand in industrial, agricultural, and chemical applications where bulk storage and transport are critical.

Manufacturers are now focusing on improving handling, storage, and transit by designing pails with space-efficient, stackable, and ergonomic features. The evolution of reinforced pails with durable structures and tamper-resistant lids is also gaining traction, particularly for sectors demanding secure storage of hazardous or perishable materials.

We design plastic pails to withstand various applications. The chemical industry requires long-lasting, hermetic vessels for secure containment and shipping. To comply with hygiene standards in the food and drink industry, packaging needs to keep products fresh and meet hygiene regulations. Pharmaceuticals will continue using specialized pails for secure and contamination-free storage.

E-commerce will also cause businesses to want more robust, tamper-proof packaging for goods in transit. As more industries implement sustainability, Manufacturers must adapt by developing more sustainable solutions.

Additionally, as sustainability continues to take the forefront for various industries, manufacturers are creating pail solutions that are recyclable, lightweight, and reusable. For example, companies are investing in enhanced molding techniques and material innovations to produce pails that are eco-friendly but still high-performing to match the needs of today's supply chain.

As South Vietnam is an area of big manufacturing and industrial zones, the demand for plastic pails will be high in that area. Export-driven industries are booming in the region, especially chemicals, food processing, and agriculture, driving the demand for high-quality storage solutions.

However, as ports and shipping lanes progress, organizations will need strong and durable packaging for logistics. Sustainability will increasingly influence the sector and lead to the use of recycled plastics and bio-based components. As South Vietnam continues to expand, demand for household and personal care-related pails will grow, making the region a key driver of Vietnam’s plastic pail industry.

With rapid industrialization and infrastructure development, Central Vietnam is becoming an important industry for plastic pails. The expanding agricultural sector of the region, driven by seafood processing and farming, will further propel the demand for bulk storage solutions.

Hotels and resorts require efficient packaging solutions for cleaning and maintenance products, contributing to the rising demand for bulk storage solutions. Prioritize cost-effective, space-optimizing, and lightweight designs to assist businesses in overcoming logistical challenges. Although industrial activity in the region is still developing, increased investment in industrial parks and export-driven businesses will support steady growth in the coming years.

North Vietnam’s strong trade ties with China and its growing industrial base will play a crucial role in shaping the plastic pail industry’s growth. Manufacturing clusters in Hanoi and neighboring provinces will boost demand for durable packaging in the chemicals, pharmaceuticals, and construction materials sectors.

Business innovation is pushing for sustainable solutions, particularly in bio-based and recycled plastic materials. North Vietnam will continue to see industry growth, driven by favorable government initiatives for industrial development and the increasing demand for sustainable packaging solutions.

The plastic pail industry in Vietnam is highly consolidated, with Tier 1 contributors holding 90% of the market share. However, growing demand for sustainable and customized packaging is creating opportunities for niche players to carve out a presence in specialized segments despite the dominance of large corporations.

Tech giants dominate the supply chain due to their economies of scale, advanced manufacturing processes, and established distribution networks. Industry leaders dominate the market, as smaller and regional players face challenges in scaling operations. However, niche players can capture market share by catering to the growing demand for sustainable and personalized packaging solutions.

Lankelma, Davpack, Sealed Air, Mondi Group, Constantia Flexibles, McLaren Packaging, Sonoco Products, Ameripack LLC, and Coveris are all major players in the industry. This makes the global sustainable packaging market very competitive, which is strengthened by the innovations that these big players work together to make.

RPC Group introduced upgraded, space-efficient pail designs that enhance storage and transportation. As the sustainability trend takes off and spreads to every industry, the industry leaders are now aiming to use bio-based plastics and enhance the recycling infrastructure they have to comply with environmental regulations and meet consumers' expectations.

RPC Group, for example, has introduced space-saving pail designs that offer efficiencies in storage and transport. Welcome to the age of sustainability: Big business started to embrace bio-based plastics, enhanced recycling systems, and fully, eco-friendly manufacturing processes. So, how do strict environmental policies and changing consumer demands force those giants to invest in more sustainable alternatives?

The plastic pail industry in Vietnam will gradually transition to green alternatives, driven by a combination of consumer demand, regulatory pressure, and growing awareness of the environmental costs of plastic packaging from established companies as well as innovative solutions from startups.

The size and scale of major industry players might work to their advantage if they can be paired with innovation, especially through tailored eco-friendly solution,s as many up-and-coming businesses have found it difficult to achieve scale in an industry dominated by large corporation.s

Industrial expansion, rising utilization across the food and chemical industries, and the shift to sustainable packaging options drive demand. These are some of the drivers that demand plastic pails in Vietnam.

Yes, many companies are incorporating recycled plastics and bio-based materials to comply with sustainability goals and regulations.

A few major players dominate the market, but smaller businesses are carving out niches for sustainable packaging.

The use of lighter but still robust materials, recyclability, and space-saving designs are some of the new technologies that will shape the plastic pail industry moving forward.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.