The packaging sector is growing at a fast rate today with eco-friendly solutions and regulatory requirements being the priority for consumers and businesses alike. Biodegradable, compostable, and recyclable are the trends being investigated by industry players substituting plastic packaging in different sectors. Food and beverages, cosmetics, and pharmaceuticals are witnessing investments in fiber-based, plant-based, and reusable packagings by brands.

Packagers are creating high-barrier paper-based packaging, molded fiber trays, and bio-based coatings to make them stronger and more product-protective. Brands are also using smart packaging solutions like QR codes and NFC technology to make them traceable and authentic. With stringent environmental regulation and increasing consumer expectations, the trend appears to be moving towards zero-waste systems, refill platforms, and biodegradability by packs that completely biodegrade.

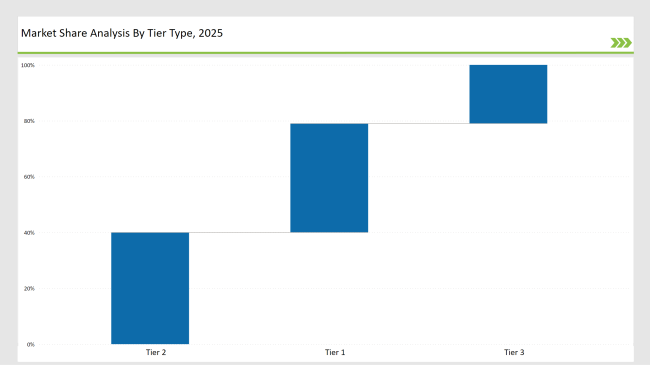

38% of the market is captured by tier one players, such as DS Smith, Mondi Group, and Smurfit Kappa, who have emerged as leaders in paper-based packaging, invested heavily in R&D, and possess a global presence.

The market is currently 41% dominated by tier two players, which consist of Stora Enso, WestRock, and UPM-Kymmene, due to innovative fiber-based packaging solutions for the food, e-commerce, and luxury segments.

Tier three includes regional and niche players that are molded pulp packaging specialists, plant-based laminate specialists, and bespoke sustainable packaging specialists to capture 21% of the market. They focus on localizing production, recyclability during packaging development, and plastic-free brand products.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (DS Smith, Mondi Group, Smurfit Kappa) | 20% |

| Rest of Top 5 (Stora Enso, WestRock) | 12% |

| Next 5 of Top 10 (UPM-Kymmene, Huhtamaki, BillerudKorsnäs, Footprint, Ecologic Brands) | 6% |

The plastic-free pack industry serves multiple sectors where sustainability, durability, and compliance with environmental regulations are crucial. Companies are designing eco-conscious packaging solutions that balance function and sustainability.

Manufacturers are optimizing plastic-free packaging with high-performance fiber materials, water-resistant coatings, and interactive branding features.

The plastic-free packing industry is witnessing changes in sustainability and innovation. AI-driven design, along with 3D printing and novel fiber sources, is helping companies achieve recyclability and avoid material loss. Water-based barrier coatings are being produced to replace plastic laminates. Lightweight and durable fiber-based packaging is being introduced by companies to cater to e-commerce and food delivery. Companies are also introducing smart packaging that encourages consumer participation and authentication features based on QR codes.

Technology suppliers should focus on automation, alternative fiber sources, and smart packaging integration to support the growing plastic-free pack market. Partnering with major brands and retailers will accelerate industry adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | DS Smith, Mondi Group, Smurfit Kappa |

| Tier 2 | Stora Enso, WestRock, UPM-Kymmene |

| Tier 3 | Huhtamaki, BillerudKorsnäs, Footprint, Ecologic Brands |

Leading manufacturers are advancing plastic-free packaging technology with smart design, compostable coatings, and high-performance fiber alternatives.

| Manufacturer | Latest Developments |

|---|---|

| DS Smith | Launched fiber-based packaging with water-resistant coatings in March 2024. |

| Mondi Group | Developed compostable food packaging films in April 2024. |

| Smurfit Kappa | Expanded molded fiber packaging solutions in May 2024. |

| Stora Enso | Introduced paper-based ready-meal containers in June 2024. |

| WestRock | Strengthened curbside-recyclable e-commerce packaging in July 2024. |

| UPM-Kymmene | Released bio-based laminates for retail packaging in August 2024. |

| Huhtamaki | Pioneered compostable coffee cup lids in September 2024. |

The plastic-free pack market is evolving as companies invest in high-performance fiber packaging, digital branding solutions, and compostable materials.

The industry will also involve AI-driven design, smart branding, and next-generation fiber technology. Brands will maximize barrier coating to develop plastic-free durable goods. Businesses will launch refill and circular packaging concepts in larger numbers. Companies will develop compostable and home-recyclable ones for mass consumption. Digital affirmation and interactive packs will enhance consumer engagement. Above this, firms will maximize the use of fiber-based molding to enhance structural performance and reduce prices.

Leading players include DS Smith, Mondi Group, Smurfit Kappa, Stora Enso, WestRock, UPM-Kymmene, and Huhtamaki.

The top 3 players collectively control 20% of the global market.

The market shows medium concentration, with top players holding 38%.

Key drivers include sustainability, smart branding, high-barrier coatings, and regulatory compliance.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.