The industry of plastic caps and closures is moving forward with sustainability, convenience, and innovation driving it. With ongoing growth trend and food & beverage, pharmaceuticals and personal care industry demand, investment in lightweight construction, tamper-evident solutions and recyclable materials is just one of many more being created by manufacturers. In search of sustainable but cost-effective solutions, the drive for bio-based, compostable, and tethered caps has been encouraged which meet global regulatory requirements and environmental policies.

Overall, businesses have moved to adopt sophisticated molding processes, intelligent closures, and high-performance sealing technologies for enhancing product integrity. All these developments reflect how well the industry is adapting to consumer demands and regulatory needs; more so, it is leaning towards low-carbon footprint plastics, refillable systems, and child-resistant packaging.

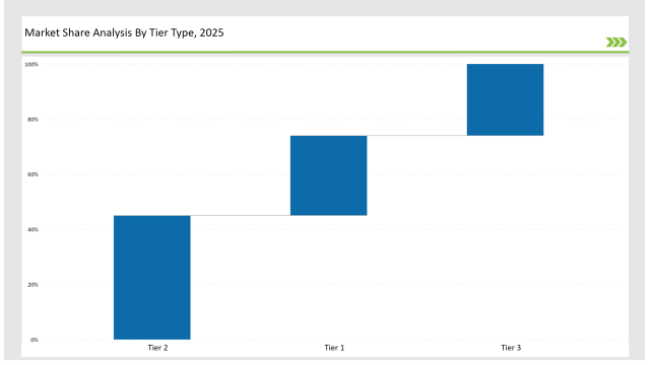

This reflects the Tier 1 players such as Berry Global, AptarGroup, and Silgan Holdings that control almost 29% of the market due to being product portfolio rich with global distribution networks as well as innovation leaders in developing sustainable packaging solutions.

Tier II players like Bericap, Closure Systems International, and United Caps have about 45 % of the market share and specialize in providing cost-effective and high-quality closures for household products and personal care and beverage.

Tier 3 are the regional niche players, and they hold 26% of the market share with specialization in customized closures, digital branding enhancement, biodegradable packaging materials, etc. They specialize mostly in localized production, smart closures, and eco-friendly packaging solutions.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Berry Global, AptarGroup, Silgan Holdings) | 16% |

| Rest of Top 5 (Bericap, Closure Systems International) | 8% |

| Next 5 of Top 10 (United Caps, Plastics Technologies, Weener Plastics, Mold-Rite Plastics, Guala Closures) | 5% |

The plastic caps and closures industry serves multiple sectors where product safety, convenience, and sustainability are essential. Companies are developing innovative closure solutions to meet evolving consumer demands.

Manufacturers are optimizing plastic caps and closures with sustainable materials, improved functionality, and smart packaging integrations.

Plastic closures and caps are rapidly evolving with sustainable development and consumer convenience. Firms are incorporating AI-driven manufacturing, bio-based resins, and tethered cap constructions to meet regulatory requirements and consumer demands. Companies are creating innovative ultra-lightweight closures to reduce material usage while improving sealing efficiency. Manufacturers have created intelligent closures with NFC and QR code authentication to improve product security. In addition, companies are introducing refillable and reusable cap systems to drive circular economy objectives.

Technology suppliers should focus on automation, sustainability, and digital integration to support the evolving plastic caps and closures market. Collaborating with food, beverage, and personal care brands will accelerate adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Berry Global, AptarGroup, Silgan Holdings |

| Tier 2 | Bericap, Closure Systems International, United Caps |

| Tier 3 | Plastics Technologies, Weener Plastics, Mold-Rite Plastics, Guala Closures |

Leading manufacturers are advancing plastic cap and closure technology with AI-powered production, sustainable materials, and smart authentication features.

| Manufacturer | Latest Developments |

|---|---|

| Berry Global | Launched fully recyclable tethered caps in March 2024. |

| AptarGroup | Developed bio-based dispensing closures in April 2024. |

| Silgan Holdings | Expanded lightweight high-barrier closures in May 2024. |

| Bericap | Released tamper-evident child-resistant closures in June 2024. |

| Closure Systems International | Strengthened smart closure authentication solutions in July 2024. |

| United Caps | Introduced premium aesthetic closures in August 2024. |

| Guala Closures | Pioneered NFC-enabled caps for interactive branding in September 2024. |

The plastic caps and closures market is evolving as companies invest in sustainable materials, digital innovations, and advanced molding techniques.

The industry's transformation into AI-facilitated manufacturing, smart packaging, and more sustainable materials is ongoing. Plastic waste minimization through fine-tuning of lightweight closure design is the manufacturer's priority. Increasing numbers of companies are integrating bio-based and compostable polymers in keeping with the precepts of the circular economy. Companies will create anti-counterfeiting smart closures for increased product security. The bond between the consumer and the brand will be enhanced with digital printing's interactive capabilities. The integration of digital printing will now assist companies in maximizing their productions using robotic automation to enhance efficiency at lower costs.

Leading players include Berry Global, AptarGroup, Silgan Holdings, Bericap, Closure Systems International, United Caps, and Guala Closures.

The top 3 players collectively control 16% of the global market.

The market shows medium concentration, with top players holding 29%.

Key drivers include sustainability, lightweight materials, smart closures, and regulatory compliance.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.