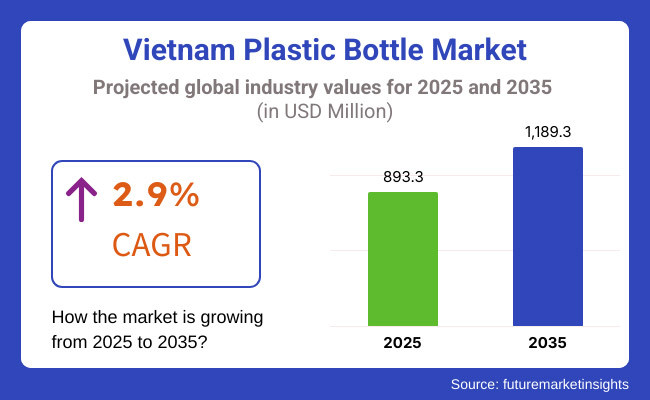

The Vietnam plastic bottle market is anticipated to be valued at USD 893.3 million in 2025. It is expected to grow at a CAGR of 2.9% during the forecast period and reach a value of USD 1,189.3 million in 2035.

A Vietnam plastic bottle is a molded packaging container produced from materials such as PET and HDPE, employed for the packaging of beverages, food, pharmaceuticals, and household chemicals. Commonly applied in the food and beverage sector, particularly for bottled water and soft drinks, these light, strong, and affordable bottles also cater to healthcare and household chemical packaging requirements.

Expansion in the plastic bottle market of Vietnam is powered by increasing drinking of beverages, especially bottled water and soft drinks, and growth in urbanization, which adds demand for ready-to-use lightweight packaging. These factors, along with increasing consumer preference for cost-effective and recyclable solutions, are fueling market expansion.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market experienced steady demand due to growing consumer fondness for packaged beverages, convenience-driven lifestyles, and growth of industries such as bottled water, soft drinks, and personal care products. | The industry will undergo structural change as issues of sustainability dictate the direction of production, with more emphasis towards biodegradable and recyclable materials, coupled with stricter environmental regulations. |

| Plastic bottles continued to be the most sought-after packaging option because of their affordability, light weight, and resilience. Demand was particularly strong in the food, beverage, and pharmaceutical industries. | Alternative packaging forms such as plant-plastic, biodegradable bottles, and reusable container systems will take center stage, reducing the consumption of conventional plastic. |

| Policymaking regulatory policies imposing waste management and recycling habits started shaping up but were not strictly enforced, still fostering bulk plastic usage. | It will be ensured that stringent green regulation and enforcement methods, including extended producer responsibilities, make companies responsible for post-consumer plastic waste. |

| Consumer awareness and recycling campaigns have been expanded yet limited by weak mechanisms and infrastructure deficiencies hampering large-scale adoption for recycling implementation. | Circular economy measures and advanced recycling technologies will be the standard, with investment in plastic upcycling plants and green practice financial incentives. |

| Firms concentrated their activities on thin and cost-bottle production techniques to utilize costs to the fullest and align with demand for bulk sales, with little concern for long-term sustainability. | Product development to be sustainable will be a priority, employing ecologically friendly designs, reusable packaging concepts, and return-of-bottle schemes to align with the natural way. |

| Foreign businesses operating in Vietnam were presenting more ecologically friendly forms of packaging, while Vietnamese producers were lagging in adopting environmental forms of packaging. | Regional as well as global producers will both embrace green production methods, with environmentally friendly branding serving as a marketing distinction within the sector. |

Sustainable Inventions Shaping the Market

Nowadays, Vietnam's plastic bottle market is experiencing huge changes in the direction of sustainability as manufacturers employ eco-friendly materials and the circular economy. They proactively develop biodegradable plastics, bio-based resins, and returnable bottle schemes to reduce environmental impacts.

With consumers now demanding more lightweight, recyclable, and reusable bottles, brands have adopted intelligent packaging strategies such as QR codes for recycling points. They also have closed-loop production whereby failed bottles are recycled and repurposed for new products. Such innovations not only support worldwide sustainability objectives but also enhance consumer confidence and brand loyalty.

Smart and Customizable Packaging Enhancing Engagement

Personalized and technology-driven packaging is transforming consumer experiences, making plastic bottles more than just containers. Brands introduce interactive designs with NFC chips and augmented reality, allowing customers to access product information, promotions, or sustainability initiatives through a simple scan.

Trend of customization is also on the rise, as companies launch color-changing bottles, ergonomic shape enhancements, and low runs for specialized designs. All these help generate emotional connections with customers and get them to follow the product, assisting in differentiation of the product in today's fierce competition.

| Attributes | Details |

|---|---|

| Top Capacity | Below 1 Liter |

| CAGR (2025 to 2035) | 2.6% |

The market is witnessing a rising demand for below 1-liter bottles, with a projected CAGR of 2.6% from 2025 to 2035. On-the-go and single-serve packaging are leading this growth as consumers increasingly look for convenience in packaging. Busy lifestyles and urbanization have placed a greater need for smaller packaging solutions, particularly in beverages.

The surge in energy drinks, bottled water, and functional beverages further supports the expansion of small-sized plastic bottles. Companies are emphasizing new and light-weight packaging to improve convenience and portability. Sustainability trends also promote the use of recyclable PET in small-sized bottles to minimize environmental effects while preserving product quality.

| Attributes | Details |

|---|---|

| Top Material | PET |

| CAGR (2025 to 2035) | 2.8% |

As per FMI estimation, the PET segment remains dominant in the market, with an expected CAGR of 2.8% from 2025 to 2035. The widespread use of PET is because it is lightweight, durable, and recyclable, which makes it the material of choice for food, drink, and personal care packaging. Its affordability and ability to preserve product integrity make it even more attractive in the market.

PET bottles provide exceptional food and beverage safety with minimal chemical transfer. This makes them appropriate for packaging sensitive products like juices, milk and dairy products, and pharmaceuticals. However, the innovation of recycled PET technology and the tightening of government policies on plastic waste are driving companies to adopt eco-friendly PET package alternatives, hence propelling market growth.

The plastic bottle industry in Vietnam is more divided than consolidated. Players like Tan Phu Joint Stock Company, Duy Tan Plastic Company, and ALPLA Group, which are some of the leading names in the industry, supply several kinds of products to meet the varying needs of consumers. These companies have active innovation arms dedicated to the improvement of design and materials for competitive advantage.

In Vietnam, packaging is an important function with a major focus on beverages, and polyethylene terephthalate (PET) is a lightweight and protective plastics increasingly used for food and beverage packaging. It is a good stretch that the market is also buoyed by the rising packaged product demands.

Sustainability trends are in the air, with companies examining safe havens for friendly materials and producing practices. The partnership of Amcor PLC and SK Geo Centric for sourcing of premium recycled materials is an indication of the industry's changing gears to sustainability. This effort is to provide packaging solutions with recycled content close to global environmental standards.

Market fragmentation notwithstanding, industry giants stay ahead through relentless innovation, strategic partnerships, and prompt responses to consumer trends. Sustainability with advanced packaging solutions determines a vibrant and dynamic landscape for the industry in Vietnam.

The Vietnamese plastic bottle market is expanding due to rising demand in beverages, personal care, and household products. Urbanization and higher consumer spending drive the need for lightweight, cost-effective packaging. The growth of modern retail and e-commerce further boosts demand, as manufacturers seek innovative solutions to improve distribution efficiency and enhance product appeal.

Sustainability is reshaping the market, with increased use of recycled materials like rPET. Consumers prefer eco-friendly alternatives, pushing companies to adopt greener packaging solutions. Efforts to reduce single-use plastics, such as replacing plastic straws, highlight the industry's commitment to environmental responsibility while maintaining functional and attractive packaging designs.

The market features strong domestic players like Duy Tan Plastics and Do Thanh Technology, alongside global firms such as ALPLA Group and Taiwan Hon Chuan. Local companies focus on innovation and adaptability, while international brands bring advanced technology and competitive pricing, making the market diverse and highly competitive.

The Vietnam plastic bottle market is expected to reach USD 893.3 million in 2025 and grow at a CAGR of 2.9% to USD 1,189.3 million by 2035.

Vietnam's plastic bottle product sales prospects remain strong, driven by increasing demand in beverages, personal care, and household products, alongside a shift toward sustainable packaging.

Key manufacturers in the Vietnam plastic bottle market include Tan Phu Joint Stock Company, Duy Tan Plastic Company, ALPLA Group, and Hon Chuan Co., Ltd.

The food and beverage segment, particularly bottled water and soft drinks, is expected to lead the industry due to rising consumer demand for convenient, lightweight packaging.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.