There has been growing demand from all segments of healthcare, biopharma, and laboratories for safe yet strong but aseptically sterilizable packaging solutions that fuels the plasma bottle industry. Major industry players continue to invest in better raw materials, sustainable operations, and accuracy in production for strict compliance and superior performance from the products.

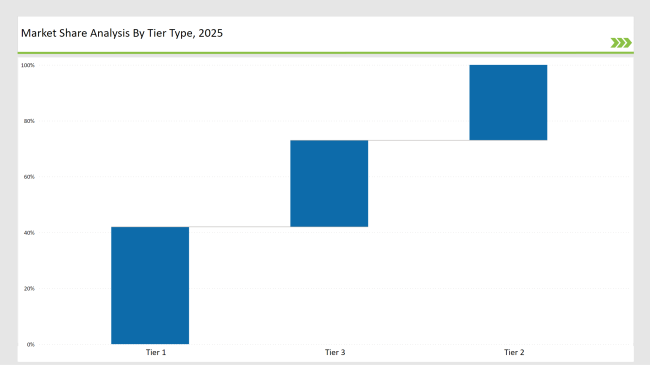

Tier 1: Leaders in the business, such as DWK Life Sciences, Corning, and Thermo Fisher Scientific, dominate 42% of the market with advanced material technology, extensive distribution networks, and compliance-driven production procedures.

Tier 2: Companies like SciLabware, Nalgene, and Greiner Bio-One account for 27% of the market, focusing on specialized solutions, cost-efficiency, and high-barrier protective plasma bottle designs.

Tier 3: Regional and niche manufacturers, specializing in custom plasma bottles for medical and research applications, make up the remaining 31%, catering to localized and emerging market needs.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

| Category | Market Share (%) |

|---|---|

| Top 3 (Thermo Fisher Scientific, Corning, DWK Life Sciences) | 18% |

| Rest of Top 5 (SciLabware, Nalgene) | 14% |

| Next 5 of Top 10 (Greiner Bio-One, Kimble Chase, BrandTech, Eppendorf, Wheaton) | 10% |

Biopharmaceuticals: Demand for contamination-free plasma storage solutions.

Medical & Clinical Research: Need for sterile, durable plasma bottles for laboratory use.

Blood Banks & Transfusion Centers: Increased demand for secure plasma containment and transport.

Diagnostics & Biotechnology: Innovations in sample preservation and plasma handling technologies.

Sterile Plasma Bottles: Ensuring contamination-free plasma collection and storage.

Biodegradable & Sustainable Bottles: Reducing environmental impact while maintaining performance.

High-Barrier Plasma Bottles: Enhanced protection against temperature variations and contamination.

Customizable Smart Plasma Bottles: IoT-enabled features for real-time tracking and monitoring.

Industry leaders are investing in sustainable, high-barrier, and smart plasma bottle solutions to enhance efficiency, regulatory compliance, and safety in medical and research applications.

Year-on-Year Leaders

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Thermo Fisher Scientific, Corning, DWK Life Sciences |

| Tier 2 | SciLabware, Nalgene, Greiner Bio-One |

| Tier 3 | Kimble Chase, BrandTech, Eppendorf, Wheaton |

| Manufacturer | Latest Developments |

|---|---|

| Thermo Fisher Scientific | Launched fully recyclable plasma bottles (March 2024). |

| Corning | Expanded high-barrier plasma containment solutions (August 2023). |

| DWK Life Sciences | Developed ultra-durable plasma storage technology (May 2024). |

| SciLabware | Introduced lightweight, eco-friendly plasma bottles (November 2023). |

| Nalgene | Enhanced impact-resistant plasma bottle designs (February 2024). |

High-performance, sustainable, and intelligent solutions are driving the plasma bottle business ahead. Businesses are advancing in areas such as AI-driven monitoring, sustainable materials, and next-generation plasma containment to meet the changing needs of biotechnology and healthcare.

Rising demand for sterile, sustainable, and high-barrier plasma storage solutions.

Major players include Thermo Fisher Scientific, Corning, DWK Life Sciences, SciLabware, and Nalgene.

IoT-enabled tracking, biodegradable materials, and high-barrier protective designs.

North America, Europe, and Asia-Pacific.

Companies are investing in fully recyclable, compostable, and high-barrier plasma bottle solutions.

Explore Function-driven Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.