The plantable packaging market is projected to grow from USD 147.6 million in 2025 to USD 418.0 million by 2035, registering a CAGR of 11.0% during the forecast period. This expansion is fueled by mounting demand for biodegradable and zero-waste packaging alternatives, particularly across food, cosmetics, and personal care sectors.

Regulatory frameworks such as the European Union’s Packaging and Packaging Waste Regulation and India’s ban on single-use plastic packaging in 2024 have catalyzed the transition toward sustainable formats. Organizations like the Ellen MacArthur Foundation have underscored the value of circular packaging systems, further accelerating industry investment in product solutions embedded with seeds or organic matter.

Sustainability-led innovation is central to corporate strategies. Botanical Paper Works - CEO Heidi Reimer-Epp captures the essence of the product when she explains, “ When you plant the paper, it grows into flowers or vegetables or herbs, and the paper pulp composts away and it leaves no waste - so it’s very eco-friendly.” Brands are embedding native wildflower or herb seeds into molded fiber containers and wraps, which consumers can plant post-use.

In retail and subscription-based models, this innovation supports consumer retention, brand storytelling, and social media virality. Amazon and L'Oréal both introduced pilot runs of plantable mailers and secondary packaging in late 2024, with plans to scale in 2025.

Technological and regulatory advances have reinforced traceability and seed viability standards. The USA Department of Agriculture updated its Seed Act compliance parameters in 2024 to allow for the commercial sale of embedded seeds in packaging formats.

Companies like Pulp Works and Botanical Paper Works received recognition from the Sustainable Packaging Coalition in 2024 for developing mold-pressed solutions with 95% germination success. By 2035, molded plantable containers are projected to comprise nearly 50% of global industry value, with e-commerce and organic grocery retail segments driving over 60% of demand. As low-impact packaging becomes a procurement priority, plantable formats will become mainstream in eco-conscious consumer ecosystems.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 147.6 million |

| Industry Value (2035F) | USD 418.0 million |

| CAGR (2025 to 2035) | 11.0% |

The plantable packaging industry is segmented into various sub-segments. By material, the segments covered include paper, cardboard, bioplastic, mushroom, and agave. In terms of packaging formats, the industry is analyzed across bags & pouches, trays, boxes & cartons, wraps & sheets, and others such as bottles, jars, and tubes. Based on end use, the study examines applications in food & beverage, personal care & cosmetics, healthcare, and other sectors, including agriculture. By region, the analysis encompasses North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA).

Among the material segments, bioplastic-based plantable packaging is projected to be the most lucrative, expected to reach USD 153.6 million by 2035, growing at a CAGR of 13.2% from an estimated USD 43.6 million in 2025. Its attractiveness stems from compatibility with existing manufacturing lines, strong biodegradability, and consumer alignment with zero-waste goals. Bioplastics also benefit from improved mechanical integrity and seed protection, making them the material of choice in high-volume applications across FMCG and personal care.

Paper-based packaging, a well-established format, is set to expand from USD 38.7 million in 2025 to USD 115.3 million by 2035, growing at a CAGR of 11.5%. It remains widely adopted due to low cost, compostability, and high consumer familiarity. Seed-embedded paper sheets and wraps are seeing growing use in promotional packaging and direct-to-consumer subscription boxes.

Cardboard-based materials, primarily used in trays and boxes, are valued at USD 29.1 million in 2025 and forecasted to grow at a CAGR of 10.8%, reaching USD 81.3 million by 2035. Cardboard supports greater load-bearing applications and allows seamless integration of seed pods or mulch-based fillers. Mushroom-based packaging, while niche, is projected to grow at a CAGR of 9.7%, from USD 18.5 million in 2025 to USD 47.3 million by 2035.

It offers superior compost ability and thermal insulation properties but is constrained by limited industrial-scale infrastructure. Agave fiber-based packaging is expected to rise from USD 17.7 million in 2025 to USD 42.6 million by 2035, growing at a CAGR of 9.1%. Its use is concentrated in Latin American regions and artisan-driven sustainable brands, with scope for expansion as processing innovations improve yield and consistency.

| Material Segment | CAGR (2025 to 2035) |

|---|---|

| Bioplastic | 13.2% |

| Paper | 11.5% |

| Cardboard | 10.8% |

| Mushroom | 9.7% |

| Agave | 9.1% |

Among packaging formats, bags & pouches represent the most lucrative growth vector, forecast to grow from USD 46.0 million in 2025 to USD 160.3 million by 2035, posting a 13.3% CAGR. Three structural tailwinds support this outperformance: rapid uptake by direct-to-consumer brands replacing plastic mailers with seed-embedded alternatives; cost convergence with conventional flexible films due to automation efficiencies; and regulatory momentum phasing out single-use multilayer laminates. This format also dominates use in personal care sachets and sustainable snack packaging, where germination adds experiential value.

Wraps & sheets, a format preferred in fresh food and deli segments, are projected to reach USD 57.9 million by 2035, up from USD 19.5 million in 2025, delivering a CAGR of 11.5%. Their role in replacing paraffin-coated paper in grocers and eco cafés positions them as an important mid-volume, high-rotation segment. Improved seed viability in thin-sheet applications has unlocked new SKUs in artisanal brands. Boxes & cartons scale from USD 37.0 million to USD 98.6 million, at a 10.3% CAGR, riding the wave of premium gifting and e-commerce packaging.

Enhanced customer retention from ‘plant-your-package’ experiences is driving repeat purchase metrics in subscription models. Trays, driven by sustainable meal delivery and bio-molded compostable formats, are expected to grow from USD 23.5 million in 2025 to USD 57.7 million in 2035, at a CAGR of 9.4%. However, production cost and tooling remain barriers to broader scale.

Others, bottles, jars, and tubes will experience moderate growth, reaching USD 42.5 million by 2035, up from USD 21.6 million, reflecting a CAGR of 7.0%. While attractive in premium beauty and nutraceuticals, material complexity and moisture sensitivity hinder widespread adoption.

| Packaging Formats Segment | CAGR (2025 to 2035) |

|---|---|

| Bags & Pouches | 13.3% |

| Wraps & Sheets | 11.5% |

| Boxes & Cartons | 10.3% |

| Trays | 9.4% |

| Others (Bottles, Jars, Tubes) | 7.0% |

Food & beverage will anchor the plantable packaging industry’s largest end-use opportunity, forecast to expand from USD 54.2 million in 2025toUSD 168.7 million by 2035, representing a CAGR of 12.1%. The segment’s dominance is underpinned by supermarket chains, QSR operators, and organic brands adopting seed-infused pouches, wraps, and trays to comply with plastic bans and meet ESG targets.

Seeded wrappers and compostable takeaway containers not only address waste concerns but also enable a storytelling advantage, particularly for ethically positioned products. Direct-to-consumer food brands have also begun bundling plantable cartons as part of their circular packaging strategies.

Personal care & cosmetics is the second-most attractive segment, scaling from USD 39.3 million to USD 112.8 million at a 10.9% CAGR. Growth is driven by natural beauty brands and boutique skincare companies seeking biodegradable formats that align with clean-label and zero-waste claims. Seeded boxes and molded containers are increasingly used in gifting SKUs, enhancing brand recall and encouraging sustainable reuse.

Healthcare, estimated at USD 17.8 million in 2025, is projected to grow at an 8.6% CAGR, reaching USD 40.5 million by 2035. Applications remain niche, primarily in wellness and nutraceutical packaging. Regulatory inertia and stringent sterility requirements limit wider adoption in pharma, though adoption in holistic and herbal product lines is gaining momentum.

Others, including agriculture, pet care, and eco-stationery, are expected to grow at a 7.3% CAGR, moving from USD 13.7 million to USD 28.2 million over the same period. Plantable tags, seed kits, and compostable pouches are seeing increased use in agro-based e-commerce bundles and seed company outreach programs.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| Food & Beverage | 12.1% |

| Personal Care & Cosmetics | 10.9% |

| Healthcare | 8.6% |

| Others | 7.3% |

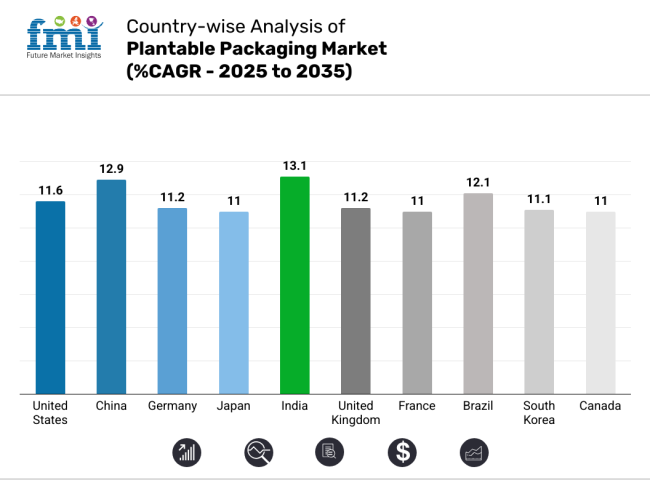

The USA is expected to lead global plantable packaging adoption, growing from USD 35.0 million in 2025 to USD 105.0 million by 2035, at a CAGR of 11.6%. Legislative momentum from state-level bans, particularly in California and New York, and federal initiatives like the Break Free from Plastic Pollution Act are reshaping corporate packaging mandates.

FMCG giants and retailers such as Amazon and Whole Foods are embedding sustainability in their supply chains, piloting seed-infused mailers and molded trays in premium SKUs. Industry readiness is supported by automation compatibility and consumer willingness to pay a green premium. The innovation ecosystem-especially in sustainable fibers and compostable polymers-is mature, driving early scalability.

However, cost pressure and inconsistent access to industrial composting facilities could temper expansion in mid-market segments. The USA industry is expected to remain a trend-setter and volume driver, particularly for e-commerce and direct-to-consumer verticals.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 11.6% |

China’s industry is projected to grow from USD 28.0 million in 2025 to USD 96.3 million by 2035, growing at a CAGR of 12.9%, the second-highest globally. This momentum is anchored in state-mandated sustainability under the 14th Five-Year Plan and large-scale plastic elimination efforts across urban centers. Alibaba and JD.com are testing eco-packaging in logistics as part of their carbon neutrality goals.

Low-cost seed-embedded pulp and access to biomass waste strengthen domestic supply chains. Export-focused agriculture and food brands are adopting plantable formats to meet international buyer standards. However, rural composting infrastructure is underdeveloped, and low-margin manufacturers remain price-sensitive. Still, China’s central policy alignment and production scalability uniquely position it to become a global manufacturing base for affordable plantable packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 12.9% |

Germany is forecast to grow from USD 22.0 million in 2025 to USD 65.3 million by 2035, at a CAGR of 11.2%. As a pioneer in green regulations, Germany’s Packaging Act (VerpackG) and EU Circular Economy mandates are driving widespread sustainable packaging transformation. Plantable formats are seeing traction in organic retail (e.g., Alnatura, DM) and gifting segments.

High public awareness and preference for biodiversity-focused products give seed-embedded formats a strategic advantage. Challenges persist in terms of composting scale and the cost of small-batch seed certification. However, Germany’s R&D funding, cross-sector circularity alliances, and design-centric sustainability ethos position it as a European leader in upscale, functional, and compostable plantable solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 11.2% |

Japan’s industry will grow from USD 18.0 million in 2025 to USD 52.0 million by 2035, registering a CAGR of 11.0%. Policy pressure under Japan’s Plastic Resource Circulation Act has prompted trials in biodegradable and regenerative packaging. Convenience retailers, beauty brands, and confectionery makers are testing seed-embedded wraps and gift boxes to appeal to eco-conscious urban consumers.

High urban density, however, limits physical space for planting, requiring innovative approaches such as desk-plantable kits or hydroponic germination. Cultural acceptance of refined minimalism and gifting enhances alignment with plantable formats, although regulatory standards for seed viability in packaging are still evolving.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.0% |

India is anticipated to grow from USD 15.0 million in 2025 to USD 52.3 million by 2035, achieving the highest CAGR of 13.1% globally. This is driven by a robust policy push, such as the nationwide single-use plastic ban, and rapid innovation from startups using agri-waste and seed-infused fibers. Plantable packaging is increasingly seen in organic FMCG, rural seed distribution, and agro-export chains.

Despite fragmented composting systems and price sensitivity in mass industries, India’s low-cost innovation and export-readiness give it an edge in scaling plantable formats across volume-heavy segments. Government schemes like Startup India are also fostering funding pipelines for green packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 13.1% |

The UK’s industry is forecast to expand from USD 12.0 million in 2025 to USD 35.4 million by 2035, at a CAGR of 11.2%. Policies like the Plastic Packaging Tax and stricter Extended Producer Responsibility rules are forcing brands to rethink packaging supply chains.

Seeded mailers, tea boxes, and personal care kits are emerging in the retail landscape, especially via eco startups and luxury goods. Composting standardization and kerbside limitations still pose barriers, but post-Brexit innovation incentives and consumer-driven sustainability expectations are catalyzing plantable format adoption in high-margin verticals.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 11.2% |

France’s industry is projected to grow from USD 10.0 million in 2025 to USD 29.1 million by 2035, at a CAGR of 11.0%. The Anti-Waste for a Circular Economy (AGEC) Law mandates strict sustainability compliance across packaging, influencing adoption across retail, food, and cosmetics. Artisanal and organic food producers, particularly in Rhône-Alpes and Nouvelle-Aquitaine, are integrating seed-embedded formats for premium product lines. Luxury beauty and gifting brands are also investing in biodegradable, plantable options to meet ESG benchmarks and enhance brand storytelling.

France’s aesthetic sensibilities and affinity for eco-luxury position it as a trendsetter in high-value packaging. Still, scale remains limited by regional disparities in composting infrastructure and slow harmonization of seed-related certifications for packaging. The country’s packaging tax credits and green design subsidies will help bridge early-stage cost disadvantages, making France a frontrunner in Western Europe’s premium segment of plantable packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 11.0% |

Brazil’s industry is expected to expand from USD 8.0 million in 2025 to USD 24.7 million by 2035, marking a CAGR of 12.1%. As pressure grows from global buyers to align with sustainable sourcing, agro-exporters are moving toward eco-packaging, particularly in specialty coffee, acai, and cacao categories. Regional legislation in São Paulo and Minas Gerais now favors compostable alternatives, and start-ups are partnering with cooperatives to distribute plantable sachets for agrochemical and seed packaging.

Informal retail and cost constraints remain hurdles in low-income zones, yet niche adoption in organics, wellness, and export-driven segments is strong. Local capacity in pulp molding and the abundance of agri-waste provide a strategic input advantage. If public-private composting initiatives gain momentum, Brazil could emerge as Latin America’s dominant hub for sustainable and regenerative packaging materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 12.1% |

South Korea’s plantable packaging industry is projected to increase from USD 7.0 million in 2025 to USD 20.4 million by 2035, at a CAGR of 11.1%. ESG mandates under the 2050 Carbon Neutral Strategy and competitive innovation in packaging technologies are pushing major brands, particularly in beauty and wellness, to adopt plantable cartons, labels, and sachets. Urban composting programs in Seoul and Busan are supporting pilot programs, and e-commerce beauty platforms are trialing seed-infused boxes to boost customer engagement.

However, cultural skepticism about at-home planting and limited indoor space slows consumer activation rates. Despite this, South Korea’s dense R&D networks and early-adopter industry behavior ensure the continuous development of smart, miniaturized, and aesthetically pleasing plantable formats. With support from government-led circular economy grants, South Korea is positioned to be a key innovation node in Asia’s sustainable packaging ecosystem.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.1% |

Canada’s plantable packaging sector is forecast to rise from USD 6.0 million in 2025 to USD 17.5 million by 2035, with a CAGR of 11.0%. Federal bans on non-essential single-use plastics, combined with provincial mandates on compostability, are pushing organic grocers, local food brands, and eco-conscious retailers toward biodegradable and plantable formats.

Start-ups in British Columbia and Quebec are leading innovations in molded trays and printed wildflower cartons. National retailers like Loblaws are conducting seed-paper trials in organic produce and private label segments. Still, challenges around consumer education and industrial compost access limit widespread rollout.

Indigenous-owned packaging businesses and local co-ops are also entering the segment, adding regional diversity to the supply base. As the country ramps up its Zero Plastic Waste targets and ESG disclosure norms, Canada will see steady, policy-supported growth in its plantable packaging footprint.

| Country | CAGR (2025 to 2035) |

|---|---|

| Canada | 11.0% |

| Company Name | Estimated Market Share 2025 (%) |

|---|---|

| Botanical PaperWorks | 18% |

| The Mend | 15% |

| Greenfield Paper Company | 14% |

| Eco Marketing Solutions | 13% |

The competitive landscape in plantable packaging is consolidating around seven players that already command roughly 90 percent of global revenue. Botanical PaperWorks sits at the premium apex with an 18 percent share today and a plausible rise to 20 percent by 2035. Its Winnipeg mill runs low-water neutralisation and sells mostly direct-to-consumer seed-paper wraps and mailers, securing gross margins north of 45 percent.

The commercial opportunity is clear: Amazon and boutique grocery pilots could treble volume, yet the company must defend a 12-to-15 percent price premium as cheaper bio-coated papers from Scandinavia enter the market. Failure to prove biodiversity benefits or guarantee germination rates above 90 percent would erode its hard-won brand equity.

India’s The Mend follows with 15 percent share and has the cleanest cost curve in the industry, converting coffee husks and banana peels into seed-infused pouches at a double-digit discount to recycled kraft. Vertical integration into anaerobic digesters provides process heat and a carbon-negative narrative that resonates with multinationals sourcing scope-3 offsets.

Scaling, however, is capital-intensive: a fully automated 30 ktpa line will cost roughly USD 25 million, and rupee volatility could inflate imported equipment bills. If financing slips past 2027, The Mend risks ceding Asia’s volume engine role to China’s Dong Guan on the Way Packaging.

Greenfield Paper Company and Eco Marketing Solutions-14 and 13 percent shares, respectively-face a strategic fork. Greenfield’s heritage is artisanal hemp sheets, but demand is shifting toward rollstock that feeds vertical-form-fill-seal lines at 60 gsm. It either invests USD 12 million in continuous-wire machines or accepts relegation to a slower-growing stationery niche.

Eco Marketing Solutions, by contrast, owns deep agency relationships and patents on seed-embedding for promotional kits; yet plant capacity is capped at 2 kt. Moving into high-volume retail would require contract manufacturing-trading brand control for scale-or licensing its IP to faster growers such as Dong Guan.

Dong Guan on the Way, currently at 10 percent share, leverages a 15-year biomass feedstock contract with Guangxi sugar mills, shaving pulp costs by nearly a fifth and running quad-cavity thermo-formers that output 20 million units per line. It is the only supplier that can meet single-order volumes from Chinese e-commerce giants-and its challenge is purely reputational: Western retailers still perceive “mass Chinese supplier” as incompatible with luxury eco-gifting. A cobranded or private-label strategy will be essential to penetrate premium channels.

Earthly Goods (11 percent) and India’s Devraaj Handmade Paper (9 percent) complete the field. Earthly Goods operates an asset-light model, designing seed-insert kits for wellness brands while outsourcing production. That keeps fixed costs below 8 percent of sales but leaves EBITDA exposed to subcontractor pricing swings.

Devraaj Handmade thrives on authenticity-hand-beaten cotton rag embedded with culturally resonant seed mixes like tulsi or marigold-but manual vats cap output at 0.5 kt. Attempts to semi-mechanise risk diluting the artisan premium; the smarter path may be licensing its geographical-indication seed blends to larger Indian converters seeking a storytelling edge.

Strategically, the battleground between now and 2035 will hinge on three levers. First, automated roll-feeding versus craft sheets: supermarket chains and QSR operators want pouch rolls compatible with existing machines, implying that only players above 10 ktpa survive. Second, bioplastic-seed composites that pass ASTM D6400 compostability open an USD 80 million sub-pool; The Mend and Dong Guan have pilots running, while Botanical must accelerate R&D or license in.

Third, seed-viability assurance: if regulators impose a >90 percent germination KPI, firms with micro-encapsulation IP-Greenfield filed a key patent in 2024-gain pricing power. Carbon-border adjustments in the EU add another twist: Asian exports will attract a 5-8 percent CO₂ penalty unless life-cycle emissions drop below 200 kg/t, nudging Chinese suppliers toward biomass boilers and Indian mills toward renewable energy credits.

Investors should note the “red-pill” caveats. Only 30-40 percent of seed-embedded packages are ever planted, so the commercial payoff relies more on social-media amplification than agronomic success. Municipal composting infrastructure remains a bottleneck-just 8 percent of USA households have curb-side access-which could stall mainstream uptake unless policy shifts. Feedstock availability is weather-exposed: drought in coffee-growing belts could slash The Mend’s husk supply by a quarter, and pulp costs for all players rise in tandem with agricultural volatility.

Bottom line: premium brands will keep paying for Botanical’s biodiversity narrative, high-volume retailers will hedge with Dong Guan’s cost-base, and The Mend stands out as the most scalable pure-play-provided it secures capex on time. Greenfield is a turnaround candidate, Eco Marketing Solutions a licensing opportunity, Earthly Goods an acquisition target, and Devraaj a niche IP play. The winners will be those who fuse germination science, low-carbon manufacturing, and reliable scale into a single, traceable supply chain-turning what was once a novelty gift paper into a mainstream USD 418 million market by 2035.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 147.6 million |

| Projected Market Size (2035) | USD 418.0 million |

| CAGR (2025 to 2035) | 11.0% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD million |

| By Material | Paper, Cardboard, Bioplastic, Mushroom, and Agave |

| By Packaging Formats | Bags & Pouches, Trays, Boxes & Cartons, Wraps & Sheets, and Others (Bottles, Jars, Tubes, etc.) |

| By End Use | Food & Beverage, Personal Care & Cosmetics, Healthcare, and Others (Agriculture, etc.) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East, and Africa |

| Countries Covered | United States, China, Germany, Japan, India, the United Kingdom, France, Brazil, South Korea, and Canada |

| Key Players | Botanical Paper Works, The Mend, Eco Marketing Solutions, Greenfield, Dong Guan on the Way Packaging Products Co., Ltd., Earthly Goods, Inc., and DEVRAAJ HANDMADE PAPER & PRODUCTS |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tonnes) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 6: Global Market Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 14: North America Market Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 22: Latin America Market Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Europe Market Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 30: Europe Market Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: East Asia Market Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 38: East Asia Market Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: East Asia Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: South Asia Market Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 46: South Asia Market Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 52: Oceania Market Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 54: Oceania Market Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: Oceania Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 60: MEA Market Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 62: MEA Market Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: MEA Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Packaging Formats, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tonnes) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Packaging Formats, 2018 to 2033

Figure 14: Global Market Volume (Tonnes) Analysis by Packaging Formats, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Packaging Formats, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Packaging Formats, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Packaging Formats, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Packaging Formats, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Packaging Formats, 2018 to 2033

Figure 38: North America Market Volume (Tonnes) Analysis by Packaging Formats, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Packaging Formats, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Packaging Formats, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Packaging Formats, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Packaging Formats, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Packaging Formats, 2018 to 2033

Figure 62: Latin America Market Volume (Tonnes) Analysis by Packaging Formats, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Packaging Formats, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Packaging Formats, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Packaging Formats, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Packaging Formats, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 82: Europe Market Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Packaging Formats, 2018 to 2033

Figure 86: Europe Market Volume (Tonnes) Analysis by Packaging Formats, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Packaging Formats, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Packaging Formats, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Europe Market Attractiveness by Packaging Formats, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Packaging Formats, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 106: East Asia Market Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Packaging Formats, 2018 to 2033

Figure 110: East Asia Market Volume (Tonnes) Analysis by Packaging Formats, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Packaging Formats, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Packaging Formats, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: East Asia Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Packaging Formats, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Packaging Formats, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 130: South Asia Market Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Packaging Formats, 2018 to 2033

Figure 134: South Asia Market Volume (Tonnes) Analysis by Packaging Formats, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Packaging Formats, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Packaging Formats, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Material, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Packaging Formats, 2023 to 2033

Figure 143: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Material, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Packaging Formats, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 154: Oceania Market Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Packaging Formats, 2018 to 2033

Figure 158: Oceania Market Volume (Tonnes) Analysis by Packaging Formats, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Packaging Formats, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Packaging Formats, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: Oceania Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Material, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Packaging Formats, 2023 to 2033

Figure 167: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by Packaging Formats, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 178: MEA Market Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Packaging Formats, 2018 to 2033

Figure 182: MEA Market Volume (Tonnes) Analysis by Packaging Formats, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Packaging Formats, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Packaging Formats, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: MEA Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: MEA Market Attractiveness by Material, 2023 to 2033

Figure 190: MEA Market Attractiveness by Packaging Formats, 2023 to 2033

Figure 191: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

The industry worth USD 147.6 million in 2025.

The industry is projected to witness USD 418.0 million by 2035.

The industry is slated to grow at 11.0% CAGR during the study period.

Food and beverages, personal care, and pharmaceutical sectors are the major end users.

Key players include Botanical PaperWorks, The Mend, Eco Marketing Solutions, Greenfield, Dong Guan on the Way Packaging Products Co., Ltd., Earthly Goods, Inc., and DEVRAAJ HANDMADE PAPER & PRODUCTS.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA