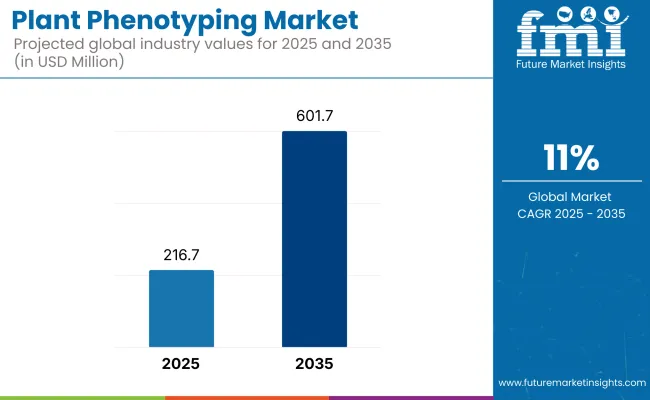

The global plant phenotyping market is projected to surge from USD 216.7 million in 2025 to USD 601.7 million by 2035, reflecting a strong CAGR of 11.0%. This growth trajectory is driven by rapid technological adoption in agricultural research and commercial farming.

Countries such as the United States, China, Germany, and Japan are spearheading adoption through heavy investment in automated imaging systems, growth chambers, and AI-integrated phenotyping platforms. Among key players, LemnaTec GmbH commands a significant market share of up to 25%, followed by Phenospex, Delta-T Devices, and WIWAM.

Adoption is largely driven by the urgent need to increase crop productivity, resilience, and sustainability amid climate uncertainties and shrinking arable land. High-throughput systems, enabled by robotics, spectral sensors, and AI-powered analytics, are allowing researchers to screen large populations of crops in real time.

These technologies help monitor plant traits such as drought tolerance, disease resistance, and nutrient uptake with high precision. Despite advancements, cost constraints and a lack of skilled personnel pose major barriers, especially in Asia-Pacific and Latin American markets.

Governments in North America and Europe are backing digital agriculture through subsidies, public-private R&D initiatives, and regulatory frameworks supporting AI deployment in the sector. Notably, the EU’s Green Deal and USDA’s NIFA programs are creating fertile ground for AI-integrated phenotyping platforms.

Countries like India, South Korea, and Brazil are catching up fast due to affordable compact systems and smart agriculture incentives. Cloud computing, edge analytics, and software-led automation are becoming cornerstones of this transformation.

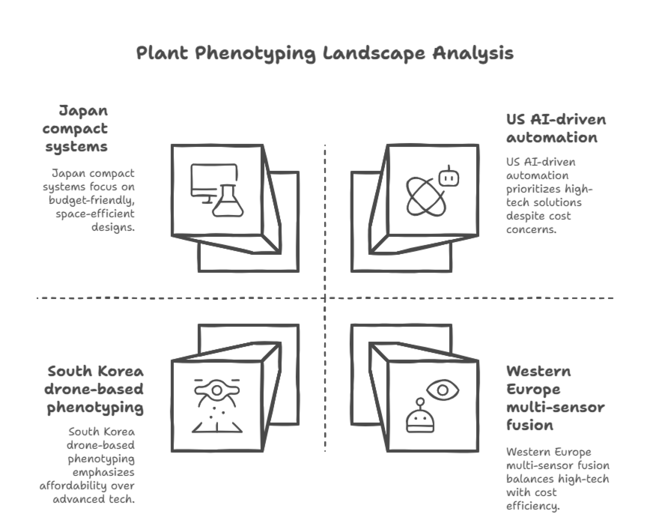

A key trend emerging is the shift from research-focused applications toward field-scale implementation, especially with the rise of drone-based phenotyping and IoT-enabled crop monitoring. Sustainability-focused phenotyping-such as non-invasive, low-energy imaging and modular sensor kits-is gaining prominence in Western Europe. Meanwhile, machine learning algorithms are being integrated into phenotyping software to predict plant behavior under stress scenarios, enhancing the efficiency of breeding programs.

Looking ahead, strategic partnerships among agritech firms, research institutions, and seed companies will drive scale and innovation. The market is also witnessing consolidation and cross-border collaborations, especially in emerging economies. With rising concerns around food security, water scarcity, and input cost volatility, plant phenotyping is transitioning from a niche research function to a critical enabler of next-gen precision agriculture.

Growth chambers are expected to lead the plant phenotyping equipment segment, offering controlled environments for reproducible and scalable testing. These chambers simulate specific light, temperature, and humidity conditions, which are essential for studying plant responses to environmental stress. Imaging systems-especially high-resolution, hyperspectral, and thermal cameras-are being increasingly used in both greenhouse and open-field applications.

Robotics and automation are gaining ground, driven by the need to handle large-scale, high-throughput experiments with minimal human error. Phenomobiles-mobile platforms equipped with sensors-are emerging as a solution for field-based studies, particularly in larger farms. The rising deployment of drones for field phenotyping also reflects a shift toward scalable, remote sensing solutions in precision farming.

| Equipment Segment | CAGR (2025 to 2035) |

|---|---|

| Growth Chambers/Phytotrons | 11.8% |

As plant phenotyping shifts from lab to field, data complexity is rising. Data management and integration software is crucial for aggregating inputs from multiple sensors and systems into a unified, actionable format. Researchers need seamless data access, visualization, and collaboration tools to interpret multi-location and multi-variate trials.

Meanwhile, statistical modeling software is gaining traction for predictive breeding, especially in climate-resilient crop development. Imaging analysis tools are now incorporating machine learning features for automated trait scoring. With cloud computing and edge analytics expanding access, the software segment is expected to see rapid modular innovation.

| Software Segment | CAGR (2025 to 2035) |

|---|---|

| Data Management & Integration Software | 12.5% |

Spectral sensors-especially hyperspectral and multispectral types-are dominating sensor investments due to their ability to detect crop health, chlorophyll content, and disease stress at different wavelengths. These sensors enable non-invasive, early-stage diagnosis and are central to AI-based phenotyping models.

Environmental sensors (measuring temperature, humidity, light intensity) are foundational, but their growth is relatively mature. Physiological sensors (e.g., measuring transpiration or water stress) are growing in importance, particularly in drought-prone regions. Integration of multi-sensor fusion-combining spectral, thermal, and fluorescence sensors-is gaining ground in Europe and the USA.

| Sensor Segment | CAGR (2025 to 2035) |

|---|---|

| Spectral Sensors | 12.8% |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Rise of Automation & AI: Adoption of AI-driven imaging, hyperspectral sensors, and LiDAR-based scanning. | Expansion to Large-Scale Applications: Increased use of drone-based phenotyping and IoT-enabled field sensors. |

| High-Throughput Systems: Widespread use in research facilities and greenhouses. | Field-Scale Implementation: AI-powered real-time analytics by aiding decision-making for farmers. |

| Cloud-Based Data Platforms: Enhanced collaboration through remote access to phenotypic data. | Edge Computing & Predictive Modeling: Faster and localized data processing for precision farming. |

| Government Funding in Developed Sector: Europe and North America led the adoption of advanced technologies. | Adoption in Emerging Sectors: Growth in Latin America, Africa, and Southeast Asia due to affordability and accessibility. |

| High Initial Costs: Limited adoption in developing regions due to expensive equipment. | Cost Reduction & Accessibility: More affordable solutions driving wider adoption. |

| Focus on Research & Development: Used mainly by research institutions and agritech firms. | Sustainability & Eco-Friendly Methods: Non-invasive phenotyping and regulatory support for precision agriculture. |

Regional Variance:

ROI Perspectives:

69% of USA stakeholders found AI-driven phenotyping systems cost-effective, whereas only 37% in Japan saw sufficient value for investment.

Consensus: Hyperspectral imaging remained the top choice (71%) due to its advanced capability in detecting plant stress and nutrient levels.

Regional Variance:

Shared Concerns: 82% cited rising equipment costs (+25% in imaging systems, +18% in cloud-based software) as a major challenge.

Regional Differences:

Manufacturers:

Distributors:

End-Users:

Global Trends:

74% of manufacturers plan to increase R&D spending on automation, AI-based predictive modeling, and remote sensing technologies.

Regional Focus Areas:

High Consensus: Standardized data collection, automation, and AI-driven phenotyping remain universal priorities.

Key Variances:

Strategic Insight:

Companies must tailor their product offerings to regional demands-high-tech AI systems for the US, eco-friendly solutions for Europe, and compact, cost-effective designs for Asian sectors.

| Countries/Regions | Key Regulations & Policies |

|---|---|

| United States |

|

| European Union |

|

| Japan |

|

| South Korea |

|

| China |

|

| India |

|

| Latin America (Brazil, Argentina) |

|

The competitive landscape in the plant phenotyping sector is characterized by pricing models, technological developments, collaborations with strategic partners, and geographical expansion. Many top players are heavily investing in AI-based automation, high-throughput imaging, and sensor fusion technologies to provide more precise and scalable phenotyping solutions, leading to industrial growth over the forecast period.

For growth, large companies are entering strategic partnerships with agritech companies, universities, and government research institutes. These partnerships with seed companies and biotechnology businesses improve breeding programs and deliver accurate crop yield predictions. A key strategy is also expansion into more emerging sectors such as Latin America, Southeast Asia, and Africa, given the increase in precision agriculture demand. This is more regionalized agricultural.

The plant phenotyping landscape is situated at the nexus of agriculture, biotechnology, and advanced data analytics and plays a crucial role in increasing global food output and sustainability. With the world grappling with increasing threats from climate change and soil erosion, which directly impact food security, both the private and public sectors have been turning to technologies that enhance crop yield, disease resistance, and environmental tolerance.

Global economic patterns largely shape the direction of the sector. Increased food demand because of population expansion, along with shrinking arable land, is fueling the demand for effective farming solutions. Farm commodity prices and inflationary pressures affect the funding and scope of research and how widely it is applied.

However, long-term government aid and subsidies in agricultural technology protect against these effects. Moreover, breakthroughs in AI, machine learning, and automation are making plant phenotyping more accessible, reducing costs of operation, and enhancing efficiency.

The United States boasts a strong and dynamic plant phenotyping sector, driven by large investments in agriculture research as well as technology innovation. The USA is a global agricultural innovation leader, with the likes of the USA Department of Agriculture (USDA) and top universities such as UC Davis, Cornell, and the University of Illinois engaged in advanced research in plant science.

The USA industry experiences extensive use of cutting-edge phenotyping technologies, such as growth chambers, imaging systems, and robotics, because of its strong agricultural industry. This is especially important in high-value crops such as corn, wheat, and soybeans, which are the mainstay of USA agriculture.

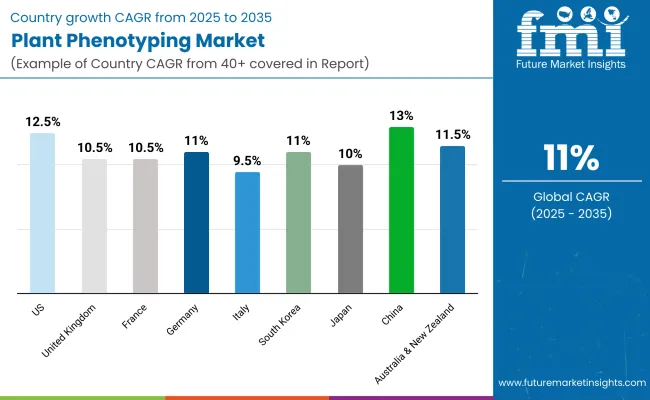

FMI opines that the United States plant phenotyping sales will grow at nearly 12.5% CAGR through 2025 to 2035.

The plant phenotyping market in the United Kingdom is also developing, as more emphasis has been placed recently on sustainable farming, climate change prevention, and food security.

The UK government and research institutions have made tremendous progress in promoting plant research through programs like the UK Plant Science Research Strategy and funding from bodies like the Biotechnology and Biological Sciences Research Council (BBSRC). The UK is notably advanced in the development of plant phenotyping software, with numerous companies that deal in image analysis and data management solutions.

FMI opines that the United Kingdom plant phenotyping sales will grow at nearly 10.5% CAGR through 2025 to 2035.

France is a prominent landsacpe for European plant phenotyping, facilitated by robust governmental programs and research organizations committed to agriculture and plant biology. French National Institute for Agricultural Research (INRA) and other agricultural universities play an important role in the advancement of phenotyping technologies.

France also has various large-scale farm producers, notably in the cereal, wine, and fruit industries, which will gain from the use of plant phenotyping in enhancing crop quality and resistance.

Technologically, France is proactively embracing growth chambers, imaging technology, and robots for both research and business use for funding initiatives. French scientists are specifically interested in how plants respond to climate change, disease resistance, and environmental stress, so sensors for monitoring environmental and physiological conditions are becoming ever more important.

FMI opines that the France plant phenotyping sales will grow at nearly 10.5% CAGR through 2025 to 2035.

Germany is among the front-runners in plant phenotyping across Europe, focusing robustly on agriculture innovation, sustainability, and precision agriculture. The agricultural research base of the country is strong, with centers like the Leibniz Institute of Plant Genetics and Crop Plant Research (IPK) and the Helmholtz Centre for Environmental Research carrying out state-of-the-art research on plant phenotyping.

Germany has a leading edge in the establishment of sophisticated imaging systems, including 3D imaging, and robotics, that are essential in high-throughput phenotyping and plant breeding. Environmental sensors for measuring soil moisture, temperature, and other important parameters are heavily utilized in Germany's agricultural and research sectors.

FMI opines that the Germany plant phenotyping sales will grow at nearly 11.0% CAGR through 2025 to 2035.

Italy's plant phenotyping landsacpe is growing as the nation emphasizes improving agricultural productivity and sustainability, especially in its most important industries such as olive oil cultivation, vineyards, and fruit orchards. Italy's government and research organizations have increasingly funded plant phenotyping programs to enhance crop resilience, maximize irrigation, and minimize the use of pesticides.

The nation's solid agricultural heritage, especially for crops in the Mediterranean region, takes full advantage of phenotyping technology to measure the health of the plants and reactions to environmental factors.

FMI opines that the Italy plant phenotyping sales will grow at nearly 9.5% CAGR through 2025 to 2035.

South Korea is a technological frontrunner, and its sector for plant phenotyping is emerging quickly as the nation invests in enhancing farm productivity, food security, and sustainability. South Korean research agencies such as the Rural Development Administration (RDA) and KAIST are spearheading the advancements in plant science by integrating innovative phenotyping methodologies.

The agricultural innovation has been given priority by the government, and it thus presents a valuable segment for entities that are researching and manufacturing plant phenotyping machines and software. In South Korea, the use of growth chambers and imaging systems is on the rise, particularly for rice and other major crops.

FMI opines that the South Korea plant phenotyping sales will grow at nearly 11.0% CAGR through 2025 to 2035.

Japan is known for its advanced technological advancement, and this includes in the area of plant phenotyping. The agricultural industry of Japan, despite being challenged by an aging population of farmers, is largely embracing precision agriculture technologies, including plant phenotyping technologies.

Japan has some premier research centers such as the National Institute of Agrobiological Sciences (NIAS) and universities that work towards enhancing crop yield, disease resistance, and stress tolerance. In Japan, growth chambers and imaging systems are widely applied to study plant growth, especially for high-value plants like rice, vegetables, and fruits.

FMI opines that the Japan plant phenotyping sales will grow at nearly 10.0% CAGR through 2025 to 2035.

China has emerged as a leading player in the plant phenotyping sector, spurred by its enormous agricultural sector and increasing emphasis on food security, sustainable agriculture, and high-tech development. Since it is the world's largest producer of rice, wheat, and other cereal crops, China has invested heavily in the study of plant phenotyping to enhance the yields and resistance of crops to pests and diseases.

Chinese institutions such as the Chinese Academy of Agricultural Sciences (CAAS) are among the leaders in advancing and applying phenotyping technologies. China's agricultural research is more and more embracing growth chambers, imaging technology, and robotics as it looks to optimize water, fertilizer, and pesticide use.

FMI opines that the China plant phenotyping sales will grow at nearly 13.0% CAGR through 2025 to 2035.

Australia and New Zealand both possess robust agricultural industries, with an emphasis on enhancing crop yield, water use efficiency, and environmental sustainability. The industry for plant phenotyping within these countries is growing as both countries fund agricultural research aimed at resolving issues such as drought, climate change, and disease. Research institutions in Australia, such as the CSIRO and the University of Melbourne, are leading the application of plant phenotyping technologies, especially in the production of grains and horticulture.

FMI opines that the Australia and New Zealand plant phenotyping sales will grow at nearly 11.5% CAGR through 2025 to 2035.

The plant phenotyping sector offers several growth prospects, driven by the growing demand for precision agriculture, sustainability programs, and technological advancements. With food security being a growing concern across the world, the necessity to maximize agricultural productivity has increased exponentially.

Precision farming, fueled by cutting-edge phenotyping technologies enables farmers to track the health of their crops in real-time, lower input costs, and enhance yields. This is especially important in regions facing environmental challenges like water scarcity.

For new players in the plant phenotyping industry, it is important to leverage these growth prospects by creating new solutions that cater to major key challenges for farmers and researchers.

New firms need to invest in cutting-edge technologies like AI-driven software and data integration platforms that can handle massive amounts of plant phenotyping data to deliver meaningful insights. Furthermore, forming entry into partnerships with agricultural research institutions or universities for co-developing new technologies and crop varieties will assist in attaining credibility and segment access.

Growth Chambers/Phytotrons, Imaging Systems, Robotics and Automation, and Phenomobiles

Imaging Analysis Software, Data Management & Integration Software, and Statistical Analysis and Modeling Software

Environmental Sensors, Physiological Sensors, and Spectral Sensors

North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa

Plant phenotyping is the process of quantifying and comparing physical and physiological plant characteristics, including growth, yield, disease tolerance, and stress resistance.

These technologies enable farmers to monitor the real-time growth and health of plants, optimize resource consumption, and increase productivity.

These most important tools include imaging systems, environmental sensors, robots, and data management software. Using high-throughput techniques based on high-resolution images, sensors, and robotic-based systems, they allow for the evaluation of various plant traits.

Artificial intelligence assists in the analysis of the huge amounts of data produced by phenotyping devices. Machine learning algorithms are able to recognize patterns and insights from the data, allowing researchers to forecast crop performance.

Plant phenotyping helps in the selection of plants with favorable characteristics like increased yields, disease resistance, and drought tolerance. Plant attributes help phenotyping hastens the breeding of more environmentally adapted crops.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA