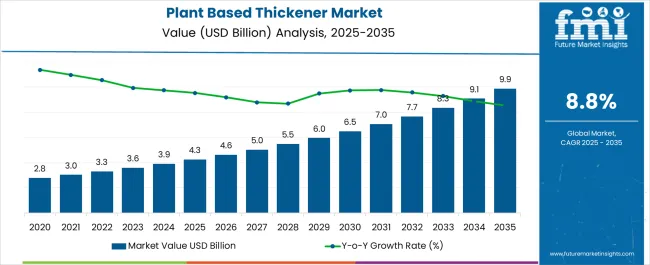

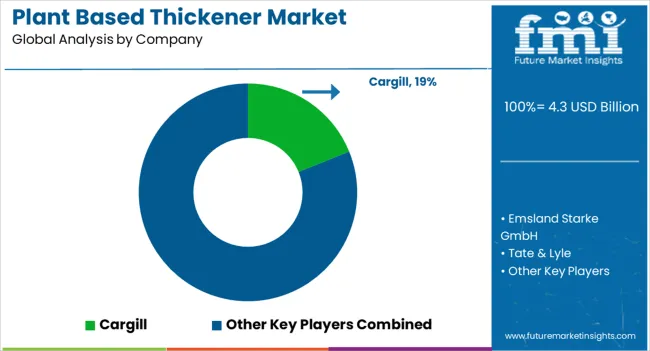

The Plant Based Thickener Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 9.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

| Metric | Value |

|---|---|

| Plant Based Thickener Market Estimated Value in (2025 E) | USD 4.3 billion |

| Plant Based Thickener Market Forecast Value in (2035 F) | USD 9.9 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The plant based thickener market is expanding steadily, supported by rising demand for clean label food products, natural emulsifiers, and allergen-free formulations. The transition toward plant-sourced additives is being encouraged by increasing consumer scrutiny of synthetic ingredients and by regulatory emphasis on food safety and sustainable sourcing.

Advances in food science, along with improvements in processing and extraction methods, have enhanced the functionality of plant-derived thickeners across various applications. The market is also benefiting from the global shift toward plant-based diets and vegan food alternatives, where natural thickeners serve as essential texturizing agents.

As food manufacturers seek to improve mouthfeel, shelf stability, and viscosity without compromising health credentials, plant based thickeners are being integrated across a wide array of product categories. Continued innovation in hydrocolloid systems and protein-polysaccharide blends is expected to expand future usage in both premium and mainstream formulations.

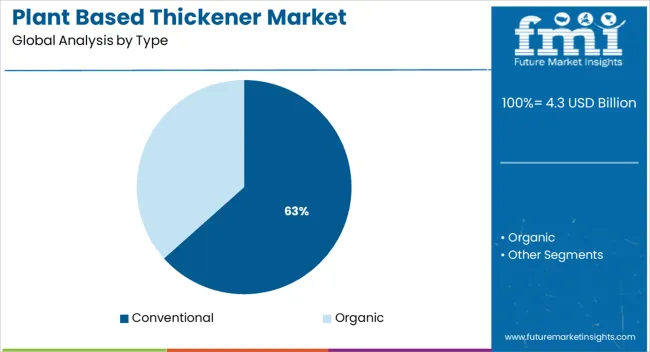

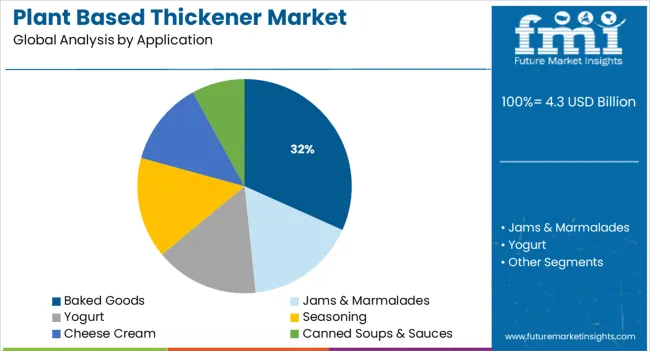

The market is segmented by Type and Application and region. By Type, the market is divided into Conventional and Organic. In terms of Application, the market is classified into Baked Goods, Jams & Marmalades, Yogurt, Seasoning, Cheese Cream, and Canned Soups & Sauces. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional type segment is projected to dominate the plant based thickener market with a 63.4% share of total revenue in 2025. This leadership is being driven by the widespread availability, lower production costs, and proven functional properties of conventionally sourced plant thickeners such as starches, gums, and pectins.

The segment continues to benefit from scalable agricultural supply chains and established processing infrastructure, making it a preferred choice for large-scale food production. Regulatory acceptance and familiarity among manufacturers have further reinforced the adoption of conventional thickeners in both emerging and developed markets.

Additionally, the broad compatibility of these ingredients with existing food systems has enabled consistent usage across baked goods, sauces, dairy alternatives, and beverages.

Baked goods are expected to hold 31.7% of the total revenue share in 2025, establishing this segment as the leading application for plant based thickeners. This position is being supported by the essential role of thickeners in improving texture, volume retention, and moisture content in plant-based bakery formulations.

Growing consumer demand for gluten-free, vegan, and fiber-rich baked items has increased the need for functional alternatives that replicate traditional baking performance. Plant based thickeners contribute to extended shelf life, uniform crumb structure, and better freeze-thaw stability, all of which are critical for commercial baked products.

Manufacturers are also leveraging natural thickeners to support clean label claims, further boosting their appeal among health-conscious consumers and retailers.

Plant-based thickener is a food additive that increases viscosity without changing the taste or other qualities of the food. Plant-based thickeners are commonly used to thicken culinary products, including soups, puddings, and other sauces, without altering their flavor. Nonfood-grade thickeners are used in paints, inks, cosmetics, and edible thickeners.

Polysaccharides and proteins are the most often utilized food thickeners. Starches, vegetable gums, and pectin make up the Polysaccharides. Recently, there has been an increase in the demand for vegan foods, necessitating the use of plant-based substances as thickeners.

Plant Based Thickener sales grew at a CAGR of 7.2% between 2020 and 2024. The period marked the entry of various market players and product innovations.

Different forms of plant-based thickeners are called functional additives since they enhance the texture and look of foods while also increasing the nutritional content of the food by substituting high-fat components in a range of dishes. Different forms of functional starches and gums are used in plant-based thickeners, which are used in soups, sauces, salad dressings, and gravies.

Rising trend of using functional food ingredients that positively impact human health, increased demand for vegan ingredients due to people's growing preference for vegan food, increased demand for an improved and smooth mouth feel in food products and rising preference for natural food ingredients.

Plant-based thickeners are also utilized for a range of culinary purposes. For example, agar is used as vegetarian gelatin since it can be used to replace gelatin in various food items and has stronger setting characteristics than gelatin.

Rising Sales of Plant-Based Food Products to Spur the Demand in the Market

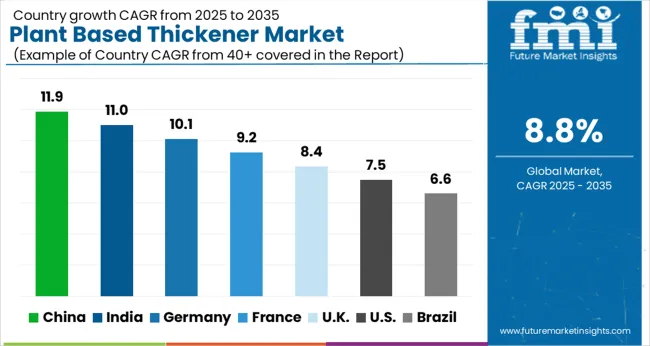

The USA is one of the largest markets for plant based thickener sales. North America is expected to hold lion’s share of 35%. In the next years, plant-based thickeners are predicted to increase at an exponential rate in the North America area.

Growth in the USA is underpinned by rising consumption of plant-based products. Further, growing demand for vegan food products is expected to boost the production of plant-based thickener. On the back of this, key players are eyeing the USA market to capitalize on rising veganism trend.

Europe Plant Based Thickener Market to Gain from Growing Consumption of Plant based Thickener

Due to the growing vegan population in Europe, the market for plant-based thickeners is poised to expand at a steady pace over the forecast period. One of the primary supply-side drivers driving market expansion is meeting the increased demand for goods that do not include animal extracts.

Plant based products are the alternative choice for meat consumers for their dose of protein. People in Europe are adopting vegan diet, boosting the market. Plant based products have major advantages over its counterpart, synthetic or animal based-products, which is driving the demand in the market.

A significant increase in urban consumption has resulted in increased demand for processed foods. As a result, allied substances such as plant-based food thickening agents have become more popular.

Because there are no close equivalents for food thickening agents, per ton increases in bread and confectionery production, sausages, dressings, and soups are directly increasing demand for food thickening agents. Processed food makers, on the other hand, are concentrating on making their goods more useful.

Introducing new product variations, acquiring smaller market competitors, and raising awareness about the advantages of plant-based thickeners through different promotional activities and programs are some of the main drivers driving market expansion in the near future.

Plant-based thickener manufacturing might benefit from the right sort of plantation, as well as the necessary technology and know-how to extract gum and starch from plants in various parts of the world.

Plant Based Thickeners: The Perfect Alternative to Animal Based Thickeners by Emsland Group, Cargill, and Ingredion Incorporated

Plant-based thickener is a food additive that increases viscosity without affecting flavor or other qualities. Plant-based thickeners typically thicken culinary products such as soups, puddings, and other sauces without altering their taste. Aside from edible thickeners, nonfood grade thickeners are utilized in paints, inks, and cosmetics.

Plant-based thickeners comprise various functional starches and gums utilized in soups, sauces, salad dressings, gravies, and other applications.

The Emsland Group is a multinational corporation that creates novel solutions for food processing using raw vegetable ingredients.

Emsland Group products are used in a wide range of food-related applications. The company also provide a diverse selection of dried potato goods in the retail food industry under the Mecklenburger Küche brand. The Emsland Group provides clients with bespoke product solutions in adhesives, flocking agents, construction additives, textile applications, and filter materials. The company uses high-quality products are utilized in high-quality home and farm animal feed.

In May 2024, JUST, a firm that uses cutting-edge science and technology to develop healthier, more sustainable meals, announced a collaboration with Emsland Group, a global leader in generating raw materials from vegetables, to expand its protein processing capacity. This collaboration will offer the volume required to address the rising worldwide demand for the award-winning plant-based product known as JUST Egg in the United States.

Another Key player, Cargill, Inc., is a privately held American multinational food conglomerate headquartered in Minnetonka, Minnesota, and incorporated in Wilmington, Delaware. Cargill's major businesses include trading, purchasing, and distributing grain and other agricultural commodities such as palm oil; trading in energy, steel, and transportation; livestock raising and feed production; and the production of food ingredients such as starch and glucose syrup, vegetable oils, and fats for use in processed foods and industrial applications.

In June 2025, Cargill stated on June 23 that it had signed a binding deal to purchase Austrian-based Delacon, a global leader in plant-based phytogenic additives, as demand for plant-based feed additives grows.

Similarly, In March 2020, Cargill acquired Smet, a Belgian supplier of chocolate and sweets decorations. This acquisition will likely expand the company's investments in food-thickening agents.

Furthermore, In February 2020, Cargill, a retail food and foodservice enterprise, may now grab their portion of the increasing plant-based protein industry under their brands. The worldwide food and agribusiness corporation said its new private-label plant-based patties and ground goods would be available in supermarkets and restaurants.

Ingredion Incorporated also mark its footprints by offering plant-based thickeners. Ingredion Incorporated is a global American ingredient provider located in Westchester, Illinois, that primarily manufactures starches, non-GMO sweeteners, stevia, and pea protein. Corn, tapioca, potatoes, plant-based stevia, cereals, fruits, gums, and other vegetables are processed into ingredients for the food, beverage, brewing, and pharmaceutical industries, as well as many other industrial sectors.

In March 2020, Ingredion Inc. recently acquired Western Polymer, a potato starch company headquartered in the U. S. Western polymer is the major provider of cationic potato starch.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025E) | USD 4.3 billion |

| Market Projected Size (2035F) | USD 9.9 billion |

| Value CAGR (2025 to 2035) | 8.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and Mt for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; and the Middle East & Africa |

| Key Countries Covered | USA, Brazil, Mexico, Germany, UK, China, India, Japan, Australia, and GCC Countries |

| Key Segments Covered | Type, Application, and Region |

| Key Companies Profiled | Emsland Starke GmbH; Tate & Lyle; Cargill; Ingredion; Novidon; Sudstarke GmbH; Avebe; Agrana; Tereos |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global plant based thickener market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the plant based thickener market is projected to reach USD 9.9 billion by 2035.

The plant based thickener market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in plant based thickener market are conventional and organic.

In terms of application, baked goods segment to command 31.7% share in the plant based thickener market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant-Based Feed Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Protein Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Bioplastic Shrink Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant-Based Methionine Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Shrimp Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Yogurt Market Analysis - Size, Share, and Forecast 2025 to 2035

Plant-Based Milk Market Insights – Growth & Demand 2025–2035

Plant-Based Chorizo Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Beef Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA