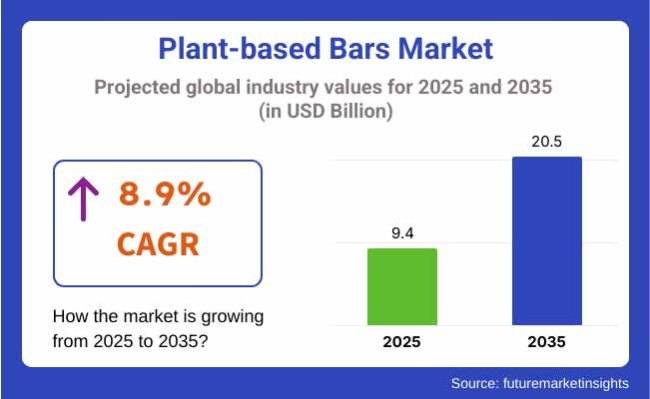

The global plant-based bars market is projected to reach USD 9.4 billion in 2025 and expand to USD 20.5 billion by 2035, growing at a CAGR of 8.9% over the forecast period.

The main factor driving rapid growth within the industry remains the rise in health-conscious, environment-friendly, and protein-rich snack options. These mainly include nuts, seeds, fruits, and plant-derived proteins, which is why there is a growing demand for a clean-label, vegan, and allergen-free diet. In addition, the increase in healthy eating and on-the-go nutrition trends is a major factor in the sales expansion.

The primary reason for growth is the increase in the adoption of plant-based diets and flexitarian living. Customers are demanding protein-rich, fiber-filled, and minimally processed snack bars that promote physical activity, weight control, and health. The rise of the sports nutrition and wellness space contributes to industry diversification.

Athletes, fitness enthusiasts, and busy people are favoring plant-based bars as a source of energy for muscle recovery and digestive health. Moreover, the growing trend of the keto diet, gluten-free, and low-sugar formulation, which is more popular among consumers, also affects consumers' preferences.

New equipment and better processing and ingredient development are enhancing the thickness, flavor, and shelf-stability of plant-based bars. The introduction of new protein types, such as pea protein, chickpea flour, and algae protein, has diversified the range of products available in the plant-based section.

The trend is pushing for sustainable and eco-friendly packaging solutions, with companies trying to align themselves with the change in demand for greener products.

Nevertheless, there are challenges, such as high production costs, competition from conventional protein and energy bars, and formulation complexities in achieving desirable taste and texture. Concerns regarding the price could additionally impact the consumers' decision to choose premium plant-based bars over traditional snack bars.

However, these challenges can be overcome by seizing the opportunities for business growth. People increasingly want personalized nutrition, like bars that help with specific goals, such as immune support, gut health, and mental wellness.

The growth of online businesses and direct-to-consumer companies has helped distribute plant-based bars worldwide. As individuals continue to alter their diets towards healthier and more sustainable food options, the industry of plant-based bars is on its path to long-term success.

Globally, there is rapid growth because of increasing demand for plant-based nutrition, clean labels, and functional ingredients. Consumers are specifically looking for healthier, sustainable snacks that have high protein levels, fiber, and essential nutrients with no artificial additives and allergens.

The retail segment has the largest consumer base, with health-conscious consumers and vegans turning to plant-based bars as a healthy and convenient snack. The sports and fitness segment is leading the demand for high-protein, energy-boosting bars for athletes and gym enthusiasts.

In the HoReCa industry, plant-based bars are being added to hotel breakfast buffets and restaurant menus as a key part of an expanding plant-forward trend. At the same time, schools and the workplace are increasingly adding healthy snack options to vending machines and cafeterias.

With ongoing innovation in ingredients, formulations, and flavors, the sales are likely to grow even more as they appeal to a wide range of consumers seeking functional, delicious, and sustainable snacking options.

During 2020 to 2024, the sales were high as consumers were more interested in health-led snacking, eco-friendly ingredients, and functional nutrition. High-protein plant-based bars made with pea, hemp, and fava bean proteins witnessed explosive demand, and adaptogenic ingredients such as ashwagandha and maca attracted wellness-oriented consumers. Personalization platforms powered by AI appeared, enabling consumers to personalize bars according to dietary needs, such as keto, paleo, and gluten-free.

Hybrid flavor innovation, e.g., turmeric-ginger and coconut-miso, was also trending as consumers wanted intense, globally influenced flavors. Manufacturers diversified the source of ingredients to fight supply chain disruption by investing in alternative proteins and local agriculture solutions.

Plant-based, personalized nutrition will drive more innovation from 2025 to 2035 as real-time nutrition monitoring and AI-based personalization become prominent in consumer trends.

Cell-based proteins and fermentation will achieve peak ingredient sustainability, and vertical farming and blockchain-based sourcing will achieve peak transparency and reliability.

The hybrid flavor will intensify, with fermented foods and multi-layered spice profiles as the new standard to address shifting taste cultures. Brands will come up with clean-label products and environmentally friendly packaging since consumers are more inclined towards healthier, greener snack foods.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| High-protein vegetable bars became trendy. | AI-driven real-time personalization defines snacking. |

| Adaptogenic ingredients such as ashwagandha trended. | Lab-grown proteins and precision fermentation maximize sustainability. |

| Hybrid flavors (turmeric-ginger, coconut-miso) trended up. | Fermented ingredients and international spice blends drive flavor. |

| AI-driven snack customization was introduced. | Nutrition tracking in real-time customized diets. |

| Diversified supply chains guarantee ingredient consistency. | Blockchain vertical farming and sourcing enhanced transparency. |

Demand for healthy, sustainable, and convenient snacks drives sales growth. On the other hand, it is still challenging to get high-quality plant-based ingredients at stable prices. Nut, seed, and plant protein supply fluctuations can lead to cost volatility, which in turn forces brands to diversify their supply sourcing strategies and develop solid relationships with suppliers.

The health claims and labeling included in regulations make the situation more severe. Different regions have different guidelines, so companies have to follow organic, non-GMO, and allergen labeling. Not meeting the rejection of compliance standards can lead to issues with law, loss of consumer trust, and withdrawal of goods; therefore, the actual need for precision compliance policies is expressed.

The competitive environment has become tough and is marked by the actions of both heavyweights and newcomers, all competing for the same piece of the pie. This situation increases the pressure on pricing and differentiation. The only way out is to innovate by using different ingredient combinations, adding extra functionality, and making sustainable packaging that will capture the interest of consumers.

Taste and texture remain the challenges for these bars to be accepted by more people. Some bars made from plants instead of traditional ingredients still struggle to compete with their conventional counterparts. The key to consumer resurgence is investing in food science and R&D to improve the product's physical attributes like texture, flavor, and shelf stability.

Shifting consumer preferences and economic factors can either negatively or positively affect demand. Economic downturns, on the other hand, may lead consumers to make other choices, such as choosing cheaper products. Using strategies such as flexible pricing and expanding to different consumer segments should help companies sustain themselves in the long term.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

| UK | 7.0% |

| France | 6.8% |

| Germany | 6.7% |

| Italy | 6.5% |

| South Korea | 7.1% |

| Japan | 6.9% |

| China | 8.5% |

| Australia | 7.2% |

| New Zealand | 7.4% |

The USA is a leader in plant-based bars because consumers are demanding more sustainable, healthy food. Soaring obesity and disease have created a push toward functional and protein-based snacks. Large players are experimenting with novel plant-based sources of protein, including peas, almonds, and hemp, to boost nutritional value.

The well-developed retail infrastructure of supermarkets, convenience stores, and e-commerce channels provides for extensive penetration in the nation. Besides, advertising expenditures on campaigns touting ethical sourcing, sustainability, and clean-label ingredients are resonating with health-conscious consumers. Venture capital presence in the industry is also driving product innovation and growth.

The UK plant-based bar sector is expanding strongly with the growing popularity of flexitarianism and veganism. Sustainability and ethical food sourcing issues have shaped consumer purchasing behavior. Supermarkets and health food store retailers are reacting by pushing specialist plant-based ranges in outlets.

Innovation involves indulgent, healthy flavors for maximum consumer appeal across a wide palatal spectrum. Government promotion of plant-based lifestyles and low carbon footprints further underpins growth. Online marketing and influencer approval are also supporting consumer mindset influences and product adoption.

France is growing consistently with the help of a cultural predisposition towards gourmet nutrition and the consumption of organic foods. There is a demand from the French consumer segment for quality ingredients and handmade products, and companies are hence moving towards high-end plant-based product formulations.

Organic food eating is a driving force, and customers have an enormous preference for locally grown and minimally processed foods. Product visibility has increased with the expansion of specialty organic and health food shops. Additionally, the government's shift towards sustainability and green food has contributed to consumer demand for plant-based foods.

Germany is expanding with the widespread adoption of flexitarian diets and a cultural focus on sustainability. The consumer wants transparency regarding ingredient origins, which is making manufacturers go in the direction of organic, non-GMO, and locally sourced ingredients.

The availability of well-known health food stores and organic supermarkets offers simple access to plant-based bars. In addition, manufacturer-retailer collaborations are advancing product positioning. Germany's pro-plant-based nutrition and pro-sustainability institutional environment aligns with the increasing popularity of ecologically sustainable food options, which is propelling growth.

The Italian plant-based bar market is growing moderately due to a heightened sensitivity towards health and well-being. While conventional consumption patterns are the norm, younger generation consumers prefer functional food and plant-based protein-based snacks. New trends include Mediterranean-style plant-based bars that include nuts, olive oil, and dried fruits.

Enhanced growth in organic food products through health food stores and high-end retail points is propelling higher penetration. Additionally, growth in fitness culture and sports nutrition consciousness is increasing demand for plant-based high-protein foods.

South Korea is evolving with the growing popularity of plant-based consumption among young people and working professionals in urban areas. The nation's sophisticated food technology industry is driving innovation in plant-based foods, resulting in the launch of bars fortified with native Korean ingredients such as red beans, barley, and rice protein. Convenience stores and online platforms are major channels of distribution, providing ease of access to products.

In addition, government campaigns for plant-based diets on environmental and health grounds are creating opportunities. Social media and celebrity endorsement are also complementing consumer adoption and visibility.

The Japanese plant-based bar market is expanding due to cultural interest in functional foods and the balance of nutrients. The focus on longevity and eating for health has driven demand for plant protein snacks.

Companies are using classic ingredients like matcha, soy, and seaweed to create distinctive product lines. Convenience stores and vending machines are the primary retailing channels, reflecting the demand for convenience nutrition. The nation's emphasis on sustainability and minimizing meat consumption also drives demand for plant-based alternatives.

Urbanization and the trend toward health-oriented diets are driving sales growth in China. The expanding middle class and rising disposable incomes are fueling demand for high-end plant-based snacks. Local brands are spending on R&D to sell new products based on native superfoods such as lotus seeds, goji berries, and mung beans.

E-commerce dominance and direct-to-consumer models guarantee widespread accessibility. At the same time, plant-based, sustainable eating policies are driving long-term growth.

Australia keeps growing with increasing consumers of plant-based nutrition driven by health motivations. Demand for high-protein, vegetable-based bars has risen due to the popularity of outdoor and fitness lifestyles.

Australia's strong, healthy organic food industry is driving consumer demand, with most of them looking for bars without artificial preservatives or additives. Distribution channels include health food specialty stores and supermarkets. Sustainability marketing initiatives also appeal to eco-conscious consumers.

New Zealand has an organic food culture and green awareness. Clean-label and minimally processed food demand drives consumers, in turn driving demand for plant-based foods. Local players focus on utilizing native ingredients like manuka honey, macadamia nuts, and hemp seeds to create product differentiation.

The nation's extremely developed retailing culture is increasing product visibility. In addition, rising exports of plant-based snacks to regional sales are driving overall growth.

| Segment | Value Share (2025) |

|---|---|

| Protein Bars (By Product Type) | 38% |

Based on product type, the plant-based bars market has been segmented as follows- Cereal/Granola Bars, Protein Bars, Energy/Meal Replacement Bars, Fruit & Nut Bars, and Others. Of these, protein bars constitute the leading segment in terms of a profound 38% value share by the end of 2025.

This leadership is growing due to consumers being increasingly interested in functional, high-protein snacks designed to support muscle recovery, weight management, and holistic health. It is blended with a wider range of plant-based proteins - pea, hemp, and brown rice - which improves bar texture, digestibility, and amino acid balance.

The booming growth is attributed to things such as rising levels of active, healthy living and a growing number of gym memberships alongside the rise in popularity of fitness-based diets, including the keto plan and high-protein diets. Titans like RXBAR (Kellogg's), Clif Bar & Company, and Orgain are introducing fortified protein bars that deliver fiber, probiotics, and vitamins.

Familiar flavors such as chocolate peanut butter, salted caramel, and mocha almond also boost consumer interest. They are easily found in supermarkets, specialty health stores, and online, maintaining their number one spot.

Energy and meal replacement bars represent 25% of the share in 2025, driven by the desire for convenient, nutrient-dense, on-the-go snacks. Consumers, especially busy professionals, travelers, and fitness enthusiasts, like these bars for their long-lasting energy and satiety.

Brands including LÄRABAR (General Mills), Huel, and GoMacro are top contenders, and most feature plant-based ingredients supplemented with vitamins, minerals, fiber, and healthy fats.

These bars typically include slow-to-digest carbs and functional ingredients like oats, seeds, and natural sweeteners. Popular flavors include apple cinnamon, peanut butter chocolate chip, and coconut almond. Greater availability via gyms, supermarkets, and e-commerce channels drives the growth of this segment further.

Supermarkets/Hypermarkets - Leading Sub-Segment in Distribution Channel

| Segment | Value Share (2025) |

|---|---|

| Supermarkets/Hypermarkets (By Distribution Channel) | 45% |

Supermarkets/hypermarkets are projected to be the preferred channels for the plant-based bars market, accounting for an estimated 45% of the overall revenue share in 2025. Those stores are popular with consumers because they give shoppers a chance to see and compare brands, ingredients, and flavors in person.

Big retailers such as Whole Foods, Kroger, and Tesco have expanded their health food sections, helping to raise awareness of plant-based nutrition. Many grocers have since introduced their bars - including Kroger's Simple Truth and Tesco's Wicked Kitchen - which help keep prices down and ratchet up competition within the category. Static formats also deliver against trials/repeat purchases, so for proven approaches, in-store promotions/bundle offers/sampling campaigns shine.

Furthermore, these retailers' adaptation to e-commerce accommodates hybrid shopping, where people can browse online and then purchase a product in-store or choose curbside pickup. By taking this omnichannel approach, consumer convenience levels are heightened, and supermarkets & hypermarkets, therefore, become an important sales channel.

E-businesses will make up 20% of the industry in 2025 due to the home delivery system, variety of products, and pricing. Amazon, Thrive Market, and iHerb enable consumers to look at nutritional profiles, consumer reviews, and niche brands like No Cow, GoMacro and Orgain.

Subscription services and direct-to-consumer (DTC) models like Huel and RXBAR provide customized product bundles, related loyalty programs, and sometimes exclusive pack discounts. Mobile commerce (m-commerce) and health-conscious online communities are enabling reach, especially among digitally savvy and wellness-oriented consumers.

As shopping habits have become more entrenched online, online retail is becoming an increasingly important feature of growth - crucial for both startups and niche brands seeking the direct consumer engagement that is often hardest to achieve in a rapidly growing category like plant-based snacks.

There is rapid growth and expansion across the globe as consumers opt for healthier alternatives to on-the-go snacking. The demand for clean-label, high-protein, and functional nutrition bars continues disrupting the competitive landscape and pushing brands to innovate around ingredient transparency or formulate products around sustainability and novel formulations.

Clif Bar & Company, RXBAR, KIND Snacks, GoMacro, and LÄRABAR are some of the key companies that serve consumers' vegan, gluten-free, or organic needs. These companies focus on building nutrient-dense formulations with natural sweeteners, superfoods, and functional ingredients such as probiotics and adaptogens.

Shifting trends in healthy consciousness towards plant-based diets and a rise in concerns regarding adverse environmental effects are the mainstream motivators for the changes in the industry. Consumers are likely becoming more interested in the bars that are less processed, high in fiber, and well sourced.

The speed of flavor innovation, the future expansion of several new retail channels like e-commerce and specialty health stores, and collaboration with fitness and wellness influencers for brand visibility make up some of the core strategic factors influencing competitiveness. Brands invest heavily in biodegradable and recyclable packaging to meet growing consumer demand for greener products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Clif Bar & Company | 18-22% |

| RXBAR | 14-18% |

| KIND Snacks | 12-16% |

| LÄRABAR | 8-12% |

| GoMacro | 6-10% |

| Other Companies (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Clif Bar & Company | Leading in organic, high-energy plant-based bars with a focus on sustainability. |

| RXBAR | Offers high-protein, minimally processed bars with simple, whole-food ingredients. |

| KIND Snacks | Focuses on nut-based, plant-powered snacks with a strong emphasis on clean-label ingredients. |

| LÄRABAR | It specializes in fruit and nut bars with minimal ingredients and caters to raw and whole-food diets. |

| GoMacro | Develops macrobiotic-inspired, organic, and vegan protein bars with a commitment to sustainability. |

Key Company Insights

Clif Bar & Company (18-22%)

With its early start in the plant-based snack category, Clif Bar is a key leader because it concentrates on organic, high-energy bars targeting athletes and active consumers. The company remains focused on sustainability in ingredient sourcing and packaging.

RXBAR (14-18%)

RXBAR has positioned itself as a clean-label protein bar company that uses minimal ingredients and is highly transparent. The company has grown its plant-based line to respond to the increasing demand for non-dairy protein sources.

KIND Snacks (12-16%)

KIND Snacks has cultivated a devoted consumer following through the provision of nut-based, plant-centric bars that prioritize nutrient density and natural ingredients. KIND Snacks remains innovative with fresh flavors and functional ingredients.

LÄRABAR (8-12%)

LÄRABAR offers minimally processed fruit and nut bars based on whole-food ingredients. The brand's commitment to raw nutrition and simplicity has established it as a favorite among health-oriented consumers.

GoMacro (6-10%)

GoMacro stands out based on its macrobiotic philosophy. It provides organic, plant-based bars that are gluten-free, non-GMO, and soy-free. Its focus on sustainability and ethical sourcing resonates with environmentally aware consumers.

Other Key Players

The segmentation is into Cereal and granola Bars, Protein Bars, Energy and meal Replacement Bars, Fruit and nut Bars, and Others.

The segmentation is into Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, and Online Retail Stores.

The segmentation is into North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa (MEA).

The industry is expected to reach USD 9.4 billion in 2025.

The market is forecasted to grow to USD 20.5 billion by 2035.

Leading companies include Clif Bar & Company, RXBAR, KIND Snacks, LÄRABAR, GoMacro, NuGo Nutrition, Primal Kitchen, PROBAR, Nakd, and Health Warrior.

China is anticipated to grow at a CAGR of 8.5% from 2025 to 2035.

The protein bars are being widely consumed.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 103: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 106: MEA Market Attractiveness by Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Snack Bars Market – Growth, Demand & Functional Nutrition Trends

Boring Bars Market Size and Share Forecast Outlook 2025 to 2035

Cereal Bars Market Growth - Health & Convenience Food Trends 2025 to 2035

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Nootropic Energy Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Automotive Light Bars Market Growth - Trends & Forecast 2025 to 2035

Two Wheeler Handlebars Market Size and Share Forecast Outlook 2025 to 2035

Automotive Door Impact Bars Market

Demand for Vegan Protein Bars in EU Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Rolled Or Extruded Aluminum Rods Bars And Wires Market Size and Share Forecast Outlook 2025 to 2035

Hot Rolled Or Cold Finished Alloy Steel Bars Market Size and Share Forecast Outlook 2025 to 2035

Demand for Taste-maskers for Plant Protein Bars and Drinks in CIS Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA