In 2024, the market for piston seals experienced growth spurred by increasing demand from automotive, aerospace, and industrial machinery sectors. The shift toward electric vehicles (EVs) drove demand for high-performance, low-friction seals to enhance efficiency and lifetimes. Artificial intelligence-based technologies reduced production costs and increased productivity, while industrial automation drove demand for hydraulic and pneumatic systems, resulting in the industry’s growth.

Changes in raw material prices, in particular rubber, elastomers, and PTFE-based products, affected the cost of production. To counteract these challenges, manufacturers focused on supply chain diversification and sought alternative materials. Moreover, the stricter environmental regulations in North America and Europe accelerated the development of seals that are environmentally friendly and energy-saving, especially the hydraulic seals.

The industry is projected to reach USD 2.5 billion by 2025 and USD 3.63 billion by 2035, growing at a CAGR of 3.8% over the forecast period. Key trends include polymer-based seals, progress in additive manufacturing (3D printing), and data- and intelligence-driven sealing solutions. With growing investments in infrastructure and renewable energy projects, demand for high-performance hydraulic systems will continue to rise, ensuring steady industry growth over the next decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.5 Billion |

| Industry Value (2035F) | USD 3.63 Billion |

| CAGR (2025 to 2035) | 3.8% |

Explore FMI!

Book a free demo

Regional Difference

Spread of High Adoption Rates

ROI Perceptions

Automation and smart seals were preferred by 72% of USA stakeholders as “worth the investment,” while 38% of Japanese respondents preferred manual wear monitoring of the seals.

Consensus

Polyurethane and PTFE-based seals gained acceptance by 64% across the globe for their chemical resistance and longer wear life.

Regional Discrepancies

Common Concerns

84% reported rising raw material and energy prices as major catalysts influencing pricing.

Regional Price Sensitivity

Manufacturers

Distributors

Industrial Operators

Alignment

70% of global manufacturers plan to invest in future-proof sealing technologies, particularly to enable predictive maintenance.

Regional Differences

Global Agreements

Safety, durability, and cost considerations are also issues of global relevance;

Key Industry Differences

Strategic Insights

To achieve maximum industry penetration and profitability, firms must tailor product offerings to regional functional needs-intelligent seals for the United States, green solutions for Europe, and low-cost, space-saving designs for Asia.

| Countries | Government Regulations & Mandatory Certifications |

|---|---|

| United States |

|

| United Kingdom |

|

| France |

|

| Germany |

|

| Italy |

|

| South Korea |

|

| Japan |

|

| China |

|

| Australia & NZ |

|

| India |

|

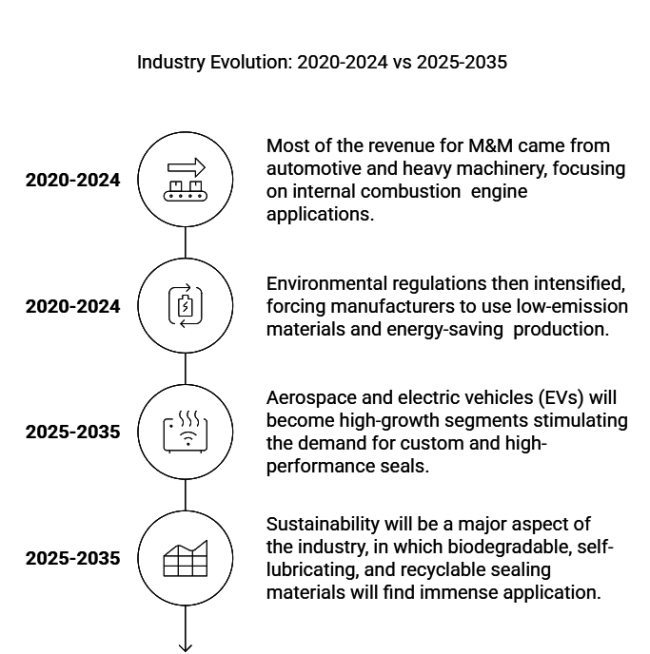

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry expanded moderately, driven by a recovery from COVID-19 disruptions and increased industrial activity. | The industry will continue to grow steadily, powered by automation, sustainability, and technological innovation in materials. |

| Manufacturing and distribution were hampered by shortages of raw materials and disruptions in the supply chain. | Supply chain resilience and localization initiatives will lessen dependence on mercurial imports. |

| Most of the revenue for M&M came from automotive and heavy machinery, focusing on internal combustion engine applications. | Aerospace and electric vehicles (EVs) will become high-growth segments stimulating the demand for custom and high-performance seals. |

| Traditional hydraulic and pneumatic seals dominated the industry, with little adoption of smart sealing solutions. | The adoption of IoT-enabled smart piston seals is expected to grow in Industry 4.0 applications and predictive maintenance scenarios. |

| Environmental regulations then intensified, forcing manufacturers to use low-emission materials and energy-saving production. | Sustainability will be a major aspect of the industry, in which biodegradable, self-lubricating, and recyclable sealing materials will find immense application. |

| Ongoing demand increases in China, North America, and Europe, driven by strong industrial growth in these regions. | Industry growth in the Asia-Pacific region, especially in India and Southeast Asia, will occur at a faster rate due to high industrialization and investment in infrastructures. |

In the industry, the double-acting rod seals segment is dominant and accounts for the largest revenue share. Hydraulic and pneumatic applications use double-acting seals when they require bi-directional sealing and enhanced performance with a more compressed fluid.

The automotive, heavy machinery, and even aerospace industries are some of those that rely most heavily on double-acting seals for their durability and ability to maintain tight seals in dynamic applications. The fastest-growing category is custom-designed hydraulic seals, driven by the increasing need for application-based sealing solutions in industries such as robotics, electric vehicles (EVs), and precision engineering.

Customization allows manufacturers to create seals based on material, pressure resistance, temperature tolerance, etc., making them ideal for niche applications in smart factories, renewable energy, and high-performance machinery. While single-acting cylinder seals remain essential for specific hydraulic applications, their development lags behind double-acting and custom seals, which are increasingly adopted in high-tech industries.

The demand for piston seals in the automotive sector is in the lead, which specifically caters to the needs of internal combustion engines (ICE), hydraulic power steering units, and braking systems. While manufacturers now place greater focus on fuel economy, emissions management, and performance engines, the need for high-quality, long-lasting rod seals remains high.

However, the most quickly flourishing sector belongs to the aerospace industry, which depends heavily on lightweight, high-precision sealing solutions for hydraulic systems, landing gear, and actuators. Aerospace manufacturers will focus on future-proof materials, such as PTFE and high-performance elastomers, to increase seal reliability, driven by the growing demand for vehicles in commercial, defence, and space exploration.

Another key driver of growth is the heavy machinery industry, which continues to see rising demand for construction, mining, and other equipment requiring high-strength, wear-resistant hydraulic seals. Meanwhile, the engineering sector's universal applications, such as industrial automation and manufacturing, are ensuring steady compound growth in the industry, particularly in developing economies that are experiencing increased industrialization.

The USA piston seals industry is set to grow at a CAGR of 4.2% between 2025 and 2035, owing to industrial automation, smart manufacturing expansion, and high safety standards. The country is a pioneer in adopting IoT-powered sealing solutions as the automotive, aerospace, and oil & gas sectors drive the demand for high-performance, low-maintenance seals.

These are OSHA and ANSI standards that greatly affect the safety and quality of the highest standard. Enhancing hydraulic, pneumatic defense, and renewable energy systems due to further investments will spur demand for rod seals with a high degree of robustness as well.

The United Kingdom has set a target for the piston seals industry to record a CAGR of 3.7% in the 2025 to 2035 period, based on post-Brexit commerce policies, the popularity of metallic sustainability applications, and extensive automation intelligence in various industries.

The movement from CE marking to UKCA certification increased compliance costs, modestly dampening industry growth. Yet stringent environmental regulations have brought a demand for sustainable and energy-saving seals. The construction, manufacturing, and oil & gas industries that require durable and weather-resistant hydraulic seals to meet the UK Health and Safety Executive (HSE) standards also drive industry growth.

Automobile & Industrial Automation Technologies anticipates 3.5% CAGR growth for the French piston seals industry by 2025 to 2035. The country is a major automotive and aerospace manufacturing hub, demanding innovative sealing solutions.

It is in this ICPE (Installations Classified for Environmental Protection) context, with grave environmental and material constraints, that this study should be carried out to push companies to use low-friction and recyclable materials. In addition, the EU's emphasis on emissions reduction and energy efficiency will also increase the need for low-maintenance and self-lubricating cylinder seals in hydraulic and pneumatic systems.

With robust industrial and automotive industries, the German piston seals industry is projected to grow at a CAGR of 4.0% during 2025 to 2035. It has one of the strictest regulatory environments and requires TÜV, DIN, and CE certifying standards for seal performance and quality.

Germany's leadership in Industry 4.0 has driven increased adoption of smart hydraulic systems with predictive maintenance technologies. With Germany’s ambitious sustainability initiatives, energy-efficient sealing solutions are also on the rise. High-durability seals are also crucial to support growth where machinery, aerospace, and renewable energy industries are concerned.

Rising manufacturing, automotive, and construction sectors are expected to propel the Italian piston seals industry at a CAGR of 3.6% during the forecast period (2025 to 2035). Italy is implementing the EU CE marking regulations. The source of this information is unclear and seems to be a typographical error.

The Ministry for Ecological Transition had been encouraging manufacturers to use sustainable and recyclable sealing products. The demand for highly accurate, wear-resistant seals is growing in hydraulic systems used in heavy machinery and automation. Due to the industrial strength of the Italian industry, particularly in textiles, food processing, and automobile manufacturing, the requirement for rugged rod seals in the country is always increasing.

The South Korea piston seals industry is expected to have a CAGR of 3.9% for the forecast period between 2025 and 2035 as a result of technological innovation in semiconductor production, intelligent factories, and robotics. The significance of high-performance and compact-sized hydraulic seals has grown in response to high-tech industrial automation in South Korea. KC certification ensures that the seals meet the safety and durability standards.

Additionally, the South Korean government's push for eco-friendly manufacturing is driving innovative energy-saving and low-emission sealing technology. Forceful growth in expansions is particularly seen in electronics, shipbuilding, and heavy machinery applications, where a broad range of highly specialized hydraulic seals are in widespread use.

Slow adoption of intelligent sealing technologies in Japan, due to a preference for traditional, high-precision components, is expected to moderate industry growth, resulting in a 3.3% CAGR from 2025 to 2035. The regulations of JIS and METI emphasize the quality of materials and performance consistency.

While Japan has a strong industrial base, companies gravitate to analogue solutions that are cheap and reliable rather than automation. The automotive, precision machinery, and heavy engineering sectors consistently expand, but their slower adoption of IoT-enabled seals compared to the USA and Europe hinders faster industry growth.

The piston seals industry in China is anticipated to grow at a CAGR of 4.5% during 2025 to 2035, making it one of the fastest-growing industries, followed closely by India at 4.1%. The demand is high due to industrialization, infrastructure development, and the manufacturing dominance of the country. CCC (China Compulsory Certification) and GB Standards regulate sealing solutions for safety and quality.

Growing demand for high-performance hydraulic and pneumatic seals is being spurred by the growth of electric vehicles (EVs) and renewable energy projects. With the push by China’s government for automation, intelligent manufacturing, and green energy programs, there is an increasing use of long-lasting, high-performance cylinder seals.

Between 2025 and 2035, the hydraulic rod seals industry in India is expected to grow at a CAGR of 4.1%, owing to fast-paced industrialization, infrastructure growth, and robust automotive growth. The Bureau of Indian Standards (BIS) and ISI certifications control the quality of products.

India's Make in India program has strengthened domestic production for hydraulic and pneumatic seals, reducing imports. The government's smart city, electric vehicles, and industrial automation initiative are also fuelling demand for high-durability, low-cost sealing solutions. There is a particular need for reliable sealing solutions in construction equipment, aerospace, and energy applications.

These companies compete with each other with respect to the pricing strategies, technological innovation, strategic partnerships, and expansion of their business horizons. Industry leaders focus on high-performance, premium seals for aerospace and electric vehicles, while others pursue cost-sensitive industries with commoditized solutions. Material innovation in terms of self-lubricating and high-temperature-resistant materials is a differentiator, with key companies investing in R&D for IoT-enabled smart seals.

Firms are also building more industrial bases in Asia and North America to localize production and reduce supply chain risks. Industry presence is strengthened through OEM and distributor partnerships, while technological innovation and regional expansion are driven by mergers and acquisitions (M&As).

Industry Share

Parker Hannifin Corporation

Freudenberg Sealing Technologies

Trelleborg AB

SKF Group

Hallite Seals International

Eaton Corporation

Saint-Gobain S.A.

Industries like automotive, aerospace, heavy machinery, and industrial automation rely on them for fluid control/sealing performance.

New IoT-enabled seals with real-time monitoring and predictive maintenance capabilities are being adopted, boosting performance and minimizing downtime.

Self-lubricating polymers, corrosion-free composites, and bio-based elastomers are leading innovation in durability and sustainability.

North America and Europe are dominating the high-performance, eco-tenable seals, whereas Asia-Pacific is developing quickly owing to the growing industries and infrastructure companies.

Production has become exceptionally complex due to raw material price volatility, stringent regulatory requirements, and customization needs.

The industry is segmented into double-acting, single-acting and custom designed

It is segmented into automotive, heavy machinery, general engineering and aerospace

It is fragmented into North America, Latin America, Europe, Asia Pacific, Middle East and Africa

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.