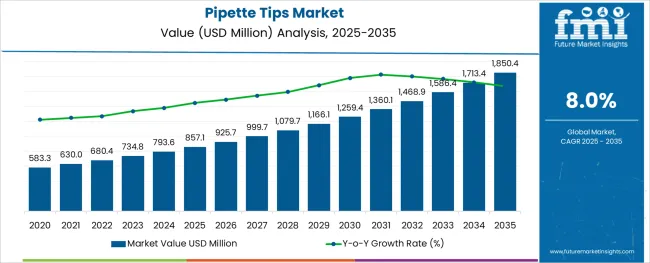

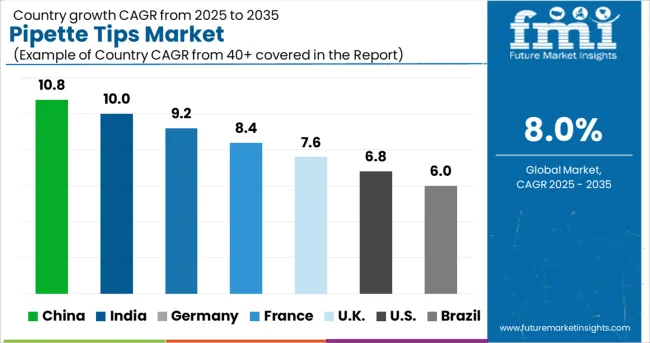

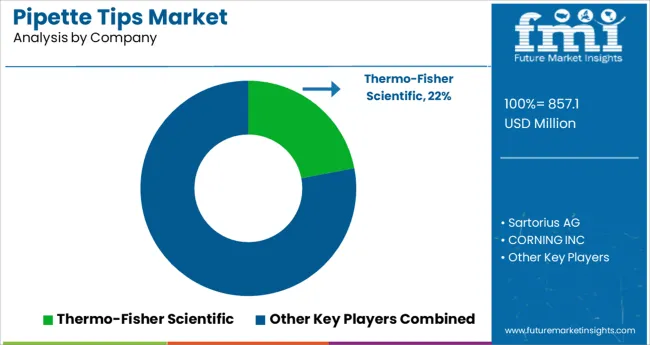

The Pipette Tips Market is estimated to be valued at USD 857.1 million in 2025 and is projected to reach USD 1850.4 million by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The pipette tips market is experiencing steady expansion, supported by increased demand from diagnostic labs, pharmaceutical research, and biotechnology applications. The growing global emphasis on infectious disease monitoring, personalized medicine, and lab automation is driving the volume of liquid handling procedures.

Precision, contamination control, and reproducibility remain critical, placing pipette tips at the core of laboratory consumables procurement. Advancements in polymer science, sterile manufacturing, and filtered tip technology are further enhancing product utility and extending tip compatibility with a wide range of pipettes.

As laboratories prioritize traceability, accuracy, and regulatory compliance, manufacturers are investing in scalable, cleanroom-based production lines. Future demand is expected to be shaped by the continued expansion of molecular diagnostics, increasing R&D budgets, and the global push for high-throughput testing across life sciences, clinical trials, and academic research.

The market is segmented by Product Type, Technology Type, and Application Area and region. By Product Type, the market is divided into Standard, Filtered, Low-retention, and Others. In terms of Technology Type, the market is classified into Non-robotic and Robotic. Based on Application Area, the market is segmented into Diagnostics and Healthcare, Pharma and Biotech, Academia and Education, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

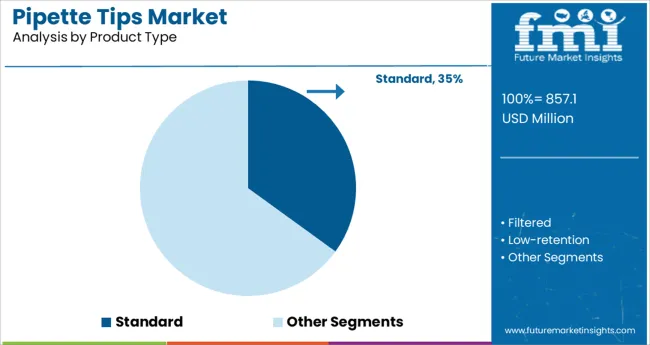

Standard pipette tips are expected to account for 35.0% of the total revenue share in 2025, making them the leading product type segment. This dominance is being driven by their widespread usage across academic labs, diagnostic facilities, and research institutions for routine liquid transfer.

Their affordability, compatibility with most manual pipettes, and consistent performance in basic assays contribute to sustained demand. Standard tips are also preferred in environments where cost containment is a priority and where precision needs do not extend to highly specialized assays.

With enhancements in sterilization, packaging, and universal fit design, standard tips continue to offer reliable utility in both low-throughput and semi-automated workflows.

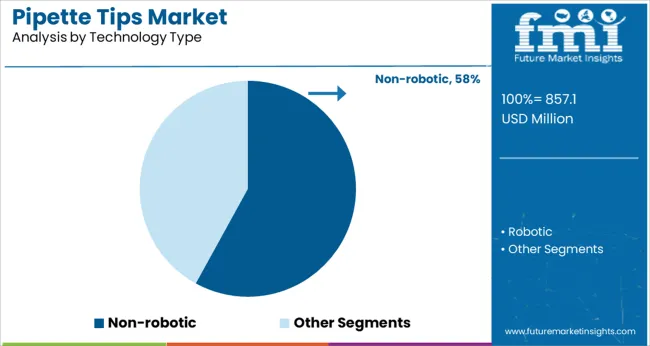

The non-robotic segment is projected to lead with 58.0% of the total pipette tips market revenue in 2025. This segment's prominence is being attributed to the continued reliance on manual pipetting systems in smaller labs, diagnostics centers, and early-stage research environments.

Non-robotic tips are widely used due to their lower cost, ease of handling, and broad compatibility with hand-held pipettes. The segment is also supported by the demand for flexibility in experimental protocols and low setup requirements.

Despite automation trends, a significant portion of lab processes still requires user control for nuanced handling or one-off procedures, sustaining the dominance of non-robotic pipette tips in core operational workflows.

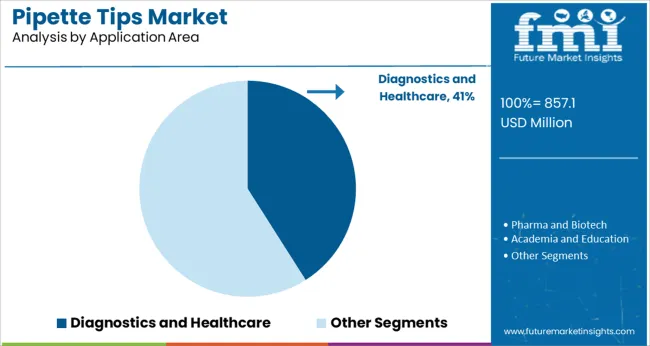

Diagnostics and healthcare applications are expected to contribute 41.0% of the pipette tips market revenue in 2025, positioning this segment as the largest in terms of application area. Growth is being fueled by increased global diagnostic testing, particularly in clinical chemistry, PCR analysis, and molecular biology workflows.

Pipette tips are critical for minimizing cross-contamination and ensuring sample integrity, which is vital in regulated healthcare environments. Rising public and private healthcare investments, especially in emerging markets, are expanding access to diagnostic infrastructure and increasing tip consumption.

The demand for sterile, precision-fit tips that support accurate volume transfer in high-stakes clinical settings continues to support this segment’s dominance.

Constant product innovation, rising demand for R&D, and an increasing number of healthcare settings, diagnostics, and liquid handling systems are key drivers driving pipette tips market future trends as well as pipette tips market growth. A pipette is a laboratory tool used to transfer a specific amount of liquid.

An airtight seal is formed between the pipette and the pipette tip at the end. A pipette tip, which is mostly made of Polypropylene and is both disposable and reusable, aids a pipette in dispensing a specific volume of liquid.

The global demand for liquid handling systems, including pipettes, is driving up the demand for pipette tips together with pipette tips adoption trends. The rise in the incidence of cancer and aids is driving medical research and development, increasing the demand for pipettes tips along with pipette tips market trends and forecast.

The increased demand for pipettes is increasing the demand for pipette tips in the medical research and development sector.

Growth in pharmaceutical industries around the world is increasing the demand for R&D in the pharmaceutical sector, which in turn increases the demand for pipette tips as well as sales of pipette tips, which in turn increases the demand for pipette tips and pipette tips market future trends in the pharmaceutical industry.

Pipette tips are significant contributors to non-chemical waste in biomedical labs due to the large volume of tips thrown out of the labs and the lack of recycling programmes to deal with tips. The lack of laboratory recycling companies in underdeveloped or developing economies is likely to be a major impediment to the pipette tips market growth.

Due to the ongoing pipette tips market trends of miniaturization of medical devices and equipment, laboratories can reduce the cost of reagents and samples.

As a result, there is a greater desire to reduce solution and reagent waste, which is more difficult with manual pipetting. The demand for pipette tips as well as reagents is expected to rise in the coming years due to the safe and precise use of the reagents via the automated pipette system.

Pipette tips are the most commonly used handheld laboratory tools because they are easily detached and discarded to prevent cross-contamination during sample handling. Since these pipette tips are disposable, there is a concern about their recyclability.

The pipette tips market has been subdivided into standard tips, filtered pipette tips, low-retention tips, and others based on product. The pipette tips market is anticipated to be dominated by the standard product segment. The segment accounted for 32.5% of revenue in pipette tips market share and is expected to grow at a healthy rate in the future.

A standard tip is a multi-purpose tip that can be used for a wide range of laboratory applications with varying performance requirements. These applications range from high accuracy to more tolerable reagent dispensing. For applications requiring the highest level of purity, sterile standard tips are available.

The most important pipetting technology is filter tips. Aerosol barrier tips are also known as filtering pipette tips because they have a filter inside the proximal part of the pipette tips that allows them to suck viscous samples into the shaft with precision.

This not only protects the pipette from physical damage, but it also prevents sample cross-contamination from aerosols. These are the factors affecting the acceleration of adoption of pipette tips.

The pharmaceutical and biotech application segment is anticipated to be dominated in the pipette tips market, accounting for 32.3% of global revenue.

The segment is expected to grow at the fastest CAGR during the forecast period, maintaining its leading position in pipette tips market. This expansion can be attributed to the demand for pipettes for various research purposes, such as accurate sample transfer for conducting any experiment.

Despite recent slowdowns in key pipette tips markets around the world, the global pharmaceutical pipette tips market is expected to grow in the coming years.

The pipette tips market opportunities has grown significantly over the last two decades, with global pharma revenues expected to reach USD 1.27 trillion in 2024. The reasons for this include an ageing population, rising income levels, new medical conditions, and increased research expenditure.

The non-robotic pipette tip segment had the highest revenue with pipette tips market share of 56.4% and is expected to grow significantly. Pipette tips that are not robotic are used with standard or manually operated pipetting systems.

The majority of laboratories used manual pipetting systems, which has a direct impact on the demand for standard or non-robotic pipette tips. The demand for automated liquid handling systems has increased in tandem with advancements and automation in the healthcare sector.

Automated pipetting systems are robotic instruments that dispense predetermined volumes of reagents and samples into vessels without the need for human intervention, ensuring consistent accuracy and reproducibility.

Robotic pipette tips can be used with automatic liquid handling workstations for Gel loading, PCR testing, DNA testing, and other applications that require high accuracy and minimal contamination impacting the pipette tips market key trends and opportunities.

North America will dominate the pipette tips market, accounting for more than 37.5% of global revenue. Since a single regulatory approval can grant access to the entire region, the region is strategically very important for the distribution of pipette tips. Furthermore, per capita healthcare expenditure in this region is higher than in developing countries, which aids in the pipette tips market growth of the medical device industry.

This indirectly promotes the pipette tips market pipette tips market. Furthermore, an increase in healthcare research and development in the region is fueling pipette tips market growth.

The pharmaceutical and biopharma industries are major contributors to European economies, which has been made possible by the region's extensive focus on R&D infrastructure.

Demand for pipette tips in the region has increased due to increased collaborations and partnerships of key pipette tips market players with universities, research institutes, and the diagnostic, pharmaceutical, and biotechnological industries.

The pipette tips market's major players account for a sizable portion of the pipette tips market share and are well-known. Small-to-medium-sized players are also present in the pipette tips market; they offer a limited selection of pipette tips and primarily sell to local clients.

Since most of these well-known companies have extensive global distribution networks to reach their large customer bases, their impact on the pipette tips market is substantial.

The major players in the pipette tips market are focusing on strategic initiatives such as product launches, acquisitions, collaborations, participation in events, and expansions to boost revenue pipette tips market growth and solidify their positions in the pipette tips market.

Recent Development

Collaboration:

In 2025, Moderna, Inc., a biotechnology company pioneering messenger RNA (mRNA) therapeutics and vaccines, and Thermo Fisher Scientific Inc. announced a 15-year strategic collaboration agreement to enable dedicated large-scale manufacturing in the United States of Spikevax, Moderna's COVID-19 vaccine, and other investigational mRNA medicines in its pipeline, resulting in increased use of essential lab supplies such as pipette tips.

Expansion:

Thermo Fisher Scientific announced a USD 140 million investment to expand its laboratory plastics disposables production in order to meet global demand for pipette tips during COVID-19 testing, as well as for the development and manufacturing of therapies and vaccines.

Acquisition:

Sartorius has acquired Biological Industries Ltd., a manufacturer of cell culture and molecular biology research products.

The global pipette tips market is estimated to be valued at USD 857.1 million in 2025.

It is projected to reach USD 1,850.4 million by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are standard, filtered, low-retention and others.

non-robotic segment is expected to dominate with a 58.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pipette Controller Market – Trends & Forecast 2025 to 2035

Micropipette Puller Market Size and Share Forecast Outlook 2025 to 2035

Serological Pipettes Market Size and Share Forecast Outlook 2025 to 2035

Glass Pasteur Pipettes Market

Child Resistant Pipette Closures Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Child Resistant Pipette Closures Manufacturers

Electronic Multichannel Pipettes Market

Applicator Tips Market Size and Share Forecast Outlook 2025 to 2035

Atypical Antipsychotic Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA