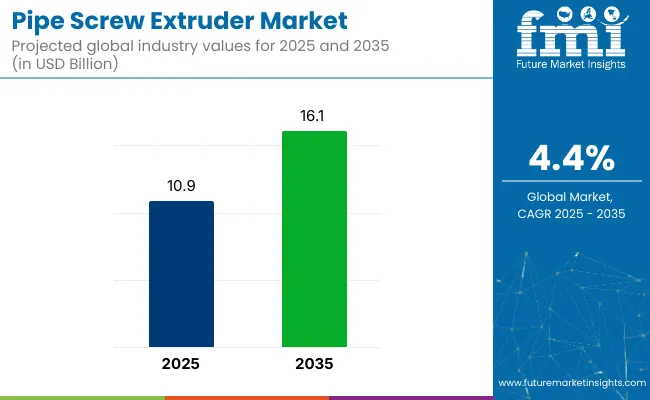

The global pipe screw extruder market is anticipated to grow at USD 10.9 billion in 2025 to USD 16.1 billion by 2035, which shows a CAGR of 4.4% over the forecast period. Growth in the market is expected to be driven by increasing demand for plastic pipes in the construction, agriculture, and infrastructure sectors.

| Metric | Value |

|---|---|

| 2025 Market Size | USD 10.9 billion |

| 2035 Market Size | USD 16.1 billion |

| CAGR (2025 to 2035) | 4.4% |

The adoption of Industry 4.0 technologies, twin-screw extruder installations, and a focus on sustainable manufacturing are also projected to fuel this expansion. Moreover, government investments in water management and sanitation infrastructure are anticipated to support market growth.

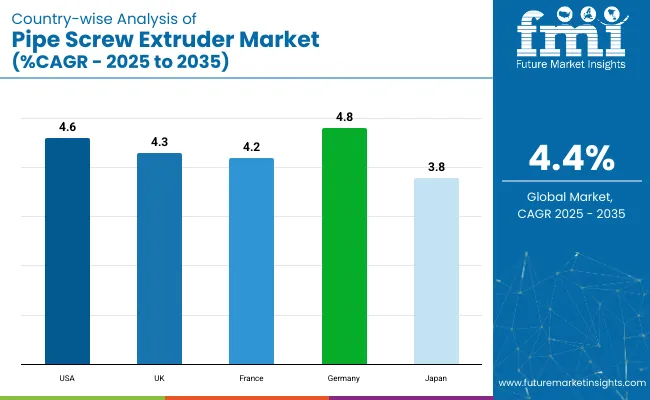

Germany is projected to grow at a CAGR of 4.8%, driven by its strong manufacturing capabilities and sustainability initiatives, while the USA posts a CAGR of 4.6% due to the replacement of old pipelines and the adoption of new technologies.

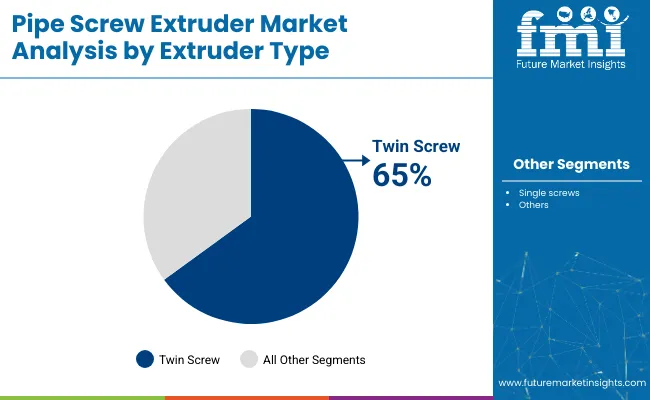

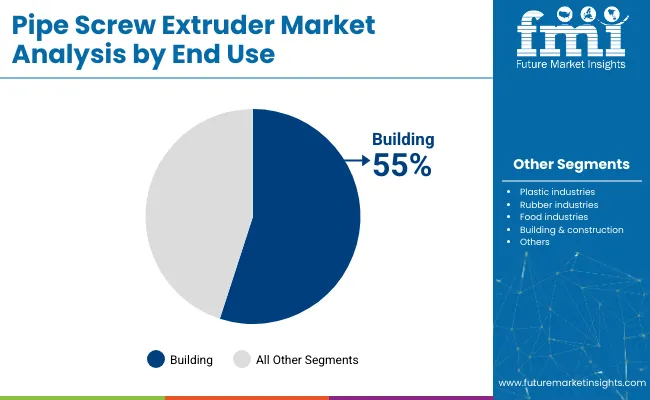

The UK pipe screw extruder market is projected to grow at a CAGR of 4.3% from 2025 to 2035. Twin-screw extruders dominate with a 65% market share because of their superior mixing and efficiency. In comparison, the building and construction sector holds the largest end-use share at 55%, driven by rising demand for plastic pipes in water supply, drainage, and sewage systems.

The pipe screw extruder market is witnessing innovations focused on energy efficiency, sustainability, and automation. Entek launched its high-output HT 162 twin-screw extruder, featuring vent flow-sensor technology and modular components, to enhance process control. Leistritz developed supercritical CO₂ injection systems that improve foaming and reduce material usage in extrusion. Bausano introduced the Multidrive 4×2 system, which improves torque distribution and reduces mechanical stress, increasing equipment life.

The pipe screw extruder market holds varying levels of share across its parent markets. Within the plastic processing machinery market, it accounts for approximately 12-15%, primarily due to its use in high-volume plastic pipe production. In the broader extrusion machinery market, it captures nearly 25-30% share, as pipe extrusion is a dominant application. For the polymer extrusion equipment market, the share is around 20-22%. In the plastics manufacturing equipment market, the share narrows to 8-10%, given the diversity of machinery types. Overall, pipe screw extruders form a key segment in extrusion-based equipment and contribute significantly to thermoplastic processing.

The pipe screw extruder market is segmented into extruder type, end use, and region. By extruder type, it includes into single screw and twin screw. The market covers end uses like plastic industries, rubber industries, food industries, building and construction, and others (pharmaceutical processing, recycling plants, and composite material manufacturing).

The market spans regions including North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia and Belarus, the Balkan and Baltic countries, the Middle East and Africa, East Asia, and South Asia and the Pacific.

Twin screw extruders dominate the market with a 65% share in 2025. Manufacturers prefer twin screw extruders because they provide better mixing, improved product quality, and higher output compared to single screw extruders.

The building and construction sector is expected to lead the market with a 55% share in 2025. Companies in this sector use pipe screw extruders extensively to produce plastic pipes for water supply, drainage, sewage, and gas distribution.

The global pipe screw extruder market is growing steadily, driven by rising demand for plastic pipes in the construction industry, increasing adoption of twin-screw extruders, and advancements in automated extrusion technologies.

Recent Trends in the Pipe Screw Extruder Market

Challenges in the Pipe Screw Extruder Market

Among the analyzed countries, Germany leads with the highest projected CAGR of 4.8% in the pipe screw extruder market, driven by its precision engineering and high R&D investment. The USA follows closely with a 4.6% CAGR, supported by infrastructure development and IoT integration. The UK and France are projected to grow at 4.3% and 4.2%, respectively, fueled by sustainable construction and government-backed urban projects. Japan lags with a 3.8% CAGR due to weaker domestic demand and operational challenges. Overall, European countries maintain stable growth, while the USA and Germany show the most robust upward trends in technology-led adoption.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA pipe screw extruder revenue is projected to grow at a CAGR of 4.6% from 2025 to 2035. Growth is driven by strong infrastructure development, replacement of old pipelines, and adoption of advanced manufacturing technologies.

The pipe screw extruder revenue in the U.K is expected to post a CAGR of 4.3% during the forecast period. Sustainable construction practices, refurbishment of old water and sewage networks, and strict environmental regulations fuel growth.

Germany’s pipe screw extruder market is expected to grow at a CAGR of 4.8% through 2035. The market benefits from precision engineering, strong manufacturing capabilities, and sustainability-focused policies.

The French pipe screw extruder sales are forecasted to expand at a CAGR of 4.2% between 2025 and 2035. Growth is driven by infrastructure revamp projects, government investments in water management, and urban renewal schemes.

Sales of pipe screw extruders in Japan are expected to grow at a CAGR of 3.8%, slightly below the global average. Market growth is driven by the replacement of old pipelines, advancements in precision engineering capabilities, and the adoption of advanced extruder technologies.

The pipe screw extruder market is moderately consolidated, with a few key players dominating the landscape. Companies compete through technological innovation, strategic partnerships, and global expansion to enhance their market presence.

Leading companies such as KraussMaffei Group, Davis-Standard, and Bausano focus on developing advanced extrusion technologies that cater to diverse industrial needs. These firms invest in research and development to introduce energy-efficient and high-performance extruders. Collaborations and acquisitions are also common strategies for expanding product portfolios and entering new markets.

Recent Pipe Screw Extruder Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 10.9 billion |

| Projected Market Size (2035) | USD 16.1 billion |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Units |

| By Extruder Type | Single Screw, Twin Screw |

| By End Use | Plastic Industries, Rubber Industries, Food Industries, Building & Construction, Others (Pharmaceutical Processing, Recycling Plants, Composite Materials) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Eaton Corporation plc, ITT Inc., Parker Hannifin Corporation, Flowserve Corporation, Graco Inc., Rotork plc, Rotomac International Limited, Schlumberger Limited, Cameron International Corporation, Weir Group plc, Metso Corporation |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

With respect to extruder type, it is classified into single screws and twin screws.

In terms of end-use, it is divided into plastic industries, rubber industries, food industries, building & construction, and others.

In terms of region, it is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

The market is expected to reach USD 16.1 billion by 2035.

Twin screw extruders lead with a 65% market share due to better mixing and efficiency.

The building and construction sector is the largest end-user, holding a 55% market share in 2025.

The market is projected to grow at a CAGR of 4.4% during this period.

Germany is the fastest-growing country with a projected CAGR of 4.8%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Pipe Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Pipetting Robots Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Safety Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipette Tips Market Size and Share Forecast Outlook 2025 to 2035

Pipette Controller Market – Trends & Forecast 2025 to 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Pipe Flange Market Analysis by Material Type, Facing, End-Use Industry, and Region through 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Pipe Marking Tapes Market Growth - Demand, Trends & Forecast 2024 to 2034

Pipe Wrapping Machines Market

Piperylene Market

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Gas Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA