The global piezoelectric sensors market is anticipated to expand significantly during the forecast period from 2025 to 2035, driven by broad applications across healthcare, automotive, aerospace, and industrial automation industries.

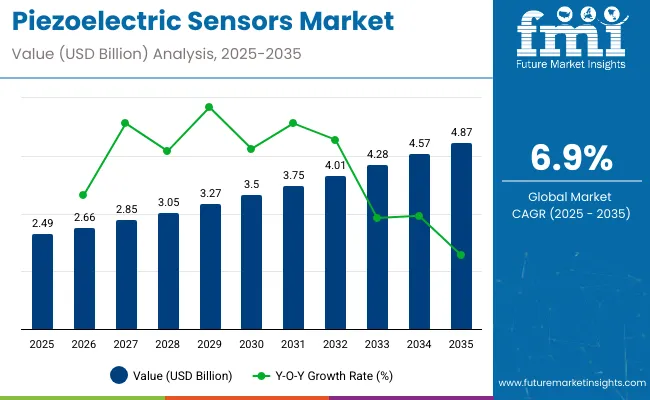

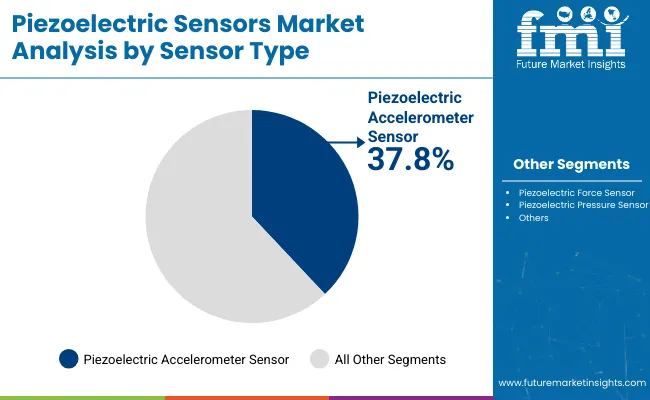

In 2025, the market is valued at USD 2.49 billion and is expected to nearly double by 2035, reaching USD 4.87 billion, registering a CAGR of 6.9%. The dominance of piezoelectric accelerometer sensors is notable, capturing approximately 37.8% of the market value in 2025. This segment’s importance stems from its critical role in vibration monitoring, structural health diagnostics, and precision sensing.

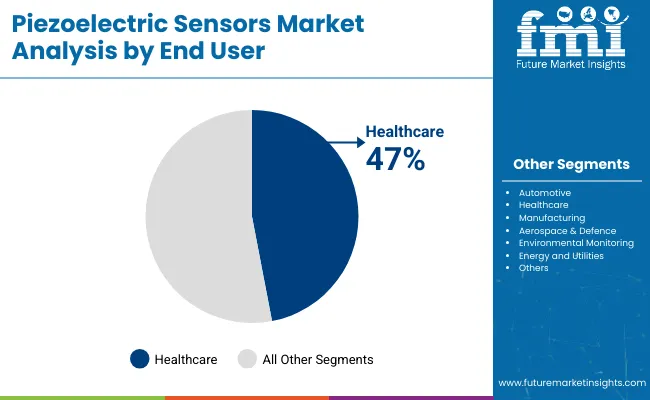

The healthcare end-user segment is projected to be the fastest-growing, with a CAGR of 7.6% over the forecast period. Increasing demand for wearable health monitoring devices, diagnostic tools, and patient management systems leveraging piezoelectric sensor technology significantly fuels this growth. Beyond healthcare, rising industrial automation and IoT adoption propel the market forward by enabling real-time sensing, data collection, and predictive maintenance.

Technological innovations such as sensor miniaturization, improved sensitivity, and enhanced integration with AI and cloud platforms are facilitating expanded applications and better accuracy. Additionally, regulatory requirements for environmental monitoring and industrial safety support wider adoption across sectors. The market is also witnessing consolidation, exemplified by major industry moves to strengthen capabilities and geographic reach.

A key recent development was the acquisition of Piezocryst Advanced Sensorics GmbH by Spectris plc in September 2024 for €133.5 million. Piezocryst specializes in advanced piezoelectric sensors for aerospace and structural health monitoring applications. This acquisition enhances Spectris’ portfolio and underlines the strategic emphasis on innovation and expanding sectoral coverage.

| Attributes | Key Insights |

|---|---|

| Market Size (2025E) | USD 2.49 billion |

| Market Size (2035F) | USD 4.87 billion |

| Value-based CAGR (2025 to 2035) | 6.9% |

The piezoelectric sensor market has seen significant innovation with the integration of smart technologies such as advanced signal processing, wireless connectivity, and AI-based diagnostics. Several leading companies are pioneering the use of these technologies to enhance sensor accuracy, reliability, and application versatility.

Government regulations in the piezoelectric sensors market focus on ensuring safety, environmental compliance, and performance standards, particularly because these sensors are used in critical sectors such as healthcare, automotive, aerospace, and industrial automation.

The below table presents the expected CAGR for the global piezoelectric sensors market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 5.5%, followed by a slightly higher growth rate of 5.8% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 5.5% (2024 to 2034) |

| H2, 2024 | 5.8% (2024 to 2034) |

| H1, 2025 | 6.4% (2025 to 2035) |

| H2, 2025 | 6.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 6.9% in the first half and remain relatively moderate at 6.4% in the second half. In the first half H1 the market witnessed a decrease of 40 BPS while in the second half H2, the market witnessed an increase of 50 BPS.

In 2025, the Piezoelectric Accelerometer Sensor segment will dominate the Piezoelectric Sensors Market with a 37.8% market share, driven by its extensive applications in vibration monitoring and shock detection. The healthcare end-user segment is expected to grow rapidly, fueled by demand for medical imaging and wearable devices.

The Piezoelectric Accelerometer Sensor segment commands a dominant 37.8% market share in 2025 within the Piezoelectric Sensors Market. This leadership is attributed to its widespread use in vibration monitoring, shock detection, and structural health monitoring across diverse industries including automotive, aerospace, industrial machinery, and defense.

Key advantages such as high sensitivity, durability, and broad frequency response enable its application in predictive maintenance in smart factories, aircraft engine monitoring, and seismic activity detection. The rise of IoT-based condition monitoring and real-time vibration analysis solutions further bolster this segment’s demand. Additionally, advancements in miniaturization and wireless connectivity enhance applicability in sectors like robotics and medical diagnostics.

Leading manufacturers focus on enhancing sensor performance to meet evolving industrial and technological requirements. This ensures the piezoelectric accelerometer sensor retains its pivotal role as a reliable solution for critical vibration and shock sensing applications globally.

The healthcare segment in the Piezoelectric Sensors Market is projected to grow at a CAGR of 7.6% from 2025 to 2035, driven by the increasing adoption of piezoelectric sensors in medical imaging, diagnostics, and wearable health devices. In 2025, healthcare accounts for a substantial and growing share of sensor end-use.

Piezoelectric sensors are integral to ultrasound imaging, electronic stethoscopes, respiratory monitors, and blood pressure measurement devices due to their precision and real-time data acquisition capabilities. The rising focus on non-invasive diagnostics, telehealth, and remote patient monitoring accelerates demand in this sector.

Innovations in miniaturized piezoelectric sensors for wearable ECG, continuous glucose monitoring, and smart prosthetics expand their healthcare applications. The convergence of AI with medical devices utilizing piezoelectric technology further drives growth, positioning these sensors as crucial components in the digital healthcare transformation and personalized medicine.

The new trend has been industrial automation, smart factories, and IoT-based predictive maintenance solution. But, the growing awareness about the industrial automation and smart factories would greatly augment the piezoelectric sensors market. Advanced sensor-based monitoring systems are being deployed across multiple industries, including automotive, manufacturing, aerospace, oil & gas, to enhance operational efficiency while minimizing instances of unplanned downtime.

Piezoelectric sensors are the key components that monitor real-time conditions, analyze the vibrations, and check the faults of machinery to maintain smooth operation in industries. Along with Industry 4.0 comes AI-paced predictive analytics which manufacturers are pairing with these sensors to enhance production quality and streamline maintenance schedules. The growing adoption of wireless and remote monitoring solutions is anticipated to drive the demand for compact, power-efficient, and high-performance piezoelectric sensors for a range of industrial applications.

One of the key driving forces for the market worldwide is the use and adopted piezoelectric sensors more in the healthcare sector, due to its application in ultrasound imaging/ultrasonography, wearable medical devices, diagnostic devices. Aging population, an increasing prevalence of chronic diseases, technological advancements in medical diagnostics, high-performance, and advanced piezoelectric sensors are boosting the demand for well-advanced piezoelectric sensors market globally.

Such sensors are extensively used in non-invasive diagnostic imaging, blood pressure monitoring and respiratory monitoring systems owing to their ability to provide accurate and real-time data. The inclusion of miniaturized wearable health monitoring devices has increased the demand for piezoelectric sensors, as they are utilized to continuously monitor patients, and provide effective diagnoses and preventions of diseases.

The demand for innovative piezoelectric sensor technologies is expected to grow as new smart healthcare solutions are being developed in response to trends towards telemedicine and remote healthcare services.

The automobile is also a pivotal growth area for piezoelectric sensors due to increasing use of Advanced Driver Assistance Systems (ADAS), electric vehicles (EVs), and safety monitoring systems. Such sensors find extensive applications in airbag deployment systems, tire pressure monitoring, engine knock detection, and structural health monitoring of the vehicle components.

Piezoelectric sensors will also see growing adoption rates, as EVs require robust monitoring solutions for battery management systems, enabling maximum energy efficiency and vehicle safety and driving the demand for such sensors. In addition, increasing government regulations related to vehicular safety, emission, and fuel efficiency are propelling the automotive players to integrate high precision sensors, for a better performance of the vehicle.

With the increased development of connected and autonomous vehicle technologies, the market for dependable and durable sensor solutions will remain the key growth factor.

Although the piezoelectric sensors market has many advantages, it has issues with signal drift, environmental sensitivity, and performance degradation over time. However, such sensors are also sensitive to temperature variation, humidity, ageing, and mechanical stress which, limits the signal quality and lifetime. Thanks to extreme conditions, sensor output can drift over time, requiring frequent recalibrating or replacement, depending on the system or environment it’s used in.

However, piezoelectric sensors may face signal interference and noise issues if they are used for high-frequency applications, limiting their use for some critical applications such as aerospace and defense. Overcoming these challenges will either require significant developments in sensor materials, coatings, and packaging technologies or event additional market segment-specific research and development efforts that not only increase the R&D burden on manufacturers but also make it an unviable opportunity for the mass adoption in use cases on an industry basis.

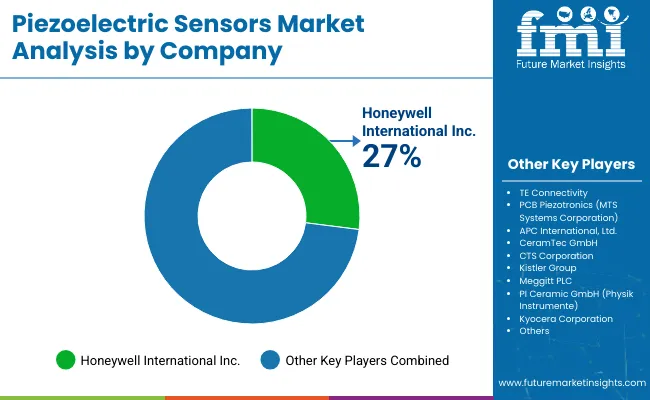

In Tier 1 category of Players, TE Connectivity, Honeywell International Inc., PCB Piezotronics (MTS Systems Corporation) are the main key market players with a large market share of the piezoelectric sensors market. High R&D capabilities, a diversified product portfolio, and a robust global distribution network are key strengths of these companies, catering to diverse industries such as aerospace, automotive, industrial automation, healthcare, and telecommunications.

Their unique competence in embedding cutting-edge AI analytics, IoT connectivity and miniature sensor solutions renders them the ideal selection for high-accuracy applications. In addition, these players have strong partnerships with OEMs and large enterprises to promote large-scale adoption of piezoelectric sensing technology.

Tier 2 players are APC International, Ltd., CeramTec GmbH, and CTS Corporation that target specialty applications, custom piezoelectric materials and tailored sensing solutions for markets such as medical imaging, defense and structural health monitoring. These companies have a robust regional presence in North America and Europe, where the demand for high-performance piezoelectric components is on the rise.

Although they may not possess the same scale as Tier 1 companies, their technological expertise, innovation in piezoelectric ceramics and application-specific sensor development are key players in the market.

In Tier 3 lies Kistler Group, Meggitt PLC, PI Ceramic GmbH (Physik Instrumente), and Kyocera Corporation-these companies target developing applications, research advanced piezoelectric materials, and develop custom solutions for wearables, energy harvesting and next-gen automotive applications.

Due to their investment in R&D for flexible, miniaturized, and bio-compatible piezoelectric sensors, these companies are future challengers in the market. They rely on their specialized products, bespoke solutions and alliances with universities and research institutes to develop next-generation piezoelectric sensing technology.

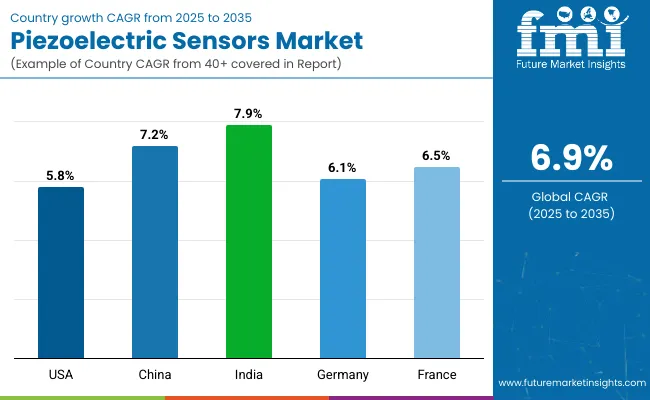

The section below covers the industry analysis for the Piezoelectric Sensors market for different countries. The market demand analysis on key countries in several countries of the world, including USA, Italy, France, China and India is provided.

The united states is anticipated to remain at the forefront in North America, with a value share of 62.9% in 2024. In East Asia, China is projected to witness a CAGR of 6.9% by 2034.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

| China | 7.2% |

| India | 7.9% |

| Germany | 6.1% |

| France | 6.5% |

North America dominated the piezoelectric sensors market in 2017, and this trend is projected to continue during the forecast period; This can be attributed to the high demand for piezoelectric sensors in aerospace & defense, automotive, healthcare, and industrial automation industries in the region. The presence of prominent defense and aerospace manufacturers such as Lockheed Martin, Boeing and Raytheon acts as a vital growth factor, as piezoelectric sensors find wide applications in structural health monitoring, vibration analysis and guided missile technology.

Industries such as oil & gas, automotive, and manufacturing, are rapidly including smart factories and predictive maintenance solutions thus driving sensor acceptance. Furthermore, with a demand within America for ultrasound imaging, wearable health monitors, and diagnostic equipment with piezoelectric sensing capable of generating high clarity images, America is a key player in medical device innovations.

The increasing deployment of 5G networks and the adoption of IoT-enabled industrial solutions are also expected to drive demand for high-performance piezoelectric sensors. Government investments in renewable energy and advanced robotics and continued R&D in miniaturized and AI-driven sensor technologies are likely to continue fueling long-term market growth in the region.

Japan is a prominent piezoelectric sensor market, largely due to its leadership in consumer electronics, robotics, automotive, and industrial automation. Demand has also been boosted by the presence of global technology giants, including Sony, Panasonic and Murata Manufacturing, who integrate advanced sensors into their devices.

The firm also ranks amongst the internationals leaders for robotics and factory automation with piezoelectric sensors being used extensively for precision motion control, vibration detection, and real-time feedback mechanisms by such automation giants as Fanuc, Yaskawa and Omron. In the automotive sector, Japanese carmakers leading in these sensors are incorporating them into electric vehicles (EVs), hybrid vehicles, and ADAS (Advanced Driver Aids) to improve vehicle safety and efficiency.

Moreover, high-precision piezoelectric sensors are increasingly utilized in environmental monitoring applications, security systems, and intelligent traffic management, supported by Japan's efforts for smart cities and IoT infrastructure.

As an emerging market, India is witnessing rapid growth in the piezoelectric sensors market, driven by factors such as industrial automation, the expansion of IoT-enabled manufacturing, and increasing investments in healthcare infrastructure. The Make in India initiative has spurred local manufacturing across key industries like automotive, consumer electronics, and telecommunications, creating strong demand for advanced sensing solutions.

With the rise of Industry 4.0 and smart factory adoption, manufacturers are integrating real-time vibration monitoring and predictive maintenance solutions, where piezoelectric sensors play a crucial role. Additionally, the country’s expanding EV ecosystem, supported by initiatives from major automakers like Tata Motors, Mahindra, and Ola Electric, is driving the need for battery monitoring and vehicle safety sensors.

The healthcare sector is also a significant contributor, with growing adoption of medical imaging devices, wearable health monitors, and point-of-care diagnostic equipment. Furthermore, India's telecom revolution, fueled by 5G deployment and smart city projects, is increasing demand for sensors in infrastructure monitoring, network security, and real-time tracking applications. As local production capacity and R&D investments continue to rise, India is poised to become a key player in the global piezoelectric sensors market in the coming years.

The Piezoelectric Sensors Market is fragmented in nature where regional and global players are competing to gain the largest Piezoelectric Sensors Market share. Market share analysis of some of the major companies in Market is as follows - TE Connectivity, Honeywell International, PCB Piezotronics. Most companies have a broad product portfolio, high investments in R&D and distribution, and strong presence beyond regional boundaries.

The mid-sized players like CeramTec GmbH, CTS Corporation, and APC International focus on niche applications and tailored piezoelectric materials. Startups are utilizing AI, IoT and miniaturized sensor technologies to create next-gen flexible and wireless piezoelectric sensors. To emerge as a strong contender in the market, companies in healthcare, automotive, and industrial automation sectors are seeking mergers, acquisitions, and collaborations to strengthen their technological portfolio and broaden their reach.

| Attribute | Details |

|---|---|

| Market Size (2025E) | USD 2.49 billion |

| Market Size (2035F) | USD 4.87 billion |

| CAGR (2025 to 2035) | 6.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data | 2018 to 2024 |

| Base Year | 2024 |

| Quantitative Units | Value in USD billion, Volume in Number of Units Sold/Installed Sensors |

| Segments Covered | Sensors Type, Sales Channel, End Users, Region |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, UK, France, Italy, Spain, Poland, Russia, China, Japan, India, South Korea, Australia, UAE, Saudi Arabia, South Africa, Israel |

| By Sensors Type | Piezoelectric Force Sensor, Piezoelectric Accelerometer Sensor, Piezoelectric Pressure Sensor, Others |

| By Sales Channel | Direct Sales, Channel Sales |

| By End Users | Automotive, Healthcare, Manufacturing, Aerospace & Defence, Environmental Monitoring, Energy and Utilities, Others |

| Key Companies Profiled | Central Electronics Limited, CTS Corporation, Honeywell International Inc., Hottinger Brüel & Kjær (HBK), KEMET Corporation, Kistler Group, Microchip Technology Inc, Mide Technology, Parker Hannifin Corporation, Physik Instrumente (PI) GmbH & Co. KG, Piezomechanik GmbH, Rion Co., LTD, TDK Corporation, TE Connectivity |

| Additional Attributes | What would manufacturers or suppliers in the Piezoelectric Sensors Market want to know? Include dollar sales, market share, adoption by end-use industries, and regional growth trends in 200-250 characters. Answer: Market size by sensor type and sales channel, regional market shares, adoption rates in automotive and healthcare, growth trends in emerging economies, and technological advancements impact. |

In terms of Sensors Type, the is divided into Piezoelectric Force Sensor, Piezoelectric Accelerometer Sensor, Piezoelectric Pressure Sensor and Others.

In terms of Sales Channel, the is segregated into Direct Sales and Channel Sales.

The End Users is classified by industries as Automotive, Healthcare, Manufacturing, Aerospace & Defence, Environmental Monitoring, Energy and Utilities and Other Industry.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global Piezoelectric Sensors industry is projected to witness CAGR of 6.9% between 2025 and 2035.

The global Piezoelectric Sensors industry stood at USD 2.49 billion in 2025.

The global Piezoelectric Sensors industry is anticipated to reach USD 4.87 billion by 2035 end.

East Asia is set to record the highest CAGR of 7.2% in the assessment period.

The key players operating in the global Piezoelectric Sensors industry include Conduent, Inc., Athenahealth, Dimagi, Inc. (Commcare), Medic, DHIS2 and Viamo.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breaking Down Market Share in Piezoelectric Sensors Manufacturing

Piezoelectric Devices Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Materials Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Polymers Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Accelerometer Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Ceramics Market Analysis by Type, Application and Region: Forecast for 2025 to 2035

Dental Piezoelectric Ultrasonic Unit Market Trends and Forecast 2025 to 2035

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

KNN Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

BNT Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Weft Sensors Market - Size, Share, and Forecast Outlook 2025 to 2035

ADAS Sensors Market Growth - Trends & Forecast 2025 to 2035

PM2.5 Sensors for Home Appliances Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA