The pickling chemicals market is projected to gain steady growth in the years head with rising demand from metal processing domain coupled with advancements in chemical formulations and growing importance of surface treatment processes. The pickling chemical used to remove metal impurities, rust and scale from the metallic surface, which improve the performance and durability of the components.

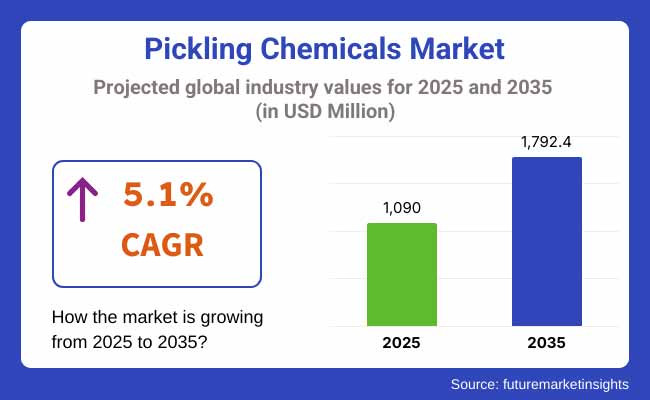

The growth of industries like automotive, construction and manufacturing has directly led to a higher demand for high-quality metal components, riding on which, there has been an upsurge in the demand for efficient pickling solutions. Spotify Market Outlook: Market to grow at a 5.1% CAGR, USD 1,792.4 Million by 2035 from USD 1,090 Million in 2025.

The North American market has the largest share due to a strong industrial base and leading automobile and aerospace industries. As a region that values technological advancements and sustainable practices, the industry is witnessing an emerging trend towards eco-friendly pickling solutions like acid-free and neutral pH alternatives.

And this trend is particularly true for the USA and Canada, where companies invest heavily in advanced acid recovery, metal surface treatment, and stripping systems to meet ever more stringent environmental regulations. Also, surge in demand for high-strength steel and lightweight alloys in defense, aviation, and transportation industries is curtailing the market growth.

Europe is expected to record sluggish growth in the pickling chemicals market, primarily driven by stringent environment regulations as well as high quality metal finishing practices. Leading nations like Germany, France, and UK, among others lead the way with industries moving towards sustainable and efficient pickling to meet regulatory standards [REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals)] Please fill in the form below:

The demand for pickling chemicals is also being driven by the well-established automotive, machinery, and metal fabrication industries in the region. Also, the introduction of acid regeneration plants and closed-loop pickling systems is increasing, which minimizes chemical waste and cost efficiency.

The Asia-Pacific region is projected to grow at the highest revenue share of USD 38% owing to rapid industrialization and significant growth of manufacturing activities. Demand for pickling chemicals is increasing in countries like China, India, and Japan, where the automotive, construction, and electronics industries are on the advanced rise.

The robust steel production industry in the region, combined with increasing investments in infrastructure projects, has driven the demand for efficient metal treatment solutions. Moreover, the supportive government initiatives for the domestic manufacturing and industrial growth are further propelling the advanced pickling methods adoption. The region's growth is also driven by rising awareness of sustainable practices as well as the transition towards low-toxicity and acid-recycling systems.

Challenges

Stringent Environmental Regulations, Corrosive Nature, and Waste Disposal Issues

These are some factors accounting for the restraints in the pickling chemicals market as acid-based pickling solution disposal is closely regulated in major regions, under zero liquid discharge (ZLD) policies and chemical safety standards, making it difficult for the manufacturers operating in the pickling chemicals market to find a solution. The strongly corrosive disposition of pickling chemicals (like hydrochloric acid, sulfuric acid, and nitric acid) results in them requiring special handling, storage, and safety precautions, that can also drive up costs in terms of operational costs. Moreover, the disposal and treatment of acidic effluents and heavy metal residues pose issues to manufacturers in terms of compliance.

Opportunities

Growth in Steel Manufacturing, Eco-Friendly Pickling Solutions, and Automated Pickling Technologies

Nonetheless, the market is growing with growing demand for premium metal finishing in steel production, auto manufacturing, and aerospace sectors. To address some of these environmental concerns, eco-friendly pickling solutions including biodegradable and organic acid-based formulations are gaining traction Moreover, automated pickling system and acid recovery technology are increasingly adopted in metal processing industry to save energy, decrease chemical waste, get higher efficiency, and improve the safety of workers.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with chemical safety and wastewater disposal regulations. |

| Consumer Trends | Increased demand for acid-based pickling in steel and automotive industries. |

| Industry Adoption | Used primarily in steel processing, galvanizing, and metal fabrication. |

| Supply Chain and Sourcing | Dependence on mineral acid-based pickling solutions. |

| Market Competition | Dominated by chemical manufacturers and industrial acid suppliers. |

| Market Growth Drivers | Increased demand for corrosion-resistant steel, efficient metal surface treatment, and industrial expansion. |

| Sustainability and Environmental Impact | Early phase of acid recovery and waste treatment initiatives. |

| Integration of Smart Technologies | Introduction of automated acid dosing and chemical monitoring systems. |

| Advancements in Pickling Technology | Development of low-fume acid formulations and inhibitor-enhanced pickling solutions. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter acid recovery mandates, eco-friendly pickling chemicals, and ZLD enforcement. |

| Consumer Trends | Growth in bio-based and non-toxic pickling solutions for sustainable manufacturing. |

| Industry Adoption | Increased adoption in renewable energy infrastructure, EV manufacturing, and precision metal finishing. |

| Supply Chain and Sourcing | Shift toward green chemistry, acid regeneration, and non-hazardous pickling chemicals. |

| Market Competition | Entry of eco-friendly chemical firms, acid recycling solution providers, and AI-driven automation companies. |

| Market Growth Drivers | Accelerated by smart pickling systems, AI-powered quality control, and biodegradable chemical alternatives. |

| Sustainability and Environmental Impact | Large-scale shift toward zero-waste pickling, energy-efficient processing, and green pickling alternatives. |

| Integration of Smart Technologies | Expansion into AI-powered corrosion detection, self-optimizing acid baths, and real-time process analytics. |

| Advancements in Pickling Technology | Evolution toward electrochemical pickling, dry pickling processes, and sustainable acid replacements. |

Diversifying steel production, growing need for anti-corrosive coatings, and stringent pollution control acts on industrial waste management are the main factors that drive the USA pickling chemicals market. The growth of acid recovery systems and closed-loop pickling processes is powering sustainability in the industry. Further, increasing investment on renewable energy infrastructure and electric vehicle (EV) production is driving demand for advanced pickling solutions during high-precision metal finishing.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

The UK market is expanding steadily due to stringent environmental regulations on chemical processing, increasing demand for precise metal finishing, and growing infrastructure development projects. The industry is also driven by the adoption of green pickling technologies and acid recovery systems, with manufacturers investing in low-emission and biodegradable pickling solutions. Moreover, vehicles need high-performance metal cleaning and corrosion resistance coatings, the factors driving requirements for automotive and aerospace industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.0% |

Stringent REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, rising investment in eco-friendly chemical processing as well as the expansion of the steel and automotive sectors are driving the market for Europe’s pickling chemicals. Germany, France, and Italy are among the top countries in recent advances in acid-free pickling alternatives and advanced surface treatment solutions. This interest in sustainable manufacturing and corrosion-resistant materials is driving innovation in biodegradable and benign pickling solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.1% |

The factors that may drive the Japan pickling chemicals market are increasing requirement for high-precision metal finishing, growing investments in advanced manufacturing technologies, and stringent industrial safety standards. The country’s automotive and electronics industries are on the cutting edge of switching to eco-friendly pickling solutions. Moreover, Nanotechnology-based Corrosion Protection & Smart Pickling Process Automation Research will be leading innovation in the sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

Strong industrial infrastructure, growing demand for steel and coated metals, and rising strict government regulations regarding disposal of hazardous chemicals are expected to make South Korea a key market for pickling chemicals. Demand for advanced metal cleaning solutions is spurred by the expansion of electric vehicle (EV) manufacturing, semiconductor fabrication, and clean energy project. Also, in the industry AI-assisted monitoring of the acid bath efficiency is emerging.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The pickling chemicals market is segmented on the basis of product type which includes the aqueous solution, paste/gel, pickling powder, and others. Such segments are very important for quality improvement of metal, improving corrosion resistant coatings, and so on, on account of these industries dealing with metals, and metallurgical related products.

Water-based pickling chemicals have gained popularity as the leading segment in the market, enabling large-scale metal surface treatment for both continuous and batch pickling processes. Mechanically, aqueous formulations are advantageous over paste or gel based pickling formulations as they penetrate uniformly and effectively remove the oxides, which make them highly suitable for industrial applications.Moreover, rising demand for greener acid-based and sustainable aqueous pickling solutions such as hydrochloric acid, sulfuric acid, and organic acid-based solutions are also contributing to market growth. More than 65% of all metal processing plants use aqueous pickling solutions due to their efficiency and low costs for scale and rust removal.

The market is further driven with the growing penetration of automated and continuous pickling lines, applied across high-speed treatment processes based on aqueous solution, which results in better surface finish along with minimized processing times in steel and metallurgical processes.Adoption has also been further enhanced, with real-time acid concentration tracking, automated chemical dosing, and predictive maintenance for pickling baths more easily accomplished, given the integration with AI-powered process/asset monitoring.

Low fume alternatives to pickling acids, biodegradable inhibitors and acid regeneration technologies are among the innovations creating optimized market opportunities for eco-friendly aqueous pickling solutions, leveraging regulatory compliance and sustainability initiatives.

While this segment benefits from the aqueous solution advantages related to large-scale processing, high efficiency, and low-cost operation; it also faces challenges related to increased wastewater treatment cost, environmental compliance in mining and manufacturing, and potential hydrogen embrittlement of metals. Innovations in acid recycling systems, AI-assisted optimization of baths, and non-toxic pickling alternatives are making these systems more sustainable, thus allowing for continued market growth in aqueous pickling chemical applications.

Paste and gel form pickling agents have achieved robust market adoption, especially in specialized and precision metal treatment uses, as industries favor localized pickling for complicated shapes and localized removal of oxides. Lower local clearances misplace acid and generate material waste; paste and gel dosing offers more controlled application and reduces aqueous runoff.

Which is further enhancing market adoption with increasing need for precision pickling including paste-based localized treatments, brush-applied gel formulations and thixotropic acid compounds. Over 50% of stainless steel finishing and high-precision metal industries are using paste or gel-based pickling chemicals for controlled oxide removal and aesthetic surface finishing according to studies.

The upsurge of customized metal finishing applications, including pickling paste for weld seam cleaning, corrosion-resistant surface preparation and post-fabrication treatments, is poised to reinforce market growth, providing higher quality control in premium metal processing.The combined effects of greater application precision with AI maturing application accuracy with integrated automated robotic pickling gel dispensers, real-time acid exposure control, and viscosity-based modulation have increased adoption, too, as have growing social incentives around chemical use footprint.

The introduction of environmentally friendly and low-fume pickling paste with reduced acid vapor emissions, along with acid-neutralizing composites and water-soluble gel formulations, has contributed to the growth of the market by promoting worker safety and compliance with regulations.

While it offers benefits such as more targeted pickling, less acid runoff, and improved ability to control the surface with an acid, the paste or gel portion of the market faces obstacles like longer application time needed, less ability to scale up for high-through channels, and more labor-intensive steps physically required to bring product to the surface. But new developments, such as automated application systems, AI-assisted acid gel penetration control, and biodegradable paste formulations, are driving efficiency and enabling the continued expansion of localized and specialty pickling applications.

As manufacturers and recyclers increasingly use pickling chemicals to improve surface quality, remove oxidation, and enhance downstream processing efficiency, the steel and metallurgy and steel and metal recycling segments represent key motivators of market expansion.Industries accounted for the most demand in metal machining market was steel and metallurgy owing to increase in the processing of metal at a larger scale. As steel manufacturers increasingly focus on surface preparation techniques to ensure steel excellence in their production, pickling chemicals have become one of the significant consumers in the steel and metallurgy sector. Pickled steel has better paint adhesion, corrosion resistance, and mechanical properties than untreated steel surfaces.

Continuous pickling lines (CP) using high-speed aqueous solution-based acid treatment processes have been popularized with increased market adoption. Research shows that more than 60 % steel processing plants including pickling treatment process in the processing of sheet metal and coil.

The introduction of advanced high-strength steel (AHSS) and production of automotive-grade steel with optimized pickling processes for enhanced adhesion & surface uniformity further spurred up market growth and assured the wider industry application in high-performance metal industry.

AI-assisted bath monitoring with automated acid concentration balancing, corrosion rate prediction, and real-time oxide layer detection capabilities has also increased adoption by improving process efficiency along with reducing chemical wastage.

Eco-efficient pickling technologies with acid regeneration systems, fume extraction units, low-temperature acid formulations and so on have developed to optimize market growth in that regards, providing better compliance with environment and worker safety standards.

While large-scale processing, improved metal surface properties, and high production efficiency are the strengths of the steel and metallurgy segment, high acid consumption, stringent wastewater treatment regulations, and more operational pain points due to acid disposal limits its market growth. That said, though, acid recycling technology, AI-driven process automation, and sustainable pickling alternatives are driving enhanced efficiencies, enabling steel and metallurgy applications to continue growing.

With recyclers placing heavy dependence on pickling chemicals to efficiently clean rust, oxidation, and contaminants from reclaimed metal surfaces, steel and metal recycling has achieved excellent market adoption with scrap metal refiners and secondary metal processors. In contrast, primary steel making involves intensive surface treatment for metal recycling to improve metal quality and usability in manufacturing.

Market adoption has been driven primarily by the growing demand for high-purity recycled metals with pre-treatment pickling baths, acid-based rust removal solutions, and oxide-reducing surface treatments. More than 55% of recycled steel processing facilities use pickling chemicals to improve the recovery rate of metal and comply with industry standards, according to studies.

The market growth has been bolstered by the proliferation of circular economy initiatives, including acid-regenerated pickling solutions, closed-loop chemical recycling systems, and sustainable scrap-metal processing processes, which ensure enhanced environmental sustainability.AI-powered recycling process optimization which includes real-time contamination detection, automated acid dosing, and predictive metal surface analysis has only encouraged the adoption with higher efficiency and less material loss.

The introduction of low-impact pickling solutions, incorporating alternatives like bio-acids, non-toxic corrosion inhibitors, and low waste acid neutralization systems is driving the market growth in terms of enhanced environmental compliance and workplace safety.

The steel and metal recycling segment seeks a strong competitive advantage in terms of metal recovery, improvement of surface purity, and usability of scrap metals, although factors such as increased acid disposal costs, chemical exposure risks, and environmental compliance are likely to hamper the growth of the market. Innovations in aspects like AI-driven waste minimization, alternate formulations for acids and automated acid recovery systems are improving feasibility, ultimately strengthening the growth of metal recycling pickling applications.

Demand for treatment of metal surfaces across industries such as automotive, aerospace and manufacturing is expected to drive the growth of the pickling chemicals market. The ideal way of removing rust and scale, along with artificial intelligence powered chemical process analysis, molding the industry, even more.

The demand for sustainable and biodegradable pickling solutions is also driving market growth, as environmental regulations encourage their use. Major Surge in Focus on AI-assisted Acid Concentration Control, Sustainable Chemical Formulations to Combat Corrosion Key participants are specialty chemical producers, metal treatment solution providers and industrial cleaning companies engaged in the development of advanced, safe, and efficient pickling chemicals.

Market Share Analysis by Key Players & Pickling Chemical Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| Henkel AG & Co. KGaA | 14-18% |

| The Sherwin-Williams Company | 12-16% |

| Solvay S.A. | 8-12% |

| Quaker Houghton | 6-10% |

| Other Pickling Chemical Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops AI-powered pickling process optimization, eco-friendly acid formulations, and high-performance corrosion inhibitors. |

| Henkel AG & Co. KGaA | Specializes in AI-driven surface treatment solutions, advanced rust removal technologies, and sustainable pickling chemicals. |

| The Sherwin-Williams Company | Focuses on AI-enhanced industrial cleaning solutions, high-strength metal pickling acids, and corrosion-resistant coatings. |

| Solvay S.A. | Provides AI-optimized acid recovery systems, biodegradable pickling solutions, and high-purity metal surface treatment chemicals. |

| Quaker Houghton | Offers AI-assisted pickling bath monitoring, sustainable metal treatment solutions, and industrial acid management systems. |

Key Market Insights

BASF SE (18-22%)

BASF leads in AI-powered pickling process enhancements, developing high-efficiency acid solutions, sustainable corrosion inhibitors, and eco-friendly metal treatment chemicals.

Henkel AG & Co. KGaA (14-18%)

Henkel specializes in AI-driven surface treatment formulations, offering biodegradable pickling chemicals and precision metal cleaning technologies.

The Sherwin-Williams Company (12-16%)

Sherwin-Williams provides AI-optimized industrial pickling solutions, focusing on high-performance rust removal, acid stability, and advanced surface preparation.

Solvay S.A. (8-12%)

Solvay integrates AI-powered acid recovery systems, offering eco-friendly metal treatment chemicals with advanced corrosion resistance properties.

Quaker Houghton (6-10%)

Quaker Houghton focuses on AI-assisted pickling bath management, delivering sustainable pickling solutions with enhanced chemical efficiency and reduced environmental impact.

Other Key Players (30-40% Combined)

Several specialty chemical manufacturers, industrial cleaning solution providers, and metal treatment firms contribute to next-generation pickling chemical innovations, AI-enhanced acid process monitoring, and sustainable corrosion control. Key contributors include:

The overall market size for the pickling chemicals market was USD 1,090 Million in 2025.

The pickling chemicals market is expected to reach USD 1,792.4 Million in 2035.

The demand for pickling chemicals is rising due to increasing steel and metal processing activities, growing demand for surface treatment solutions, and advancements in chemical formulations. The expansion of the automotive, construction, and manufacturing sectors is further driving market growth.

The top 5 countries driving the development of the pickling chemicals market are the USA, China, Germany, Japan, and India.

Aqueous Solution and Paste/Gel Forms are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

Oxo Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fluorochemicals Market Size and Share Forecast Outlook 2025 to 2035

Paper Chemicals Market Growth – Trends & Forecast 2023-2033

Leather Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Roofing Chemicals Market Size & Trends 2025 to 2035

Sulphur Chemicals Market

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Membrane Chemicals Market Growth - Trends & Forecast 2025 to 2035

Aluminum Chemicals Market Growth & Demand 2025 to 2035

Oilfield Chemicals Market Report - Growth, Demand & Forecast 2025 to 2035

Polishing Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oral Care Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Precision Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA