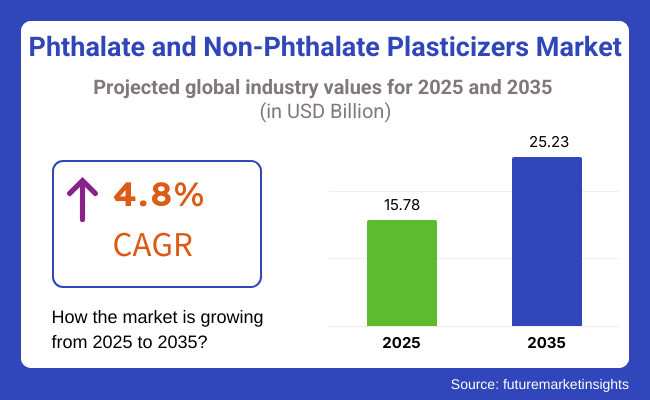

The phthalate and non-phthalate plasticizers market is anticipated to be valued at USD 15.78 billion in 2025. It is expected to grow at a CAGR of 4.8% during the forecast period and reach a value of USD 25.23 billion in 2035.

The phthalate and non-phthalate plasticizers industry grew steadily worldwide in 2024, primarily owing to increasing demand for flexible PVC products in the automotive, construction, and medical sectors.

The transition toward non-phthalate plasticizers gained considerable momentum due to stringent regulations and increasing consumer sensitivity to health risks posed by traditional phthalates. This was seen more evidently in North America and Europe, where numerous regulatory agencies have implemented bans on specific phthalates for applications in food packaging and medical purposes.

In addition to stricter regulations, the industry saw an increase in the utilization of bio-based plasticizers, fueled by producers investing in eco-friendly as well as non-toxic alternatives from renewable resources such as vegetable oils and citrates.

The Asia-Pacific region, primarily China and India, continued to dominate owing to high PVC output and infrastructure development. However, manufacturers were hindered by volatile raw material prices, affecting production stability and pricing strategies.

By 2025, there will be continuous regulatory pressure on the industry for non-phthalate plasticizers, stimulating innovative developments in the field of material science and triggering additional demand.

The increasing requirements for the light weighting of car components and for insulating materials will boost the development of the sector. Industry players will differentiate within evolving regulatory frameworks through strategic collaborations and innovative product offerings, both of which will drive growth.

Explore FMI!

Book a free demo

The major trends and challenges have been captured from an FMI survey among the most key stakeholders on the industry. A large majority of respondents has indicated an increasing pace in the shift to non-phthalate plasticizers due mainly due to regulatory pressures and consumer preferences leaning more toward safer, eco-friendly alternatives.

Of the manufacturers surveyed, 60% reported investing in new portfolios of bio-based plasticizers, driven by sustainability goals and regulatory compliance. It also established demand for automotive and construction sectors as a growth driver that would continue to draw on demand.

Among the weighty mentions with relative incidence are weight reduction and durability features in new vehicle designs and energy-efficient infrastructures- over 70% of the respondents. One of the application areas increasingly being used with non-phthalate plasticizers is medical and food packaging, where safety is paramount.

The cost of production and supply chain bottlenecks that bio-based alternatives face were remarked by stakeholders as being of concern. Another important takeaway from the survey was that adoption varies from one region to another.

Although Europe and North America are ahead of the curve when it comes to regulation-driven transitions, Asia-Pacific nonetheless boasts the largest consumption due to its strong PVC manufacturing base. Consumer education, along with stricter regulatory frameworks, could further catalyse the adoption of safer plasticizer options across regions.

The industry's continued evolution will require collaboration between manufacturers, regulators, and end-users to develop sustainable solutions. Stakeholders were also heard urging governments for policy incentives as well as technology advancements to make more of the green plasticizers cost-competitive with traditional alternatives. Companies proactive in the present tend to be better positioned to enjoy dividends in terms of competitive advantages as the years go by in the future.

Government regulations and safety standards are significantly reshaping the industry. Stricter policies on hazardous chemicals, especially in consumer goods, medical devices, and food packaging, are accelerating the transition to safer alternatives. Adhering to regional certifications is now crucial for manufacturers to sustain sector access and remain competitive.

| Countries/Region | Regulations & Certifications Impacting the Industry |

|---|---|

| United States | The Toxic Substances Control Act (TSCA) restricts certain phthalates in consumer products. The Consumer Product Safety Improvement Act (CPSIA) bans the use of specific phthalates in children's toys and childcare products. - FDA regulations limit phthalates in food packaging and medical devices. - Companies must comply with California Proposition 65, which mandates warnings for products containing harmful chemicals. |

| European Union | REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) strictly regulates phthalates like DEHP, DBP, and BBP. - EU Directive 2005/84/EC bans the use of certain phthalates in toys and childcare articles. - Food Contact Material (FCM) regulations limit the presence of phthalates in food packaging. - Mandatory CE certification for compliant products. |

| China | GB 9685 to 2016 national food safety standard restricts the use of certain phthalates in food packaging. - RoHS (Restriction of Hazardous Substances) regulations ban specific phthalates in electronics and electrical equipment. - China Compulsory Certification (CCC) is required for certain plasticized materials used in consumer goods. |

| India | BIS (Bureau of Indian Standards) regulations impose limits on phthalates in toys and childcare products. - Plastic Waste Management Rules encourage the shift toward non-phthalate and bio-based plasticizers. - FSSAI (Food Safety and Standards Authority of India) guidelines restrict phthalates in food contact materials. |

| Japan | Chemical Substances Control Law (CSCL) classifies certain phthalates as “Class I Specified Chemical Substances,” limiting their use. - JIS (Japanese Industrial Standards) compliance is required for safe plasticizer use in industrial applications. |

| South Korea | K-REACH (Korea’s version of REACH) regulates the use of specific phthalates in consumer and industrial applications. - The Food and Drug Safety Act restricts phthalates in food packaging and medical devices. - KC Certification is required to comply with safety standards. |

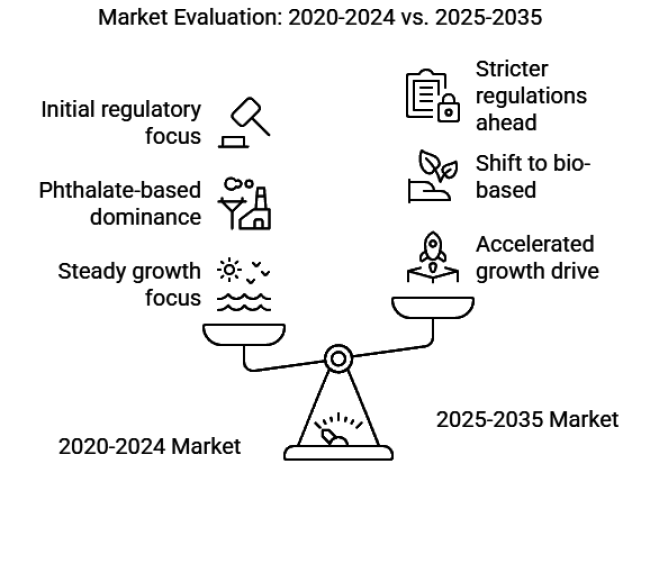

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady growth with increasing adoption in construction, automotive, and medical industries. | Accelerated growth is driven by rising demand for non-phthalate plasticizers and stricter environmental regulations. |

| Expanding the use of PVC products, rapid urbanization, and growing consumer goods sector. | Shift towards bio-based plasticizers, regulatory restrictions on phthalates, and increasing adoption in electric vehicles. |

| Stricter policies on certain phthalates, with bans in medical and food-contact applications. | Further tightening of regulations, increasing the preference for non-toxic, sustainable alternatives. |

| Focus on improving phthalate-based plasticizers for enhanced performance and lower toxicity. | Development of bio-based and high-performance plasticizers to meet evolving industry needs. |

| Cost advantages and widespread applications dominate phthalate plasticizers. | Non-phthalate plasticizers are expected to gain a larger share due to health and environmental concerns. |

| The construction and automotive sectors lead to high demand in North America, Europe, and Asia-Pacific. | Strong growth in Asia-Pacific, particularly China and India, fueled by infrastructure and industrial expansion. |

| Demand growth from developing regions, innovation in sustainable plasticizers, and emerging applications. | Expansion in green chemistry solutions, increasing demand for lightweight materials, and further regulatory-driven changes. |

The phthalate plasticizers segment will maintain its dominance, driven by a projected CAGR of 4.2% from 2025 to 2035. Dioctyl and diethylhexyl phthalate are widely used due to their cost-effectiveness and compatibility with PVC.

These plasticizers enhance flexibility, durability, and processing efficiency, making them essential for construction materials, medical devices, and consumer goods. Their widespread use in flooring, cables, automotive interiors, and packaging materials will continue to drive steady demand through the forecast period.

The wires and cables segment is projected to grow with a CAGR of 4.5% from 2025 to 2035. Plasticizers such as diisononyl phthalate (DINP) improve cable flexibility, preventing breakage and enhancing safety. Rising demand for high-performance cables in the automotive, construction, and electronics industries will fuel plasticizer consumption. The expansion of electrical infrastructure and renewable energy projects will further boost segment growth over the coming years.

The building and construction industry remains a key end-user of plasticizers due to their role in flooring, wall coverings, and insulation materials. Diisodecyl phthalate (DIDP) is widely used in PVC flooring and roofing membranes, offering durability and weather resistance.

Increasing urbanization, rapid infrastructure development, and stringent building regulations emphasizing energy-efficient materials will drive sustained demand for high-performance plasticizers in the global construction sector through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

| UK | 4.2% |

| France | 4.3% |

| Germany | 4.6% |

| Italy | 4.4% |

| South Korea | 4.7% |

| Japan | 4.3% |

| China | 5.1% |

| Australia & New Zealand | 4.2% |

The USA is projected to grow at a CAGR of around 4.5% between 2025 and 2035, driven by stringent regulatory frameworks and rising demand for safer alternatives. The Toxic Substances Control Act (TSCA) and Consumer Product Safety Improvement Act (CPSIA) have restricted the use of certain phthalates in consumer products, fueling the shift toward bio-based and non-phthalate plasticizers.

The construction sector, particularly in PVC-based flooring and insulation materials, remains a key end-use industry. Additionally, the automotive sector’s push for lightweight materials is increasing demand for non-phthalate plasticizers. Manufacturers are investing in sustainable formulations to meet California Proposition 65 compliance, ensuring continued industry expansion.

The UK industry is projected to grow at a 4.2% CAGR from 2025 to 2035, driven by stringent environmental regulations and increasing adoption of non-toxic plasticizers. Following Brexit, the UK continues to align its rules with EU REACH, restricting phthalates in consumer goods, medical devices, and food packaging.

The construction industry remains a key driver, particularly for PVC-based applications such as cables, pipes, and flooring. The government’s emphasis on sustainability is also promoting bio-based plasticizers, with manufacturers actively investing in alternatives derived from vegetable oils and esters. The rising demand for greener solutions is driving increased R&D investments in non-phthalate plasticizers in the UK.

France is projected to register a CAGR of 4.3% between 2025 and 2035, fueled by government regulations and increasing consumer awareness of the health risks associated with phthalates. Under EU REACH regulations, France has implemented strict restrictions on harmful plasticizers, particularly in food packaging and medical devices.

The demand for bio-based plasticizers is growing rapidly, with manufacturers focusing on plant-derived alternatives such as citrates and epoxies. The French construction sector, which prioritizes sustainable building materials, is also boosting demand for non-phthalate plasticizers. In addition, strong government initiatives promoting a circular economy are pushing companies to invest in recyclable and biodegradable plasticizer formulations.

Germany is forecast to grow at a CAGR of 4.6% between 2025 and 2035, driven by stringent chemical safety regulations and the strong presence of industrial manufacturers. As part of EU REACH compliance, Germany has placed restrictions on high-risk phthalates in consumer products, pushing industries toward safer alternatives.

The country’s robust automotive and construction sectors are key end-users of non-phthalate plasticizers, particularly in lightweight vehicle components and PVC-based insulation materials. Additionally, Germany’s sustainability initiatives are accelerating investment in bio-based plasticizers, including plant-derived alternatives and biodegradable additives. DINP (Diisononyl Phthalate) is increasingly being adopted as a safer alternative in multiple applications.

Italy is anticipated to expand at a CAGR of 4.4% from 2025 to 2035, primarily driven by demand from the packaging and construction industries. Italy enforces EU REACH regulations, restricting the use of hazardous phthalates in various applications, particularly food packaging and medical devices.

The country is witnessing a growing preference for bio-based plasticizers as companies align with sustainability goals. PVC-based materials remain dominant in the construction industry, driving steady demand for non-phthalate alternatives such as adipates and terephthalates. Additionally, Italy’s focus on circular economy initiatives is encouraging manufacturers to develop recyclable and low-emission plasticizer formulations.

South Korea is set to grow at a CAGR of 4.7% between 2025 and 2035, propelled by stringent regulations under K-REACH and increasing demand for safer plasticizers in consumer goods. The country has imposed strict limits on hazardous phthalates in electronics, medical devices, and food packaging.

The domestic automotive industry, known for its technological advancements, is also transitioning toward non-phthalate alternatives for lightweight vehicle components. In addition, South Korea’s sustainability initiatives are boosting investments in bio-based plasticizers, with companies developing citrate- and epoxidized oil-based solutions to cater to rising demand.

Japan is expected to record a CAGR of 4.3% between 2025 and 2035, supported by advanced material innovations and strict regulatory policies. Under the Chemical Substances Control Law (CSCL), Japan has classified certain phthalates as restricted substances, leading to a growing shift toward non-phthalate plasticizers.

The country’s automotive sector is a major driver, with manufacturers integrating non-toxic plasticizers in interior components and wiring. Additionally, Japan’s packaging industry is witnessing increasing adoption of food-safe, non-phthalate plasticizers, particularly in flexible films and coatings. Combine instances or specify which companies are leading biodegradable developments.

China is poised to expand at a CAGR of 5.1% from 2025 to 2035, making it one of the fastest-growing regions globally. The country’s massive PVC production sector is the key demand driver, particularly in construction, automotive, and consumer goods. While GB 9685 to 2016 restricts phthalates in food packaging, China’s plasticizer industry remains expansive, with both phthalate and non-phthalate products in high demand.

However, increasing government initiatives promoting environmental sustainability and reducing toxic emissions are accelerating the shift toward bio-based plasticizers. Manufacturers are investing in cost-effective non-phthalate alternatives to cater to the rising demand for safer plasticizers in export industries.

Australia and New Zealand are projected to grow at a CAGR of 4.2% between 2025 and 2035, influenced by strict chemical regulations and growing sustainability trends. NICNAS (National Industrial Chemicals Notification and Assessment Scheme) in Australia and NZ EPA (New Zealand Environmental Protection Authority) regulates the use of hazardous phthalates in consumer products, encouraging the adoption of non-phthalate plasticizers.

Demand for eco-friendly plasticizers is rising in the construction and packaging sectors, with companies focusing on phthalate-free solutions for enhanced consumer safety. Additionally, manufacturers are developing low-VOC and bio-based plasticizers to meet sustainability targets and align with evolving regulations.

As of 2024, the phthalate and non-phthalate plasticizers industry has undergone significant changes due to stricter regulations, environmental concerns, and rising demand for safer, sustainable alternatives.

Leading players such as BASF SE, Dow Chemical Company, Eastman Chemical Company, ExxonMobil Corporation, LG Chem, and Evonik Industries AG have been actively implementing strategies to strengthen their positions and cater to the evolving needs of industries such as construction, automotive, and consumer goods.

BASF SE continues to dominate the industry with an estimated 20-25% share in 2024. The company has focused on innovation and sustainability, launching a new line of bio-based non-phthalate plasticizers in early 2024.

These products, designed for use in flexible PVC applications, have been well-received for their environmental benefits and performance. BASF's strong global presence and commitment to R&D have further solidified its leadership in the industry.

Dow Chemical Company holds approximately 18-20% of the industry share in 2024. The company has prioritized technological advancements, introducing a new range of high-performance non-phthalate plasticizers with enhanced flexibility and durability.

Launched in mid-2024, these products gained traction in the automotive and construction sectors for their superior quality and performance. Dow's focus on innovation and customer satisfaction has helped it maintain a competitive edge and expand its customer base.

Eastman Chemical Company accounts for roughly 15-18% of the industry share in 2024. The company has invested heavily in R&D, launching a new series of non-phthalate plasticizers with improved thermal stability and low volatility. These products, designed for high-temperature applications, have been well-received for their performance and safety. Eastman's emphasis on innovation and sustainability has enabled it to capture a significant portion of the industry.

ExxonMobil Corporation has seen its industry share grow to around 12-15% in 2024. The company has focused on developing sustainable plasticizer solutions, introducing a new line of recycled-content phthalate plasticizers in collaboration with industry stakeholders. ExxonMobil's focus on sustainability and strong R&D investments has solidified its position as a key industry player.

LG Chem holds an estimated 10-12% industry share in 2024. The company has expanded its product portfolio by launching a new series of non-phthalate plasticizers with enhanced compatibility and processing efficiency.

These products, designed for use in consumer goods and packaging, have been well-received for their versatility and environmental benefits. LG Chem's focus on specialized solutions has helped it establish a strong position in the industry.

Evonik Industries AG has maintained an industry share of approximately 8-10% in 2024. The company has focused on strategic partnerships, collaborating with automotive manufacturers to develop customized non-phthalate plasticizers for interior applications. Evonik's emphasis on innovation and collaboration has strengthened its reputation as a trusted provider of high-quality plasticizers.

In 2024, strategic collaborations and partnerships emerged to address challenges in performance and sustainability. For instance, BASF SE partnered with a leading construction company to develop a new line of non-phthalate plasticizers for eco-friendly building materials. This collaboration has enhanced BASF's credibility and industry reach.

Overall, the industry in 2024 is characterized by intense competition, with the top six players collectively accounting for over 85% of the share. These companies are leveraging innovation, sustainability, and technology to meet the growing demand for safer and eco-friendly plasticizers.

The phthalate and non-phthalate plasticizers industry falls within the specialty chemicals industry, which plays a critical role in enhancing the functionality of materials across multiple sectors, including construction, automotive, healthcare, and consumer goods. As a key segment of the global polymer additives industry, plasticizers improve the flexibility, durability, and processability of materials such as polyvinyl chloride (PVC).

From a macroeconomic perspective, the industry is directly influenced by global industrial output, urbanization trends, regulatory policies, and shifting consumer preferences toward sustainability. Economic growth in emerging regions, particularly in Asia-Pacific and Latin America, is driving higher demand for infrastructure development, automotive production, and medical applications, fueling plasticizer consumption.

However, rising environmental concerns and stringent government regulations are reshaping the landscape, with a noticeable shift toward bio-based and non-toxic alternatives. Fluctuations in crude oil prices also impact raw material costs, as most traditional plasticizers are derived from petrochemicals.

Additionally, the growing circular economy and innovations in biodegradable plasticizers are set to redefine competitive dynamics. With governments implementing green policies and industries striving for eco-friendly solutions, non-phthalate plasticizers are expected to gain a larger share of the global industry over the next decade.

Growth Opportunities

Expansion in Bio-Based Plasticizers

Strict regulations on phthalates are driving demand for bio-based plasticizers from vegetable oils, citrates, and epoxies. Companies investing in biodegradable, low-toxicity alternatives will gain traction, particularly in Europe and North America, where sustainability laws are stringent.

Rising Demand for Electric Vehicles (EVs)

EV growth boosts demand for plasticizers in lightweight cables, battery insulation, and interiors. Non-phthalate alternatives like terephthalates and trimellitates are gaining preference as automakers seek lighter, energy-efficient materials for sustainable vehicle production.

Medical-Grade Plasticizers for Healthcare Applications

The shift to phthalate-free medical devices presents an opportunity for citrate- and trimellitate-based plasticizers. Compliance with USP Class VI and ISO 10993 will be crucial for adoption in tubing, blood bags, and catheters, ensuring patient safety and industry access.

Strategic Recommendations

Strengthen Regulatory Compliance & Certification Portfolio

Manufacturers should align with evolving REACH, FDA, and RoHS regulations. Investing in in-house regulatory teams and third-party certifications will improve compliance, enhance credibility, and ensure smooth global sector access.

Develop Customized Formulations for Target Industries

Companies should focus on industry-specific plasticizer formulations tailored to automotive, healthcare, and construction applications. Customization enhances product value, helping manufacturers capture niche industries and secure long-term contracts.

Leverage Strategic Partnerships & Acquisitions

Collaboration with polymer manufacturers, automotive OEMs, and medical device companies can accelerate product development and sector entry. Acquiring bio-based chemical firms will provide access to advanced technologies and expand sustainable product portfolios.

Rising demand from industries like automotive, construction, and healthcare, along with regulatory restrictions on traditional phthalates, is fueling adoption.

Automotive, construction, healthcare, electrical and electronics, and consumer goods industries are the largest users of plasticizers.

Stricter global regulations on phthalates are accelerating the shift toward non-phthalate and bio-based plasticizers, especially in Europe and North America.

Advancements in bio-based, low-toxicity, and recyclable plasticizers are driving the development of safer and more sustainable solutions.

North America and Europe lead adoption due to stringent regulations, while Asia-Pacific is growing rapidly due to industrial expansion.

By product type, the industry is segmented into phthalate plasticizers and non-phthalate plasticizers.

Based on application, the sector is segmented into wire and cables, flooring and wall coverings, coatings, films and sheets, consumer and industrial goods, upholstery, medical products, and others.

Based on the end-use industry, the industry is segmented into healthcare, aerospace, automotive, building and construction, food and beverage, electrical and electronics, consumer goods, and others.

The sector is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Precipitation Hardening Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Plywood Market Growth - Innovations, Trends & Forecast 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

Pyrogenic Silica Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenoxycycloposphazene Market Growth - Innovations, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.