By 2025, the global photovoltaic mounting system market is expected to be valued at USD 33.9 million. Due to developing investments in solar infrastructure, advancements in mounting technologies, and evolving policy support for decarbonization, the industry is expected to witness explosive growth in the coming years. The industry is also forecasted to grow at a CAGR of 17.46% from 2025 to 2035 to reach USD 166.6 million in 2035. The growth further highlights the strategic importance of the industry in supporting the solar revolution worldwide.

Several forces are driving the PV mounting systems industry. First, solar energy has exploded recently, thanks to demands for energy independence due to shifting public consensus about the environment, government incentives, and the rising prices of fossil fuels. The increase in installed solar panels is usually accompanied by increased demand for quality mounting systems that provide strength, correct orientation of panels, and longevity.

Second, the innovation of mounting system designs has made installations quicker, more efficient, and more adaptable for all types of terrain and architectural structures. Manufacturers are now going for lightweight, corrosion-resistant, and adjustable mounting solutions based on designs using aluminum alloys and galvanized steel. Such advancements reduce installation time, man-hours, and long-term maintenance costs, thus making solar power affordable and accessible for the end user.

The industry also gains from diversification in mounting systems ranging from fixed-tilt and tracking systems to ballasted, rail-less, and floating mountings. In particular, tracking systems are slowly gaining acceptance in large solar farms for tracking the sun's movement, thereby boosting energy yield a lot. On the other hand, rooftop mounting systems are preferred for residential and commercial industries, particularly in urban settings with a limitation on ground space.

Conversely, even with their strong growth prospect, the industry is still faced with the challenges of high initial investment costs, varying regulations in different regions, and intermittent supply chain disruptions determining raw material availability. Nevertheless, scientific research and development are being carried out to mitigate these challenges, enhance product durability, decrease costs, and expedite both standardization and certification processes as well as installation.

In addition, increased emphasis on BIPV, floating solar farms, and solar canopy structures also presents mounting systems suited only for these innovative applications with fresh opportunities. Emerging industries in the Asia-Pacific region, Latin America, and Africa play a considerable role in growing the PV infrastructure worldwide, which impacts the demand for advanced and scalable mounting systems.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 33.9 million |

| Industry Value (2035F) | USD 166.6 million |

| CAGR (2025 to 2035) | 17.46% |

Explore FMI!

Book a free demo

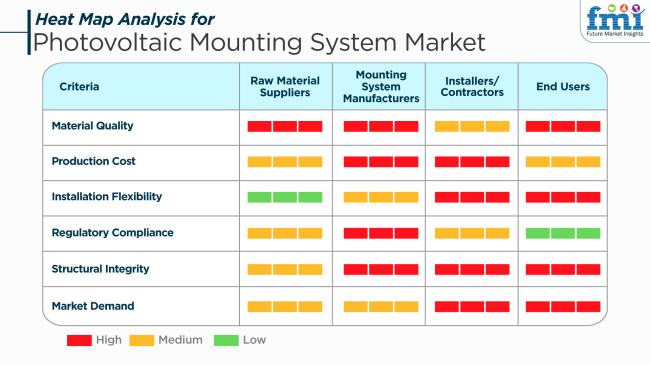

he industry plays an influential role in establishing or adapting a solar power plant because, among other considerations, it should meet the long-term durability and ease of installation with compliance. Use material durability and structural integrity as per end user and manufacturer preferences, ensuring that it is capable of sustaining harsh environmental conditions over decades.

Manufacturers also must pay higher production costs and comply with stringent conditions while being warranted within the scope of the local codes of construction and safety. Installers and contractors look at flexibility during installation, cost, and industry demand. Hence, these designs shall offer maximum flexibility in terms of minimizing labor time and ensuring acceptance from the customer side.

End users, such as the residents and commercial collectors, tend to be biased toward assurance, and their taking or perception of the system factor would lead to demand driven by the return on investment and reliability. For most end users, regulatory compliance would not be a direct concern, but upstream players must ensure that all systems meet the legal and structural standards. This industry is developing through the rising process of adoption of renewable energy, with a need as well for high-performance yet cheap and easy-to-install solutions.

The industry has shown steady growth from the year 2020 to 2024 owing to an increase in solar installs across the globe and the assistance presented by the governments to the renewable energy sector. The domestic segment was driven by rapid growth in solar rooftops, while the utility-scale segment was motivated by ground mounts.

Materials suppliers focused on improving material durability, installation speed, and corrosion protection - essential in coastal and desert areas. Due to the halt of the supply chain during the COVID-19 crisis, there was uncertainty in raw materials prices, including aluminum and steel and postponement of production in the industry.

The trend for mounting system is going forward from the experimental stage to automated, modular, AI-enabled system (2025 to 2035) - because they save labor in installation and allow more accurate alignment for higher energy output. Trends such as Agrivoltaics and floating solar systems, which will affect design flexibility and dual land use.

Higher sustainability requirements will increase the demand for lighter, recyclable materials and carbon-free production processes. Smarter monitoring integrated with the mounting structure - allowing predictive maintenance and real-time structural health monitoring - will become more common. Solar as a baseline energy source will emerge rapidly in emerging industries, notably Africa, Southeast Asia, and Latin America.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Government subsidies, rooftop and utility-scale solar expansion | Energy security needs, climate goals, and electrification in emerging economies |

| Rooftop (residential/commercial) and fixed ground-mount systems | Tracker-based systems, agrivoltaics, and floating PV mounts |

| Aluminum and galvanized steel dominance | Lightweight, high-durability composites and recyclable materials |

| Improved corrosion resistance and simpler assembly | Smart mounts with tilt automation, AI-driven alignment, and load-balancing features |

| Manual, modular racks with some pre-assembly in commercial use | Pre-engineered, AI-assisted robotic and semi-automated installation systems |

| Limited production sustainability and material recycling | Circular design focus, low-emission production, and lifecycle environmental labeling |

| Visual inspection: simple integrity checks | IoT sensors integrated to enable real-time diagnosis and predictive maintenance |

| High penetration in China, the USA , India, and Europe | Growing penetration in Africa, Southeast Asia, Latin America, and Middle East |

The industry is growing at an unprecedented rate due to the global thrust towards renewable energy sources. Nevertheless, this growth does enjoy a fair share of risks. Most of the risks arise as a consequence of a strong dependence on solar energy.

Solar energy adoption has increased mainly due to government support, subsidies, and climate targets, but the high capital cost for installation, especially for good-quality mounting systems, can deter development in price-sensitive regions. Spatial constraints in urban settings that hinder the setting up of conventional mounting structures may thus impede the industry's growth in densely populated areas.

In general, operations create demand for mountings that are extremely strong and standardized, particularly in the context of long-term durability and safety viewed against changing environmental conditions. Some manufacturers, in their zeal for low costs and under competition, may jeopardize the integrity of their products.

Further sophistication, such as intelligent and adjustable systems in mounting frameworks, thus creates added variables for these complex structures, requiring advanced engineering solutions and denser maintenance protocols, thereby increasing operational costs and failure risks in the event of neglect.

There is, of course, exposure to technological risks due to the rapidly changing solar panel technologies. For example, the introduction of bifacial and larger-format solar panels brings about changes in the designs of mounting systems that have to be complemented.

Those who fall behind on these technological advancements run great risks of bringing obsolete products to the industry. In addition, with increasing digitalization, mounting systems are more and more expected to support sensors and tracking features, which need continuous R&D investment, thus putting financial pressure on smaller players.

On a more general scale, political and environmental risks have a leverage effect on the supply chain and production processes. Global tensions, from trade wars to regional conflicts, may affect the supply chain of primary raw materials such as aluminum and steel. Enactment of environmental regulations to address the carbon footprint of solar infrastructure places an additional burden on manufacturers to consider green materials and clean production, which potentially could increase costs and burden for compliance burdens.

Competitive risk is hitting hard in this fragmented and fast-paced industry. Here, the demand side consists of a plethora of players at both global and regional levels vying for price and innovation. This zealous competition usually creates price wars, whose acrimonious climate eats into profit margins and threatens long-term sustainability for a number of these companies. Overreliance on a few selected customers or so-called regional industries, however, predisposes firms to a higher degree of vulnerability should those linkages be severed or demand for these products suddenly taper.

Ground-mounted systems and Rooftop systems together form the highly segmented industry in 2025. Ground-mounted photovoltaic mounting systems boast a dominant industry share of about 58%, whereas Rooftop systems, the minor component, make up the remaining 42%.

Ground-mounted PV systems are scalable, easy to maintain, and have the highest energy yield among the three. These systems offer flexibility in adjusting panel orientation and tilt such that irradiance capture is optimally done throughout the year.

Countries such as the USA, China, and India are investing heavily in large-scale solar parks and floating solar projects that primarily employ ground-mounted frameworks. Leading companies such as Array Technologies, Nextracker (Flex), and Arctech Solar offer tracking-enabled ground-mount systems that can enhance efficiency by about 20-25% compared to fixed installations.

Rooftop photovoltaic mounting systems, at 42% of the industry, are offered for self-consumption applications in urban areas where space is limited. Roof-mounted systems have been deployed across Europe, Japan, and Australia in residential, commercial, and industrial (C&I) sectors.

These systems offered a new alternative to the cost-competitive form of energy to produce energy at consumption points and reduce dependency on grids, thus lowering billing costs. Innovations in lightweight mounting materials integrated racking systems, and simplified installation procedures all spurred the growth of this rooftop industry. The winners on this level are the likes of Schletter Group, Unirac, and K2 Systems, which supply modular and ballasted rooftop solutions for flat and sloped surfaces.

They are expected to grow under policy incentives, reduce solar PV costs, and encourage more corporations and homeowners to invest in renewable energy infrastructure because of increasing solar adoption in the decarbonization agenda around the globe.

The industry for photovoltaic mounting systems will be segmented globally in 2025 into systems of fixed and tracking types. Fixed will lead with an estimated 60 percent share, and Tracking will make up the remaining 40%.

Fixed PV mounting systems are some of the most widely used due to their ease of use, lower initial installation costs and minimal maintenance. They are primarily used in small-scale commercial rooftop installations and residential rooftops, as space and budget constraints make tracking systems infeasible.

Fixed systems also constitute a large part of utility-scale installations in areas with less variable solar irradiance. Companies like Schletter Group, Unirac, and K2 Systems manufacture durable fixed mounting solutions intended for ground and rooftop settings.

Tracking PV mounting systems hold 40% of the industry and are used more and more prominently for utility-scale and high-efficiency solar farms. These systems change the angle of solar panels all through the day to follow the sun's track, resulting in energy yield increases, especially compared to fixed systems, up to about 25-35%.

In sun-rich areas like the USA Southwest, the Middle East, Latin America, and Australia, single-axis and dual-axis trackers are increasingly being deployed. Nextracker, Array Technologies, and Arctech Solar are the three most renowned global leaders in tracking technologies, developing robust systems featuring state-of-the-art control software, wind management capabilities, and real-time performance optimization.

Fixed systems dominate today since they are the most cost-effective solution. However, the tracking segment is. Expected to grow even faster in years to come as solar developers focus on ROI and efficiency gains for large-scale projects, and government incentives continue to develop regarding decreasing the cost of tracker components.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

| UK | 7.5% |

| France | 7.1% |

| Germany | 6.8% |

| Italy | 6.4% |

| South Korea | 7% |

| Japan | 6.6% |

| China | 8.7% |

| Australia | 7.8% |

| New Zealand | 6.9% |

The USA industry is projected to grow at a CAGR of 8.2% during the period 2025 to 2035 through increasing solar project installations and favorable policy conditions for renewable energy infrastructure. The shift to utility-scale solar electricity generation and expansion in distributed solar projects in states such as California, Texas, and Florida are fueling growth in fixed-tilt as well as tracking mounting systems. Increasing focus on carbon reduction and chasing net-zero targets is also driving industry activity.

Key players in the USA industry include Array Technologies, Unirac, and Solar FlexRack, each leveraging innovation to provide cost-effective, durable mounting solutions. Increased adoption of smart tracking technologies that optimize energy output is also driving industry trends. Commercial and industrial uses are driving the trend of rooftop solar installations, giving rise to roof mounts as well as ground mounts on utility projects.

The UK industry is expected to register a CAGR of 7.5% from 2025 to 2035, spurred by national decarbonization targets and the rapid advancement of solar capacity additions. Trends towards local clean energy generation, combined with rising investments in solar farms, are fueling strong demand for ground-mounted tracking and fixed systems. Residential and community-scale rooftop installations are contributing to industry dynamics.

Leading industry players such as K2 Systems, Schletter Group, and Sunfixings are offering specialized systems tailored to the UK's own climate and structural codes. Solar deployment growth in northern and urban regions is compelling innovation in weather-resistant and space-efficient solutions. Government support schemes and renewable obligation schemes continue to stimulate installations within both urban and rural settings.

The industry of France is poised to grow at a CAGR of 7.1% in the period 2035, driven by a shifting regulatory landscape favoring solar adoption across urban and agricultural lands. Large-scale solar tender programs in national energy transition plans are leading to greater demand for robust ground-mounted solutions, particularly in rural and semi-urban regions.

Major industry stakeholders like Mecosun and Systovi are contributing to industry growth by providing innovative structural designs to address the two-way utilization of land for agriculture and solar. France is also seeing increased uptake of building-integrated photovoltaic (BIPV) systems, further underscoring the demand for flexible and modular mounting solutions. The push for energy independence in industrial and public sectors is also contributing to demand.

Germany's industry is expected to record a CAGR of 6.8% over the forecast period because of the Energiewende program and the increasing penetration of solar in commercial as well as residential sectors. Renewable electricity policy support incentives and government support for the installation of solar on public buildings are also fueling the use of rooftops as well as ground-mounted systems.

Industry leaders such as Mounting Systems GmbH, Renusol, and Schletter are setting the pace, offering engineering-optimized solutions specific to Germany's building codes and climatic requirements. The comeback of small-scale installations, along with continued utility-scale project development, supports a balanced demand scenario. Emphasis on durability, recyclability, and aesthetic integration remains robust in the German industry.

Italy's industry is expected to grow in the range of 2025 to 2035 at a CAGR of 6.4%, which is mainly led by growth in rooftop solar adoption in residential and commercial segments. Incentives of tax deductions for investing in solar and for energy efficiency improvement are fostering local demand. Regional development plans are also encouraging solar plans in southern Italy and island areas.

Significant industry players include Sunerg Solar and Esdec, offering flexible systems that can be adapted to Italy's varied architectural and environmental situations. Ground-mounted systems are still substantial, especially in agrivoltaic installations for double land use. Seismic and lightweight constructions are increasingly becoming significant with regard to specific regional geophysical conditions.

South Korea's industry is expected to grow at a CAGR of 7% over the forecast period, supported by government strategies to diversify energy sources and reduce fossil fuel dependence. The Renewable Energy 3020 Implementation Plan is encouraging increased investments in utility-scale and distributed solar systems, particularly in coastal and industrial regions.

Companies such as Hae Sung Solar and OCI Power are leading innovations in high-mountain elevation mounting systems and corrosion-resistant solutions suitable for South Korea's terrain and climatic variations. Building and public infrastructure-based, urban-oriented installations are opening up industries for high-density, space-efficient rooftop mounting systems. The intersection of industrial decarbonization targets and the coherence of energy policy is also fuelling growth.

Japan's industry is projected to register a 6.6% CAGR during 2025 to 2035, spearheaded by Japan's commitment to achieve net emissions of zero by 2050 and a change towards distributed solar infrastructure. The unavailability of horizontal land has surged the utilization of rooftop and upper structures in towns and mountain areas, inducing structure adaptability innovation.

Key manufacturers such as Mitsui Chemicals Tohcello and West Holdings Corporation are offering advanced systems tailored to seismic regions and extreme wind-load requirements. Carport-based solar plants and floating PV systems are becoming more popular, which is forcing diversification in mounting designs. Industry momentum is also being propelled by municipal support for community-scale solar projects.

The Chinese industry is anticipated to experience the highest CAGR of 8.7% over the forecast period, with unmatched goals of solar capacity additions and prevailing leadership in world PV supply chains. Government regulations to promote rural electrification and industrial decarbonization are driving large-scale utility and distributed installations.

Pioneering domestic players such as Clenergy, Antaisolar, and Xiamen Grace Solar Technology are leading the way in manufacturing fixed and tracking systems suitable for various geographic locations. AI-based tracking systems and anti-corrosive materials are improving efficiency and lifespan under varied climatic conditions. A strategic focus on exporting to global countries is also fueling product development.

Australia's industry will grow at a CAGR of 7.8% through 2035, fueled by the strong uptake of residential and utility-scale solar in Queensland, New South Wales, and South Australia. Favorable solar irradiation combined with friendly net metering regulations is encouraging the large-scale deployment of rooftop as well as ground-mounted systems.

Industry players like Clenergy Australia and Soltech Energy are introducing long-term, UV-resistant, and wind-tolerant structures that are made to suit regional needs. Growing demand for agrivoltaic programs and commercial rooftop solar is creating opportunities for customized and modular mounting systems. Government incentives and carbon reduction commitments are also raising investment levels.

New Zealand's industry is expected to post a CAGR of 6.9% over the 2025 to 2035 timeframe, driven by national targets to produce 100% renewable electricity and increased interest in decentralized solar power. The industry is gaining momentum with growing installations on commercial buildings, farms, and schools

Companies such as SolarMounts NZ and Enasolar are offering systems that are compatible with New Zealand's building code and fluctuating climatic conditions. Corrosion resistance and expandable modularity are influencing product design. Facilitative regulatory environments and domestic energy policy are pivotal in elevating industry participation in the North and South Islands.

The industry has a highly competitive environment, with specialized solar racking companies focusing on structural integrity, modularity, and ease of installation. The likes of Schletter Group, Unirac Inc., and K2 Systems GmbH dominate the industry by providing efficacious mounting solutions for residential, commercial as well as utility-scale projects. The companies enjoy a competitive advantage in the worldwide deployment of solar by virtue of their patented tracking technologies, wind-resistant structures, and lightweight materials.

Through engagements in strategic partnerships with solar panel manufacturers, energy developers, and engineering, procurement, and construction (EPC) firms, the industry leaders have been advancing. Firms such as SolarWorld AG and RBI Solar Inc. emphasize integrated racking solutions based on advanced corrosion resistance and aerodynamics to enhance system operability and lifetime in tougher environments. Quick Mount PV and Mounting System GmbH have, meanwhile, fortified their place in the residential rooftop sector with certified waterproof flashing systems and extra-durable mounts for sloped and flat roofs.

Chinese manufacturers, including Land Power Solar, Xiamen Grace Solar and Clenergy, are creating a buzz by offering cheap and readily customizable mounting solutions for utility-scale solar farms. These companies leverage their vertically integrated supply chains and aggressive pricing strategies to take advantage of the growing global demand for sustainable energy infrastructure. Therefore, Tata International Ltd. is gradually increasing its footprint by focusing on emerging solar industries across Asia and Africa with low-cost and scalable racking solutions.

Innovation is the core area for further growth of this industry, and industry leaders invest in solar tracking systems, adjustable tilt mounts, and automated installation systems. The companies that can leverage AI for optimization and analytics of wind loads will have the upper hand over industry competition as solar takes off in the coming decades.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Schletter Group | 18-22% |

| Unirac Inc. | 14-18% |

| K2 Systems GmbH | 12-16% |

| RBI Solar Inc. | 10-14% |

| SolarWorld AG | 8-12% |

| Combined Others | 25-35% |

| Company Name | Offerings & Activities |

|---|---|

| Schletter Group | High-durability, wind-resistant ground as well as roof-mounted solar racking systems. |

| Unirac Inc. | Modular mounting solutions with quick-installation designs for commercial and residential applications. |

| K2 Systems GmbH | Aerodynamic PV mounting structures optimized for maximum energy efficiency. |

| RBI Solar Inc. | Large-scale, utility-grade solar racking solutions with integrated tracking technology. |

| SolarWorld AG | Corrosion-resistant mounting systems engineered for long-term performance in extreme environments. |

Key Company Insights

Schletter Group (18-22%)

Schletter leads with wind-optimized mounting structures, corrosion-resistant materials, and AI-driven installation design software, catering to large-scale and rooftop solar projects.

Unirac Inc. (14-18%)

Unirac focuses on innovative quick-installation PV mounting systems, reducing labor costs and increasing efficiency in commercial and residential solar installations.

K2 Systems GmbH (12-16%)

K2 Systems excels in lightweight, aerodynamic mounting solutions engineered for optimized tilt angles and high load-bearing capacity.

RBI Solar Inc. (10-14%)

RBI Solar specializes in utility-scale solar racking with single-axis tracking integration, improving solar energy yields in large solar farms.

SolarWorld AG (8-12%)

SolarWorld develops advanced corrosion-resistant mounts for extreme weather conditions, enhancing solar panel longevity and operational efficiency.

Other Key Players

The industry is projected to be valued at USD 33.9 million in 2025.

The industry is forecasted to reach USD 166.6 million by 2035.

China is leading with a projected 8.7% growth rate.

Ground-mounted photovoltaic mounting systems are the most dominant type, especially for utility-scale solar farms.

Leading companies include Schletter Group, Unirac Inc., SolarWorld AG, K2 Systems GmbH, Quick Mount PV, Land Power Solar Technology Co. Ltd., RBI Solar Inc., Mounting System GmbH, Xiamen Grace Solar Technology Co. Ltd., Clenergy, Tata International Ltd., Xiamen Universe Solar Tech. Co. Ltd., Xiamen Corigy New Energy Technology Co. Ltd., PV Racking, and Van der Valk Solar Systems BV.

By product, the industry is categorized into rooftop and ground-mounted.

By technology, the industry is divided into fixed and tracking.

By end use sector, the industry is segmented into residential, commercial, and civic utilities.

By region, the industry is segmented into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Composting Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.