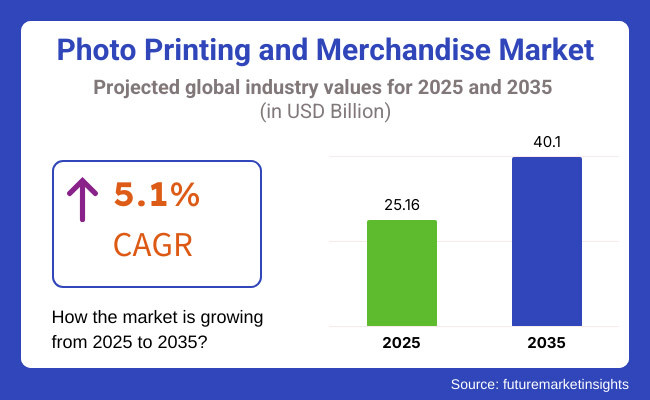

The photo printing and merchandise market is anticipated to see steady development over the next decade, with sales reaching USD 25.16 billion in 2025 and likely USD 40.1 billion by 2035. That represents a CAGR of 5.1 % from 2025 to 2035.

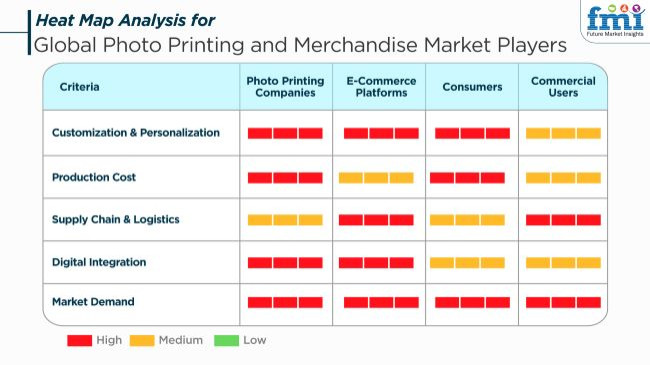

The growing demand for personalized and high-quality printed items is pushing growth, with consumers and firms seeking customized photo-based gifts, branding materials, and artistic applications. The web-based platforms and mobile apps, along with the wide variety available in photo printing services worldwide, have further simplified customization procedures.

The photo printing and merchandise industry deals with the transformation of digital and physical images into print products such as prints and photo books, calendars, home decor items, and clothes.

Nowadays, the quality of digital printing technology varies, just as it does for traditional and digital services. Public and event organizers all utilize the company's services for merchandise customization and promotion. These have led to product availability and making purchasing as well as designing customized goods easier and more convenient for users.

Several key drivers push the market forward. Encouraged by the popularity of personalized gifts, customized photo-based products like mugs or canvases, as well as framed prints, are in demand. Businesses are also using customized products for promotion, corporate branding, and as gifts to employees.

The maturation of digital printing technology has led to improved natural quality and longer life, as well as lower production costs of custom printing. On the other hand, the increasing popularity of social media and digital cameras has driven people to capture their memories in the form of printed items and in this way has further stimulated market growth.

However, the market does face some difficulties. Chief among these is the premium pricing of high-grade printing materials and state-of-the-art printing technology. Besides, the growing tendency to share photos digitally through cloud storage has cut down on the need for hard copies in many instances. There are also concerns about environmental sustainability and the future of ink used in printing. It is changing consumer behavior, so manufacturers are developing environmentally friendly technologies to fulfill people's needs.

Moreover, supply chain disruptions and raw material price fluctuations remain challenges for manufacturing companies as well as retailers. Trends in the industry see AI-assisted design technologies making it easier for customers to produce high-quality customized prints. Eco-friendly printing techniques utilizing things like water-based inks or biodegradable-printing supplies have heightened consumer awareness.

Explore FMI!

Book a free demo

The photo printing and merchandise industry is one of the fastest-growing sectors in the world, and the main reason for that is the increasing demand for personalized products, the development of digital printing technology, and the expansion of e-commerce platforms. For instance, the make-my-own photo book, print-on-canvas personal prints, and custom gift products are the pictures that constitute the major trends among consumers who have been searching for high quality, customizable prints for their houses, gifts, and memorabilia.

There is no need to go far. Influencers have reached out to e-commerce platforms to collaborate with them as key players who provide intuitive user interface design tools, easy order processing, and auto-custom design features. Enterprises, for their parts, prefer to order items in bulk, have their branding on the products, and deliver fast so promotional materials are available as soon as possible.

Splitters in the photo-printing domain target the digital route that consists of the provision of high-quality prints with a digital solution. They focus on mobile applications to enable the user to facilitate the entire process and ensure quality standards are met.

The buying decision of the consumers involves the following factors: quality, cost, ease of making custom orders, amount of time needed for delivery, and being an eco-friendly organization. The market will still be able to grow more because of the developments in 3D printing, materials that are more environmentally friendly, and design solutions enhanced by artificial intelligence.

Contracts and Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| Fujifilm Holdings Corporation | 13.5 |

| Shutterfly, Inc. | 7.1 |

| Snapfish | 7.4 |

| Vistaprint | 4.9 |

Between 2020 and 2024, the industry expanded due to growing personalization trends, advancements in digital printing technology, and the rising popularity of customized gifts. The increasing use of smartphones with high-resolution cameras fueled demand for printed photo products, including photobooks, canvas prints, and personalized accessories.

Online shopping platforms were instrumental in market expansion, providing consumers with hassle-free personalization and home delivery. Supply chain disruptions, unpredictable raw material prices, and digital photo storage trends were setbacks for traditional printing companies.

From 2025 to 2035, the market is anticipated to transform with AI-based design automation, green printing products, and augmented reality (AR) integration to offer good-quality photos. On-demand printing facilities will continue to grow, enabling businesses and consumers to produce custom merchandise with little or no production waste.

Eco-friendly methods, such as waterless printing and biodegradable printing supplies, will become more prominent. Also, the development of 3D photo printing and holographic imaging will transform luxury photo merchandise and create new opportunities in high-end customization.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consumers favored personalized photo products like photo books and coffee mugs. Several people who did customizations, marketed online. | AI-driven personalization enhances product recommendations, enabling dynamic customization for users. Augmented reality (AR) allows consumers to preview photo products before purchase. |

| Cloud-based photo storage and mobile printing apps gained popularity. AI-powered image enhancement tools improved print quality. | 3D printing advances enable new personalized products. AI-powered photo restoration and generative imaging expand creative possibilities. |

| Online marketplaces and retail stores collaborated to offer same-day or next-day printing services. Subscription models gained traction. | Direct-to-consumer (DTC) websites thrive, providing instant customization. Robotic kiosks and drone delivery make instant and on-demand printing efficient. |

| Brands used environment-friendly inks and recycled paper to cater to consumers' need for sustainable products. | Green production becomes standard. Carbon-neutral production, waterless printing, and biodegradable photo paper revolutionize the industry. |

| Vacations, birthdays, and weddings fueled the need for personalized photo prints and mementos. | Interactive digital moments such as virtual memory books and NFT photo souvenirs revolutionize how consumers store and share memories. |

| Small businesses and photographers used high-quality prints for promotions and building brands. | Professional photo touch-ups are automated by AI. |

| Instagram and Facebook opened up the market for real-time printing. Influencers made personalized merchandise fashionable, and growth in the market was boosted. | Direct printing from social posts and top-line revenue streams from user-generated content through AI-powered social media integrations will dominate. |

| AR/VR-backed interactive photo books and holographic prints pick up pace, bringing immersive digital-physical hybrid experiences. | The emergence of digital photography, e-commerce, and AI-driven design software drove adoption. Competitive pricing and convenience drove market growth. |

| AI-powered automation, hyper-personalization, and sustainable innovations fuel long-term growth. The sector responds to changing consumer behavior with intelligent and immersive printing. | AI-powered automation, hyper-personalization, and sustainable innovations fuel long-term growth. The sector responds to changing consumer behavior with intelligent and immersive printing. |

The market is subject to threats of technological progress, supply chain interruptions, intellectual property matters, cyber security threats, and obsessive competition in the market.

The disturbances in the supply chain, which have decreased the supply of raw materials, especially high-quality paper, inks, and printing equipment, are another issue. The Geopolitical instabilities, which have resulted in increased production costs, and logistics delays, which have caused delays, are the primary suspects. To some extent, the exhaustible supply by embracing the localized model can be mitigated by these factors.

Labor issues with the IP sector are a cause of anxiety when it comes to the non-licensed use of protected images, which means that the rights of the copyright owners are being offended. Companies not only need to ensure copyright compliance but also must have strict licensing agreements, in addition to adopting watermarking technologies to protect against IP infringement.

The market is heavily saturated with the presence of many online and offline players that are offering similar products, with price competition being incredibly high. For other players to continue growing in the market, the main thing is to differentiate themselves with the help of customization, premium materials, eco-friendly printing, and AI-initiated personalization.

| Product Type | Value Share (2025) |

|---|---|

| Photo Print | 27.5% |

Photo Prints Rule the Market

Photo print lines helped the industry grow because of their universal demand among personal consumers and companies. This holds 27.5% of the market share in 2025. Basic and high-quality photo prints are a top preference for remembering moments, but wall decoration has also become popular as the consumer attempts to find personalized home styles.

The growing need for personalizing homes and offices with their works of art, family paintings, and inspirational prints has accelerated demand. The internet and shopping websites have saved buyers time placing best-quality prints with various customization options like size, material, and finish.

Business customers also use customized wall decor for planning office space, brand messaging, and publicity campaigns. The financial attractiveness of digital printing solutions has lowered the price of personalized wall artwork, stimulating the market's growth.

| End User | Value Share (2025) |

|---|---|

| Individual Consumers | 31.7% |

Individual Consumers Create Market Demand

Individual consumers propel the photo and merchandise printing industry by holding 31.7% of the value share in 2025. They constitute the largest number of sales. Personalized accessories, home decorations, and gifts are more sought after than ever. Individuals enjoy making photo books, mugs, clothing, and framed prints for themselves or as presents.

Birthdays, weddings, and anniversaries usually demand something special. Smartphone cameras and social media have enabled the trend of printing digital memories. Simple-to-use websites and AI-driven apps simplify customization, further increasing demand.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| The USA | 6.3% |

| Germany | 6.0% |

| China | 7.3% |

| India | 8.7% |

| Saudi Arabia | 5.2% |

The USA dominates the merchandise and photo-printing business with strong e-commerce, strong consumer expenditures on personalized gifts, and digital print technologies. Shutterfly, Snapfish, and Vistaprint are dominant market players providing AI-driven design features for instant online personalization. Customers tend to buy personalized home decor, apparel, and photo books backed by a strong gift culture.

The AR and AI pairing reinforces customer engagement, resulting in higher conversion. Environmental efforts have prompted vendors to take up green materials and electronic printing. The availability of mobile photo printing apps facilitates quick on-the-spot personalization for young consumers who value convenience.

Branded promotional merchandise and products are still purchased by corporate procurement, generating high market revenue. Major fulfillment centers and an established logistics network guarantee quick delivery, boosting customer satisfaction. The American market continues to grow with digital transformation, increasing with the strength of technology and changing consumer trends.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Robust E-commerce Infrastructure | Amazon and Walmart offer broad digital customization features. |

| Advanced Printing Technologies | UV and digital printing increase print quality and efficiency. |

| Hefty Consumer Expenditure | USAcustomers heavily invest in personalized gifts. |

| AI and AR Integration | Platforms employ AI to create and AR to personalize customer experience. |

| Mobile Printing Solutions | Apps allow people to print photographs straight from their mobile phones. |

| Green Printing Practices | Environmentally friendly inks and recyclable products become more popular. |

| Corporate Demand | Companies spend money on promotional and brand merchandise. |

Market growth in China lies in its strong manufacturing base, enormous consumer market, and increased demand for personalized products. A powerful supply chain supports low-cost mass production of customized merchandise, such as photo-printed t-shirts, mugs, and home decor. Online retail titans Alibaba and JD.com allow easy customization at low costs.

As disposable incomes rise, people prefer customized presents. Digital print technologies like UV and dye-sublimation enhance quality and speed. Social shopping on WeChat and Douyin boosts sales directly to customers. Sustainability, too, is becoming mainstream, with firms implementing biodegradable materials and green inks. Small and medium businesses and firms spend more on company gift branding merchandise.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Robust Manufacturing Base | Effective supply chains lower the cost of personalized products. |

| Growing E-commerce Market | Alibaba and JD.com support multiple methods of personalization. |

| Rising Disposable Income | Greater consumer expenditure on customized gifts and products. |

| Integration with Social Media | WeChat and Douyin support direct sales to customers. |

| Digital Print Technology | UV and dye-sublimation prints improve efficiency and quality. |

| Ecological Printing Methods | Firms employ environmentally friendly materials and biodegradable ink. |

| Corporate Branding Need | Firms spend on corporate gifts and promotional merchandise. |

India has a fast-growing market with rising internet penetration, increasing disposable incomes, and low-cost customization services. Online portals such as Flipkart, Amazon and domestic players such as Printvenue and Zoomin provide customized photo products to millions. The social media-savvy youth of the country creates demand for customized, differentiated products such as T-shirts, mugs, and photo books.

Mobile-optimized websites and app-based photo print ordering make ordering easy. Low-cost digital printing keeps customization within reach of individuals and small businesses. Prints of wedding and event photography are a strong growth driver, with high-end-quality albums and wall decor in high demand.

Corporate gifts and promotional items are also increasing as businesses invest in branded giveaways and employee incentives. Sophisticated logistics and last-mile delivery networks provide greater reach and speed of fulfillment. With digital infrastructure getting better, India's personalized photo printing and merchandise businesses will continue to grow.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Increasing Internet Penetration | Personalized online shopping of products is growing at a rapid rate. |

| Increasing Disposable Income | Folks are spending more on personalized gifts and merchandise. |

| Continued E-commerce Growth | Flipkart and Amazon offer extensive photo product ranges. |

| Mobile-first Solutions | App-based customization is attractive to a young, technology-savvy audience. |

| Cost-effective Customization | Digital printing at low prices makes customization affordable. |

| Event-driven Demand | Festivals and weddings generate demand for photo albums of higher quality. |

| Corporate Gifting Expansion | Branded promotional items and staff gifts are company investments. |

A robust digital printing market is fueling the market in Germany, consumer interest in higher-quality products, and increased demand for customized gifts. German customers are quality-conscious, which fuels the need for high-resolution photo prints and long-lasting merchandise.

Market leaders CEWE and Photobox have the upper hand with advanced online customizing software. Mobile ordering platforms have made it more convenient. Secondly, companies invest in corporate gifts that are used for promotion and employee rewards. The shift towards green printing is increasing, with companies using green materials and digital printing methods to minimize waste.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Established Digital Printing Industry | High-quality printing processes provide photo products. |

| High Demand for Quality from Consumers | German consumers demand durable, high-definition photo merchandise. |

| E-commerce Platform Growth | CEWE and Photobox are the market leaders in online photo personalization. |

| Focus on Sustainability | Firms embrace green printing options. |

| Corporate Merchandise Demand | Firms invest in promotional items and logo gifts. |

| Mobile Ordering Growth | Growing use of mobile applications for easy ordering. |

The Saudi Arabian photo printing and merchandise market is expanding on the strength of rising disposable income, growing e-commerce, and a growing demand for personalized products. The number of socially active young people in Saudi Arabia supports the surge in the popularity of customized T-shirts, mugs, and mobile phone cases.

Personalized print services are made available by online shopping websites such as Noon and Amazon Saudi Arabia. Growth within the market comes primarily from gifting and wedding culture, along with high demands for personalized décor and souvenirs. Electronic printing technology and increased demand for high-quality products drive further expansion. Corporate branding is also growing, with businesses investing in promotional products.

Growth Factors in Saudi Arabia

| Key Drivers | Details |

|---|---|

| Rising Disposable Income | Shoppers are spending more on customized gifts and products. |

| E-commerce Growth | Sites like Noon and Amazon Saudi Arabia make it easier to reach them. |

| Social Media Consumption | Younger consumers drive demand for cool customized products. |

| High Wedding Culture | More demand for customized wedding photo albums, wedding gifts, and wedding decorations. |

| Technology Advancements | Advancements in digital printing technology make the product better and more efficient. |

| Expansion of Corporate Branding | Companies spend money on branding and promotional items. |

The global photo printing and merchandise market has a lot of competition. Companies are giving their best to show that they are different from other companies. For this, they are using advanced technology for personalization, making logistics efficient, and offering a broad variety of products. Market leaders use AI-based design tools, AR previews, and mobile integration to enhance user experience and expand market coverage.

Key Players are Shutterfly, Snapfish, Vistaprint, Mixbook, and Mpix. They are well-established players in the market with strong digital platforms, superior print solutions, and efficient pricing models. Their huge e-commerce presence and better customization capabilities increase the competition.

Key Offerings include personalized photo books, calendars, and wall art for business and promotional products. Companies are also spending money on eco-friendly printing technologies, such as the use of environmentally friendly materials and recyclable packing, to gain consumers concerned about the environment.

Market evolution is taking place as mobile-based printing services are in high demand, with AI-powered customization and faster delivery. Companies are focusing on automation and cloud-based solutions to optimize production and improve service efficiency.

Strategic drivers are reflected in the form of mergers and acquisitions, e-commerce platform alliances, and direct-to-consumer business model innovations. Competitiveness is still defined by sustainability and pricing techniques.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Shutterfly | 25-30% |

| Snapfish | 15-20% |

| Vistaprint | 12-18% |

| Mixbook | 8-12% |

| Mpix | 5-10% |

| Other Players | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Shutterfly | Leading provider of personalized photo products and gifts. |

| Snapfish | Offers affordable online photo printing with a strong digital presence and a focus on customization. |

| Vistaprint | This company focuses on business and promotional printing. They use AI-powered design tools to customize. |

| Mixbook | Produces high-quality, design-focused photo books and wall art. They mostly emphasize personalization. |

| Mpix | Professional-grade printing service catering to photographers and high-end consumers. |

Key Company Insights

Shutterfly (25-30%)

This company has a strong e-commerce presence. They provide a very broad range of personalized products.

Snapfish (15-20%)

Online photo printing service. They have affordable prices. The design platform is easy to use.

Vistaprint (12-18%)

Large player in customized business and promotional items, with global reach and solid B2B relationships.

Mixbook (8-12%)

The company is popular for high-quality photo books. Several consumers are attracted because of creativity and premium products that the company provides.

Mpix (5-10%)

A high-end preference among professional photographers, providing high-quality photo prints and fine art printing services.

Other Key Players (20-30% Combined)

Recent Developments

In January 2025, Shutterstock and Getty Images started working together. This content company has an enterprise value of about USD 3.7 billion. Printful and Printify announced a merger in November 2024 to improve their e-commerce and custom product fulfillment offerings.

The industry is projected to reach USD 25,165.1 million in 2025.

The industry is expected to grow significantly, reaching USD 40,121.6 million by 2035.

India is poised for the fastest growth, with a CAGR of 8.7% from 2025 to 2035.

Key companies in the market include Bay Photo Lab, Printique LLC, WhiteWall, Cardfactory, Hallmark Licensing, LLC, Kodak Alaris Inc., AdoramaPix LLC, Cimpress, District Photo, Inc., Photobox, and Jondo, Ltd.

Digital printing is being widely used in the market.

By product, the industry is segmented into photo printing and merchandise printing.

By mode, the sector is segmented into desktop and mobile.

By module, the market is segmented into film printing and digital printing.

Distribution channels segment the industry into instant, over-the-counter, online, and retail kiosks.

The market is segmented by region into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.