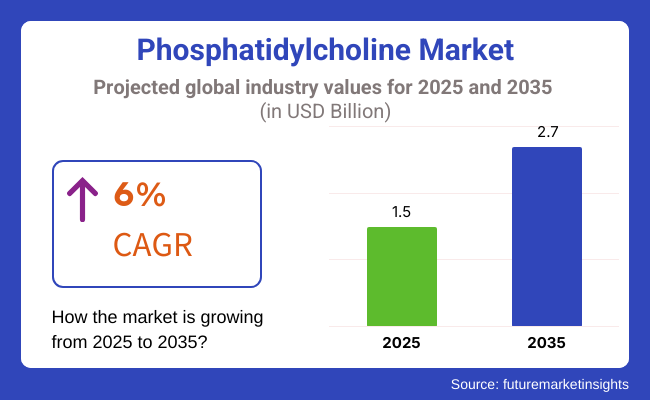

The global phosphatidylcholine market is estimated to be worth USD 1.5 billion in 2025. It is projected to reach a value of USD 2.7 billion by 2035, expanding at a CAGR of 6% over the assessment period of 2025 to 2035.

The industry is witnessing an advance along the way due to the rising use of phosphatidylcholine (PC) in the production of drugs, nutritional supplements, and cosmetics. Its addition to systems designed to deliver drugs and as a component of functional food supplements is a crucial factor in growth.

The primary trend is the result of increasing consumer awareness regarding the advantages that include health improvement. It is a well-known dietary supplement for brain health, liver health, and cardiovascular health. What is more, supplementing liposomal drug formulations and fat emulsification technologies with the ingredient has been a new source of growth in the pharmaceutical sector.

New technologies in extraction and purification processes make high-purity chemicals, such as soy lecithin and egg yolk, easily available. The ongoing trend towards plant-based and non-GMO products is also a consequence of the industry being directed by consumers' needs who are looking for clean-label and allergen-free choices.

There are certain challenges, such as the prevalence of continuously changing raw material prices and the necessity for special dietary rules in supplement compositions. There might be competition from phospholipid alternatives and bioactive compounds primarily used in cognitive health. The stability and bioavailability of the products in formulations have also remained a problem for the companies involved.

Though there are difficulties, the expansion of the industry is quite feasible. The research is increasingly devoted to finding out the areas where this phospholipid can be applied in the therapy of neurodegenerative diseases, and the targeted drug delivery is what will keep the green light for innovations.

New opportunities for products, such as functional food and personalized nutrition solutions, are also present. Biopharmaceutical industries have this phospholipid as a new option for the treatment of neurodegenerative diseases and also as a means of targeted drug delivery.

Explore FMI!

Book a free demo

The sales grew steadily from 2020 to 2024 with growing demand in the pharmaceutical, cosmetic, and nutraceutical sectors. Demand is also likely to remain strong on the back of its ability to enhance drug delivery, moisturize skin, and maintain liver health.

In the drug industry, it was widely used in liposomal formulations due to its ability to increase bioavailability and targeted delivery. The growing use of natural and plant-based ingredients in cosmetics and food supplements also supported expansion. Price volatility in raw materials and supply chain disruptions undermined the consistency of manufacturing.

Regulatory pressure on genetically modified (GMO) PC sources also impacted sourcing strategy. In the next 2025 to 2035 period, the industry will expand as liposomal drug delivery technology and exploration of the cognitive and metabolic welfare benefits are continuously improving.

PC sources that are non-GMO and organic will become more prominent with growing demand from consumers for clean-label options. Moreover, its application in the formation of targeted drug delivery systems for cancer therapy and neurodegenerative diseases will stimulate new uses. Environmentally friendly manufacturing processes and enhanced supply chain transparency will be top priorities for manufacturers when addressing changing consumer and regulatory demands.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| High demand in pharmaceuticals for liposomal drug delivery. | Growing use in cancer and neurological disease-targeted drug delivery. |

| Familiar with cosmetics and nutraceuticals for skin and liver health. | Growing use in cognitive and metabolic health. |

| Mainly produced from soy and sunflower. | Growing demand for organic and non-GMO sources. |

| Raw material price volatility and supply chain disruption. | Sustainable production and improved supply chain transparency. |

| Regulatory concerns with GMO-sourced phosphatidylcholine. | Improved extraction and purification to offer improved product consistency. |

The global industry is experiencing a high pace of growth due to reasons such as increased applications in pharmaceuticals, nutraceuticals, cosmetics, and food industries. Phosphatidylcholine (PC), an important phospholipid, is prized for its application in cell membrane function, liver health, and drug delivery systems.

In the drug industry, PC is mainly applied as an excipient in lipophilic drug products because it is highly bioavailable and has compatibility with APIs. The nutraceutical industry prefers it for cognitive and liver function supplements derived mostly from soy and sunflower lecithin.

In cosmetics, PC is used as an emulsifier and skin-conditioning agent, providing improved penetration when applied topically. The food and beverage industry uses PC as a natural emulsifier, specifically for natural and functional foods and beverages. As the demand for non-GMO and plant-derived lecithin rises, manufacturers are turning to sustainable sources such as sunflower-derived PC, which supports clean-label and natural ingredient trends.

The industry is on the rise due to the increased utilization of PC in the pharmaceutical, dietary supplements, and cosmetics sectors. However, the strict regulatory standards for the specifications of the product related to purity, labeling, and safety aspects in certain areas make compliance a challenging task. It is a must for the companies to keep up with the changes in the standards, get the permissions and certifications that are needed, and keep the transparency to the clients in order to get and keep their trust.

The change in consumer attitudes towards non-GMO, allergen-free, and plant-based extracts, naturally, is a big challenge for traditional producers. The increased interest in sustainably and ethically sourced products is fostering the emergence of alternative lipid-based compositions. Businesses must come up with solutions for such problems by employing cleaner extraction techniques and permanently changing the practices of sourcing materials.

The competition for substitutes for oil-based emulsifiers is fierce, and the pressure is on the price and the need for new product functionalization. For the competitiveness of the companies to be maintained, they should concentrate on R&D, making product-specific formulations for neuroprotection, liver health, and advanced skincare solutions.

Some customers are affected by economic conditions, trade policies that are being changed over time, and the overall development of health trends. For the long-term growth of a company, it is important to optimize the production process, enter new industries, and work together with healthcare and cosmetic manufacturers to design innovative solutions that will meet the changing industry needs.

| Segment | Value Share (2025) |

|---|---|

| Soybean-Based Phosphatidylcholine (By Source) | 48.5% |

In 2025, the industry will be bifurcated by source, wherein soybean-derived PC will attain the top position, with a share of 48.5%. Because of its low cost, high availability, and high lecithin content, PC derived from soybeans is used widely in pharmaceuticals, nutraceuticals, and cosmetics.

It is widely used as a key ingredient in drug delivery systems, supplements for liver health, and skincare formulations. Major suppliers include significant companies like Cargill, ADM, and Lipoid GmbH, and soy-derived PC is often used in liposomal drug formulations to enhance food bioavailability of active ingredients. For instance, PC obtained from soy lecithin is already extensively used in functional foods as well as supplements for brain health, cellular membrane repair, and lipid metabolism.

20% of the share is occupied by PC derived from eggs, as it provides high purity and superior emulsification ability. It is frequently used in intravenous lipid emulsions, pharmaceutical formulations, and cosmetic products.

Companies like Kewpie Corporation and Lecico GmbH specialize in egg-derived PC, which is favored in parenteral nutrition therapies due to its high choline concentration and phospholipid profile. Additionally, its application in anti-aging and skin hydration products is growing, particularly in luxury skincare brands.

Good growth is anticipated as consumer demand for natural, non-GMO, and bioavailable phospholipids burgeons. At the same time, innovations in liposomal drug delivery, functional foods, and high-end cosmetics drive the adoption of this phospholipid.

| Segment | Value Share (2025) |

|---|---|

| Pharmaceutical Grade (By Grade) | 55.2% |

By grade, the industry accounted for the largest share in 2025, with pharmaceutical-grade PC representing 55.2% of the total revenue. The major applications are attributed to its prevalent use in drug formulations, intravenous lipid emulsions, and targeted drug delivery systems.

Liposomal drugs enhance the bioavailability of active pharmaceutical ingredients (APIs) produced using PC. Top providers include Lipoid GmbH, Avanti Polar Lipids, and Cargill, which supply high-quality grade PC used for neuroprotective agents, liver health products, and parenteral nutrition providing solutions. Innovative formulations within the advanced nanomedicine landscape, especially concerning gene therapy and vaccine delivery systems, are trending to grow.

Food-grade PC accounts for 35.0% of the total share, dominated by functional foods, dietary supplements, and nutraceutical products. Both are frequent ingredients in brain health supplements, lipid metabolism boosters, and digestive health products.

Food-grade PC derived from soybeans and eggs is supplied by major players, including ADM, Kewpie Corporation, and Lecico GmbH, to meet the growing consumer demand for non-GMO, plant-based, and natural emulsifiers. Its emulsification and encapsulation properties have also made it an important additive in chocolate, margarine, and processed foods.

As awareness of phosphatidylcholine's health benefits climbs, the pharmaceutical and food-grade segments are anticipated to expand as technological innovation drives advances in liposomal nutrition, drug delivery technology , and clean-label food ingredients.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 5.0% |

| China | 6.2% |

| Germany | 4.8% |

| Japan | 4.5% |

| India | 6.5% |

| UK | 4.7% |

| France | 4.6% |

| Italy | 4.4% |

| South Korea | 5.2% |

| Australia | 4.3% |

| New Zealand | 4.1% |

The USA dominates the worldwide share, with the maximum revenue share up to 2025. It is estimated to achieve a 5.0% compound annual growth rate (CAGR) in 2025 to 2035 and grows primarily based on the need for functional food and dietary supplements. Consumers are becoming increasingly health-conscious, and hence, demand for products containing PC increases.

Additionally, the pharma sector is responsible for most industry expansion, with PC boasting broad usage in drug delivery systems and, consequently, the enhancement of the strength of most drugs. Having giant key players within the USA ensures product improvement and ongoing improvement of new uses of PC, thus firming its grip on the industry.

As a result of the ongoing wellness and health trends affecting consumers' behavior, the USA is ready to see long-term growth through domestic demand in combination with product formulation innovation. Industry giants such as Cargill and Archer Daniels Midland Company are taking control of the industry with their consistent research and development expenditures.

An increase in vegan PC products, benefiting from the trend in plant-based diets, is also driving product diversification. Also, the increased occurrence of liver disorders has stimulated demand for PC treatments, and the USA market appears to be a target for drugs.

China is expanding swiftly at an estimated 6.2% CAGR through 2035. Increased consumer knowledge about the health effects of PC, particularly from the growing middle-class consumer base, fuels the business. Increasing consumers searching for nutritional foods and supplements fuel the growing demand for PC.

Government-funded healthcare and wellness-enhancing programs also propel the industry ahead. The developing pharmaceutical sector is among the main demand drivers. China's deep domestic production base and high research and development expenditures also position it as a top player in the global industry.

Domestic firms such as Hubei Yuancheng Pharmaceutical and Wuhan Yuancheng Gongchuang Technology Co. are driving supply chain efficiencies. With the increasing health consciousness, the industry ought to thrive, reflecting a pattern of healthier food consumption habits and diets among the Chinese. The growing application of PC in traditional Chinese medicines is also a distinct industry driver that differentiates China from the rest of the globe.

Germany is projected to grow steadily at a projected CAGR of 4.8% over the next decade. This growth is driven by the country's strong emphasis on high-quality, natural, and non-GMO products, which resonate with dietary supplement and functional food consumers' preferences.

German pharmaceutical manufacturing is also a significant factor in development, employing PC in the formulation of medications to increase the therapeutic effect. Strict regulations ensure purity and product safety, which sustains customer trust and preference.

Further, German research focuses on innovation and continues to dominate the international market. Lipoid GmbH and Evonik Industries AG lead the innovation drive, providing over-the-counter and pharmaceutical formulations with extremely pure phosphatidylcholine.

The trend towards clean-label ingredients is helping to drive demand, with consumers increasingly looking to purchase ethically produced and transparent products. Consumers interested in concern for quality and efficacy in their healthcare products place Germany in a great position to keep up its growth, reflecting a broader trend towards consumption-led by health within Europe.

The UK is expected to grow at a CAGR of 4.7% between 2025 and 2035. High-quality health supplements are popular in the UK, and the demand for PC has been increasing because of this. The most significant reason is an aging population, as PC is used extensively in cognitive health supplements to enhance brain function and memory. Increased consciousness regarding liver health has also resulted in greater application in hepatoprotective formulations.

Leading UK brands like Holland & Barrett and Vitabiotics are introducing phosphatidylcholine-based ranges, responding to the need for evidence-based supplements. Britain's rigorous regulation requirements maintain product purity and effectiveness, making it a site of preference for high-quality health supplements. Plant-based diets also spurred increases in soy and sunflower-derived products as a complement to product ranges.

France will develop at a 4.6% CAGR from 2025 to 2035. The country's focus on organic and natural food additives has been the most effective driver for the market. The masses favor clean-label products, and this is generating a higher demand for non-GMO-based PC production. The pharmaceutical sector also contributes significantly by using it in drugs, especially for liver and neuro-related ailments.

French companies like PiLeJe and Nutrisanté have strong control over the supplements market, with natural products being the emphasis. Beyond this, the growing demand for cosmetic applications is another key force, and it also has applications in dermato-cosmetic formulations for rectifying and rejuvenating the skin. Enhanced research regarding drug delivery systems with the use of lipids in France is also favorable to the growth in the market.

The market in Italy will expand at a 4.4% CAGR during the period 2025 to 2035. Increasing consumption of Mediterranean diets has boosted demand for natural health products and fueled the application. Italian pharmaceutical companies such as Italfarmaco S.p.A. are incorporating it into specialty drugs for liver and brain function.

Its vast history of plant and herb-based supplements has encouraged the use of soy-based OC. Apart from this, the higher demand for dermo-cosmetics and anti-aging in Italy has also encouraged its use in the dermo-cosmetics industry. Due to the growing popularity of preventive medicine, the Italian market will continue to expand.

South Korea is expected to grow at a CAGR of 5.2% for the forecast period of 2025 to 2035. Sophisticated pharmaceutical and cosmetics industries in South Korea are driving demand. K-beauty players such as Amorepacific are tapping into the potential of this phospholipid to develop next-generation skincare products. High rates of liver disease incidence and a rising health-conscious population are also fueling the market.

Japan is expected to grow at a CAGR of 4.5% during 2025 to 2035. Demographic aging in Japan is creating a demand for brain and liver health supplements. Asahi Group and Suntory are investing in nutraceuticals based on this phospholipid. Japan's focus on functional food is the most active market driver, which is most evident as consumers seek science-based health solutions.

Australia is projected to expand at a CAGR of 4.3% from 2025 to 2035. The country's strong preference for natural health products and dietary supplements is a significant driver of demand. Australian consumers prioritize clean-label, non-GMO, and plant-based supplements, leading to increased sales of soy and sunflower-derived phospholipids.

Leading Australian brands such as Blackmores and Swisse are integrating this phospholipid into their product lines, capitalizing on the rising demand for cognitive health and liver support supplements. Additionally, the pharmaceutical sector in Australia is witnessing growth, with increased research into PC-based drug formulations. The country's regulatory framework ensures high-quality standards, making it a key player in the Asia-Pacific phosphatidylcholine market.

New Zealand is expected to grow at a CAGR of 4.1%. The country has a strong focus on natural and organic health products, driving demand for the supplements that use this phospholipid. Brands like Comvita are expanding their product lines to include phosphatidylcholine-based formulations. The emphasis on sustainability and quality ingredients positions New Zealand as a niche but growing industry.

The sales are expanding owing to increasing applications in pharmaceuticals, nutraceuticals, and cosmetics. Driving the growth are rising requirements for brain health supplements, liver support formulations, and drug delivery systems based on lipids.

Major companies such as Cargill, Archer Daniels Midland (ADM), Lipoid GmbH, Avanti Polar Lipids, and Bunge Limited dominate with high-purity phosphatidylcholine coming from soybean, sunflower, and egg yolk sources. Lipoid GmbH has diversified its product line for application in liposomal drug formulations; Avanti Polar Lipids focuses on phospholipids for advanced biomedical applications.

The evolution of the industry depends on advances in extraction technologies, increased awareness by consumers about the health benefits of this phospholipid, and regulations that approve new formulations. Companies invest in sustainable sourcing, non-GMO lecithin, and clinical studies to validate efficacy and broaden the use of products in functional foods and therapeutics.

Key strategic factors governing competition include the sustainability of supply chains, cost-effective production methods, and innovation in phospholipid-based formulations. Significant efforts are being made towards increasing distribution networks as well as forming partnerships with pharmaceuticals and nutraceutical companies, benefiting from biotech advancements in becoming well-positioned in the industry and addressing emerging consumer demand.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill | 18-22% |

| Archer Daniels Midland (ADM) | 14-18% |

| Lipoid GmbH | 10-14% |

| Avanti Polar Lipids | 8-12% |

| Bunge Limited | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Focus |

|---|---|

| Cargill | Leading supplier of soy-derived and sunflower-based phosphatidylcholine, focusing on sustainability and pharmaceutical-grade lecithin. |

| Archer Daniels Midland (ADM) | Specializes in non-GMO and organic solutions, catering to nutraceutical and functional food applications. |

| Lipoid GmbH | A key player in phospholipid-based drug delivery systems, supplying high-purity chemicals for injectable formulations. |

| Avanti Polar Lipids | It focuses on lipid-based drug delivery research, offering customized compounds for liposomal and nanoparticle drug formulations. |

| Bunge Limited | Produces food-grade phospholipids for emulsification and dietary supplements, emphasizing plant-based lecithin extraction. |

Key Company Insights

Cargill (18-22%)

A key leader in plant phosphatidylcholine and focusing strongly on pharmaceutical and nutraceutical applications.

Archer Daniels Midland (ADM) (14-18%)

It specializes in clean-label, non-GMO phosphatidylcholine while expanding its footprint in the functional foods and dietary supplements segment.

Lipoid GmbH (10-14%)

The main producer of pharmaceutical-grade phosphatidylcholine for lipid-based drug delivery is coming as a response to the increasing demand for injectable formulations.

Avanti Polar Lipids (8-12%)

Research-driven lipid innovation that customizes its solutions for drug development.

Bunge Limited (6-10%)

Major supplier of phosphatidylcholine for food as well as nutraceutical applications, leveraging its expertise in lecithin processing.

The global phosphatidylcholine market is projected to grow at a CAGR of 6.0% from 2025 to 2035.

The phosphatidylcholine market is expected to reach approximately USD 2.7 billion by 2035.

The pharmaceutical-grade segment is expected to grow the fastest due to increasing use in drug formulations, liver health supplements, and advanced lipid-based drug delivery systems.

The market is driven by the rising demand for natural and non-GMO sources, increasing applications in pharmaceuticals and nutraceuticals, and innovations in liposomal drug delivery technologies.

Leading players in the market include Cargill, ADM, Lipoid GmbH, Avanti Polar Lipids, Bunge Limited, and Kewpie Corporation.

segmented into eggs, soybean, sunflower, mustard, and others, with plant-based sources gaining traction due to clean-label demand.

By grade, the segmentation is into food grade, pharmaceutical grade, and others.

By function, the segmentation is into moisturizing, solubilizing, emulsifying, and others.

By end use, segmentation is as pharmaceuticals, cosmetics, nutraceuticals, and others.

Segmented by region into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Korea Fusion Beverage Market Analysis by Beverage Type, Ingredient Profile, Distribution Channels, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.