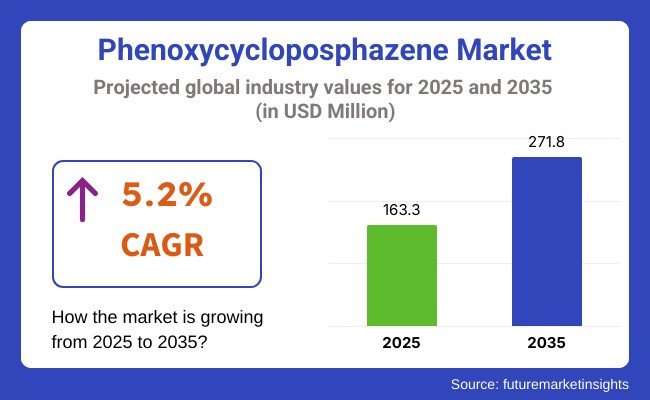

The phenoxycycloposphazene market is expected to grow steadily with the industry size projected to be USD 163.3 million in 2025 and reach approximately USD 271.8 million by 2035, at a CAGR of approximately 5.2%. The growth is being driven by the factors such as increasing demand for halogen-free flame retardants in electronics, automotive, and construction sectors.

One of the industry leaders is the global shift towards halogen-free flame retardants as environmental and health regulations become stricter. Halogen-contained retardants currently available may work, but they release poisonous emissions when combusted.

Phenoxycycloposphazene is a safer alternative that has high regulatory compliance such as the RoHS, REACH, and WEEE directives. The electrical and electronic sector accounts for the majority of the consumption of phenoxycycloposphazene. It finds widespread application in circuit boards, connectors, casing, and insulation materials to suppress fire transmission and conform to UL94 V-0 standards. As demand for consumer electronics, 5G networks, and miniaturized devices increases, flame-resistant materials are more sought after than ever.

Automotive is another significant application area. With the fast-growing demand for electric vehicles (EVs), there is increased need for fire-safe battery enclosures, wire coverings, and interior components. Phenoxycycloposphazene improves thermal stability and reduces flammability in lightweight polymers used in modern vehicle architecture.

Asia Pacific dominates the industry, i.e., China, Japan, and South Korea, where automotive and electronics manufacturing is increasing. North America and Europe are hotspots of innovation, driven by the need for strict regulatory compliance and high-end polymer research.

Phenoxycycloposphazene is becoming a vital component of the future of fire-safe products. With its unique balance of flame retardancy, compatibility, and regulatory acceptability, it is a key choice for industries that value safety, sustainability, and high-performance product innovation.

Explore FMI!

Book a free demo

The industry is increasing at a very fast rate as a result of increased demand for halogen-free flame retardants in various industries. The growth in the industry is being driven by aspects such as increased demand for raising fire safety levels and compliance with government policies.

The industry is dominated by a broad range of applications such as epoxy resins, LED luminous diodes, copper-clad plates, paints, and encapsulating materials. Technological development has seen phenoxycycloposphazene compounds with greater thermal stability and environmental advantages.

Growth is likely to be enormous in the Asia-Pacific region as a result of industrialization and urbanization. Producers target manufacturing high-performance phenoxycycloposphazene products that meet the stringent requirements of electronics and construction industries. They commit to environmentally friendly manufacturing processes and ensure they have a firm supply chain to meet the growing global demand.

During the period 2020 to 2024, the industry was mostly driven by growing demand in the flame-retardant segment, particularly electronics and high-performance plastics. The demand for halogen-free flame-retardant solutions in consumer electronics and electrical parts resulted in growing use of phenoxycycloposphazene based on its suitable thermal and chemical characteristics.

However, expansion in the industry was tempered by high production costs, limited manufacturing capacity outside East Asia, and regulatory scrutiny of chemical composition used in key applications. With more demand coming up for safer alternatives, the material will become increasingly influential in high-end electronic devices where regulation and performance were prioritized over pricing.

The industry in the pipeline from 2025 to 2035 will likely be more innovation-led and diversified on a global scale. Technological advancements in material science will make the compound less expensive and accessible with more efficient synthesis methods. Its usability with recyclable and bio-based polymers will further enhance its standing in sustainable material design, especially in the aeronautical and automotive industries. Upcoming regulations on environmental conformity will further increase the demand for halogen-free flame retardants, making phenoxycycloposphazene a central material in the next-generation polymer engineering.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Halogen-free flame retardant demand in electronics and electrical parts. | Sustainability-inspired innovation and increased application in bio-based, recyclable polymer systems. |

| Constrained by high manufacturing expense and limited application range. | Advances in technology enable the synthesis process to become more cost-effective and efficient, opening more applications. |

| Pioneering compliance with halogen-free and low-toxicity standards, particularly in Asia and Europe. | Strenuous global regulations on chemical safety and environmental exposure drive industry evolution. |

| Mainly in electronics and specialty plastics. | Greater use in automotive, aerospace, and high-tech building materials. |

| Extremely concentrated production in Asia with dependency on specific chemical suppliers. | Production geographic diversification and increased local sourcing initiatives. |

| Resistant migration towards non-halogen products in high-value applications. | Expansion in accelerated demand for sustainable flame retardants and recyclability material compatibility. |

The industry, whose major driving force is its uses as a high-performance flame retardant in the electronics, construction, and coating industries, has a number of major threats in 2024 that can destabilize it and undermine its long-term growth. Arguably the most immediate one is the high cost and lower availability of the raw materials used in the synthesis of phenoxycycloposphazene compounds. Such materials tend to be based on specialty chemicals that are price-volatile because of volatile feedstock availability, energy prices, and geopolitical factors.

This price volatility makes it challenging for producers to control stable margins, especially in competitive end-use industries with high cost sensitivity. Moreover, the industry is under growing competitive pressure due to emerging alternative flame retardant technologies such as halogen-free and bio-based alternatives. Those firms depending exclusively on phenoxycycloposphazene risk dwindling demand if they do not diversify or enhance cost efficiency.

Another major risk is regulatory pressure, particularly as environmental and health authorities increasingly place stricter controls on chemical production and emissions. Adherence to REACH (EU), TSCA (US), and other international standards may involve costly testing, certification, and operational changes.

In the future, the industry also risks disruption from accelerating technological change. If new, more effective or safer flame retardant products are brought to industry, phenoxycycloposphazene may experience product obsolescence or substitution in major industries like consumer electronics and automotive uses.

The industry has revealed that fire retardants remain the largest application, with a industry share of 68% in 2025, while coatings account for the remaining 32%.The heavy tilt toward fire retardant applications is mainly attributed to the flame resistance, thermal stability, and compatibility of the material with many polymers and composites.

It is an extremely valuable additive across industries such as electronics, automotive, and construction within the flame retardant formulation. For example, our two electronics customers, TE Connectivity and Panasonic, incorporate fire-retardant polymers with phenoxycycloposphazene into cable insulation and circuit board encapsulants to pass stringent UL94-V0 and IEC requirements.

Automotive OEMs are increasingly looking for halogen-free flame retardants to meet emerging regulatory requirements and fire safety. Phenoxycycloposphazene was developed by manufacturers such as SABIC and BASF to complement polymer systems for enhancing fire resistance in dashboards, battery enclosures, and interior panels; mechanical properties were not sacrificed during this improvement.

The coatings segment also supports the strong use of phenoxycycloposphazene because it enhances flame resistance and thermal durability in surface treatments with a share of 32%. For instance, high-performance coatings in aerospace and industrial machinery sectors seek the applicability of the additive in high-temperature settings that require protection by heat-resistant protective layers. Companies such as AkzoNobel and PPG Industries are developing phosphazene-based additives for next-generation requirements in aerospace and oil & gas pipeline coatings.

The industry is segmented by product form, is expected to witness solid formulations capturing around 60% of the share in 2025, while their liquid counterparts will hold the remaining 40%. Solid application is primarily favored for their ease of handling, longer shelf life, and better compatibility with thermoplastics and thermoset resins engaged in the manufacture of flame-retardant products.

Solid phenoxycycloposphazene powder and granules are in massive use in other areas of application, such as electronics, construction materials, and automotive polymers. ICL Group and Jiangsu Yoke Technology Co., Ltd. manufacture solid formulations specifically for high-performance polycarbonate, epoxy resins, and ABS compounds. These materials are commonplace in consumer electronics, circuit boards, and automotive components that need to meet very strict fire safety regulations, such as UL94 V-0 and RoHS.

In other aspects, solid forms are also preferred in cases where compounding or masterbatch processing is used, in which consistent dispersion and dosage control are major parameters. This will also further negate the need for special containment or temperature control during storage and transport, which benefits manufacturers in terms of cost reduction and better operational efficiency.

Liquid formulations enjoying a 40% industry share are progressively gaining recognition in niche applications, comprising flame-retardant coatings, adhesives, and sealants, for instance, where uniform surface coverage and fast curing are required. Liquid phenoxycycloposphazene-based additives are offered for advanced coatings in aerospace, electronics encapsulation, and textile finishing by companies such as ADEKA Corporation and Nippon Carbide Industries.

The key advantage of the liquid form lies in its rapid reactivity and ease of incorporation into solvent-based and waterborne systems. Limitations such as short shelf life and restrictions on storage conditions have, however, limited its acceptance in comparison to its solid counterpart.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK | 5% |

| France | 5.1% |

| Germany | 5.3% |

| Italy | 5% |

| South Korea | 5.4% |

| Japan | 5.2% |

| China | 5.6% |

| Australia | 5.1% |

| New Zealand | 5% |

The industry in the USA is expected to grow at a CAGR of 5.2% during the period between 2025 and 2035. The uptick in demand for high-performance flame retardant applications across electronics, defense and aerospace industries primarily supports high growth in the industry.

Growing regulatory pressure in the push toward the use of halogen-free retardants has written a strong growth trend on the pace of adoption of phenoxycycloposphazene, driven primarily by excellent thermal stability, together with compatibility with epoxy resins.

Industry leaders such as Merck KGaA (USA operations), Dow, and Hexcel Corporation are investing in new material innovations, creating favorable circumstances for long-term industry development. Additionally, alliances among chemical companies and electronics sectors are increasing domestic value chain content [Source: OECD].

The UK industry is anticipated to grow at a CAGR of 5% over the forecast period. Growing investment in sustainable production and REACH compliance has increased the need for halogen-free flame retardants in polymer composites. This trend has made phenoxycycloposphazene a solution of choice in printed circuit board (PCB) applications and niche coatings.

Companies such as Victrex plc and Johnson Matthey have grown more interested in advanced polymer chemistry for transport infrastructure and electronics, which is expected to fuel steady industry growth. In addition, investment support from innovation hotspots such as Innovate UK bolsters research-driven advances in material science [Source: UK Government Science and Technology].

France is also forecast to expand at a CAGR of 5.1% between 2025 and 2035 in the phenoxycycloposphazene industry. Regulatory reforms towards non-toxic flame retardants, particularly in aerospace and public infrastructure sectors, are serving as prime growth drivers. French aerospace players and electronics producers are increasingly adopting high-performance phosphazene polymers to comply with EU safety standards.

Other native producers, such as Arkema S.A., are increasing R&D capacity for the substitution of conventional flame retardants with phenoxycycloposphazene, specifically epoxy and polyurethane systems. Government-sponsored clean energy operations indirectly consolidate demand via material protection and insulation [Source: European Chemicals Agency].

Germany is ready to witness a robust CAGR of 5.3% over the forecast period. As Europe's manufacturing center, Germany's hi-tech engineering sectors are finding it more and more convenient to utilize phenoxycycloposphazene as a material for electronic encapsulation, PCB lamination, and industrial coating. High thermal resistance and electrical insulation provide competitive advantages.

Large players like BASF SE, Evonik Industries, and Lanxess are focusing on creating phosphazene chemistry portfolios. Sustained investment in premium materials for the automotive and electronics sectors drives the growth trajectory, supported by the government's move towards sustainable industrial practices [Source: German Federal Ministry for Economic Affairs and Climate Action].

The Italian industry will grow at a CAGR of 5%. Growth in the industry is driven by the increasing use of flame retardants in consumer electronics and transportation equipment. Supported by the nation's industrial modernization policies, the demand for high-end material solutions such as phenoxycycloposphazene is gaining traction.

High-profile Italian businesses like Solvay (with local activities) and Europlasma are collaborating with electronics OEMs to embrace safer fire-retardant alternatives. Furthermore, greater awareness of health and environmental risks generated by brominated retardants has influenced industry conditions in favor of phosphazene derivatives [European Environment Agency Source].

South Korea is forecast to achieve a CAGR of 5.4% from 2025 to 2035. The dynamic electronics manufacturing hub of the nation, led by industry giants in semiconductors and consumer electronics, is one of the major drivers of demand. Flame retardants used on multilayer PCBs and memory packaging systems have seen a growing movement towards phenoxycycloposphazene compounds.

Major players such as LG Chem and Songwon Industrial Co. are investing significantly in the production of halogen-free flame retardants. Technological innovation, coupled with favorable export policies, ensures a robust industry prospect, particularly in advanced electronics and automotive electronics [Source: World Bank Report].

The industry in Japan will expand at 5.2% CAGR. Increasing demands from automotive electronics, robotics, and electrical insulations have encouraged the application of phenoxycycloposphazene as a more favorable alternative to traditional retardants. Its compatibility with thermoset resins is particularly profitable within Japan's high-tech manufacturing context.

Large firms such as Mitsubishi Chemical Group and Sumitomo Bakelite Co. have established specialty polymer units, integrating advanced phosphazene chemicals into electronic substrates and flame-resistant materials. Government support in the manufacturing of clean electronics also promotes industry development [Source: IMF].

China is likely to be the growth driver, with a CAGR of 5.6%, the highest among the countries surveyed. The nation's huge electronics and construction industries have accelerated the use of advanced flame retardants in wire insulation, PCB assembly, and intelligent devices. Industry penetration has gained strength due to environmental reform and product innovation.

Domestic companies such as Sinochem International and Wynca Group are enhancing production capacity and establishing joint ventures to cater to domestic and international demand. The continued focus on industrial safety and environmental regulation within China's 14th Five-Year Plan is highly supportive of a sustainable long-term industry [Source: UN].

Australia is projected to post a CAGR of 5.1% from 2025 to 2035. Growing focus in the nation on electronics safety and high-performance coatings in the mining and infrastructure sectors has given rise to a modest but steady demand. Regional fire safety codes have been the key driver in this development.

Companies like Nuplex Industries and local distributors are forming partnerships with overseas chemical producers to ensure consistent supply. Government-backed programs to manufacture value-added chemicals domestically also provide incremental growth opportunities [Source: Australian Trade and Investment Commission].

New Zealand is also expected to clock a CAGR of 5%. While the industry size is modest, demand is emerging from premium construction materials, consumer electronics, and specialty industrial applications. There is interest in green flame retardant technologies, which are affecting public and private sector purchasing plans.

Partnerships at the regional level with suppliers in Asia and Australia have created easier access to phenoxycycloposphazene-based solutions. Government policies that promote green electronics and more secure construction methods are pushing incremental assimilation [Source: OECD].

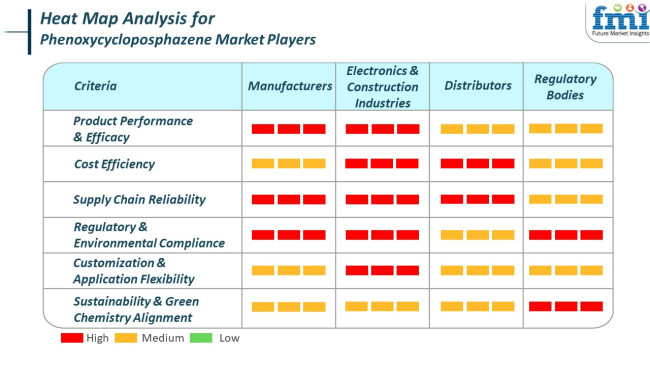

The industry is a highly competitive space for chemical manufacturers. The major players focus mainly on flame-retardancy applications, electronic coatings, and high-performance polymer composites. Leading companies emphasize high-purity production processes, regulatory compliance, as well as customized formulations to meet the diverse demands of different industries.

Industry leaders such as DuPont, as well as Mitsubishi Chemical, rely on strong capabilities in R&D coupled with extended networks across their supply chains. These firms emphasize superior value offerings in phenoxycycloposphazene products to suit performance needs in electrical insulation, flame-retardant plastics, and highly specialized coating applications.

In fact, Tianjin ZhongxinChemtech Co., Ltd. and Zibo Lanyin Chemical Co. Ltd. serve the growing demand within the Asia-Pacific region through cost-efficient and bulk supply opportunities for electronics and automotive applications. These companies focus strongly on efficient production to sustain price competitiveness in the global industry.

Such companies as J & K Scientific Ltd., Chembridge International Corp., and T&W GROUP have focused on specialty-grade phenoxycycloposphazenes for high-end applications in medical devices, aerospace, and semiconductor coatings. Thus, these companies have made development on customized product formulations, very high purity standards, and tie-ups with research institutions their competitive advantage.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DuPont | 20-24% |

| Mitsubishi Chemical | 16-20% |

| Tianjin Zhongxin Chemtech | 12-16% |

| Zibo Lanyin Chemical | 10-14% |

| J & K Scientific Ltd. | 8-12% |

| Other Companies (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| DuPont | High-purity phenoxycycloposphazene for flame retardancy , insulation coatings, and polymer enhancement. |

| Mitsubishi Chemical | Innovative chemical formulations for electronics, industrial applications, and thermoplastic composites. |

| Tianjin Zhongxin Chemtech | Bulk supply of phenoxycycloposphazene for electronic and automotive flame-retardant applications. |

| Zibo Lanyin Chemical | Cost-effective phosphazene derivatives for high-volume industrial applications. |

| J & K Scientific Ltd. | Specialized chemical solutions for research, semiconductor coatings, and high-performance materials. |

Key Company Insights

DuPont (20-24%)

DuPont is the leader in advanced formulations of phenoxycycloposphazene for high-end insulation, flame-retardant plastics, and the semiconductor industry.

Mitsubishi Chemical (16-20%)

Mitsubishi Chemical targets phosphazene solutions for specific use: integrated high-performance additives in electronic and industrial applications.

Tianjin ZhongxinChemtech Co., Ltd. (12-16%)

Tianjin ZhongxinChemtech supplies phosphazene derivatives at a cheaper rate, focusing on bulk production and cost.

Zibo Lanyin Chemical (10-14%)

Zibo Lanyin Chemical specializes in the mass production of phenoxycycloposphazene tailored to flame-retardant applications in the automobile and aerospace industries.

J & K Scientific Ltd. (8-12%)

J & K Scientific Ltd. targets highly pure and research-grade phenoxycycloposphazene that is suitable for medical devices as well as coatings for semiconductors.

Other Key Players (25-35% Combined)

The market is estimated to reach USD 163.3 million by 2025.

The market is projected to grow to USD 271.8 million by 2035.

China is expected to grow at a rate of 5.6%.

Fire retardants are the leading application segment.

Key players in this market include DuPont, Mitsubishi Chemical, Tianjin Zhongxin Chemtech Co., Ltd., Zibo Lanyin Chemical Co. Ltd., J & K Scientific Ltd., Chembridge International Corp., T&W GROUP, Skyrun Industrial, Tokyo Chemical Industry Co., Ltd., and TCI EUROPE N.V.

By application, the industry is segmented into fire retardants and coatings.

By end user industry, the industry is segmented into automotive industry and construction industry.

By product form, the industry is segmented into liquid formulations and solid formulations.

By distribution channel, the industry is segmented into direct sales and online sales.

By grade, the industry is segmented into technical grade and industrial grade.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Precipitation Hardening Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Plywood Market Growth - Innovations, Trends & Forecast 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.