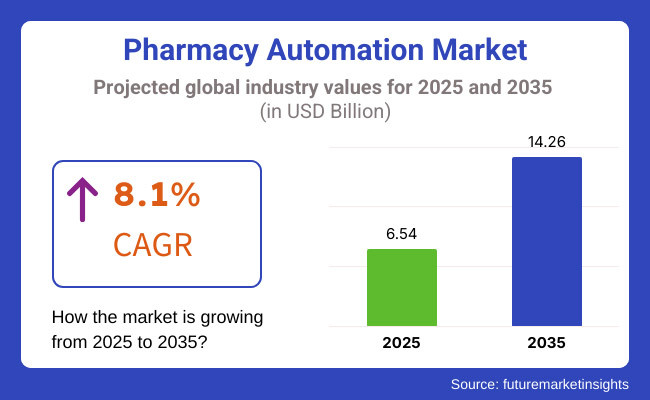

The pharmacy automation industry is anticipated to witness tremendous growth from 2025 to 2035 due to growing need for medication safety, healthcare digitization, and technological advancements in robotic dispensing systems. The industry is likely to grow from around USD 6.54 billion in 2025 to around USD 14.26 billion by 2035 at a compound annual growth rate (CAGR) of 8.1% during the forecast period.

Major growth drivers are, the surging demand of minimizing medication errors, extended use of automated prescription dispensing systems, and enhanced emphasis on enhancing pharmacy workflow efficiency.

Furthermore, expansion of e-prescribing, artificial intelligence (AI) integration in pharmacy operations, and increasing investment in robotic medication management solutions are improving market penetration. However, industry growth will be hindered by issues like high implementation costs, interoperability with existing healthcare IT systems, and data security concerns.

Looking back to 2024, the pharmacy automation industry was expanding steadily driven by the rapid adoption of automated systems by healthcare ventures and pharmacies to ensure accuracy rate and elevated procedures.

The demand for robotic dispensing units, AI-based pharmacy management solutions and automated packaging/labeling systems surged with the need for improved patient safety and uninterrupted workflow. Investments in digital healthcare infrastructure also provided the groundwork for faster industry growth in 2025. Such developments set the sector for the next decade of rapid growth.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Medication safety regulation compliance and electronic prescription management. | Increased AI and blockchain regulation for pharmacy automation security and efficacy. |

| Use of robotic dispensing, barcode scanning, and cloud-based pharmacy management. | Integration of AI-based predictive analytics, blockchain-enabled prescription tracking, and intelligent robotics. |

| More preference for faster, error-free prescription processing. | Increased personalized medicine and in-home pharmacy automation demands. |

| Growing prescription numbers, medication safety issues, and hospital automation initiatives. | Increase in remote pharmacy services, drug interaction monitoring powered by AI, and intelligent dispensing of medications. |

| Early measures in minimizing pharmaceutical waste and enhanced energy efficiency in automation. | Increased deployment of green pharmacy packaging and efficient energy-saving automation technology. |

| Reliance on centralized pharmacy networks and on-site prescription filling. | Development of decentralized pharmacy automation, supporting direct-to-consumer medication dispensing. |

The pharmacy automation industry is categorized under the medical devices and healthcare technology sector, more precisely the healthcare IT and robotics automation. The sector is shaped by various macroeconomic factors, including healthcare expenditure, technological advancements, regulations, and demographic changes.

At the macro level, the sector for pharmacy automation will gain from growing worldwide spending on healthcare as population ages, chronic diseases spread, and people demand better patient safety. A transition to value-based healthcare is also prompting investment in automation for improved efficiency, lower drug dispensing errors, and optimized pharmacy operations.

Further, government measures promoting digital healthcare transformation through the adoption of AI and electronic prescribing mandates are fast-tracking the adoption of the segment. The economic landscape also comes into play.

In the Asia-Pacific and Latin American emerging sectors, they are seeing swift investments going into healthcare infrastructure, which serves as substantial growth drivers. In mature regions such as North America and Europe, on the other hand, automation becomes the need to tackle labor scarcity and operational inefficiencies.

The United States pharmacy automation industry is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2025 through 2035. This increase is based on the growing necessity of minimizing medication errors, improving workflow efficiency, and coping with the growing number of prescriptions.

The use of sophisticated technologies like automated dispensing cabinets, robotic dispensing systems, and medication management solutions is gaining momentum in hospital as well as retail pharmacies. Major players in the USA industry are organizations like McKesson Corporation, Omnicell, Inc., and Baxter International Inc., which provide end-to-end pharmacy automation solutions.

Furthermore, the use of artificial intelligence (AI) and machine learning in pharmacy operations will continue to improve inventory management and patient safety. Challenges like initial investment expenses and compatibility with existing systems could, however, slow rapid adoption. Generally, though, the future of pharmacy automation in the United States is bright, with ongoing innovations expected over the next few years.

The industry for pharmacy automation in the United Kingdom will have a CAGR of 9.1% during the period from 2025 to 2035. The major drivers of the industry include increasing demands for automated medication dispensing systems, ensuring minimization of human errors, and increased pressures on healthcare services.

The National Health Service (NHS) has been strongly investing in automated technologies to enhance the delivery of services and patients' outcomes. Organizations like Becton, Dickinson and Company (BD) and Swisslog Healthcare are leading automation solution providers in the UK industry.

The attention is on integrating automated systems in hospital and community pharmacies to improve operations and lighten the workload on healthcare professionals. In addition, the concern for patient safety and the effective use of resources are promoting the implementation of technologies such as automated dispensing cabinets and robotic dispensing systems.

The industry for pharmacy automation in China is expected to develop at a CAGR of 9.5% during 2025-2035. The urbanization process, growing healthcare spending, and the emphasis of the government on upgrading healthcare infrastructure are driving forces behind the growth. Implementation of automation technology is intended to solve issues of medication errors and inefficiencies of manual dispensing operations.

Chinese firms such as Beijing Sincoheren S&T Development Co., Ltd. and global firms such as Omnicell, Inc. operate in this industry. Adoption of AI and data analytics within pharmacy operations is also picking up, improving inventory management and patient safety.

However, issues of high cost of implementation and the requirement for standardization across heterogeneous healthcare environments may influence the adoption rate. In total, China's industry for pharmacy automation will grow considerably, led by technological innovation and favorable government policies.

The pharmacy automation industry in Japan is expected to develop at a CAGR of 9.3% during the forecast period of 2025-2035. The aging population and the resultant growth in medication requirements are the key drivers for the adoption of pharmacy automation in pharmacies. The government of Japan has been encouraging the adoption of cutting-edge technologies to enhance healthcare services.

Tosho Inc. and Panasonic Healthcare are some of the key players in the provision of pharmacy automation solutions in Japan. Focus is placed on improving efficiency, lowering drug errors, and streamlining inventory management.

Despite these improvements, steep upfront costs and workforce training could slow the pace of adoption. Nevertheless, Japan's dedication to technologic advancement places its pharmacy automation industry on the precipice of significant growth in the next few years.

South Korea's pharmacy automation industry will witness the highest CAGR among the mentioned countries, at 10.1% during 2025-2035. The advanced technological infrastructure of the country and the government's efforts to update healthcare services are major drivers for this growth.

Pharmacies like JVM Co., Ltd., which is owned by Hanmi Pharmaceutical, are major South Korean players, providing a variety of pharmacy automation solutions. AI and robotics are increasingly being used in pharmacy operations as well, further streamlining processes.

High costs of implementation and the necessity of regulatory clearances can, however, become obstacles to its widespread use. In total, South Korea's pharmacy automation industry is set to grow at a rapid pace due to technological advancements and favorable government policies.

India's pharmacy automation industry is at the nascent stage but will grow at a fast pace in the next few years. Growth drivers include the rising healthcare infrastructure burden, necessity to minimize drug errors, and increasing use of digital technologies. The government initiative towards digitization in healthcare, such as the National Digital Health Mission, is also fueling the growth of the industry.

Omnicell, Inc., and BD are among the companies that are investigating opportunities in the Indian sector with solutions specific to local requirements. Rapid adoption can be hindered by challenges such as budget constraints, unawareness, and infrastructure development needs. India's pharmacy automation sector, though facing such challenges, has high potential and is expected to grow at a CAGR of 8.0% during the forecast period.

Germany's pharmacy automation sector will continue to grow gradually from 2025 to 2035. Germany's highly developed healthcare system and the focus on technological advancements are major drivers of this expansion. The implementation of automation technologies is focused on increasing efficiency, minimizing drug errors, and streamlining pharmacy operations.

BD Rowa and KUKA AG are among the top vendors of pharmacy automation systems in Germany. The convergence of AI and robotics in pharmacy processes is also picking up steam, improving inventory control and patient safety.

Nevertheless, issues like expensive implementation and the requirement for standardization across a wide range of healthcare environments can influence the adoption rate. Germany's pharmacy automation industry as a whole is set to grow steadily, at a CAGR of 6.5% between 2025 to 2035.

The Brazilian industry for pharmacy automation is expected to register a compound annual growth rate (CAGR) of 7% during the period between 2025 and 2035 and reach an estimated value of USD 422.85 million by 2031. The growth is fueled by the escalating requirement to optimize medication dispensing efficiency, minimize errors, and enhance patient safety in the healthcare system.

The use of automated prescription processing software, robots, and automatic packaging systems is increasingly common among hospital and retail pharmacies with a view to accelerating the filling process and minimizing waiting times for customers.

Talyst, LLC and Omnicell, Inc. are some of the major players in the Brazilian industry, among others. They provide end-to-end pharmacy automation solutions that address the unique demands of the Brazilian healthcare industry.

Nonetheless, the potential risks such as high upfront investment and staff training requirements could slow fast adoption. Regardless of these risks, the overall scenario for pharmacy automation in Brazil is bright with ongoing developments projected in the next few years.

Pharmacy automation industry includes different product segments that all play a role in pharmaceutical operation enhancement. Medicine dispensing systems, with an estimated compound annual growth rate (CAGR) of 7.9% between 2025 and 2035, play a key role in facilitating the automatic delivery of medicines accurately, thus eliminating errors and enhancing patient safety.

These systems facilitate streamlined dispensing, avoiding delays and ensuring accurate medication delivery. Automated drug compounding machines have a key function in compounding customized dosages of medications, increasing accuracy and decreasing contamination potential.

Labeling and packaging machines mechanize packaging medications for shipping, right labeling, and conformity to safety levels. Storage and retrieval systems are efficient inventory handlers, optimizing use of space and allowing fast retrieval of drugs.

Tabletop tablet counters are precise counter tablets with improved efficiency for both hospital and retail pharmacies. The use of such automation products is responding to the increasing need for efficiency, accuracy, and safety in pharmaceutical processes, which is consistent with the shift of the industry towards modernization.

Pharmacy automation is offered to different end-use sectors, each uniquely supported by technological development. Inpatient pharmacies, being part of the hospital environment, are expected to grow at a CAGR of 7.7% from 2025 to 2035. Automating these pharmacies improves drug handling, minimizes errors, and enhances patient health.

Acute care environments utilize automation to expedite and maintain accurate medication distribution, which is vital for acute patient care. Long-term care facilities are advantaged by automation in terms of effective medication management for chronic diseases, improved resident safety, and quality of care.

Outpatient pharmacies and fast-track clinics use automation to speed up prescription processing, shortening wait times and enhancing patient satisfaction. Hospital retail environments use automation to handle both inpatient and outpatient medication requirements effectively.

Pharmacy benefit management companies and mail-order pharmacies use automation to process high volumes of prescriptions accurately and in a timely manner. Retail pharmacies embrace automation to automate processes, optimize inventory, and improve customer service. The common use of automation in these industries is an indication of the industry's desire to enhance efficiency, accuracy, and patient safety in medication management.

FMI surveyed stakeholders in the pharmacy automation sector to evaluate industry trends, challenges, and future prospects. According to the results, there is high optimism regarding the growth of the sector, fueled by the evolution of automation and the rising need for medication safety.

Stakeholders underscored that automated dispensing systems, robotic filling of prescriptions, and AI-based inventory management all cut down significantly on human error and improve efficiency. Many respondents believe these technologies will allow pharmacists to focus more on patient care, improving overall healthcare outcomes.

In spite of the advantages, the survey also pointed out challenges that are preventing large-scale adoption. High upfront investment and compatibility with current healthcare infrastructure were the biggest concerns. Data security threats and the requirement for large-scale staff training were also seen as major obstacles. Most stakeholders emphasized that overcoming these challenges is essential to ensure maximum impact from automation.

Ahead, the respondents had faith in up-and-coming trends like machine learning and AI in pharmacy practices. These will enhance decision-making, streamline inventory, and support personalized patient treatment. The findings of the survey reaffirm the industry's push for the advancement of pharmacy automation despite current barriers to develop an efficient, secure, and tech-oriented pharmaceutical industry.

| Countries | Regulatory Impact on Pharmacy Automation |

|---|---|

| United States | United States set rigorous state and federal standards to ensure efficient dispensing practices keeping in mind the public safety. These laws necessitate pharmacy automation systems, integrated with advanced technologies to protect both patients and healthcare operators. |

| United Kingdom | The UK has enforced sophisticated healthcare standards to facilitate the adoption of automation in pharmacies to improve the treatment accuracy. Systems that maintain patient information must adhere to the data protection laws, such as General Data Protection Regulation (GDPR). |

| China | The regulatory standard of China encourages modernization of healthcare practices, like integration of pharmacy automation. Policies focus on elevating healthcare delivery standards alongside prioritizing patient safety and data security. |

| Japan | Japan is making efforts of encouraging the adoption of advanced technologies in healthcare, including pharmacy automation. The authorities are imposing supportive regulations to elevate the healthcare efficiency. |

| South Korea | South Korea’s regulations promote the integration of automation pharmacies to take the region’s operational services to next level and eradicating the medication errors. |

| India | India is also constantly developing and shaping its regulations to encourage pharmacy automation, focusing on improving medication dispensing accuracy. |

| Germany | Germany has rigid law framework that prioritize patient safety in medication dispensing. The government initiatives are supporting technological developments and data protection laws to adhere to the healthcare guidelines. |

| Brazil | The regulatory environment of Brazil is transforming to accommodate pharmacy automation, aiming to enhance healthcare efficiency and patient safety. The policies are targeting in balancing conventional healthcare infrastructure with the modern technological adoption. |

Pharmacy automation industry holds immense growth prospects, driven by technological advancements in artificial intelligence (AI), machine learning, and digital healthcare transformation. Incorporating AI into pharmacy automation will improve the accuracy of medication dispensing, reduce inventory management complexity, and maximize patient care.

Growth sectors also provide huge opportunity as governments and healthcare providers are investing to upgrade their infrastructure. Businesses can capitalize on these possibilities by adapting solutions to local requirements in a way that complies with local legislation.

Joint collaborations with technology companies, healthcare centers, and research centers can further push innovation to help create sophisticated automation solutions that resolve industry problems successfully. To achieve optimal growth, businesses need to focus on investing in research and development (R&D) that will further develop affordable, user-friendly automation systems.

Cloud-based and AI-based pharmacy management innovations can enhance the efficiency of workflow and increase customer adoption. Regulatory compliance is still important since divergent international standards affect industry entry and growth.

Businesses need to ensure that automation systems are compatible with changing regulations, especially in data security and interoperability. In addition, a customer-focused strategy is essential for success. Creating adaptable automation solutions that can be customized to various pharmacy environments can drive adoption rates.

During 2024, the pharmacy automation industry witnessed consolidation and cooperation to a large extent, which demonstrated a strategic turn towards improving technology capabilities and broader industry coverage.

Some of the major mergers and acquisitions included Corza Medical's takeover of Takeda's TachoSil manufacturing business in Linz, Austria. This strategic acquisition allowed Corza Medical to take direct control over manufacturing priorities, thus improving levels of service and support to surgeons, partners, and patients around the world.

With the pharmacy automation industry still developing, new players in 2025 are using cutting-edge strategies to make their mark and compete favorably. One of the major strategies is utilizing artificial intelligence (AI) to maximize clinical trial effectiveness.

Organizations such as Unlearn are at the forefront of applying 'digital twins'-AI models simulating disease development-to improve clinical trials. This approach not only speeds up the process of drug development but also keeps new entrants at the innovation forefront of technology in healthcare.

Additionally, startups are aggressively pursuing mergers and acquisitions to strengthen their capabilities and reach in the industry. This M&A-driven strategy allows new entrants to quickly consolidate advanced technologies and diversify services, thereby establishing a competitive advantage in the pharmacy automation space.

Advancements in AI, robotic dispensing, and digital prescriptions, along with the need for medication safety and workflow efficiency, are key growth factors.

Governments enforce safety, data security, and interoperability standards, influencing investment in automated pharmacy solutions.

High costs, integration with existing systems, data security concerns, and staff training are common obstacles.

AI improves medication accuracy, predicts inventory needs, personalizes patient care, and enables robotic dispensing.

AI-driven management, blockchain for prescription tracking, cloud-based solutions, remote pharmacy services, and sustainability initiatives are shaping the future.

Anti-hyperglycemic Agents Market: Growth, Trends, and Assessment for 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.