The global Pharmacovigilance Market is estimated to be valued at USD 9025.2 million in 2025 and is projected to reach USD 20,977.1 million by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period. This growth is driven by the increasing incidence of adverse drug reactions (ADRs), the rising prevalence of chronic diseases, and the expanding pharmaceutical industry.

The demand for effective drug safety monitoring systems has intensified, prompting investments in advanced pharmacovigilance solutions. Additionally, stringent regulatory requirements and the need for real-time data analysis have propelled the adoption of sophisticated pharmacovigilance practices. The market's expansion is further supported by the integration of artificial intelligence (AI) and machine learning (ML) technologies, enhancing the efficiency and accuracy of drug safety assessments.

The U.S. Food and Drug Administration (FDA) and global regulatory authorities have intensified their efforts in establishing comprehensive frameworks for the responsible integration of artificial intelligence (AI) in pharmaceutical processes. In January 2025, the FDA issued a draft guidance titled “Considerations for the Use of Artificial Intelligence to Support Regulatory Decision-Making for Drug and Biological Products.”

This guidance outlines a risk-based framework for AI applications across the entire lifecycle of both small molecule drugs and biologics, emphasizing the importance of transparency, model credibility, and regulatory collaboration. The document also elaborates on AI’s role in regulatory decision-making, including its application in pharmacovigilance.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9025.2 million |

| Industry Value (2035F) | USD 20,977.1 million |

| CAGR (2025 to 2035) | 8.8% |

Further reinforcing its strategic focus, the FDA’s Center for Drug Evaluation and Research (CDER) launched the Emerging Drug Safety Technology Program (EDSTP) to serve as a central hub for evaluating AI and other innovative technologies in pharmacovigilance. The program aims to foster knowledge exchange, contextual understanding, and informed regulatory responses concerning AI use.

The pharmaceutical sector is witnessing rapid AI adoption, driven by its ability to enhance lifecycle management, accelerate development timelines, improve compliance, and ultimately support better patient safety outcomes. These regulatory and institutional actions underscore the FDA’s proactive stance in guiding the integration of AI with scientific rigor and regulatory accountability.

Prominent players in the pharmacovigilance market include IQVIA, Parexel International Corporation, ICON plc, and Oracle Corporation. These companies are actively investing in technological advancements and expanding their global footprint to meet the growing demand for pharmacovigilance services.

As stated by Marcela Miño, Senior Director, Lifecycle Management Global Head, IQVIA “In 2025, AI will reshape pharmacovigilance (PV) and regulatory affairs, transforming compliance into a proactive strategy that drives efficiency, enhances global agility, and redefines resource allocation”.

North America holds a significant share of the pharmacovigilance market, driven by a well-established healthcare infrastructure and stringent regulatory frameworks. The region's focus on patient safety and the presence of major pharmaceutical companies contribute to the demand for advanced pharmacovigilance solutions.

Government initiatives and investments in healthcare IT further facilitate the adoption of innovative drug safety monitoring systems. Europe's pharmacovigilance market is characterized by robust regulatory compliance and a strong emphasis on patient safety.

The European Medicines Agency (EMA) mandates rigorous pharmacovigilance practices, prompting pharmaceutical companies to invest in comprehensive drug safety monitoring systems. Collaborations between industry stakeholders and regulatory bodies enhance the effectiveness of pharmacovigilance activities across this region.

In 2025, the Clinical Trial Pharmacovigilance segment is anticipated to hold approximately 35.0% revenue share in the global pharmacovigilance market, emerging as the leading segment by type. This dominance has been attributed to the heightened global emphasis on drug safety during the clinical development phase, driven by increasingly stringent regulatory requirements from agencies such as the USA FDA, EMA, and PMDA.

The rise in clinical trial complexity, particularly for oncology, biologics, and cell and gene therapies, has necessitated proactive risk management and adverse event monitoring from Phase I through post-marketing surveillance. Growth in this segment has also been influenced by the global surge in investigational drug pipelines and the shift toward decentralized and multi-regional trials, which require real-time safety data aggregation and analysis.

The growing trend of outsourcing clinical pharmacovigilance functions to specialized CROs and safety service providers has further contributed to the market expansion, offering operational scalability and compliance expertise. Furthermore, the integration of AI-enabled pharmacovigilance platforms has improved the detection of safety signals and streamlined case processing.

By Drug class, Small Molecule Drugs segment is expected to hold 29.5% of the overall revenue share in the global pharmacovigilance market, maintaining its position as the leading drug class segment. This dominance has been driven by the vast number of small molecule therapeutics in both development and commercial use across a broad range of therapeutic areas, including oncology, cardiovascular, and infectious diseases.

Due to their relatively simpler manufacturing processes and well-established pharmacokinetic profiles, small molecules continue to account for the majority of new drug approvals globally. The pharmacovigilance burden associated with small molecules has increased due to heightened post-marketing surveillance mandates and the growing emphasis on personalized treatment approaches, where off-target effects and drug-drug interactions require close monitoring.

Regulatory agencies have intensified adverse event reporting standards for generic and branded small molecule drugs, especially those used chronically. Additionally, the sheer volume of generics in circulation has amplified the need for continuous safety evaluations.

With many originator molecules approaching patent expiry, pharmacovigilance activities are being scaled up by both innovators and generic manufacturers to manage lifecycle safety risks and ensure regulatory compliance. These dynamics, supported by automation tools in adverse event data processing for small molecules, are expected to reinforce the segment’s continued growth in pharmacovigilance spending and operations.

Challenges

High Cost Associated With Implementing and Maintaining Comprehensive Pharmacovigilance Systems

Setting up and keeping good drug safety systems is costly for drug companies, mostly when using new tech for spotting signals, handling cases, and reporting side effects. These systems need complex software, well-trained staff, and constant updates to meet rules. For big drug companies, handling these systems themselves can be practical. However, smaller firms often struggle to afford these big systems. The high costs for setup, training, and continuous rule-following can stretch budgets, pushing many companies to choose outsourcing as a cheaper choice.

Hiring outside firms to handle drug safety tasks can help companies cut costs and manage their work better. But, outsourcing brings its own risks, especially in data safety and quality checking. Sharing sensitive info about patients and drug safety with outside groups can risk data leaks or unauthorized access.

Opportunities

AI and Machine Learning Integration in the Pharmacovigilance Process Expanding Opportunities in the Pharmacovigilance Market

The use of AI and machine learning (ML) in drug safety is changing how we monitor drugs. AI and ML can look over lots of data from studies, patient records, and real-world data quickly to spot safety issues faster than older ways. These tools can find patterns in bad drug reactions and spot risks that might not be clear right away. This helps us act sooner to reduce risks.

When handling cases, automation cuts down the need for putting in data by hand and checking it, which saves time for more important work. This greatly lowers mistakes and speeds up the work, making drug safety operations more efficient. AI also helps make sure that all safety reports are put together, checked, and sent in the right way according to global rules, lowering the chance of breaking rules.

The market of the pharmacovigilance field expanded robustly between 2024 and 2020 supported by increasing drug approvals, growing demand for adverse drug reaction monitoring, and the regulatory drug safety mandates. The COVID-19 pandemic has been the prime factor in the fast adoption of digital pharmacovigilance platforms, artificial intelligence, and real world data analytics to enhance signal detection for low-risk patients and correct risk management. The main reason for the more widespread practice of the pharmacovigilance services to be outsourced to contract research organizations and business process outsourcing firms was the higher cost efficiency and better global compliance.

In the upcoming 2025 to 2035, the market will be characterized by the dispersion of digital automation, secure data management availability, and biosimilar and personalized medicine. This will in turn be enabled by the development of pharmacovigilance applications in personalized medicine and biologics. Regulatory bodies will further refine global safety reporting guidelines by focusing on proactive risk assessment and real-time ADR monitoring.

The demand for predictive analytics and machine learning bottlenecks which are proposed to be used in the pharmacovigilance monitoring of drugs will largely increase. The sustainable development transformation will be directed at cutting off paper based reporting systems and switching to cloud-based, eco-friendly data management platforms. Supply chain resilience will be additionally boosted by outsourcing of pharmacovigilance services that are provided by different partners and decentralized safety monitoring with increased adoption of this model.

The United States' pharmacovigilance market is undergoing significant progress due to the rising spread of chronic diseases, which result in larger drug consumption and a corresponding increase in adverse drug reactions. The strict regulatory framework applied by the USA Food and Drug Administration that imposes stringent drug safety monitoring of the drugs is pushing the demand for pharmacovigilance services which is even further.

Also, the technological improvement and wide adoption, with the likes of artificial intelligence and machine learning, has grown the efficiency of ADR detection and risk management processes. Even so, barriers procured by high operative costs and the need to adhere to complex regulation may be an obstacle to market growth. Nevertheless, the devotion towards patient safety and the perpetual development of new therapeutics will bring about the market growth.

Market Growth Factors

Market Outlook

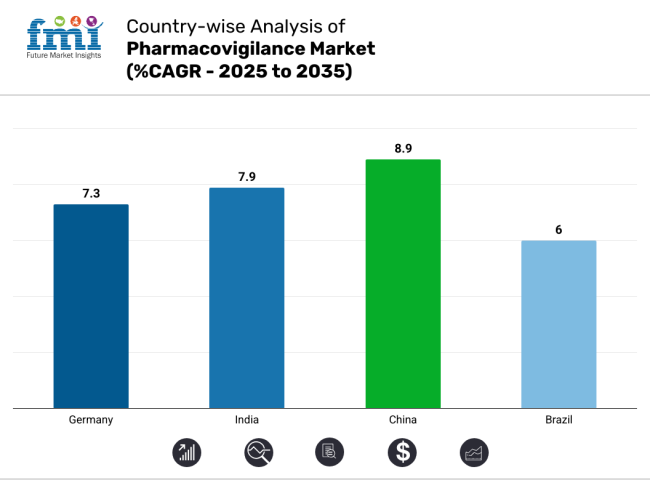

Germany's pharmacovigilance market is growing out for well functioning health care system and the highly pronounced regulatory conditions that are being implemented by the Federal Institute for Drugs and Medical Devices in Germany. The aging population of the country drives higher medication consumption and, consequently, the possibility of ADRs as well as the necessity for an integrated pharmacovigilance. With the pharmaceutical industry prioritization of innovation and utilization of sophisticated data analytics approaches on drug safety monitoring is improving. Cooperation between regulatory bodies and pharmaceutical manufacturers is made to enhance the ADR reporting infrastructure, and this is expected to have a positive effect on the size of the country.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.3% |

Market Outlook

The pharmaceutical industry is growing and emphasizing drug safety, and India's pharmacovigilance industry is thus expanding. Operating in collaboration with the Pharmacovigilience Program of India, the Central Drugs Standard Control Organisation is evolving reporting and adverse drug reaction surveillance procedures. Increasing demand for robust pharmacovigilance, which is likely to drive market growth in the country, coincides with increased access to healthcare facilities and an increasing burden of chronic diseases fueling drug consumption.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.9% |

The flourishing China's pharmacovigilance industry is spurred by the development of its pharma industry and increasing healthcare expenditure. The National Medical Products Administration (NMPA) strict regulations aimed at enhancing drug safety have assisted in improving pharmacovigilance methods. Further, with increasing drug consumption, the occurrence of ADRs also on the rise which fueling the need for pharmacovigilance

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.9% |

The Brazilian market for pharmacovigilance is expanding as a result of enhanced healthcare infrastructure and added regulatory interest in drug safety by the National Health Surveillance Agency (ANVISA). The expanding burden of chronic diseases and enhanced access to medicines enhances the utilization of medicines, thus creating more need for effective pharmacovigilance.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.0% |

The market for pharmacovigilance is growing rapidly with growing regulatory needs, growing adverse drug reactions (ADRs), and the development of drug safety monitoring technologies. Market leaders are concentrating on automation, AI-based data analysis, and global pharmacovigilance services to enhance their market position. The market is highly competitive, with contract research organizations (CROs) and pharmaceutical companies investing in innovative drug safety solutions.

IQVIA (25-30%)

IQVIA leads the pharmacovigilance market with AI-driven analytics, automation, and comprehensive drug safety services. The company continues to expand its technological capabilities and regulatory compliance expertise.

Parexel International (18-22%)

Parexel specializes in outsourced pharmacovigilance, post-market surveillance, and global drug safety reporting. The company focuses on enhancing efficiency and compliance in clinical trials.

Covance (Labcorp) (12-15%)

Covance provides risk management solutions, regulatory reporting, and ADR monitoring, catering to pharmaceutical and biotech firms worldwide.

ICON plc (8-10%)

ICON integrates real-world data and automation into its pharmacovigilance services, ensuring proactive drug safety monitoring and compliance.

Other Key Players (40-50% Combined)

Various other pharmaceutical and medical device companies contribute significantly to the Pharmacovigilance market through a variety of drug formulations and surgical interventions. Notable players include:

Clinical Trial Pharmacovigilance, Post-Marketing Pharmacovigilance, Comparative Pharmacovigilance, Herbal and Traditional Medicine Pharmacovigilance, Vaccine Pharmacovigilance, Targeted Pharmacovigilance and Active and Passive Pharmacovigilance

Pre-clinical, Phase I, Phase II, Phase III, and Phase IV

Large Molecule Drugs, Small Molecule Drugs and Herbal & Natural Products

Oncology, Cardiology, Neurology, Immunology & Autoimmune Diseases, Gene & Cell Therapy-Related Adverse Events and Others

In-House Pharmacovigilance and Outsourced Pharmacovigilance

Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations (CROs), Business Process Outsourcing (BPOs) Firms, Regulatory Authorities (e.g., FDA, EMA, MHRA), and Hospitals & Healthcare Providers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Pharmacovigilance Market was USD 9025.2 million in 2025.

The Pharmacovigilance Market is expected to reach USD 20,977.1 million in 2035.

Rising prevalence of chronic disease that creating demand for advanced therapeutics for better treatment is likely a key driving growth factor of this market.

The top key players that drives the development of Pharmacovigilance Market are IQVIA, Parexel International, Covance (Labcorp), ICON plc. and Syneos Health.

Clinical trial pharmacovigilance in type of pharmacovigilance of Pharmacovigilance market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Phase of Drug Development, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type of Methods, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Service Type Provider , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Phase of Drug Development, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Type of Methods, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Service Type Provider , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Phase of Drug Development, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Type of Methods, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Service Type Provider , 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Phase of Drug Development, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Type of Methods, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Service Type Provider , 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Phase of Drug Development, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Type of Methods, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Service Type Provider , 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Phase of Drug Development, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Type of Methods, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Service Type Provider , 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Phase of Drug Development, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Type of Methods, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Service Type Provider , 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Phase of Drug Development, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Type of Methods, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Service Type Provider , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Phase of Drug Development, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type of Methods, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Service Type Provider , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Phase of Drug Development, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Phase of Drug Development, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Phase of Drug Development, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Type of Methods, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Type of Methods, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type of Methods, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Service Type Provider , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Service Type Provider , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Service Type Provider , 2023 to 2033

Figure 17: Global Market Attractiveness by Phase of Drug Development, 2023 to 2033

Figure 18: Global Market Attractiveness by Type of Methods, 2023 to 2033

Figure 19: Global Market Attractiveness by Service Type Provider , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Phase of Drug Development, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Type of Methods, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Service Type Provider , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Phase of Drug Development, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Phase of Drug Development, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Phase of Drug Development, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Type of Methods, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Type of Methods, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Type of Methods, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Service Type Provider , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Service Type Provider , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Service Type Provider , 2023 to 2033

Figure 37: North America Market Attractiveness by Phase of Drug Development, 2023 to 2033

Figure 38: North America Market Attractiveness by Type of Methods, 2023 to 2033

Figure 39: North America Market Attractiveness by Service Type Provider , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Phase of Drug Development, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Type of Methods, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Service Type Provider , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Phase of Drug Development, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Phase of Drug Development, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Phase of Drug Development, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Type of Methods, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Type of Methods, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Type of Methods, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Service Type Provider , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Service Type Provider , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Service Type Provider , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Phase of Drug Development, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Type of Methods, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Service Type Provider , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Phase of Drug Development, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Type of Methods, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by Service Type Provider , 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Phase of Drug Development, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Phase of Drug Development, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Phase of Drug Development, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Type of Methods, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Type of Methods, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Type of Methods, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by Service Type Provider , 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Service Type Provider , 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Service Type Provider , 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Phase of Drug Development, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Type of Methods, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Service Type Provider , 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Phase of Drug Development, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Type of Methods, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by Service Type Provider , 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Phase of Drug Development, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Phase of Drug Development, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Phase of Drug Development, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Type of Methods, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Type of Methods, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Type of Methods, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Service Type Provider , 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type Provider , 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type Provider , 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Phase of Drug Development, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Type of Methods, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Service Type Provider , 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Phase of Drug Development, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Type of Methods, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by Service Type Provider , 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Phase of Drug Development, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Phase of Drug Development, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Phase of Drug Development, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Type of Methods, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type of Methods, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type of Methods, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Service Type Provider , 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type Provider , 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type Provider , 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Phase of Drug Development, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Type of Methods, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Service Type Provider , 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Phase of Drug Development, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Type of Methods, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Service Type Provider , 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Phase of Drug Development, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Phase of Drug Development, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Phase of Drug Development, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Type of Methods, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Type of Methods, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Type of Methods, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Service Type Provider , 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Service Type Provider , 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Service Type Provider , 2023 to 2033

Figure 137: East Asia Market Attractiveness by Phase of Drug Development, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Type of Methods, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Service Type Provider , 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Phase of Drug Development, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Type of Methods, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Service Type Provider , 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Phase of Drug Development, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Phase of Drug Development, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Phase of Drug Development, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Type of Methods, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Type of Methods, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type of Methods, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Service Type Provider , 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type Provider , 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type Provider , 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Phase of Drug Development, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Type of Methods, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Service Type Provider , 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA