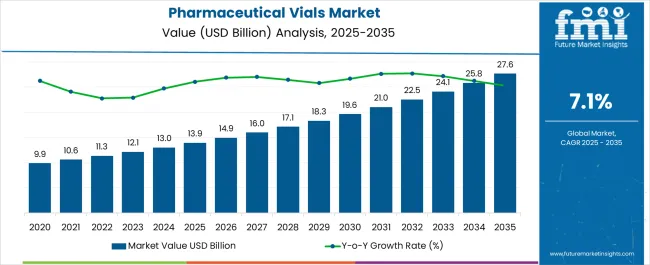

The pharmaceutical vials market is estimated to be valued at USD 13.9 billion in 2025 and is projected to reach USD 27.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

The market demonstrates accelerated expansion driven by biopharmaceutical manufacturing growth, injectable drug development, and sterile packaging requirements that necessitate specialized glass and polymer containers capable of maintaining drug stability while preventing contamination throughout storage and administration. Pharmaceutical manufacturers implement advanced vial systems that accommodate lyophilized products, liquid formulations, and sensitive biologics requiring precise barrier properties and compatibility with automated filling processes. The industry's evolution toward personalized medicine and targeted therapies creates demand for small-batch vials with specialized coatings and closure systems that preserve drug efficacy across extended shelf life periods.

Injectable drug manufacturing represents the dominant application segment where borosilicate glass vials provide chemical inertness and thermal stability necessary for sterile filling operations and terminal sterilization processes. Production facilities specify vial configurations that accommodate freeze-drying cycles, gamma irradiation sterilization, and automated inspection systems while maintaining dimensional consistency required for high-speed filling equipment. Quality assurance protocols emphasize container integrity testing, extractable substance analysis, and compatibility verification with drug formulations throughout accelerated stability studies that support regulatory approval processes.

Biologics and biosimilar markets demonstrate increasing adoption of specialized vial technologies including silicone-free stoppers, low-protein binding surfaces, and break-resistant polymer alternatives that address compatibility concerns with sensitive protein therapeutics and monoclonal antibodies. Biotechnology companies utilize vials with controlled surface chemistry that prevent protein aggregation and maintain therapeutic potency during storage under refrigerated conditions. Clinical trial applications require small-volume vials with tamper-evident features and serialization capabilities that support patient safety and regulatory traceability requirements.

Technology integration trends emphasize automated inspection systems and serialization capabilities that enable comprehensive quality control and supply chain tracking throughout pharmaceutical distribution networks. Machine vision systems detect cosmetic defects, dimensional variations, and particulate contamination that could compromise product quality or patient safety. Radio frequency identification and data matrix coding provide individual vial identification and authentication capabilities that prevent counterfeit drug distribution while supporting recall procedures when quality issues arise.

Supply chain considerations impact raw material sourcing as pharmaceutical-grade glass requires specialized manufacturing processes and stringent quality control to achieve chemical durability and dimensional consistency necessary for sterile drug packaging. Borosilicate glass suppliers maintain controlled manufacturing environments and comprehensive testing protocols that verify container performance under pharmaceutical processing conditions. Polymer vial manufacturers develop specialized resins and additive systems that provide barrier properties and chemical compatibility while meeting pharmaceutical regulatory requirements.

| Metric | Value |

|---|---|

| Pharmaceutical Vials Market Estimated Value in (2025 E) | USD 13.9 billion |

| Pharmaceutical Vials Market Forecast Value in (2035 F) | USD 27.6 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The pharmaceutical vials market is expanding steadily due to rising demand for injectable drugs, biologics, and vaccines that require secure and sterile storage solutions. Growing investments in biopharmaceutical research and development, coupled with the increasing prevalence of chronic diseases, are driving the need for high quality vials with superior barrier properties.

Regulatory emphasis on packaging integrity, product safety, and compliance with international pharmaceutical standards is reinforcing the adoption of advanced vial formats. Continuous innovation in vial coatings, anti breakage technologies, and lightweight designs is enhancing performance across manufacturing and distribution.

Furthermore, the global focus on vaccination campaigns and expansion of contract manufacturing services is accelerating market penetration. The outlook remains positive as vials continue to play a critical role in ensuring product stability, maintaining sterility, and supporting scalable pharmaceutical production worldwide.

The self standing segment is expected to account for 54.20% of total market revenue by 2025, making it the leading product type. This dominance is attributed to its enhanced stability during handling, storage, and transportation which minimizes the risk of spillage and contamination.

The design enables efficient automated filling processes and better integration into high speed pharmaceutical packaging lines. In addition, its user friendly handling properties and compatibility with diverse therapeutic formulations have reinforced its widespread adoption.

As the pharmaceutical sector continues to prioritize safety and operational efficiency, the self standing type remains the preferred product format.

The glass segment is projected to hold 63.70% of total revenue by 2025, positioning it as the dominant material type. This leadership is driven by its superior chemical resistance, high transparency, and proven ability to maintain drug stability over extended storage periods.

Glass vials are widely trusted for sensitive formulations including biologics and vaccines where purity and inertness are critical. Despite advancements in polymer alternatives, the reliability and global regulatory acceptance of glass packaging continue to ensure its market leadership.

Additionally, sustained investment in strengthened glass technologies has improved break resistance and supply chain efficiency. These attributes collectively reinforce the glass segment’s dominance in the pharmaceutical vials market.

The 0 to 1 ml capacity size segment is expected to capture 47.90% of total revenue by 2025, making it the largest capacity category. This prominence is supported by the rising use of unit dose packaging formats in vaccines, biologics, and injectable therapeutics where precision dosing is required.

Smaller capacity vials are preferred for minimizing drug wastage, enhancing portability, and facilitating single patient administration. Their increasing adoption in prefilled syringe systems and clinical trial supply chains further underlines their importance.

With growing focus on targeted therapies and patient centric dosage formats, the 0 to 1 ml capacity segment is set to maintain a leading position in the pharmaceutical vials market.

Increasing demand for parenteral drugs has been a key factor enabling the expansion of the pharmaceutical vials market in recent years. Between 2020 and 2024, the market grew at around 8% CAGR, says Future Market Insights (FMI) in its recent report.

| Particulars | Details |

|---|---|

| Jan-Jun (H1), 2024 (A) | 7.50% |

| Jan-Jun (H1), 2025 Projected (P) | 7.30% |

| Jan-Jun (H1), 2025 Outlook (O) | 7.70% |

| BPS: H1,2025 (O) - H1,2025 (P) | 20 |

| BPS: H1,2025 (O) - H1,2024 (P) | 40 |

Short-term growth (2025 to 2029): National Cancer Institute reports that in 2024, around 13 million new cancer cases were diagnosed in the USA. Rise of new cancer cases across the globe has further elevated the demand for pharmaceutical vials, especially for chemotherapy drugs.

In June 2024, Zydus Cadila Healthcare received tentative approval from the USA Food and Drug Administration (FDA) to market and sell pemetrexed in 100mg/vial, 500 mg/vial, and 1000 mg/vial, and single-dose vials for injection. Pemetrexed is a chemotherapy drug and is found effective in slowing or stopping the growth of cancer cells.

Medium-term growth (2035 to 2035): Unprecedented outbreak of the COVID-19 pandemic has increased the demand for parenteral drugs, encouraging market players to develop new pharmaceutical vials that are safe, sterile, and remain contamination free before administration. This is expected to create lucrative growth opportunities for the market.

Responding to the high demand for COVID-19 parenteral drugs, in 2024, SGD Pharma launched its new ready-to-use 20ml EasyLyo molded glass Type I vials packed in its modern secondary packaging format called “SG EZ-fill® Nest & Tub.”

The company claims that this new primary and secondary packaging combination is likely to offer biopharmaceutical producers the necessary flexibility in terms of delivering innovative medicines to patients at a faster rate.

Long-term growth (2035 to 2035): Increasing vaccination drives and high demand for parenteral drugs like insulin and corticosteroids are expected to drive the demand for pharmaceutical vials globally in the forthcoming decade.

Pharmaceutical vials are a type of small containers that are used for the purpose of storing liquid medications. They are made up of plastic or glass and are mainly used for unit dose packaging of medications. Pharmaceutical vials also help patients in consuming their medications in the right dosage and at the right time.

Ever since the last few decades, low medical adherence by patients has posed a critical situation for the healthcare industry as it involves the safety of the patients and causes increased healthcare spending.

To solve these issues, the healthcare industry is making constant efforts to improve the intake of medications by patients and ensure that the patients take the right dosage of drugs at the right time. In this process, the packaging of drugs and various medicines plays an important part.

Particularly in the United States, it has been reported that around 50 percent of the prescribed medications are taken incorrectly by patients. In addition, in an independent study, it was found that since patients don’t take their medications in the right manner, there are increased medical costs to the tune of USD 200 billion.

Due to this situation, there is a demand created for such kind of pharmaceutical products that contain medications in such form that can be easily taken by the patients. This helps the patients to take the right dosage of medicines at the correct time, thus reducing their time of recovery and reducing the burden on the healthcare system as well.

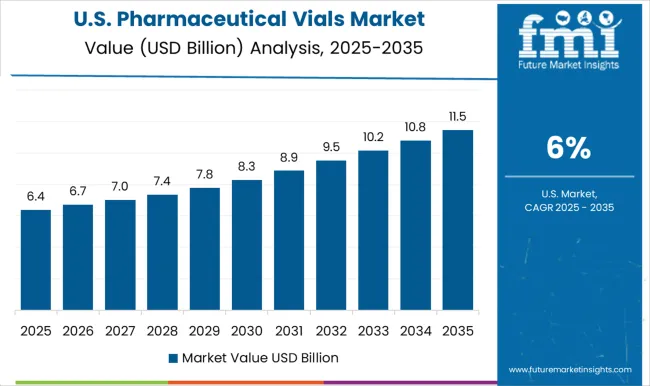

The demand for injectable drugs is growing due to the increasing prevalence of chronic diseases such as cancer and diabetes. As vials are a popular choice for packaging and delivering injectable drugs, this is driving the demand for pharmaceutical vials in the USA market.

There is a growing emphasis on safety and compliance in the pharmaceutical industry, driven by regulatory requirements, as well as the desire to reduce medication errors and improve patient outcomes. This is driving the demand for high-quality pharmaceutical vials that can ensure the safe and accurate delivery of medications.

Technological advancements in the production of vials, such as the use of automation and robotics, are creating new opportunities for manufacturers to produce high-quality vials at a faster rate while reducing costs. The trend toward personalized medicine is driving the demand for customized vials that can accommodate specific dosages and delivery requirements.

Overall, these factors are contributing to the growth of the pharmaceutical vials market in the United States and are expected to continue to do so in the coming years.

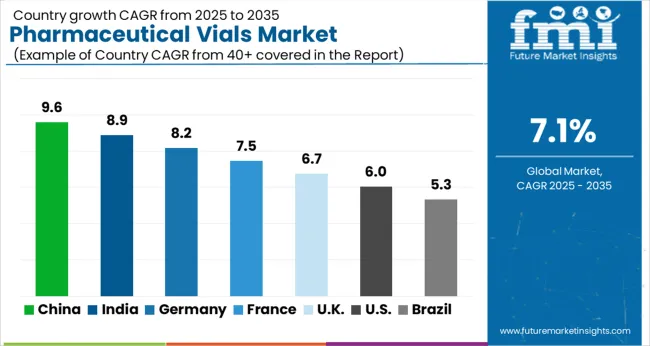

China is the second-largest market for pharmaceuticals globally, and it is expected to expand significantly in the upcoming years. The rising demand for medications in China is leading to an increased requirement for pharmaceutical packaging, which includes vials. There is a growing need for superior quality packaging products, including vials, as the Chinese pharmaceutical sector is developing and becoming more mature. This is because it is essential to guarantee that medications are safe and effective, and that they meet regulatory requirements.

The Chinese government has implemented policies to promote the growth of the pharmaceutical industry, such as offering tax incentives and making regulatory procedures efficient. As a result, this is making it easier for manufacturers of pharmaceutical packaging, including vials, to operate in a more favorable environment.

China's middle class is expanding, which is driving the demand for high-quality healthcare products, including medicines and packaging. This presents an opportunity for manufacturers of pharmaceutical vials to offer premium and valuable products.

The pharmaceutical vials market is expected to continue to offer lucrative opportunities, and Asia Pacific is expected to play a significant role in their expansion. Outstanding developments in the pharmaceutical manufacturing sector in emerging economies, particularly India, have prodded businesses to extend their supply chains there. Over the years, the expansion of hospitals and pharmaceutical companies in those economies has increased the regional market's potential for revenue.

India is a desirable market for pharmaceutical packaging manufacturers seeking to cut costs while maintaining high standards because it has historically had lower labor and production costs than other nations. The demand for pharmaceutical packaging, including vials, is anticipated to increase further as a result of India's expanding pharmaceutical export market, opening up new business opportunities for suppliers.

The plastic sub-segment in the material type category is anticipated to grow at a robust growth rate and register a CAGR of 5.1% during the period of assessment. This is a highly lucrative segment in the material type category.

As per the projections of Future Market Insights, the plastic sub-segment is estimated to touch a value of nearly USD 7,700 million at the end of the year 2024 and is expected to touch a value of nearly USD 12,000 million at the end of the year 2035.

The glass sub-segment is trailing the plastic sub-segment in the material type category and is projected to register a CAGR of 3.8% during the period of assessment.

The glass sub-segment is estimated to be valued at nearly USD 2,450 million in the year 2024 and is expected to touch a value of nearly USD 3,400 million at the end of the period of assessment in the year 2035.

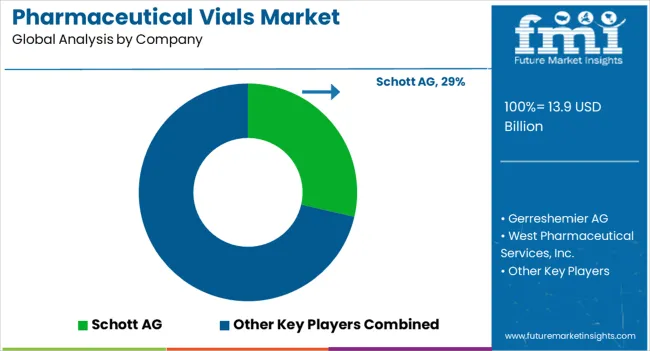

The pharmaceutical vials market is led by established global packaging and glass manufacturers offering high-quality primary packaging solutions designed for injectable drugs, vaccines, and biologics. Schott AG dominates with its advanced borosilicate and polymer vial technologies, known for superior chemical resistance, dimensional accuracy, and compatibility with sensitive formulations. The company’s innovations in pre-sterilized and ready-to-use vial systems strengthen its position among leading pharmaceutical producers.

Gerresheimer AG and Stevanato Group S.p.A. are major players offering complete glass and polymer vial portfolios, integrated with advanced surface treatments and barrier coatings to enhance drug stability and reduce interaction risks. Their global manufacturing footprints and partnerships with pharmaceutical and biotech companies position them as preferred suppliers for injectable packaging. West Pharmaceutical Services Inc. specializes in containment and closure systems, providing vial components such as stoppers and seals that ensure sterility and integrity throughout the supply chain.

Piramal Glass Pvt. Ltd. and SGD Pharma SA supply Type I glass vials for parenteral and vaccine applications, focusing on lightweight designs and sustainability through recyclable materials. Adelphi Healthcare Packaging and Pacific Vial Manufacturing Inc. cater to small and mid-sized pharma companies with customizable vial solutions and precision manufacturing for laboratory and clinical use. O.Berk Company LLC provides glass and plastic vial solutions for pharmaceutical and healthcare applications, emphasizing flexibility in design and volume supply. Nipro Corporation integrates vial production within its broader medical packaging portfolio, ensuring consistent quality and traceability.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 13.9 billion |

| Product Type | Self-Standing; Round Bottom |

| Material Type | Glass; Plastic |

| Capacity Size | 0–1 ml; 1–10 ml; 10–50 ml; 50–100 ml |

| Regional Coverage | North America; Latin America; Europe; Asia Pacific Excluding Japan (APEJ); Japan; Middle East & Africa (MEA) |

| Key Countries Covered | United States; Canada; Germany; United Kingdom; France; China; India; Japan; South Korea; Brazil; Mexico; GCC; South Africa |

| Top Companies Profiled |

Schott AG, Gerresheimer AG, West Pharmaceutical Services Inc., O.Berk Company LLC, Adelphi Healthcare Packaging, Pacific Vial Manufacturing Inc., Piramal Glass Pvt. Ltd., SGD Pharma SA, Stevanato Group S.p.A., and Nipro Corporation. |

| Additional Attributes | Dollar sales by product type, material, capacity, and region; driven by injectable drug growth, biologics production, and sterile packaging demand; focus on automation, serialization, anti-contamination coatings, polymer innovation, sustainability, and regulatory compliance in pharmaceutical-grade vial systems. |

The global pharmaceutical vials market is estimated to be valued at USD 13.9 billion in 2025.

The market size for the pharmaceutical vials market is projected to reach USD 27.6 billion by 2035.

The pharmaceutical vials market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in pharmaceutical vials market are self-standing and round bottom.

In terms of material type, glass segment to command 63.7% share in the pharmaceutical vials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Autoclave Machine Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA