The Indian commercial contract packaging sector for pharmaceuticals is growing as pharmaceutical companies attempt to make more efficient, regulatory-compliant, and cost-effective packaging solutions. With increasing drug development rates and more complicated supply chains, contract packaging organizations (CPOs) expect to configure their system for smart packaging, serialization, and sustainability.

Outsourcing enables pharma companies to focus on their core competencies while leveraging specialized packaging expertise.AI-based quality control, child-resistant, tamper-evident design, and environmental-friendly packaging alternatives are the investments made by companies. The industry trends toward prefilled syringes, blister packaging innovations and digital authentication as patients adopt safe practices.

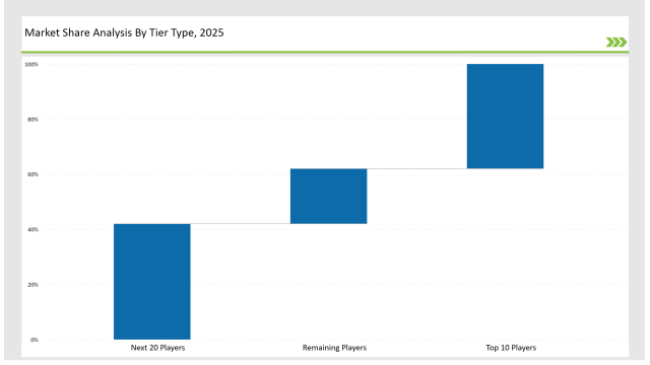

These tier 1 players include PCI Pharma Services, Sharp Packaging, and Catalent, constituting 38% of the market with their offerings of advanced packaging solutions, global presentability, and strict adherence to pharmaceutical regulations.

WestRock, CCL Industries, and Körber Pharma hold 42% of the market for Tier 2 players, as they provide high-quality, custom-designed contract packaging services for branded, generic, and specialty drugs.

The tier 3 consists of many local, regional, and material specialist companies that provide biologic drug packaging, cold-chain solutions, and other sustainable material packaging. Together they represent about 20% of the market. Such companies are known for localized production, customized serialization capabilities, and high-performance materials.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (PCI Pharma Services, Sharp Packaging, Catalent) | 18% |

| Rest of Top 5 (WestRock, CCL Industries) | 12% |

| Next 5 of Top 10 (Körber Pharma, Almac Group, Nipro Corporation, Aphena Pharma, Romaco Group) | 8% |

The pharmaceutical contract packaging industry serves multiple sectors where precision, safety, and compliance are critical. Companies are developing cutting-edge solutions to meet evolving regulatory and patient needs.

Manufacturers are optimizing pharmaceutical contract packaging with sustainable materials, digital tracking, and patient-friendly designs.

Parallely with patient safety, regulatory compliance becomes the backbone for innovation in pharmaceutical contract packaging. Adoption of AI-based quality inspections, serialization technologies, and bio-based plastics will become the mainstay for improving the sustainability of drug packaging. Emerging packaging solutions are prefilling injectables that accommodate biologics growth. Cold-chain packaging solutions can now be further broadened to address temperature-sensitive drug stability. NFC-enabled smart labels would then complete the integration process of QR codes to ensure consumer education and medication tracking.

Technology suppliers should focus on automation, digital authentication, and eco-friendly materials to support the evolving pharmaceutical contract packaging market. Collaborating with pharmaceutical companies and healthcare providers will drive innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | PCI Pharma Services, Sharp Packaging, Catalent |

| Tier 2 | WestRock, CCL Industries, Körber Pharma |

| Tier 3 | Almac Group, Nipro Corporation, Aphena Pharma, Romaco Group |

Leading manufacturers are advancing pharmaceutical contract packaging with AI-driven automation, smart labels, and sustainability-focused materials.

| Manufacturer | Latest Developments |

|---|---|

| PCI Pharma Services | Launched track-and-trace-enabled blister packaging in March 2024. |

| Sharp Packaging | Developed biologics-friendly prefilled syringe packaging in April 2024. |

| Catalent | Expanded sustainable contract packaging solutions in May 2024. |

| WestRock | Released innovative child-resistant pharmaceutical packaging in June 2024. |

| CCL Industries | Strengthened tamper-proof label security features in July 2024. |

| Körber Pharma | Introduced AI-driven quality control systems in August 2024. |

| Almac Group | Pioneered cold-chain packaging for temperature-sensitive drugs in September 2024. |

The pharmaceutical contract packaging market is evolving as companies invest in sustainable materials, digital security, and high-precision packaging solutions.

AI-based quality control, eco-friendly packing solutions, and digital authentication technologies will continue to be integrated within the industry. Manufacturers will update smart labels for real-time tracking applications to increase patient adherence. Temperature-stable packing will attract investments from the industry to facilitate the expanding usage of biologics in drugs.

Pharmaceutical packaging with full recyclability is being designed to have less environmental impact. Automating filling and sealing is anticipated to enhance production efficiency. Further advancements in patient safety will involve tamper-proof and interactive packaging systems.

Leading players include PCI Pharma Services, Sharp Packaging, Catalent, WestRock, CCL Industries, Körber Pharma, and Almac Group.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 38%.

Key drivers include regulatory compliance, digital tracking, sustainable materials, and automation.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.