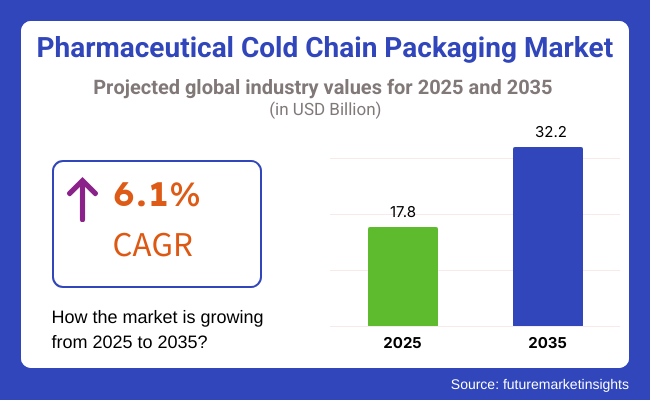

The market size of pharmaceutical cold chain packaging market is estimated to reach USD 17.8 billion in 2025 and is likely to reach a value of USD 32.2 billion by 2035. Sales are expected to increase at a CAGR of 6.1% during the forecast period of 2025 and 2035. Revenue from in pharmaceutical cold chain packaging market in 2024 was USD 17.0 billion.

The vaccine packaging industry is dependent greatly on pharmaceutical cold chain packaging because vaccines, especially mRNA types, are highly sensitive to temperature. Good cold chain solutions retain their strength, ensuring safety and efficacy when being handled, stored, and transported-especially for vaccines that require very low temperatures. The vaccine packaging industry is predicted to capture a large market share of more than 36% among the various end users of pharmaceutical cold chain packaging during the evaluation period.

Pharmaceutical cold chain packaging is extensively applied to vaccines and diagnostics because of their sensitivity to temperature and frequent need for rigid temperature control in order to preserve efficacy. Vaccines, particularly viral and mRNA vector vaccines, need to be stored in constant refrigeration or extremely low temperatures to prevent degradation.

Likewise, diagnostic samples and reagents need exact temperature control. Therefore, the pharmaceutical cold chain packaging use in vaccines and diagnostics would represent over 42% of the market in 2035. Pharmaceutical cold chain packaging market is expected to increase with favorable opportunities over the assessment period, offering a further opportunity worth USD 15.2 billion and increasing by 1.9 times its current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global pharmaceutical cold chain packaging market over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 3.5% (2024 to 2034) |

| H2 | 4.7% (2024 to 2034) |

| H1 | 4.5% (2025 to 2035) |

| H2 | 5.9% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.5%, followed by a slightly lower growth rate of 4.7% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.5% in the first half and rise to 5.9% in the second half. In the first half (H1) the market witnessed a decrease of 100 BPS while in the second half (H2), the market witnessed an increase of 120 BPS.

Increasing Biologics and Specialty Drugs Drive Cold Chain Packaging Requirements

Emerging markets for biologics, cell and gene treatments, and biosimilars are driving demand for pharmaceutical cold chain packaging. For these advanced medications to remain stable and effective, strict temperature control between -80°C and to 20°C must be maintained. Pharmaceutical companies rely on niche packaging solutions as their pipelines of biologics increase to prevent degradation in transit and storage.

Increased reliance on biosimilars requires more reliable cold chain logistics in turn. Beyond this, packaging manufacturers are required to innovate through high-performance insulating materials, phase change material (PCMs), and internet of things (IoT) based monitoring solutions to ensure the product integrity all the way from manufacturing to storage to delivery for cell and gene therapies, which rely on live cells.

Need for Pharmaceutical Cold Chain Packaging to Comply With Stringent Regulations

Stringent temperature monitoring and validation regulations for pharmaceutical cold chain logistics are imposed by regulatory agencies like the FDA, EMA, WHO, and IATA. To ensure medication efficacy and patient safety, these agencies mandate manufacturers, distributors, and logistics providers to maintain precise temperature conditions. Companies invest heavily in advanced cold chain packaging solutions to comply with GDP and avoid product loss due to temperature variations.

The sector is being driven towards intelligent packaging solutions by regulations that also demand data gathering, real-time monitoring, and risk reduction methods. Consistent, validated, and regulatory-approved cold chain packaging solutions are the need of the hour in the current market, and pharmaceutical firms. Different packaging providers are constantly developing to address evolving compliance requirements as enforcement becomes stricter across the world.

Infrastructure Gaps in Emerging Markets May Hinder Cold Chain Packaging Demand

It is difficult to sustain the required temperatures for pharmaceutical products in developing countries due to their sometimes poor cold storage units and unreliable electricity supplies. Spoilage is higher in situations where there are poor chilled storage units, warehouses, and power backup facilities. Poor airport infrastructure, rough roads, and inefficient last-mile distribution also lead to logistical issues that cause delays in deliveries and reduce product efficacy.

Pharmaceutical companies often use third-party logistics providers (3PLs), whose services may be inconsistent in quality, leading to compliance issues and temperature excursions. Ultimately, these infrastructure limitations reduce demand for pharmaceutical cold chain packaging within developing countries by increasing costs, disrupting supply chains, and threatening product integrity. These challenges can slow growth.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Advanced Temperature Control Technologies | To enhances product performance and reduce waste during storage and shipping by providing more precise and reliable temperature control for sensitive medications. |

| Smart Packaging & IoT Integration | Will enables real-time monitoring and tracking of temperature and humidity and increasing the efficiency of compliance and logistics processes. |

| Sustainable Cold Chain Packaging Materials | Invests in recyclable, reusable, and environmentally friendly products will address growing environmental concerns without sacrificing the cold chain's integrity. |

| Automated and AI-Driven Cold Chain Logistics | Enhances the efficiency of handling shipments, tracking, minimizing human error, and facilitating faster response to possible temperature deviations. |

| Ultra-Low Temperature Storage Solutions | Aids the increasing demand for vaccinations, gene therapies, and biologics-all of which often require extremely low temperatures for secure storage and transport. |

The global market of pharmaceutical cold chain packaging recorded a CAGR 4.7% during the historical period between 2020 and 2024. Market growth of pharmaceutical cold chain packaging was positive as it reached a value of USD 17.0 billion in 2024 from 14.0 billion in 2020.

The increasing demand for temperature-sensitive products like biologics, vaccines, and specialty drugs fueled the global pharmaceutical cold chain packaging industry's fast growth between 2020 and 2024. Advances in traceability technology and insulators and the distribution of the COVID-19 vaccine hugely expanded the market and induced a surge in sales during these years.

The market is projected to continue expanding between 2025 and 2035 owing to sustained advancements in gene therapies, biologics, and personalized medications. Long-term market growth is projected due to the uptake of advanced packaging systems, advanced monitoring devices, and stringent regulatory environments, which will spur demand for premium cold chain solutions.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Technological Advancements | Development in insulated packaging materials, phase change materials (PCMs), and Internet of Things (IoT) for temperature monitoring. |

| Market Growth | Significant growth driven by increased demand for biologics, vaccines, and temperature-sensitive drugs. |

| Sustainability Trends | Growing interest in sustainable materials, although environmental footprint of refrigerants was an issue. |

| Regulatory Landscape | Strict regulatory requirements with emphasis on Good Distribution Practices (GDP) and temperature monitoring. |

| Market Challenges | Cold chain infrastructure in emerging markets, high costs of transportation and packaging. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Technological Advancements | Increase in advanced active packaging systems, artificial intelligence-based temperature monitoring, and automation of cold chain logistics |

| Market Growth | Anticipated further growth with greater dependence on biologics, gene therapies, and cold-chain vaccines. |

| Sustainability Trends | Focus on green packaging solutions, eco-friendly refrigerants, and reduced carbon footprints in logistics. |

| Regulatory Landscape | Growing global standardization, with stricter regulatory requirements for temperature-sensitive medicines, particularly in emerging economies. |

| Market Challenges | Continued issues with last-mile distribution, but progress in cost-effective solutions and infrastructural improvements. |

Tier 1 companies are market leaders that have high market share in the global market. These market leaders are known for their large production capacity and diversified product range. These leaders are identified by their broad expertise in manufacturing various packaging formats and a strong presence across geography, supported by a strong consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Sonoco ThermoSafe, Cold Chain Technologies, Sealed Air Corporation and CSafe Global LLC.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Envirotainer Holding AB, va-Q-tec AG, EMBALL'ISO, Sofrigam SAS, Intelsius, Peli BioThermal LLC, BIOBASE Group, Intelsius, SkyCell AG, Chill-Pak and TESSOL.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier-3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| Latin America | An increase in the need for vaccines and biologics resulted in an increase in cold chain solutions in nations such as Brazil, but infrastructure challenges affected efficiency. |

| Europe | The stringent regulations of temperature-sensitive items, especially vaccines in the era of COVID-19, drove the German, French, and UK cold chain packaging market highly. |

| Asia Pacific (APAC) | Rapid development of cold chain infrastructure in China and India occurred to cater to mounting pharmaceutical needs, especially for vaccines and biologics, as logistics challenges raged on. |

| North America | The US and Canada experienced a surge in cold chain packaging demand, mainly due to COVID-19 vaccine distribution, with focus on sustainability and improving logistics efficiency. |

| South Asia | India was a major participant, with government efforts to improve vaccine cold chain logistics, however efficiency was impacted by regional transportation issues. |

| Middle East & Africa | While efficiency was constrained by weather and power supply challenges, South Africa, the United Arab Emirates, and Saudi Arabia made gradual progress in their cold chains, especially for vaccinations. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| Latin America | More investments in cold chain infrastructure will be made in Latin America, especially in Brazil and Argentina, focusing on technological advancements and meeting the region's growing demand for biologics. |

| Europe | Europe will lead in sustainable cold chain packaging solutions, with growth in biologics and cell therapies, driven by countries like Germany and France investing in advanced tech. |

| Asia Pacific (APAC) | With smart packaging developments and growing e-commerce propelling growth in pharmaceutical logistics, APAC will continue to expand cold chain solutions, particularly in China and India. |

| North America | To enhance the pharmaceutical supply chain, North America will advance cold chain technology and infrastructure, with the US leading the way in packaging techniques and compliance. |

| South Asia | South Asia, especially India, will increase cold chain infrastructure, fueled by growing pharmaceutical manufacturing and sophisticated packaging solutions to bridge logistical challenges.. |

| Middle East & Africa | To address the region's growing pharmaceutical requirements, Middle East & Africa will establish robust cold chain infrastructures in South Africa, UAE, |

The section below covers the future forecast for the pharmaceutical cold chain packaging market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 4.5% through 2035. In Western Europe, Germany in anticipated to rise at a CAGR of 2.9%.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

| India | 7.4% |

| Germany | 2.9% |

| China | 6.9% |

| Spain | 3.2% |

| UK | 3.1% |

| Canada | 3.5% |

Effective packaging options are more necessary today as the number of online pharmacies and direct-to-consumer pharmaceutical providers increase in the USA Packaging must ensure the product remains safe across longer shipping timeframes because an increasing number of individuals are purchasing prescription pharmaceuticals and other products online. That means protecting the drugs from weather conditions like varying temperatures, moisture, and damage has become important.

The purity of drugs should be maintained by tamper-evident, secure, and durable packaging. The patients also require easy packing as home delivery options are gaining traction. This ensures that drugs reach in desired condition, on time, and ready for immediate use.

Specialized packaging solutions are significantly driven by the UK's focus on biopharmaceutical innovation, particularly in the areas of gene therapy and regenerative medicine. The packaging must ensure product stability, sterility, and temperature management in transit since such treatments employ complicated biologics.

Packaging capable of protecting sensitive substances while in storage and in transit is required for innovations such as gene editing and stem cell therapies. CAR-T cell treatment packaging is an example, whereby safe, cold-chain solutions must be used in order to keep these personalized medications effective until a patient receives the treatment. The packaging manufacturers are driven by this trend to provide safer, advanced systems capable of managing new-age biopharmaceuticals.

The section contains information about the leading segments in the box liner market industry. In terms of product, small boxes are estimated to account for a share above 45% by 2035. By packaging format, passive packaging is estimated to dominate by holding a volume share of 74.8% by the end 2035.

| Product | Market Share (2025) |

|---|---|

| Small Boxes | 44.1% |

The most commonly utilized product in pharmaceutical cold chain packaging are small boxes due to its versatility, cost-effectiveness, and suitability for a range of temperature-sensitive drugs. They are ideal for shipping single-dose drugs, vaccinations, and clinical trial samples in small quantities-all of which are often required by medical practitioners or research facilities.

Their compact nature renders them the best option for both domestic and international distribution because it makes handling, storage, and shipping easier. To ensure that the drug remains within the correct temperature range when shipped to pharmacies or clinics, small quantities of insulin pens for patients, for example, are often packaged in insulated compact containers.

| Packaging Format | Market Share (2025) |

|---|---|

| Passive Packaging | 72.5% |

Pharmaceutical cold chain solutions employ passive packaging more so than active packing because it is cheaper and easier. It does not need refrigeration or any form of external power to ensure it keeps in the range of temperature that is needed; it instead employs insulating elements such as phase change materials (PCMs) or gel packs.

Consequently, it is simpler to implement and cost-effective. For example, insulated containers containing frozen gel packs or dry ice can be used in a passive-packed vaccination shipment that is shipped with constant temperature conditions throughout. Passive packing is the ideal option for most shipments because it is effective in fulfilling the needs for ultra-cold storage and strict temperature control and is therefore best suited for the majority of shipments.

The competitive landscape of the pharmaceutical cold chain packaging market is driven by key players focused on product innovation, sustainability and strategic partnerships for strengthening their market presence. Company and consumer manufacturers are investing in environmentally friendly materials and advanced packaging technologies to meet evolving industry demands. Mergers, acquisitions and collaboration with regional manufacturers and distribution partners are becoming more common to expand market reach and optimize supply chains.

Key Developments in Pharmaceutical Cold Chain Packaging Market

| Manufacturer | Vendor Insights |

|---|---|

| Sonoco ThermoSafe | Offers passive and active temperature-controlled packaging solutions with a focus on intelligent monitoring technology and global reliability. |

| Cold Chain Technologies | Emphasizes on environmental friendly temperature-stable packaging and adds RFID and IoT for regulatory and real-time tracking. |

| Sealed Air Corporation | Emphasizes on product purity and personalization while offering foam-based, environmentally friendly cold chain solutions with automated systems. |

| CSafe Global LLC | Renowned for its global air cargo experience for critical pharmaceuticals, real-time tracking, and active cold chain solutions with refrigerated containers. |

| Envirotainer Holding AB | Offers a global network for safe delivery of pharmaceuticals, active containers with temperature control features, and real-time monitoring. |

What is the future of pharmaceutical cold chain packaging market industry?

The global pharmaceutical cold chain packaging market industry stood at USD 17.0 billion in 2024.

Global pharmaceutical cold chain packaging market industry is anticipated to reach USD 32.2 billion by 2035 end.

South Asia & Pacific is set to record a CAGR of 8.1% in assessment period.

Some of the key players operating in the pharmaceutical cold chain packaging industry are Sonoco ThermoSafe, Cold Chain Technologies, Sealed Air Corporation and CSafe Global LLC.

In terms of packaging format, the industry is segmented into active packaging and passive packaging. Passive packaging further includes single-use or one way packaging and multiple use or reusable packaging.

In terms of product, the industry is segmented into small boxes, pallets and large sized pallet containers. Pallets further include single pallets and double pallets.

In terms of material, the industry is segmented into polymer, metal and paper. Polymer further includes polyethylene, polypropylene, PET, EPS, polyurethane and others.

In terms of application, the industry is segmented into biologics & biological samples, vaccines & diagnostics and others.

In terms of application, the industry is segmented into diagnostic centers, clinical research organizations, blood banks, vaccine packaging industry, pharmaceuticals other healthcare units.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa are covered.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.