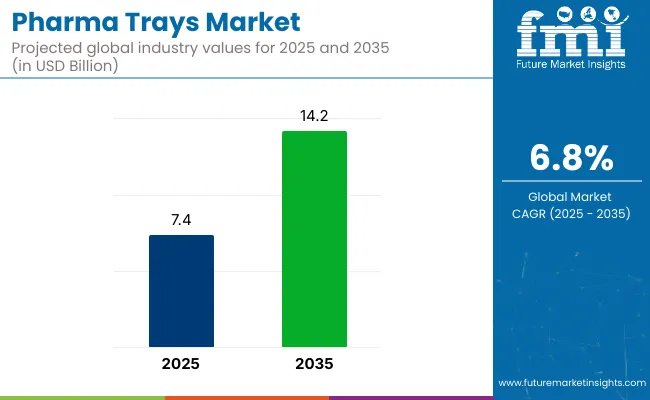

The pharma trays market is projected to grow from USD 7.4 billion in 2025 to USD 14.3 billion by 2035, registering a CAGR of 6.8% during the forecast period. Sales in 2024 reached USD 50.6 billion. Growth has been supported by rising needs for tamper-evident, durable, and sterile packaging across pharmaceutical logistics.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 7.4 billion |

| Projected Market Size in 2035 | USD 14.3 billion |

| CAGR (2025 to 2035) | 6.8% |

In India and globally, demand from hospitals, clinics, and contract manufacturers has led to wider use of thermoformed trays for injection vials, ampoules, and surgical kits. Increased spending on advanced healthcare infrastructure and vaccine distribution efforts has also stimulated usage. Recyclable and reclosable formats have gained traction across bulk packaging and secondary containment. Government procurement programs have also encouraged regional tray suppliers to expand production.

In May 2025, Nelipak Corporation, a leading global provider of healthcare packaging solutions for medical device, diagnostic, pharmaceutical drug delivery, and other demanding applications, announced that it will establish a new packaging production site in Costa Rica. “We are excited to announce another major investment in our global operating footprint in order to support customers on a global, regional and local basis” said Pat Chambliss, CEO of Nelipak.

“Costa Rica is a significant and growing hub for medical device manufacturing and this investment demonstrates our commitment to serve customers in the region with world-class local production.” Production capabilities at the site will include thin-gauge thermoforming for medical device trays and blisters; heavy-gauge thermoforming for deep draw tubs and trays, and die cut pouch cards and inserts.

Eco-conscious formulations and minimal-waste formats have shaped innovation in the pharma trays market. Compostable trays, PET-G substitutions, and mono-material laminates have been introduced to meet regulatory targets and brand sustainability goals.

Pharma companies have also adopted AI-based quality control systems and automated forming machines to improve hygiene, accuracy, and turnaround times. In India, pharma exporters have begun investing in reusable packaging systems, particularly for clinical trial kits and vaccine shipments. The market has responded by offering cleaner extrusion lines, lower gauge materials, and tamper-resistant lid seals. Pharmaceutical logistics standards have created room for innovation in bio-based and cold chain-compliant tray formats.

Over the next decade, opportunities in the pharma trays market will be driven by stricter GMP guidelines, global pharma outsourcing, and expansion of biopharma cold chains. India’s export sector is expected to account for a significant portion of tray-based packaging adoption, especially in vaccine logistics.

Additional growth has been projected in temperature-sensitive transport trays, supported by demand from the U.S., Europe, and Japan. Strategic R&D will be directed toward recyclable, RFID-compatible tray formats with improved seal integrity. Competitive advantages will be gained by suppliers offering scalable, cleanroom-ready tray designs and compliant barrier coatings. The pharma trays market will remain central to the sterile packaging ecosystem.

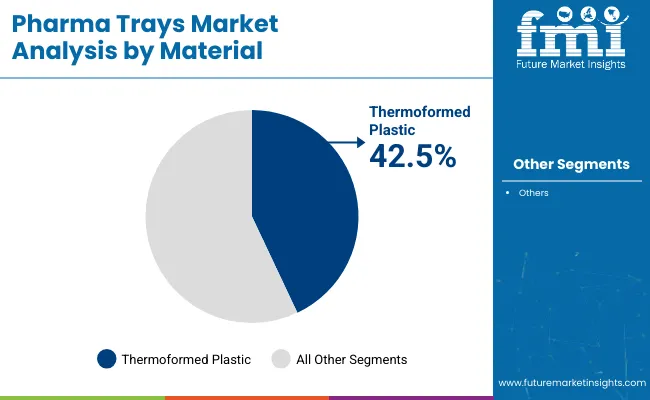

The market is segmented based on material type, tray type, end-use setting, and region. By material type, the segmentation includes thermoformed plastic (PET, PVC, PS, PP), polycarbonate, HDPE, paper-based & molded fiber, and biodegradable/bio-based polymers, with thermoformed plastics dominating due to their lightweight, clarity, and design adaptability for sensitive pharma items.

Tray types include blister trays, compartmental/divided trays, nest able/stackable trays, insert trays, lidded trays, and anti-static trays, with blister trays being most utilized for their product visibility and contamination prevention in controlled environments.

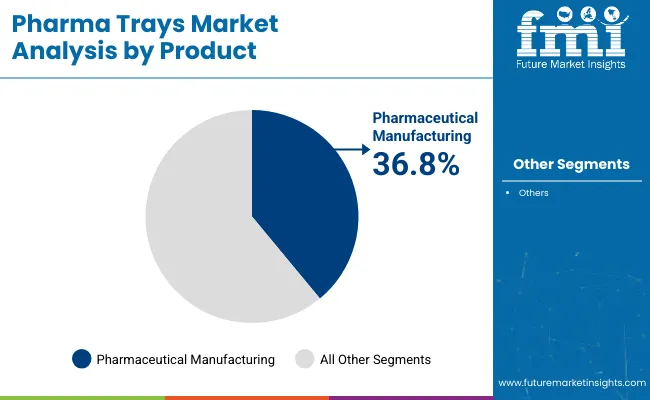

End-use settings span pharmaceutical manufacturing units, hospitals & clinics, diagnostic laboratories, contract packaging organizations (CPOs), and research & academic institutions-where manufacturing units lead due to automation in high-throughput packaging. Regionally, the market is distributed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Thermoformed plastic trays are projected to account for approximately 42.5% of the global pharma trays market by 2025. Materials such as PET, PVC, PS, and PP have been widely utilized due to their clarity, chemical resistance, and formability under heat. These trays have supported aseptic packaging for ampoules, vials, and prefilled syringes in both cleanroom and high-speed lines.

Recyclable grades and antimicrobial coatings have gained traction for reducing contamination risk and aligning with sustainability goals. Custom cavities, tamper-evident seals, and moisture barriers have been incorporated to meet global pharmaceutical compliance standards.

The lightweight profile and stackable design of thermoformed trays have optimized packaging volume and logistics. Manufacturers have favored PET/PP combinations for dual-compartment drug-device packaging. Regulatory approvals and material traceability have reinforced the adoption of medical-grade thermoformed plastics in GMP environments.

The scalability of thermoforming processes has allowed for rapid production of trays tailored to specific pharmaceutical applications. Advancements in thermoforming technology have enhanced the precision and consistency of tray dimensions. This has been crucial for automated filling and sealing operations.

The cost-effectiveness of thermoformed trays has also contributed to their widespread adoption. As the demand for biologics and personalized medicine grows, the need for customized and reliable packaging solutions has intensified. Thermoformed plastic trays have met this demand by offering flexibility in design and compatibility with various sterilization methods. Their role in ensuring product integrity during storage and transportation has been indispensable. Consequently, their market share is expected to remain significant in the foreseeable future.

Pharmaceutical manufacturing units are estimated to hold a 36.8% share of the pharma trays market by 2025. These facilities have relied on trays to facilitate the organized handling of components during production processes. Trays have been instrumental in maintaining batch integrity and ensuring compliance with stringent regulatory standards. Their use has enhanced efficiency and reduced the risk of cross-contamination.

The integration of trays into automated systems has streamlined operations in pharmaceutical manufacturing units. Trays have been designed to be compatible with robotic arms and conveyor systems. This compatibility has minimized manual handling and improved overall productivity. Additionally, trays have been customized to accommodate specific product dimensions and configurations.

The adoption of trays in manufacturing units has also supported traceability and quality control measures. Unique identifiers and barcodes have been incorporated into tray designs to facilitate tracking throughout the production cycle. This has been essential for meeting regulatory requirements and ensuring product safety. Furthermore, the use of trays has simplified the cleaning and validation processes within manufacturing environments.

As pharmaceutical manufacturing continues to evolve with advancements in technology and increased production demands, the reliance on trays is expected to grow. Their role in enhancing operational efficiency, ensuring compliance, and maintaining product quality has been well-established. Ongoing innovations in tray materials and designs will further support their utilization in manufacturing units. Therefore, their market share is anticipated to remain substantial in the coming years.

Material compatibility, sterilization limits, and environmental compliance remain key constraints.

The pharma trays industry is bloated with sustainable material selection sticking to sterility and recyclability standards. While many high-grade plastics are non-biodegradable, eco-friendly alternatives often fail to survive sterilizing processes like gamma irradiation or autoclaving. Moreover, variations in packaging compliance standards, including effective data submission to authorities, vary by country, further complicating product standardization, and increasing regulatory obstacles for exporters.

Cleanroom-ready designs, smart integration, and cold chain innovations fuel future expansion.

Opportunities exist for trays for automated pharma lines and robotics. This will help to mitigate the risk of contamination while increasing the ability to track compliance through integration of smart features such as RFID tagging, serialization support, and compartment-specific cushioning. Additionally, cold-chain pharma logistics and biologic drug packaging cause to develop the demand for moisture-resistant, temperature-stable tray formats used for vaccines and biosimilars. Hospital and pharmacy unit-dose delivery also creates opportunities for new tray formats.

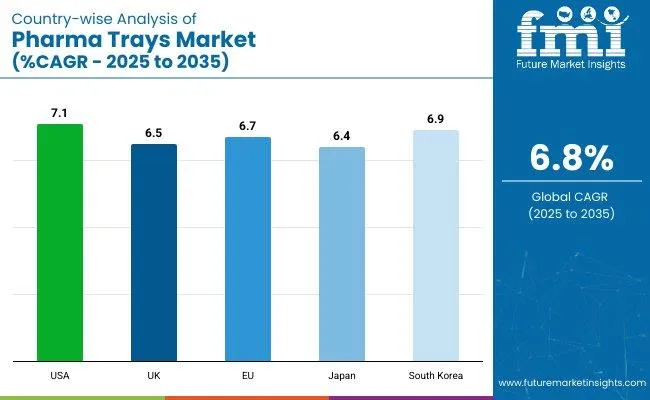

Increasing pharmaceutical production and demand for precise-oriented packaging are contributing keys to the growth of the USA pharma trays market. Thermoformed trays are commonly used to handle medicines, transport vaccines, or organize surgical kits. Pharma trays must be held to high standards of cleanliness, traceability, and sterilization compatibility under stringent regulatory oversight by the FDA.

All of this means that manufacturers are increasingly using recyclable PETG and medical grade polypropylene to meet their sustainability objectives. Custom trays design services: tiered for biotech and helping CDMOs (Contract Development and Manufacturing Organizations) Implementation of automation in pharmaceutical packing lines is increasing the demand for dimensionally stable tray systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.1% |

In the UK, pharma trays are firmly established in temperature-controlled transport, clinical trials, and unit-dose drug distribution. Increased digitalization driven by the NHS and a greater movement toward central pharmacy services are some of the factors shaping demand for tamper-evident and RFID / radio frequency identification integrated trays.

Domestic suppliers are looking to lightweight, recyclable materials that meet MHRA (Medicines and Healthcare products Regulatory Agency) guidelines. Text Innovations in anti-static and low-particulate tray formats are driving growth in the biologics sector as well. Other major producers are increasing production capabilities close to the innovation centers near Oxford and Cambridge.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

The EU pharma trays market is being driven by the growing number of drug exports, the increasing production of vaccines, and the strict enforcement of GMP standards in member states; the region is expected to retain its top position throughout the forecast period. Countries like France, Germany, and the Netherlands were already using smart packaging solutions such as tamper-proof cavities and automation-ready blister trays.

A clear and compartment vessels are preferred in clinical diagnostics as well as infusion therapy kits. Even materials are being guided by circular economy principles and PET, rPET and recyclable PS trays have taken hold. Development of temperature-stable, sterile barrier tray systems is among the packaging innovation supported by EU funding initiatives for pharmaceuticals.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.7% |

A mature medical system and emphasis on high-tech precision packaging for both domestic and export utilization contributes to Japan's pharma trays market. Stackable trays are used by both hospitals and compounding centers for sterile drug handling and single-use administration kits.

Producers are focusing on “high-barrier” materials, anti-contamination features and ergonomic designs for ease of handling. Japan’s PMDA regulatory standards dictate stringent documentation and consistency in packaging practices. As new eco-focused packaging goals mature, companies in Tokyo are adopting hybrid formats, such as plastic-paper trays.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The biopharma industry is booming in South Korea, leading to more widespread use of specialty pharma trays for vaccines and injectables, as well as oral solid dosage forms. These high-speed production lines can be found in Incheon and Seoul; they are driving demand for tray formats that are precision-molded and compatible with automation systems.

Policies supporting domestic pharma capacity are driving local innovation within cleanroom-certified and ESD-safe tray materials. Exporting manufacturers are designing different packaging that meets international packaging standards USP as well as EU MDR. Consumers are also adopting transparent blister trays for single-patient-use therapies in hospital settings and home-care services.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.9% |

Pharma trays market is currently witnessing a flourishing growth owing to the rising demand for disinfect, safe and compartmented packaging of pharmaceuticals, particularly in case of biologics, diagnostics and injectable therapies. With demands for tamper-proof and trackable packaging formats growing, pharma trays are evolving with anti-static materials, cleanroom compliance and thermoformed or injection-molded designs as regulatory frameworks tighten.

Film and container manufacturers are developing specialty, high-barrier polymers that help enhance product preservation, as well as trays integrated with RFID technology and cavity layouts that provide customizability for optimal product segregation and shipping integrity. The growth of biologics and temperature-sensitive drugs further drives innovation in sealed and insulated tray systems.

The overall market size for the pharma trays market was USD 7.4 billion in 2025.

The pharma trays market is expected to reach USD 14.3 billion in 2035.

The demand for pharma trays is rising due to increasing pharmaceutical production, growing emphasis on sterile packaging, and the need for safe handling and transport of medical devices and drugs. The adoption of sterilization trays and cost-effective plastic materials is further accelerating market growth.

The top 5 countries driving the development of the pharma trays market are the USA, Germany, China, Japan, and India.

Sterilization trays and plastic materials are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharma and Healthcare Social Media Marketing Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharma Sampling Valve Market Size and Share Forecast Outlook 2025 to 2035

Pharma Peeler Centrifuge Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA