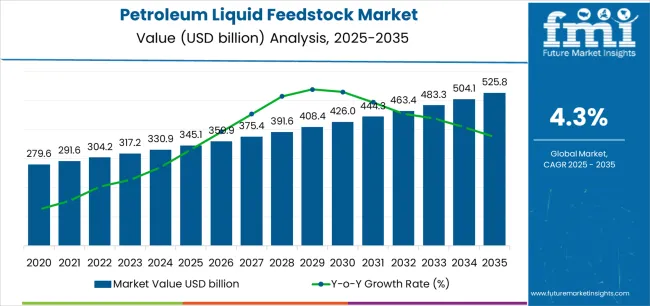

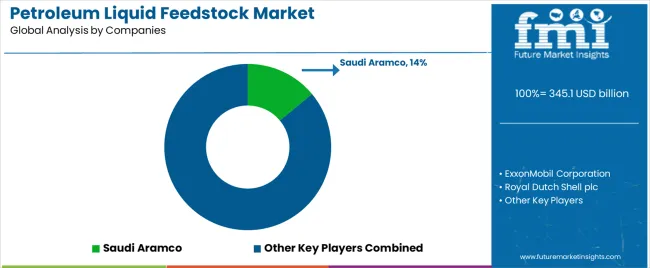

The petroleum liquid feedstock market stands at the threshold of a decade-long expansion trajectory that promises to reshape refining operations and petrochemical production technology. The market's journey from USD 345.1 billion in 2025 to USD 525.8 billion by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced refining processes and optimized feedstock utilization across petroleum refineries, petrochemical complexes, and integrated energy facilities.

The first half of the decade (2025-2030) will witness the market climbing from USD 345.1 billion to approximately USD 420 billion, adding USD 74.9 billion in value, which constitutes 41% of the total forecast growth period. This phase will be characterized by the rapid expansion of petrochemical integration projects, driven by increasing downstream demand for chemicals and plastics, and the growing need for advanced cracking technologies and feedstock optimization solutions worldwide. Enhanced conversion capabilities and process efficiency systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 420 billion to USD 525.8 billion, representing an addition of USD 105.8 billion or 59% of the decade's expansion. This period will be defined by mass market penetration of integrated refinery-petrochemical complexes, adoption of advanced conversion technologies, and seamless compatibility with renewable feedstock integration initiatives. The market trajectory signals fundamental shifts in how energy companies approach feedstock management and value chain optimization, with participants positioned to benefit from growing demand across multiple product types and application segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Petroleum refining feedstock | 42% | Traditional crude distillation, hydroprocessing |

| Petrochemical naphtha cracking | 28% | Ethylene, propylene production | |

| Fuel blending components | 15% | Gasoline, diesel optimization | |

| Aromatics production feedstock | 10% | BTX extraction, xylene isomerization | |

| Hydrocracking applications | 5% | Middle distillate production | |

| Future (3-5 yrs) | Integrated petrochemical complexes | 35-40% | Refinery-chemical integration, crude-to-chemicals |

| Advanced cracking technologies | 25-30% | Steam cracking, catalytic cracking optimization | |

| Specialty chemical feedstocks | 12-18% | High-value derivatives, performance chemicals | |

| Low-carbon fuel components | 10-15% | Renewable integration, hybrid feedstocks | |

| Aromatics & BTX production | 8-12% | Para-xylene demand, benzene applications | |

| Circular economy feedstocks | 3-8% | Plastic pyrolysis oil, waste-derived streams |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 345.1 billion |

| Market Forecast (2035) | USD 525.8 billion |

| Growth Rate | 4.30% CAGR |

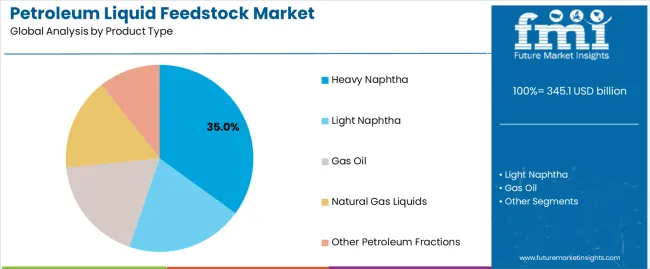

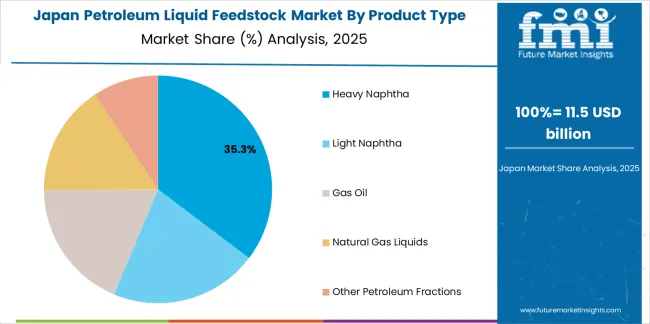

| Leading Product Type | Heavy Naphtha |

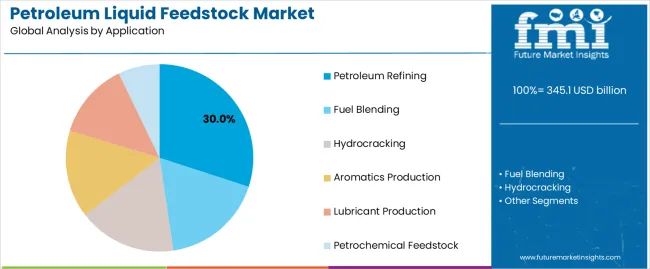

| Primary Application | Petroleum Refining |

The market demonstrates strong fundamentals with heavy naphtha capturing a dominant share through versatile refining applications and optimal conversion characteristics. Petroleum refining applications drive primary demand, supported by increasing global energy consumption and transportation fuel requirements. Geographic expansion remains concentrated in Asia Pacific and Middle East with expanding refining capacity, while developed markets show steady demand driven by petrochemical integration and value optimization initiatives.

Optimize for Integration and Flexibility

The market segments by product type into heavy naphtha, light naphtha, gas oil, natural gas liquids, and other petroleum fractions, representing the evolution from straight-run distillation products to sophisticated feedstock blends for comprehensive refining and petrochemical optimization.

Application segmentation divides the market into petroleum refining, fuel blending, hydrocracking, aromatics production, and lubricant production sectors, reflecting distinct requirements for conversion processes, product quality specifications, and economic value optimization across diverse end-use applications.

Geographic segmentation covers major producing and consuming regions including Asia Pacific (China, India, Japan, South Korea), North America (United States, Canada), Europe (Germany, United Kingdom, France), Middle East (Saudi Arabia, UAE, Kuwait), and emerging markets in Latin America and Africa.

The segmentation structure reveals industry progression from traditional refining operations toward integrated petrochemical complexes with enhanced conversion efficiency and product value optimization, while application diversity spans from transportation fuel production to high-value chemical intermediate manufacturing requiring precise feedstock quality and processing technology solutions.

Market Position: Heavy naphtha commands the leading position in the petroleum liquid feedstock market with approximately 35% market share through versatile refining applications, including catalytic reforming for aromatics production, petrochemical cracking feedstock, and gasoline blending components that enable refineries to maximize value extraction from crude oil across diverse processing configurations.

Value Drivers: The segment benefits from refinery preference for flexible feedstock streams that provide multiple processing options, optimal reforming yields for high-octane gasoline components, and suitable properties for ethylene cracker feedstock without requiring extensive pre-treatment. Advanced processing capabilities enable aromatics extraction, hydrogen production through reforming, and integration with both fuel and chemical production pathways, where product flexibility and economic optimization represent critical operational requirements.

Competitive Advantages: Heavy Naphtha differentiates through proven processing versatility, established technology platforms for conversion, and compatibility with existing refinery infrastructure that enhance facility economics while maintaining optimal yields suitable for diverse market conditions and product slate requirements.

Key market characteristics:

Light Naphtha maintains approximately 25% market position due to preferred characteristics for petrochemical steam cracking operations, where lower molecular weight and optimal hydrogen-to-carbon ratio provide superior ethylene and propylene yields. Market growth is driven by petrochemical capacity expansion, particularly in Asia Pacific and Middle East regions implementing world-scale ethylene crackers requiring light hydrocarbon feedstocks.

Market Intelligence Brief:

Gas Oil captures approximately 20% market share through critical applications in hydrocracking for diesel and jet fuel production, fluid catalytic cracking feedstock for gasoline manufacturing, and specialty applications in lubricant base stock production. The segment shows steady growth aligned with middle distillate demand in transportation and aviation sectors.

Value Drivers:

Natural Gas Liquids account for approximately 15% market share, including ethane, propane, and butane streams serving petrochemical cracking operations, fuel blending applications, and LPG markets. The segment demonstrates strong growth driven by shale gas production in North America and associated gas monetization in Middle East regions.

Growth Characteristics:

Other petroleum liquid feedstocks including condensates, raffinate streams, and specialty refinery cuts capture remaining market share through niche applications requiring specific processing characteristics or serving as blending components for optimizing refinery operations and product quality specifications.

Market Context: Petroleum Rrefining applications dominate the market with steady growth reflecting continued global demand for transportation fuels, heating oil, and industrial energy products that require petroleum liquid feedstocks as primary processing inputs across refinery conversion units.

Appeal Factors: Refining operators prioritize feedstock quality, processing flexibility, and economic optimization that enable maximum value extraction from crude oil while meeting product specifications and environmental regulations. The segment benefits from substantial refinery investment in upgrading and integration projects that emphasize advanced conversion technologies for heavy crude processing and product quality improvement.

Growth Drivers: Transportation fuel demand in developing economies, aviation sector recovery, and marine fuel quality requirements drive continued petroleum refining activity. Refinery modernization programs incorporating hydrocracking and residue upgrading units create sustained demand for appropriate feedstock streams.

Application dynamics include:

Fuel Blending captures approximately 20% application share through critical role in gasoline and diesel specification compliance, where naphtha streams, reformate, and other components blend to meet octane, volatility, and emissions requirements across diverse regulatory environments.

Hydrocracking applications account for approximately 15% market share, serving heavy oil upgrading operations that convert vacuum gas oil and other heavy feedstocks into high-value diesel, jet fuel, and lubricant base stocks through advanced catalytic processes requiring hydrogen integration.

Aromatics Production captures approximately 12% application share through extraction of benzene, toluene, and xylenes from reformate and pyrolysis gasoline streams, serving downstream markets for polyester fibers, plastics, solvents, and chemical intermediates with premium pricing for high-purity aromatics.

Lubricant Production applications account for approximately 8% market share through specialized processing of heavy naphtha and gas oil streams into high-quality base stocks for automotive, industrial, and marine lubricant formulations requiring specific viscosity and performance characteristics.

Market Context: Asia Pacific dominates the petroleum liquid feedstock market with fastest growth rate driven by expanding refining capacity, rapid petrochemical development, and increasing energy demand across China, India, and Southeast Asian nations requiring comprehensive feedstock supply and processing infrastructure.

Business Model Advantages: The region provides largest consumption volumes for both refining and petrochemical applications, driving sustained feedstock demand while supporting integrated complex development that maximizes crude oil value through chemical production integration and advanced conversion technologies.

Operational Benefits: Asia Pacific markets benefit from proximity to Middle East crude suppliers, established petrochemical downstream markets, and government support for refining and chemical industry development that create integrated value chains and competitive manufacturing economics for petroleum liquid feedstock utilization.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Petrochemical capacity expansion (especially Asia Pacific & Middle East) | ★★★★★ | New world-scale crackers and aromatics complexes create sustained feedstock demand; integrated projects drive long-term offtake agreements |

| Driver | Refinery-petrochemical integration trends (crude-to-chemicals concepts) | ★★★★★ | Maximizes crude oil value by increasing chemical yields from 10-15% to 40-50%; fundamentally reshapes feedstock allocation and pricing dynamics |

| Driver | Transportation fuel demand growth (developing economies, aviation recovery) | ★★★★☆ | Sustained mobility growth in Asia, Africa requires refining capacity additions; quality specifications drive demand for optimal feedstock blends |

| Restraint | Energy transition & electric vehicle adoption (long-term demand pressure) | ★★★★☆ | EV penetration reduces gasoline demand growth; refining industry must pivot toward petrochemical integration and sustainable aviation fuel |

| Restraint | Crude oil price volatility & margin pressure | ★★★★☆ | Feedstock cost fluctuations impact refining economics; margin compression during crude price spikes reduces processing profitability |

| Restraint | Environmental regulations & carbon pricing | ★★★☆☆ | Emissions restrictions increase processing costs; carbon pricing mechanisms impact refinery competitiveness and investment economics |

| Trend | Circular economy feedstocks (plastic pyrolysis oil, bio-based streams) | ★★★★★ | Waste plastic conversion to chemical feedstocks enables circular plastics; refiners and chemical producers developing processing capabilities |

| Trend | Digital optimization & advanced process control | ★★★★☆ | AI-driven refinery optimization maximizes yields and energy efficiency; real-time feedstock selection and blending optimization improve margins |

| Trend | Hydrogen economy integration (hydroprocessing, clean fuels) | ★★★★☆ | Low-carbon hydrogen enables deep desulfurization and heavy oil upgrading; green hydrogen integration reduces carbon intensity of refining operations |

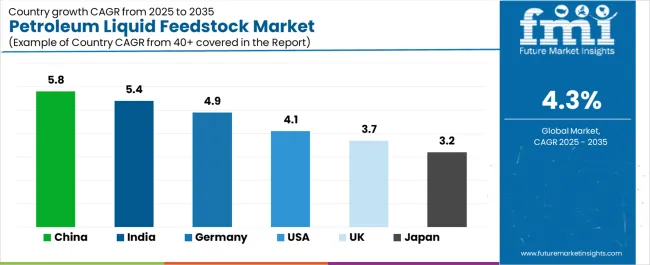

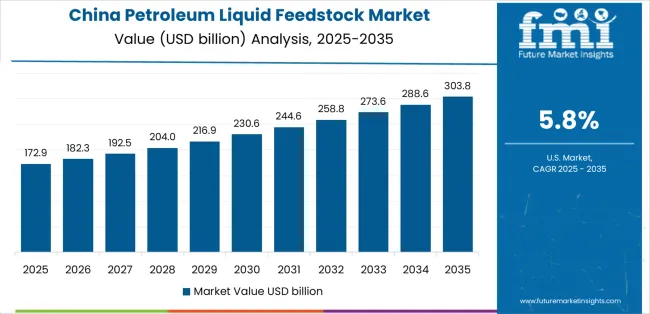

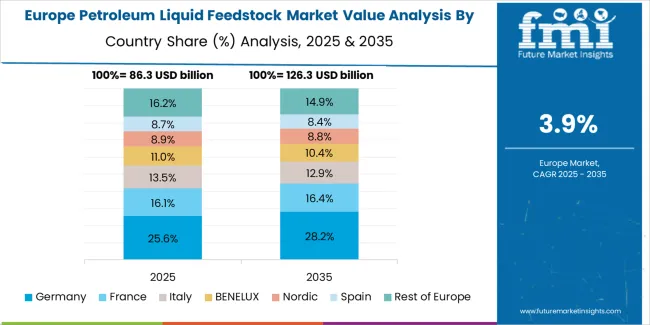

The petroleum liquid feedstock market demonstrates varied regional growth dynamics, with Growth Leaders including China (5.8% growth rate) and India (5.4% growth rate) driving expansion through rapid refinery capacity additions, petrochemical sector integration, and strong domestic demand for industrial and transport fuels. Steady Performers include the United States (4.1% growth rate) and Germany (4.9% growth rate), where mature refining industries benefit from modernization programs, integration of cleaner processing technologies, and stable demand from established downstream industries. Emerging Markets feature the United Kingdom (3.7% growth rate) and Japan (3.2% growth rate), where slower demand growth is balanced by investments in refinery optimization, energy efficiency, and adoption of lower-carbon liquid feedstock strategies.

Regional synthesis indicates that Asia-Pacific dominates global expansion, led by China and India, where petrochemical demand, urbanization, and industrial growth are fueling higher feedstock consumption. North America demonstrates stable performance, supported by advanced refining technologies, shale integration, and compliance with evolving environmental regulations. Europe shows moderate growth, emphasizing sustainability frameworks, quality integration, and steady consumption in industrial sectors. Together, these dynamics illustrate a market where emerging Asia anchors growth, while mature Western regions contribute through technology leadership, regulatory compliance, and refinery modernization.

| Region/Country | 2025–2035 Growth | How to Win | What to Watch Out |

|---|---|---|---|

| India | 5.4% | Invest in downstream integration & refinery upgrades | Infrastructure bottlenecks; import dependency |

| China | 5.8% | Expand petrochemical integration & scale efficiencies | Policy shifts; oversupply risks |

| United States | 4.1% | Leverage shale integration & advanced refining | Environmental regulation; CAPEX intensity |

| Germany | 4.9% | Drive efficiency & low-carbon feedstock adoption | High energy costs; sustainability pressures |

| UK | 3.7% | Focus on flexible, cleaner feedstock supply | Brexit trade impacts; aging refinery base |

| Japan | 3.2% | Prioritize high-quality specialty feedstocks | Slow demand growth; aging industrial assets |

India demonstrates strong growth in the petroleum liquid feedstock market, recording a 5.4% CAGR through 2035. Expansion is anchored by large-scale refinery modernization programs and integration of downstream petrochemical capacity in hubs like Jamnagar, Vadodara, and Visakhapatnam. The government’s focus on energy security and import substitution fuels investments in both refining and petrochemical feedstock production. India’s growing vehicle fleet and industrialization increase demand for naphtha, reformates, and other liquid feedstocks. Indian refiners are focusing on cost efficiency and capacity expansion while international suppliers are exploring strategic partnerships with state-owned enterprises to secure long-term demand.

Strategic Market Indicators:

China records the highest growth rate at 5.8% CAGR through 2035, maintaining its position as the largest petroleum liquid feedstock consumer. Growth is fueled by rapid petrochemical sector expansion, massive refinery integration projects, and energy security policies. Regions such as Shandong, Zhejiang, and Guangdong host large independent refiners (“teapot refiners”) and state-owned giants, all of which are expanding liquid feedstock capacity. China’s policies emphasize self-reliance in fuel and petrochemical supply, driving large investments in refining complexes. International players must localize operations and protect intellectual property to succeed.

Strategic Market Indicators:

Germany grows at a 4.9% CAGR through 2035, leveraging its advanced chemical industry and strong demand for naphtha and petrochemical feedstocks. Growth is centered in Bavaria, Hamburg, and North Rhine-Westphalia, where chemical clusters and integrated refineries anchor demand. Germany emphasizes low-carbon transition, with refiners incorporating efficiency improvements and co-processing of renewable feedstocks. International suppliers must align with Germany’s sustainability-focused regulations while ensuring premium quality standards.

Strategic Market Indicators:

The USA petroleum liquid feedstock market expands at a 4.1% CAGR through 2035, supported by shale oil integration, advanced refining systems, and petrochemical growth in the Gulf Coast region. Major hubs include Texas, Louisiana, and Illinois, where large integrated refineries supply both domestic and export markets. Demand growth is tempered by energy transition policies and stricter environmental regulations, but advanced refining capabilities support consistent throughput. To succeed, suppliers must provide compliance-driven, efficient feedstocks and adapt to regulatory cost pressures.

Strategic Market Indicators:

The UK grows at a 3.7% CAGR through 2035, reflecting slow but steady refinery modernization efforts. Demand is centered in Grangemouth and Humber regions, with focus on meeting domestic fuel needs and supplying petrochemical inputs. Post-Brexit trade complexities and aging refinery infrastructure remain challenges. International players must emphasize flexible, lower-carbon feedstock solutions to capture opportunities.

Strategic Market Indicators:

Japan records a 3.2% CAGR through 2035, reflecting slower growth compared to emerging Asian markets. Demand is driven by specialty petrochemical feedstocks and high-efficiency refining, with hubs in Yokohama, Osaka, and Nagoya. With an aging population and plateauing domestic fuel demand, growth relies on export-driven petrochemical production. Japanese refiners focus on precision, reliability, and integration of cleaner technologies, prioritizing efficiency over volume.

Strategic Market Indicators:

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Integrated oil majors | Upstream supply, global refining, downstream markets | Supply security, technology portfolio, market access | Agility; energy transition speed |

| National oil companies | Domestic resources, strategic assets, market control | Resource access, government support, cost position | Technology gaps; international competitiveness |

| Independent refiners | Processing flexibility, market responsiveness, niche focus | Operational excellence, optimization focus, adaptability | Supply security; capital constraints |

| Petrochemical integrators | Refinery-chemical linkage, value optimization, product diversity | Margin capture, feedstock flexibility, market resilience | Complexity management; capital intensity |

| Technology licensors | Process IP, catalyst systems, engineering expertise | Innovation leadership, licensing revenue, global reach | Market cyclicality; technology commoditization |

| Item | Value |

|---|---|

| Quantitative Units | USD 345.1 billion |

| Product Type | Heavy Naphtha, Light Naphtha, Gas Oil, Natural Gas Liquids, Other Petroleum Fractions |

| Application | Petroleum Refining, Fuel Blending, Hydrocracking, Aromatics Production, Lubricant Production |

| Regions Covered | Asia Pacific, North America, Europe, Middle East, Latin America, Africa |

| Countries Covered | China, India, United States, Germany, United Kingdom, Japan, South Korea, France, Canada, Australia, Saudi Arabia, UAE, Kuwait, Brazil, Mexico, and 25+ additional countries |

| Key Companies Profiled | ExxonMobil Corporation, Saudi Aramco, Royal Dutch Shell plc, TotalEnergies SE, Reliance Industries Limited, Sinopec, PetroChina, BP plc, Chevron Corporation, Equinor ASA |

| Additional Attributes | Revenue analysis by product type and application categories, regional consumption patterns across Asia Pacific, Middle East, and North America, competitive landscape with integrated oil majors and independent refiners, refinery operator preferences for feedstock flexibility and conversion efficiency, integration with petrochemical production and value chain optimization, innovations in processing technology and circular feedstock utilization, development of sustainable refining practices with carbon intensity reduction and renewable integration capabilities |

Heavy Naphtha

The global petroleum liquid feedstock market is estimated to be valued at USD 345.1 billion in 2025.

The market size for the petroleum liquid feedstock market is projected to reach USD 525.8 billion by 2035.

The petroleum liquid feedstock market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in petroleum liquid feedstock market are heavy naphtha, light naphtha, gas oil, natural gas liquids and other petroleum fractions.

In terms of application, petroleum refining segment to command 30.0% share in the petroleum liquid feedstock market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Jelly Market Growth - Trends & Forecast 2025 to 2035

Petroleum Fuel Dyes and Markers Market 2025 to 2035

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Petroleum Gas Storage Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA