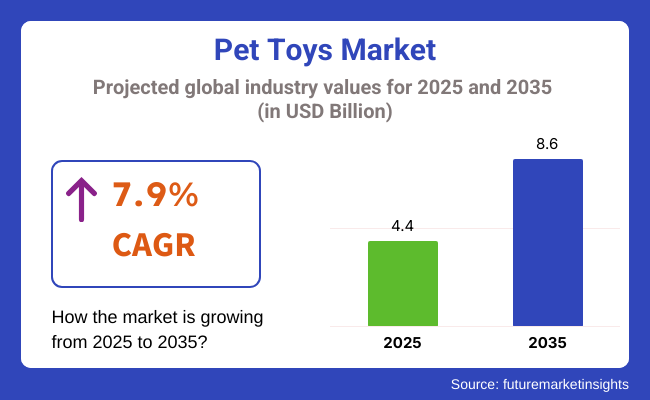

The global pet toys market is expected to witness significant growth, valued at USD 4.4 billion in 2025 and is anticipated to reach USD 8.6 billion by 2035. This growth reflects a robust CAGR of 7.9% over the forecast period.

The increasing number of pet owners worldwide, coupled with rising disposable incomes and evolving consumer attitudes toward pet care, are driving demand for a wide variety of pet toys. Pet owners are increasingly viewing pets as family members, which has led to greater spending on pet products, including toys designed to enhance their pets’ well-being and quality of life.

Over the coming few years, the market will be shaped by a growing preference for interactive and enrichment toys that provide both physical and cognitive stimulation to pets. Pet parents are seeking toys that go beyond mere entertainment, looking for products that help alleviate boredom and promote mental health.

Smart toys integrated with sensors and automation are gaining popularity, as they offer engaging play experiences that can adapt to a pet’s behavior. Additionally, there is a notable trend toward durable, eco-friendly, and non-toxic materials as consumers become more conscious of environmental sustainability and pet safety. These innovations cater to the modern pet owner's demands for products that are not only fun but also safe and sustainable.

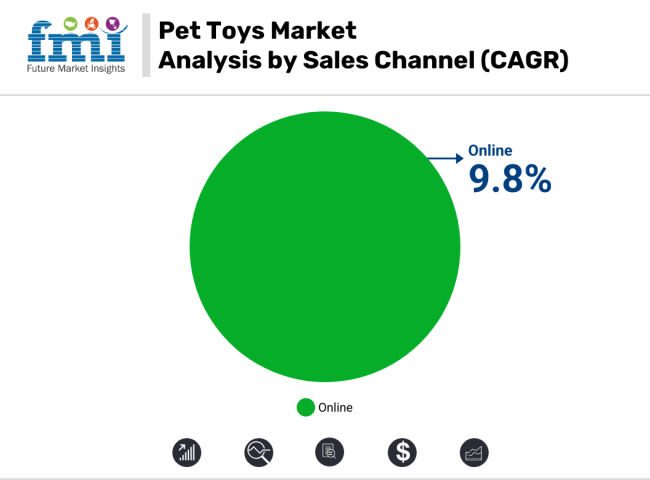

The pet toys market’s growth is also propelled by digital transformation and the rise of e-commerce channels, which have made pet toys more accessible to a broader consumer base, especially in regions like Asia Pacific, where pet adoption rates are increasing rapidly.

Social media platforms and pet influencers further enhance brand visibility and consumer engagement, creating new marketing opportunities for pet toy manufacturers. This heightened awareness and visibility are encouraging more pet owners to invest in premium and tech-enabled toys, thus supporting the market’s expansion. The combination of shifting consumer preferences, technological advancements, and increasing pet humanization will continue to drive the pet toys market forward through 2035.

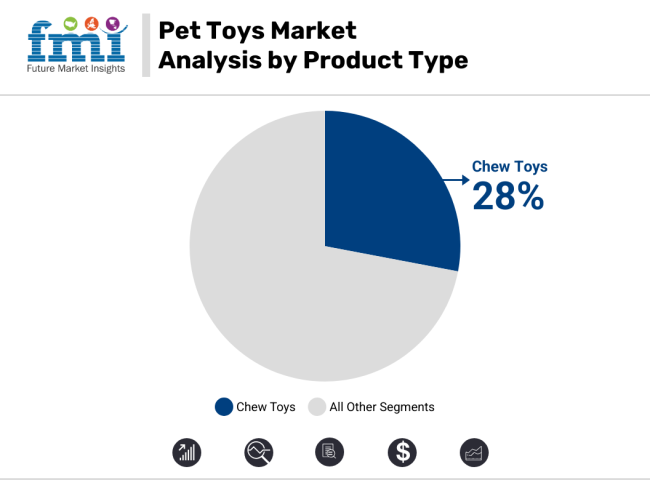

The pet toys market is segmented by product type, sales channel, pet type, and region. By product type, the market includes plush toys, rope and tug toys, balls, chew toys, squeaky toys, interactive toys, and others (floating toys, fetch sticks, laser toys for cats, and puzzle feeders).

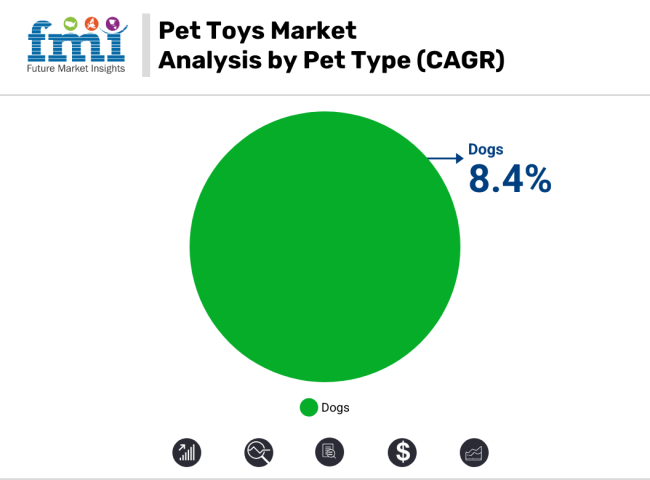

In terms of sales channel, the market is divided into supermarkets/hypermarkets, convenience stores, online, and others (pet stores, veterinary clinics, pet grooming salons, and local pet boutiques). When analyzed by pet type, the market caters to dogs, cats, birds, and others (small mammals and reptiles). Regionally, the market is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Chew toys dominate the global pet toys market, accounting for the largest market share of 28% in 2025. These toys remain highly popular among pet owners due to their role in promoting dental health, satisfying chewing instincts, and preventing destructive behavior in pets, particularly dogs. The widespread availability of chew toys in a variety of shapes, materials, and price ranges further enhances their market leadership across both developed and emerging markets.

Meanwhile, the interactive toys segment is growing due to rising demand for interactive toys, which is driven by the increasing preference of pet owners for products that offer mental stimulation, automation, and sensor-based play features. These toys are especially appealing for busy pet parents seeking to keep their pets engaged even when they are not at home, supporting this segment’s rapid expansion in urban and tech-savvy markets.

Other key product segments, such as plush toys, rope and tug toys, balls, squeaky toys, and others, are also expected to witness steady growth during the forecast period. The demand for these traditional toy types remains consistent due to their affordability, ease of availability, and the versatility they offer for various pet species.

Plush toys continue to be favored for smaller pets and cats, while balls and squeaky toys maintain a strong presence among dog owners, ensuring that these categories sustain their relevance in the evolving pet toys market landscape.

The online segment is expected to emerge as the fastest-growing distribution channel in the global pet toys market, recording a remarkable CAGR of 9.8% between 2025 and 2035. This rapid expansion is primarily driven by the increasing penetration of e-commerce platforms such as Amazon, Chewy, and Petco, which offer a vast assortment of pet toys across price ranges, brands, and functionalities. Consumers, especially in urban and metropolitan areas, prefer the convenience of browsing multiple product options, accessing user reviews, and availing doorstep delivery services.

The growth of online channels is further propelled by the popularity of auto-replenishment subscriptions, discounts for bulk purchases, and influencer-driven promotions on social media platforms like Instagram, TikTok, and YouTube. These digital marketing strategies are playing a crucial role in influencing pet owners’ buying behavior, particularly among millennials and Gen Z consumers who prioritize ease, variety, and value-added services.

In contrast, supermarkets and hypermarkets continue to hold a significant share of the pet toys market, favored for the in-store shopping experience that allows pet owners to physically examine products before purchase.

These retail outlets also attract customers with in-store promotions, bundled offers, and seasonal discounts, making them an appealing choice for price-sensitive and traditional consumers. Convenience stores occupy a modest market share, mainly serving consumers seeking quick and impulse purchases, especially in densely populated urban neighborhoods where accessibility and speed of purchase are critical.

Meanwhile, the "others" segment comprises specialty pet stores, veterinary clinics, and pet grooming centers, which cater to niche market demands by offering premium, curated pet toy selections. These channels often provide expert advice and personalized recommendations, enhancing the customer experience for discerning pet owners seeking unique or health-focused products for their pets.

The dog segment is projected to register the fastest growth in the global pet toys market, expanding at a CAGR of 8.4% between 2025 and 2035. This growth is largely attributed to the rising global dog population, increasing dog adoption rates, and the growing culture of treating dogs as integral family members.

Pet owners are becoming more conscious of their dogs’ mental and physical well-being, leading to higher spending on toys that aid in exercise, reduce anxiety, and provide enrichment. Chew toys, fetch balls, tug ropes, and smart interactive toys specifically designed for dogs remain in high demand, as they help address behavioral issues like boredom and destructive chewing while improving obedience and activity levels. Furthermore, the availability of breed-specific and age-specific toys has broadened product variety, encouraging owners to invest in high-quality, durable, and innovative dog toys.

The cat segment commands a considerable share of the market, supported by the growing trend of cat adoption in urban regions where space constraints make cats a preferred pet choice. Cat owners are increasingly purchasing toys such as plush mice, feather wands, scratching posts, and laser pointers to stimulate their cats’ natural hunting instincts and prevent inactivity-related health issues. This steady demand reflects the shift in consumer behavior toward prioritizing feline mental and physical health.

In comparison, the birds segment remains relatively niche but stable, catering to bird owners who seek safe, vibrant, and functional toys that promote climbing, pecking, and swinging activities essential for avian enrichment. Products in this segment are designed to encourage natural bird behaviors and prevent stress-related issues in caged environments.

The "others" category includes small mammals such as hamsters and guinea pigs, reptiles like turtles and lizards, and exotic pets, where specialized toys are in demand among hobbyists and pet enthusiasts who prioritize species-specific enrichment. Although this segment represents a smaller portion of the market, it maintains consistent sales driven by a dedicated consumer base looking for customized, functional pet toys.

Challenges

One of the primary challenges in the pet toys request is product safety and continuity. Pet possessors demand high- quality toys that arena-toxic, resistant to aggressive chewing, and free from dangerous accoutrements. Still, maintaining these safety norms while keeping prices competitive can be challenging for manufacturers. Regulatory compliance in different requests further complicates product development.

Another challenge is the rising concern over environmental sustainability. Numerous traditional pet toys contribute to plastic waste and environmental declination. As consumers come more environmentally conscious, brands must invest in sustainable accoutrements and Eco-friendly product processes, which may lead to advanced manufacturing costs.

Opportunities

The growing trend of pet humanization presents a major occasion for decoration and customized precious toys. Pet possessors decreasingly view their faves as family members, leading to increased spending on high- end, substantiated products. This opens up avenues for brands to offer customizable pet toys acclimatized to specific pet preferences and actions.

E-commerce and direct- to- consumer deals channels will continue to expand request reach. Subscription- grounded pet toy boxes and online-exclusive products will drive deals, offering convenience and variety to pet possessors. Brands that work digital marketing strategies, including social media influencers and targeted advertising, will gain a competitive edge.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 25.80 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 12.40 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 18.20 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 16.90 |

| Country | France |

|---|---|

| Population (millions) | 65.6 |

| Estimated Per Capita Spending (USD) | 15.40 |

The USA pet toy market, which stands at USD 8.91 billion, is increasing as pet parents are looking for pet toys that are durable, interactive, and enrichment-based. Pet parents are looking for green, chew-proof, and smart pet toys. Internet shopping platforms and specialty pet stores fuel sales. Subscription boxes and customized toys take off. Key brands pay attention to sustainability and pet health trends.

The American pet toy market, which stands at USD 8.91 billion, increases as pet parents are looking for pet toys that are durable, interactive, and enrichment-based. Pet parents are looking for green, chew-proof, and smart pet toys. Internet shopping platforms and specialty pet stores fuel sales. Subscription boxes and customized toys take off. Key brands pay attention to sustainability and pet health trends.

Germany's USD 1.53 billion pet toy market is fuelled by high pet adoption rates and demand for safe, high-quality, and eco-friendly toys. Consumers want toys that are interactive, stimulating, and biodegradable. Veterinary clinics and pet specialty stores are the most common points of sale. Green and recyclable packaging become trend drivers with emphasis placed on durability and animal health.

The UK USD 1.15 billion pet toy industry is driven by increasing demand for enrichment toys and eco-friendly pet products. Puzzle toys, treat-dispensing toys, and ethically sourced materials are popular with consumers. Online shopping platforms, pet stores, and veterinary clinics drive market growth. Natural rubber, non-toxic colouring, and long-lasting design are emphasized by brands

France's USD 1.01 billion pet toy industry experiences growing orders for ergonomic and behaviour-enhancing toys. Upmarket, natural, and locally produced pet goods are more desirable to consumers. Pet specialty chains, vet offices, and internet stores power the purchases. Upscale pet businesses launch upscale designer toys, with biodegradable and organic materials being in vogue.

The pet toys market is growing with the growing pet ownership, growing humanization of pets, and the need for durable, interactive, and environmentally friendly toys. A consumer survey of 250 USA, UK, EU, and Korea, Japan, Southeast Asia, China, ANZ, and Middle East consumers captures consumer behaviour according to consumer choice.

Safety and durability are the most important selection criteria, with 72% of USA and 68% of UK consumers choosing durable, non-toxic material for pet toys. Likewise, 61% of EU customers choose BPA-free and chew-resistant toys, whereas in China and Southeast Asia, 45% of respondents choose low-cost products with average durability.

Intelligent and interactive pet toys are gaining popularity, with 58% of the ANZ consumers and 54% of Japan choosing sensor-enabled, treat-dispensing, or robotic toys to interact with pets. While 52% of the Korean pet owners are looking to own puzzle toys for brain stimulation, 47% in the Middle East choose tech-enabled toys for training support.

Geographically, price sensitivity also differs, whereby 65% of USA and 60% of UK consumers are prepared to pay USD 30+ for a toy for high-end brands, whereas in China and Southeast Asia, only 38%-42% opt for high-end brands. Mid-range pet toys are increasingly sought after in Japan (50%) and Korea (48%), where there is the aspiration to balance price and durability.

Pet toy buying is controlled by digital channels, where 66% of USA and 62% of Chinese consumers are buying on Amazon, Tmall, and Shopee, attracted by reviews and subscription offers. Offline continues to be robust in Japan (55%) and India (50%), where pet owners value personalized advice and pet encounters offline.

The pet toys assiduity is expanding with pet possessors looking for innovative, long- lasting, and interactive toys. Enterprises can profit from trends in the request by emphasizing continuity, intelligent technology, and value, and maximizing-commerce, subscription, and in- store visit to increase consumer commerce.

The USA pet toys request is passing strong growth, driven by adding pet relinquishment rates, rising disposable inflows, and a growing trend of pet humanization. Major players include Kong Company, Chuckit!, and Pet Safe.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

The UK pet toys request is expanding due to adding pet power, growing mindfulness of pet internal stimulation, and demand for high- quality, durable pet accessories. Leading brands include Rosewood, Trixie, and Ancol.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.4% |

Germany’s pet toys request is growing, with consumers fastening on high- quality, durable, and Eco-friendly products. Crucial players include Hunter International, Trixie, and Karlie.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.5% |

India’s pet toys request is witnessing rapid-fire growth, fuelled by adding pet relinquishment, rising disposable inflows, and lesser mindfulness of pet well- being. Major brands include Heads Up For Tails, Dogsee, and Choostix.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.1% |

China’s pet toys request is expanding significantly, driven by adding disposable inflows, rising demand for luxury pet products, and a growing emphasis on pet heartiness. crucial players include Petmate, Pawz Road, and Ferules.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.4% |

Kong Company (18-24%)

Kong Company dominates the pet toy industry with its legendary indestructible rubber toys that are conducive to chewing and enrichment. Kong diversifies its product offerings into dental toys, interactive puzzles, and puppy-focused products. Kong invests in research for creating toys to enhance mental stimulation and behavioral enrichment. The brand enhances global distribution relationships and supports online sales channels to expand coverage.

Petmate (14-20%)

Petmate continues to be a key player in the pet toys category, with products available in various pet categories. Petmate focuses on sustainability by incorporating recycled and biodegradable materials into its toys. Petmate increases its visibility through pet specialty retailers and large retail chains. The company also increases its design emphasis by launching ergonomic toys that ensure pet safety and interaction.

Barebones LLC (10-16%)

Barebones LLC captures market share by appealing to environmentally aware consumers with natural rubber and responsibly sourced materials. Barebones creates simple toys that focus on durability and simplicity. Barebones specializes in chew-specific items that encourage dental health and extended use. The company establishes its brand presence through direct-to-consumer sales and strategic partnerships with boutique pet stores.

Ethical Products, Inc. (8-12%)

Ethical Products, Inc. has a wide range of pet toys, from plush and rope toys to squeaky and seasonal designs. The firm leverages pet gift-giving and themed bundles of toys to drive consumer demand. Ethical Products continues to invest in safe, non-toxic materials and adds value to its packaging with sustainability. The brand deepens retail penetration with private label partnerships and promotional initiatives.

Pet Sport USA, Inc. (6-10%)

Pet Sport USA specializes in high-durability toys for active dogs and high-energy play. Pet Sport USA sells fetch balls, tug ropes, squeaky toys, and interactive products made for solo and shared play. Pet Sport USA establishes strategic relationships with pet retailers and veterinarians to market wellness-based toys. Pet Sport USA continues to expand its product line with rugged textures and pet-friendly synthetic materials.

Other Key Players (30-40% Combined)

A number of players make significant contributions to the growth and development of the pet toys industry. Such companies introduce novel product designs, niche appeal, and eco-friendliness. Some of the prominent players are:

These brands create plush, puzzle, and novelty products that appeal to dogs and cats alike. Fluff and Tuff specializes in premium stitched plush toys, whereas Zippy Paws adds theme-based toys and enrichment puzzles. Jolly Pets competes in the large-breed market with ultra-durable rubber toys. Honest Pet Products highlights organic products and hand-made toy lines for the eco-aware consumer.

| Attribute Category | Details |

|---|---|

| Industry Size (2025) | USD 4.4 billion |

| Projected Market Size (2035) | USD 8.6 billion |

| CAGR (2025 to 2035) | 7.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/Volume in million units |

| Segments by Product Type | Chew Toys, Interactive Toys, Plush Toys, Rope Toys, Ball Toys, Others |

| Segments by Sales Channel | Supermarkets/Hypermarkets, Specialty Pet Stores, Online, Veterinary Clinics, Others |

| Segments by Pet Type | Dogs, Cats, Birds, Fish, Small Mammals, Reptiles |

| Key Regions | North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA) |

| Key Countries | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Leading Companies | KONG Company, West Paw, Inc., Jolly Pets, Outward Hound, Pet Safe, SodaPup, Goughnuts, Nylabone, Chuckit, Planet Dog |

| Additional Attributes | Demand driven by growing pet humanization, sustainability, and online pet retailing |

| Customization and Pricing | Customization and Pricing Available on Request |

Chew Toys, Interactive Toys, Plush Toys, Rope Toys, Ball Toys, and Others.

Supermarkets/Hypermarkets, Specialty Pet Stores, Online, Veterinary Clinics, and Others.

Dogs, Cats, Birds, Fish, Small Mammals, and Reptiles.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Pet Toys industry is projected to witness a CAGR 7.9% between 2025 and 2035.

The Pet Toys industry stood at USD 3.2 billion in 2024.

The Pet Toys industry is anticipated to reach USD 8.6 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 7.3% in the assessment period.

The key players operating in the Pet Toys industry include KONG Company, Outward Hound, Pet Safe, Chuckit!, West Paw, and Zippy Paws.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Pet Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Pet Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Pet Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Pet Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Pet Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Pet Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA