The pet tick and flea prevention market is witnessing steady expansion, driven by rising pet ownership, increased awareness of pet health, and the growing humanization of companion animals. Veterinary organizations and pharmaceutical company updates have emphasized the importance of year-round parasite prevention as part of routine pet care, prompting higher demand for both systemic and topical solutions.

Climate shifts contributing to longer flea and tick seasons have extended treatment timelines, further stimulating product usage across geographies. Leading animal health brands have invested in improved formulation technologies, resulting in better efficacy, ease of administration, and extended protection periods.

Consumer demand for convenient and vet-recommended products has also influenced product development and packaging strategies. Additionally, regulatory approvals for novel active ingredients and expanded product labels have supported market diversification. The outlook for the market remains positive as preventive health becomes a core element of pet wellness programs. Product adoption is expected to remain highest among dog owners, with pharmacy stores and oral pill formats continuing to drive segmental growth through greater accessibility and improved compliance.

| Metric | Value |

|---|---|

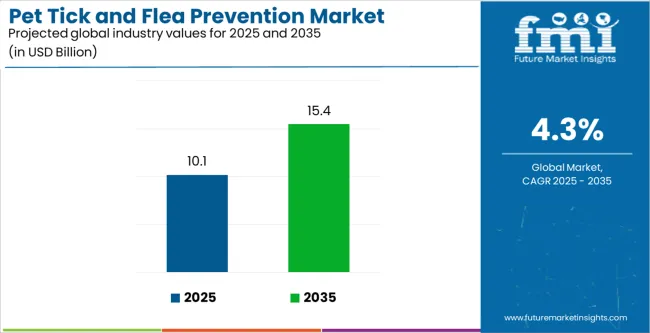

| Pet Tick and Flea Prevention Market Estimated Value in (2025 E) | USD 10.1 billion |

| Pet Tick and Flea Prevention Market Forecast Value in (2035 F) | USD 15.4 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

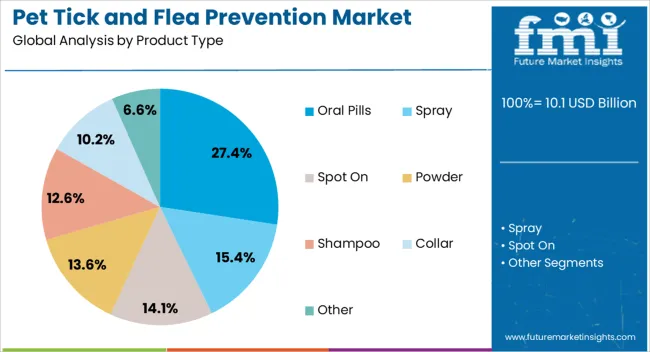

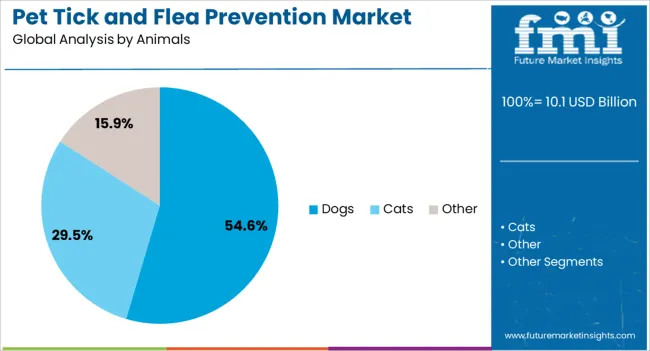

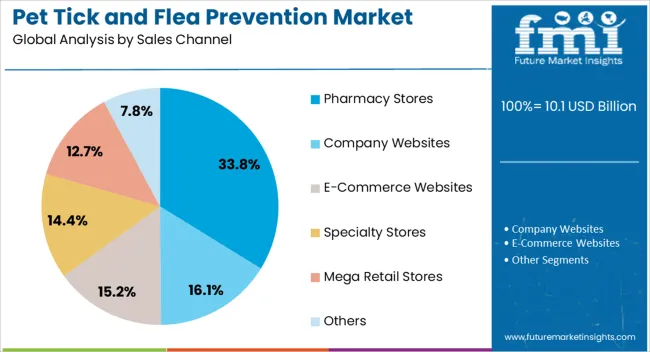

The market is segmented by Product Type, Animals, and Sales Channel and region. By Product Type, the market is divided into Oral Pills, Spray, Spot On, Powder, Shampoo, Collar, and Other. In terms of Animals, the market is classified into Dogs, Cats, and Other. Based on Sales Channel, the market is segmented into Pharmacy Stores, Company Websites, E-Commerce Websites, Specialty Stores, Mega Retail Stores, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Oral Pills segment is projected to account for 27.4% of the pet tick and flea prevention market revenue in 2025, establishing itself as a leading product category. Growth in this segment has been driven by the preference for oral administration, which eliminates the messiness and application errors often associated with topical treatments.

Veterinary guidance has increasingly supported oral formulations due to their systemic efficacy and ability to kill parasites through blood contact rather than surface exposure. Additionally, once-monthly or extended-release dosing schedules have improved treatment adherence among pet owners.

Product innovation from major animal health companies has led to chewable formulations with palatable flavors, increasing acceptance among pets. Reports from veterinary clinics have shown that oral pills are preferred for their reliability, ease of use, and lower risk of accidental transfer to humans or household surfaces. As consumer demand continues to favor convenience and effectiveness, the Oral Pills segment is expected to maintain its upward trajectory in the pet parasite control market.

The Dogs segment is projected to contribute 54.6% of the pet tick and flea prevention market revenue in 2025, maintaining its status as the dominant animal category. This segment’s growth has been attributed to the higher incidence of outdoor exposure in dogs, increasing their vulnerability to flea and tick infestations.

Veterinary publications have consistently recommended year-round protection for dogs, particularly in regions with warm or humid climates where parasites thrive. Dog owners are more likely to seek preventive care, often prompted by veterinary consultations, annual wellness exams, and community awareness campaigns.

Furthermore, the broader range of tick and flea products available for dogs compared to other animals has enabled tailored protection based on breed, size, and lifestyle. Pharmaceutical companies have also focused marketing and R&D efforts predominantly on canine applications, expanding product portfolios with oral, topical, and collar-based formulations. As pet health spending continues to rise, the Dogs segment is expected to dominate product uptake across various treatment modalities.

The Pharmacy Stores segment is expected to account for 33.8% of the pet tick and flea prevention market revenue in 2025, emerging as the leading sales channel. This segment’s performance has been supported by strong consumer trust in professional pharmacy environments and the ability to receive pharmacist or veterinarian guidance on product selection.

Pharmacy stores often stock a wide range of prescription and over-the-counter tick and flea prevention options, catering to both routine and specific pet health needs. Brick-and-mortar pharmacies have also benefited from immediate product availability and established relationships with local veterinary clinics, which frequently refer pet owners to nearby outlets.

Additionally, the inclusion of pet health aisles in retail pharmacy chains has increased product visibility and consumer accessibility. In-store promotional campaigns and loyalty programs have further encouraged repeat purchases. As pet care becomes increasingly integrated into mainstream health retailing, the Pharmacy Stores segment is projected to remain a key channel for pet parasite control product distribution.

Players Developing Natural and Organic Tick and Flea Solutions for Eco-conscious Pet Owners

Players are observing ample opportunities in the natural and organic sector of the pet tick and flea prevention industry. This is because the polluting conventional flea and tick prevention items are coming under the radar of various organizations.

This, along with many side-effects to the pets, has led players to develop organic and natural flea products. These products are made of chemical-free alternatives or plant-based formulations and are pet and environment-friendly. Thus, gaining acceptability among eco-conscious pet parents.

Nowcast Model Developed to Alert Pet Parents About Accelerated Flea Activity

The development of effective models like the nowcast model emerges as a valuable tool to educate pet owners about fleas and flea-borne disease risk. They also shed light on the need for routine checkups and administration of flea preventatives.

Several pets remain vulnerable to flea infestation. Thus, alerting pet parents about the increased local risk of flea activity over certain times may motivate them to administer routine preventives.

Side Effects of Pet Tick and Flea Prevention Products to Inhibit their Adoption

Products available for flea and tick prevention among pets may cause certain side effects on the pet's body. Some common side effects include spots and itching across the body. Application of these products also causes irritable behavior among pet animals. Thus, making the veterinary specialists believe that the product might not suit the animal’s skin.

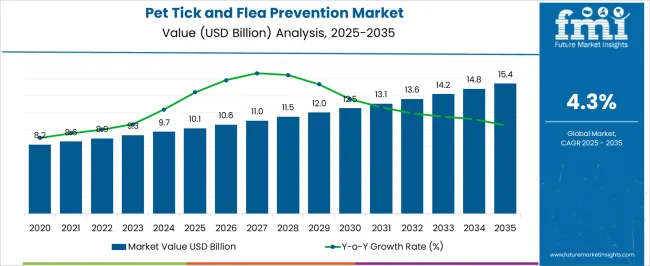

Global pet tick and flea prevention sales rose at a CAGR of 2.7% from 2020 to 2025. From 2025 onwards, the industry is projected to increase at a 4.3% CAGR till 2035, as the pet population surges.

Pet owners are now increasingly investing in pet tick and flea prevention products. Steady sales of pet tick and flea prevention products are thus prompting manufacturers to develop more effective formulas for pet tick and fleas.

Wide-scale pet adoption across economies is fueling the demand for flea, tick, and heartworm prevention products. Increasing incidences of contagious diseases among domestic animals are also promoting the sales of these products. Increasing government programs to raise awareness for flea, tick, and heartworm infections are also contributing to the products’ sales uptick.

Manufacturers are delivering a range of products, like sprays, oral pills, shampoo, powder, etc. Players are also strengthening their distribution networks. The motive of this initiative is to ensure that main products are steadily available in online and offline stores. Increasing products’ accessibility on eCommerce websites, company websites, specialty stores, pharmacy stores, etc. are fueling industry growth.

Following table gives a market outline of pet tick and flea prevention across the top five geographies. The industry is gradually maturing in the United States and Germany.

Thus, encouraging players to invest in emerging countries of Asia Pacific like India, China, and Australia. These economies present lucrative opportunities for players who adapt to local requirements in pet tick and flea prevention products.

| Countries | CAGR 2025 to 2035 |

|---|---|

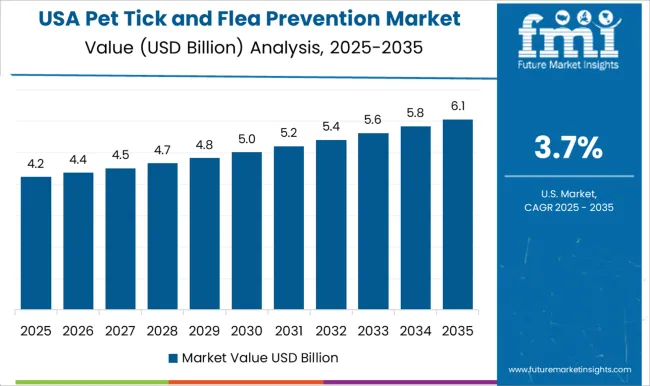

| The United States | 2.3% |

| Germany | 3.1% |

| China | 6.9% |

| India | 7.5% |

| Australia | 5.1% |

Though the pet tick and flea prevention market continues to expand in the United States, it does so sluggishly. Through 2035, the industry is estimated to exhibit a 2.3% CAGR. This indicates that the market is reaching maturity in the country.

Despite slow growth, leading enterprises in the country are working on breakthrough therapies to increase the lives of animals. Several research-driven biopharmaceutical companies are creating value through inventions in areas of high unmet medical need. Growing demand for natural, nontoxic flea prevention products is further raising the efforts of players.

In Europe, Germany is a frontrunner in the pet tick and flea prevention industry. The country is estimated to progress at a steady 3.1% CAGR through 2035. Like the United States, Germany’s future is also tilting toward saturation.

Demand for pet tick and flea prevention products is rising due to funding by the government and leading corporations. Increasing research activities are also rising to inhibit ticks and fleas’ growth.

Players are demonstrating unwavering commitment to assisting pet owners and veterinarians to safeguard their pets’ well-being and health.

India offers a profitable avenue for the pet tick and flea prevention industry. The industry is predicted to expand at a lucrative 7.5% CAGR over the forecast period.

The tropical conditions of India are creating conducive weather for the propagation of tick-borne and flea-borne pathogens in dogs, cats, and other animals. These pathogens develop larger health concerns for humans. Thus, making it critical for pet parents to be conscious of and administer parasite control to their pets regularly.

The surging use of pet ticks and flea products is further making human and pet co-living meaningful and safe. Many investors are expected to raise their stakes in the country, taking into account the rising healthcare infrastructure.

From the pet tick and flea prevention industry segmentation, spot-on medications and dogs emerge as the leading contenders. Their demand drivers are discussed in detail in this section.

The spot-on product enjoys a notable share of 26.3% in the market. Demand for this product is surging on account of the ease and convenience associated with its usage. They also have deeper penetration into the animal’s skin and a subtle odor, making it preferable as a tick and flea prevention tool.

| Segment | Spot On (Product Type) |

|---|---|

| Value Share (2025) | 26.3% |

Spot-on treatments for tick and flea prevention among pets tend to be more cost-effective as opposed to some newer oral medications. Thus, the affordability factor is inducing higher sales of spot-on flea and tick preventive products.

Consumers can easily purchase these products from over-the-counter (OTC), making them easier to obtain than certain prescription flea and tick medications.

| Segment | Dogs (Animal) |

|---|---|

| Value Share (2025) | 60.6% |

Dogs make up 60.6% of the global market share. Thus, making dog owners significant contributors to the growth of the pet tick and flea prevention market.

Demand for these prevention items is increasing among pet parents, to avoid any serious disease ranging from infections to allergies. The surging adoption of pets in developing economies is also making these markets conducive for tick and flea prevention product sales.

The pet tick and flea prevention industry offers a lucrative opportunity to aspiring entrepreneurs. Increasing investments in niche industries by funding agencies, governments, and affluent individuals are also firing up the startup ecosystem.

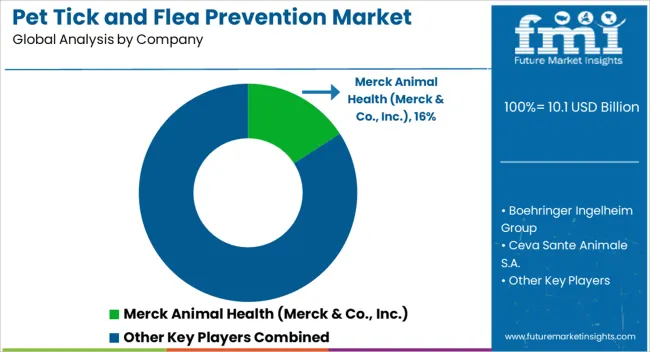

Concerning established players, the industry is observing many strategic collaborations to increase its product portfolio and reach. Leading brands are increasingly innovating effective, safe, and vet-quality pet care products for cats and dogs, such as tick and flea protection, etc. Some of the latest developments include palatable flavored chewables that are designed to kill fleas.

Companies are also offering personalized flea treatments that provide more flexible and friendlier ways to care for their pets. Key players in the pet tick and flea prevention industry are delivering pet care products at an affordable price. Thus, giving customers more autonomy and flexibility without compromising on customization or price.

Industry Updates

Based on product type, the industry is divided into oral pills, spray, spot on, powder, shampoo, collar, and other products.

Manufacturers offer pet tick and flea prevention products for animals like dogs, cats, and other animals, including mice, rats, etc.

Different sales channels from where tick and flea prevention solutions can be bought are company and eCommerce websites, pharmacy stores, specialty stores, mega retail stores, etc.

The product is sold across North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

The global pet tick and flea prevention market is estimated to be valued at USD 10.1 billion in 2025.

The market size for the pet tick and flea prevention market is projected to reach USD 15.4 billion by 2035.

The pet tick and flea prevention market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in pet tick and flea prevention market are oral pills, spray, spot on, powder, shampoo, collar and other.

In terms of animals, dogs segment to command 54.6% share in the pet tick and flea prevention market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA