The PET preform market is experiencing notable growth driven by increasing demand for lightweight, durable, and cost-effective packaging solutions. By 2035, the market is projected to reach USD 26.9 billion, expanding at a compound annual growth rate (CAGR) of 4.4%. Key drivers include the growing beverage industry, demand for sustainable and recyclable packaging, and technological advancements in PET production.

Manufacturers are focusing on producing lightweight and high-strength preforms to meet consumer demands. Partnerships with beverage companies, FMCG firms, and retail chains are driving adoption while aligning with global sustainability goals.

| Attributes | Values |

| Projected Industry Size 2035 | USD 26.9 billion |

| Value-based CAGR (2025 to 2035) | 4.4% |

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Summary

The SWOT analysis reveals the competitive positioning of leading companies in the PET preform market. Leading companies like Amcor lead in product innovation but face challenges related to fluctuating raw material prices. ALPLA Group excels in global presence and customization but struggles with energy-intensive production processes. Plastipak is recognized for cost efficiency but faces competition from emerging players. Opportunities lie in developing innovative designs and expanding in emerging markets, while threats include regulatory restrictions and raw material price volatility.

Amcor

Amcor is a leader in PET preform production, known for innovation in lightweight and durable designs. Strengths include a diverse product portfolio and strong relationships with beverage companies. Challenges include managing fluctuating raw material costs. Opportunities include expanding into eco-friendly product lines, while threats arise from stricter environmental regulations.

ALPLA Group

ALPLA Group is recognized for its global presence and customizable preforms. Strengths include advanced production facilities and sustainability-focused initiatives. Challenges include the high energy requirements for PET production. Opportunities include investments in renewable energy and bio-based PET materials. Threats include increasing competition from regional players.

Plastipak

Plastipak stands out for its cost-effective and high-quality preform production. Its strength lies in targeting both large-scale and mid-size beverage companies. However, challenges include limited market penetration in Asia-Pacific. Opportunities exist in expanding operations in emerging markets and adopting advanced technologies. Threats include growing competition and compliance with evolving regulations.

| Category | Market Share (%) |

|---|---|

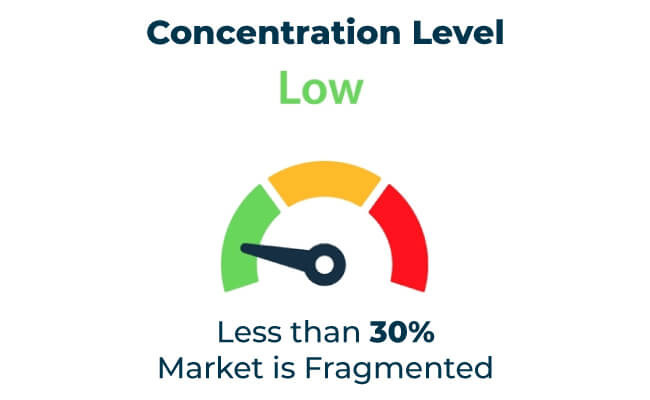

| Top 3 Players (Amcor, ALPLA, Plastipak) | 16% |

| Rest of Top 5 Players (RETAL, Graham Packaging) | 06% |

| Next 5 of Top 10 Players | 07% |

Type of Player & Industry Share

| Type of Player | Market Share (%) |

|---|---|

| Top 10 Players | 29% |

| Next 20 Players | 45% |

| Remaining Players | 26% |

North America enforces strict recycling regulations and bans on single-use plastics, driving PET innovations. Europe’s sustainability laws promote the use of recycled PET. Asia-Pacific’s growing economies drive demand for affordable PET preforms while implementing recycling initiatives.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Emerging markets in Asia-Pacific, Africa, and South America offer significant potential. Cost-efficient and recyclable PET preform solutions are increasingly sought to meet both regulatory and consumer expectations.

In-House vs. Contract Manufacturing

| Region | North America |

| Market Share (%) | 30% |

| Key Drivers | Rising recycling rates and regulatory support. |

| Region | Europe |

| Market Share (%) | 35% |

| Key Drivers | Innovation in recyclable PET materials. |

| Region | Asia-Pacific |

| Market Share (%) | 25% |

| Key Drivers | High demand for cost-effective and recyclable PET. |

| Region | Other Regions |

| Market Share (%) | 10% |

| Key Drivers | merging opportunities in recycling infrastructure. |

The PET preform market will grow through sustainability-driven innovations, material advancements, and partnerships with beverage and FMCG companies. Companies prioritizing cost-efficient production, scalability, and regional expansion will lead the market. Investments in recycling infrastructure will further accelerate growth.

| Tier | Key Companies |

| Tier 1 | Amcor, ALPLA Group, Plastipak |

| Tier 2 | RETAL, Graham Packaging |

| Tier 3 | Sidel, Pretium Packaging, Resilux |

The PET preform market is poised for significant growth, driven by increasing demand for recyclable and lightweight packaging solutions. Companies investing in innovative materials, scalable production, and strategic partnerships will maintain a competitive edge in this dynamic and evolving market.

Key Definitions

Abbreviations

Research Methodology

This report is based on primary research, secondary data analysis, and market modeling. Industry expert consultations validated insights.

Market Definition

The PET preform market encompasses the production and distribution of PET-based preforms for use in packaging solutions across various industries, addressing both consumer and industrial needs.

Rising demand for recyclable, lightweight, and cost-effective packaging solutions.

the market is projected to reach USD 26.9 billion, expanding at a compound annual growth rate (CAGR) of 4.4%.

Amcor, ALPLA Group, and Plastipak are leading players.

Fluctuating raw material prices, regulatory inconsistencies, and limited recycling infrastructure.

Innovations in recyclable materials, automation, and partnerships with FMCG companies.

Explore Packaging Formats Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.