The market for pet OTC medication is booming, due to an increase in pet owner awareness of maintaining good health and wellness in pets. Increased awareness in preventive healthcare makes pet parents invest in over-the-counter drugs, such as flea and tick treatments, joint supplements, digestive aids, and skin care solutions.

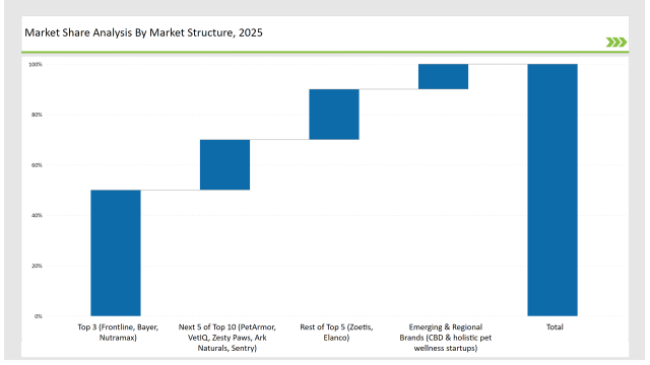

The big players are thus focused on natural formulations, easy-to-administer formats, and vet-approved solutions catering to changing consumer preferences. The leading players of the market include Frontline, Bayer, and Nutramax with robust distribution channels, high ratings in terms of efficacy, and consumer confidence that amount to 55% market share.

Regional brands and holistic pet wellness companies take 30%, and new startups specializing in organic and CBD-infused pet remedies amount to 15%.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Frontline, Bayer, Nutramax) | 50% |

| Rest of Top 5 (Zoetis, Elanco) | 20% |

| Next 5 of Top 10 (PetArmor, VetIQ, Zesty Paws, Ark Naturals, Sentry) | 20% |

| Emerging & Regional Brands (CBD & holistic pet wellness startups) | 10% |

The pet OTC medication market in 2025 is moderately concentrated, with the top players accounting for 50% to 60% of the total market share. Leading brands such as Frontline, Bayer, and Nutramax dominate the segment, while natural supplements and homeopathic pet remedies add competitive diversity.

This market structure reflects strong brand influence while allowing space for holistic pet health innovations and regulatory advancements.

The pet OTC medication market has multiple sales channels through which it functions. Online pet pharmacies and e-commerce platforms are leading the market at 55%, as pet owners want convenience and auto-replenishment services. Brick-and-mortar pet stores account for 25% and offer in-store expert recommendations and immediate availability.

Veterinary clinics and pharmacies account for 15% and sell vet-approved OTC solutions for specific pet health concerns. DTC brands and holistic pet wellness boutiques account for the remaining 5% and serve premium, organic, and niche pet health products.

The pet OTC medication market can be segmented into flea & tick treatments, joint supplements, digestive health aids, skin & coat care, and calming solutions. Flea & tick treatments dominate the market at 40% due to growing pet ownership and awareness about parasite prevention. Joint supplements comprised 25%, which helps improve the mobility of aging pets.

Digestive health aids made up 15% that support gut health and immunity. Skin & coat care products comprised 10% that helped solve allergies and dermatological issues. Calming solutions comprised 10% and are on the rise due to the growing rate of pet anxiety and behavioral problems.

The year 2024 has been transformative for the pet OTC medication market, defined by innovation in natural remedies, CBD-infused products, and preventative health solutions. Industry key players:

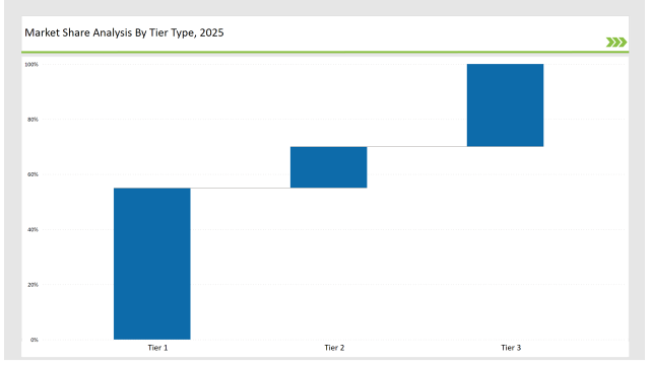

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Frontline, Bayer, Nutramax |

| Market Share (%) | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Zoetis, Elanco |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, holistic pet startups |

| Market Share (%) | 30% |

| Brand | Key Focus Areas |

|---|---|

| Frontline | Long-lasting, all-natural flea & tick prevention |

| Bayer | Fast-acting dewormers & anti-inflammatory supplements |

| Nutramax | Joint mobility supplements with advanced formulas |

| Zoetis | Probiotic-based digestive health solutions |

| Elanco | Multi-protection flea, tick, and heartworm prevention |

| Emerging Brands | Organic, CBD-infused pet wellness solutions |

The market for pet OTC medications will continue to expand, with factors such as natural and organic remedies, digital convenience, and the shift towards preventive pet health care. Brands will focus on holistic formulations vet-approved, smart tracking of medication, and combination solutions to address changing pet owner requirements.

As consumer education around pet wellness increases, companies will increase their online presence and develop AI-driven pet health platforms. The future of the industry is all about innovation, sustainability, and personalized pet healthcare solutions.

Leading players such as Frontline, Bayer, and Nutramax collectively hold around 55% of the market.

Regional brands and specialty pet wellness companies contribute approximately 30% of the market by offering niche, locally developed solutions.

Startups specializing in CBD-infused pet products and organic pet health solutions hold about 10% of the market.

Private labels from online pet pharmacies and veterinary clinics hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.