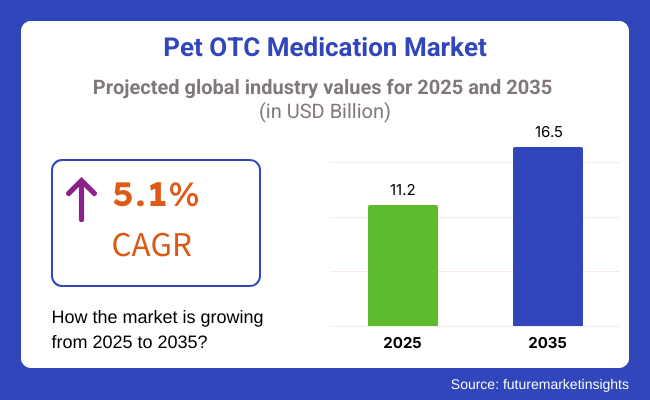

The pet OTC medicine market is expected to grow substantially between 2025 and 2035 because of rising pet ownership, growing awareness about pet healthcare, and growing need for easy, non-prescription medication. The industry will grow from USD 11.2 billion in 2025 to USD 16.5 billion in 2035 at a CAGR of 5.1% during the forecast period.

The industry expansion is being driven by pet owners' growing desire for self-medication, growth in e-commerce channels, and the emergence of natural and organic pet health products. Firms are concentrating on preventive care products such as flea and tick protection, gastrointestinal health supplements, and skin care products. The impact of humanization in pet care is also compelling brands to innovate with high-quality and niche products.

Further, enhancing accessibility to over-the-counter pet medicine through pharmacies, veterinary centers, and internet businesses is decreasing treatment expenses and the pet owner access barrier. Growth in demand for technology, such as AI-enabled animal health tracking and smart dispensers, is driving the industry, too. Because animals' wellness will grow as a concern, there will be higher demand for specialty, breed, and age-targeted medicine.

Explore FMI!

Book a free demo

The industry is on the way to being the fastest growing industry is the result of the increase in the number of pet owners as well as the higher degree of awareness of pet health care. The pet owners Neva don't tell anything about the use of the drug without saying its effectiveness, its safety, its affordability, and convenience, they prefer it over trusted brands and the doses that are easy to use such as chewable tablets or liquid drops.

The veterinary clinics commonly prescribe the medications that have to follow the strictest regulations and tests, they are often made of solely natural and organic ingredients that are believed to be the best for pets. On the one hand, the pet stores and pharmacies provide the cheap and easily available to customers OTC drugs while on the other hand, the online retailers sell even more than the pharmacies, as they have the advantages of the simplest buying process, the best prices, and the delivery to customers' homes.

The industry grew continuously from 2020 to 2024, driven by increasing pet ownership, increased pet health consciousness, and pet humanization. Pet owners sought OTC products more for flea and tick prevention, gastrointestinal health, pain, and anxiety.

The popularity of natural and organic products, such as products containing CBD, attracted consumers who favored their wellness. Internet sites widened industry coverage, and veterinary support boosted customers' trust. Although there were regulation issues and quality issues of products, manufacturers focused on producing improved products, line extension, and safe and convenient packaging.

During the period 2025 to 2035, AI-based pet health monitoring, tailored supplements, and eco-friendly products will drive the industry forward. Occasional medication combined with smart collars and disease monitoring software will deliver tailored dosage prescriptions based on recent pet health reports.

Breed-specific and age-oriented supplements will grow in popularity. Green packaging and green ingredients will appeal to green aspirations, and product authenticity with blockchain technology will ensure quality and integrity. More telemedicine for pets will also drive AI-driven OTC medicine need as part of home care.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Brands launched innovative formulations for flea, tick, and allergy relief using natural and chemical-free ingredients. CBD-based pet drugs became popular. | AI-powered pet health monitoring devices suggest OTC drugs based on real-time biometrics. Smart dispensers provide accurate dosage administration. |

| Companies embraced green packaging, refillable medicine dispensers, and plant-based formulations. Sustainable ingredient sourcing is a differentiator. | Zero-packaging for pet drugs becomes standard. AI simplifies supply chain transparency for sustainable, ethically sourced ingredients. |

| Pet health trackers utilizing IoT with OTC medication reminder and symptom monitoring smartphone apps. Telemedicine consultations online influencing drug choice. | Pet health platforms based on AI provide personalized OTC treatment. Blockchain ensures authenticity and traceability of OTC drug sourcing. |

| Increased pet keeping and increased vet costs fueled the demand for OTC alternatives. Pet health boxes on subscription were in vogue. | Emerging industries drive take-up of affordable, AI-enabled pet healthcare options. AI-powered pet diagnostic solutions forecast medication requirements prior to symptom onset. |

| Tighter FDA and EU regulations mandated labeling transparency in pet medications and ingredient safety. Veterinary groups supported natural OTC substitutes. | International pet healthcare regulations require rigorous testing and eco-friendly manufacturing. Blockchain provides regulatory compliance and counterfeiting protection for OTC pet drugs. |

| Brands launched breed-specific supplements and condition-specific drugs. Subscription plans provided recurring, tailored pet wellness packages. | AI-based pet drug plans adjust to specific pet health profiles. 3D-printed personalized supplement formulas deliver targeted health benefits. |

| Pet influencers and veterinarians endorsed OTC drugs on social media and online communities. Amazon and Chewy dominated DTC (direct-to-consumer) sales mania. | Virtual pet influencers and metaverse-supported pet wellness consults reframe marketing. AR-based product demos assist pet owners with OTC medication benefits. |

The industry encounters risks relating to regulatory problems, product safety, counterfeit medications, and fluctuating customer behavior. The most effective way to prevent legal penalties and product recalls is to follow the rules of FDA, EMA, and regional veterinary drug regulations.

Product safety is an issue that stands out. There are some OTC medications that might cause adverse reactions in pets if they are not used appropriately. The absence of veterinary supervision can lead to incorrect dosages, allergic reactions, or drug reactions that might damage the brand's reputation and hike up the legal risks. Warnings on the product and advertising campaigns would be of help to those who do not know the correct dosage of the popular medication.

The appearance of counterfeit and subpar pet medications is a great threat to the industry's reliability. The lack of authorization on some sellers in e-commerce sites can be a platform for the distribution of the expired or banned products, which leads to serious health issues for the pets involved and erosion of trust from the consumers' side.

The first thing the companies could do would be to make the security measures against counterfeiting, implement tracking systems, and operate only through the authorized distribution channels to safeguard their products.

Moreover, the inclination of consumers towards natural remedies and holistic pet care has also had an effect on the industry for traditional OTC medications. Furthermore, the economic recession could trigger the owners to cut back on the health products that are not essential, thus raising a question over the next quarter sales. Therefore, the companies should consider a wider range of strategies such as product diversification and organic and herbal alternatives research and development investment.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| UK | 7.2% |

| Germany | 7.3% |

| India | 8.1% |

| China | 8.4% |

The USA industry is expanding due to increasing pet ownership and preventive care expenditure. With over 67% of the population owning a pet, customers are on the lookout for cost-effective, effective solutions to treat pet health.

The industry has been revolutionized through e-commerce, with Chewy and Amazon retailing direct-to-door pet medications. Zoetis, Bayer Animal Health, and PetArmor dominate the industry, introducing new products for flea, tick, and parasite control. FMI is of the opinion that the USA industry is slated to grow at 7.5% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Pet owners' demand for flea, tick, and parasite control products | Pet owners seek easy-to-use products like spot-on and chewable tablet forms to avoid infestation risks. |

| Natural and herbal pet supplement industry popularity | Customers have become aware of overall pet health, and natural and plant-derived supplements like CBD-treated pet items have shown a rise in sales. |

| Web-based and subscription-form pet pharmacies' growth | Flash platforms commoditize products by making them more affordable and accessible, with auto-renewal subscriptions providing improved customer retention. |

The UK industry is fueled by robust veterinary retailing and rising consumer demand for alternative therapy. The pet population is over 50 million, and owners spend a lot of money on preventive medicine.

Industry leadership is retained by brands such as Frontline, Beaphar, and Bob Martin to encourage new pet health solutions through both offline and online store channels. FMI is of the opinion that the UK industry is slated to grow at 7.2% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Upsurge in demand for nutritional and preventive supplements | Pet owners invest in long-term pet health with a focus on vitamins, joint supplements, and immuno-boosters. |

| Growth of online availability of pet medicines at stores and pharmacies | The growing availability of additional OTC pet medicines at stores and neighborhood pharmacies makes access easy. |

| Online veterinary consultation and telemedicine development | Online vet consultation makes diagnosis and online prescription easier with reduced clinic visits. |

Germany's industry thrives after a demand for high-quality veterinarian-approved medicine. Germany has a population of over 34 million pets and features a large and mature pet group that is generating demand for bespoke healthcare products.

Boehringer Ingelheim, Virbac, and Merial are a few of the business entities that harness pet owners needing effective science-proven solutions. FMI is of the opinion that the German industry is slated to grow at 7.3% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Need for joint and digestive health supplements | Older animals require special nutrition, which has been pushing the sale of glucosamine and probiotic supplements. |

| Organic, chemical-free medication for animal growth | Organic, sustainable products attract consumers, propelling demand for herbal medicines. |

| Increased veterinary shopping over the Internet and home delivery | Internet shopping malls provide the luxury of easy access to veterinarian-qualified pet medication. |

India's industry experiences high growth, driven by increasing disposable incomes and increasing pet adoption. The pet care industry is expanding with an increasing demand for herbal and ayurvedic products.

Local players like Himalaya Pet Care, Drools, and Petcare offer cost-effective yet effective solutions that are tailored to regional industries. FMI is of the opinion that the Indian industry is slated to grow at 8.1% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Herbal and Ayurvedic pet drug popularity | Ayurvedic and herbal pet medicines have gained popularity among pet owners. |

| Home and low-priced pet treatments demand | Home brands satisfy middle-class family needs with low-priced treatments. |

| E-commerce and direct-consumer pet health products emergence | Flipkart and Amazon facilitate countrywide coverage for OTC pet medicines. |

China's industry is expanding at an increasing rate because of increased incomes and a move towards premium-quality pet health products. China's pet industry measures up to USD 50 billion, with increasing client demand for high-quality domestic and foreign brands.

Robust competitors like Tianjin Ringpu, Zoetis China, and VetPlus benefit from the rising tide. FMI is of the opinion that the Chinese industry is slated to grow at 8.4% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Increasing demand for probiotics and immune-boosting pet supplements | Pet owners appreciate digestive health and disease prevention through scientifically formulated supplements. |

| Expansion of cross-border e-commerce and overseas pet medicine brands | European and American foreign pet health products become more mainstream among Chinese consumers. |

| Increased role of smart pet healthcare and online consultations with veterinarians | Technology-based solutions, such as AI-based vet consultations, transform pet healthcare access. |

Based on animal type, the global pet OTC medication market is segmented into dogs, cats, birds, small mammals, and others. Dogs and cats account for the largest share, which is likely to include pet ownership and rising expenditure on animal healthcare.

In 2025, dogs will account for 60-65% of all sales. This industry is at the forefront due to the premiumization of pet care, an increase in veterinary visits, and a rise in pet insurance coverage. The most popular over-the-counter products for dogs continue to include joint supplements, dewormers, pain relievers, and flea and tick treatments.

The top brands include Bravecto, NexGard, and Simparica Trio from Zoetis, Boehringer Ingelheim, and Merck Animal Health, amongst others, reflecting the growing consumer demand for broad-spectrum antiparasitic treatment with long-lasting effects. Underlying sales growth, growing concern over canine obesity and arthritis is boosting sales of glucosamine-based joint supplements, such as Cosequin.

Cats account for 35-40% of the industry and have plenty of room to grow, with rising cat adoption rates and preventative health becoming a priority. Cats are more susceptible to flea infestations, gastrointestinal worms, and stress-related diseases, boosting demand for topical and oral flea treatment, probiotics, and calming supplements.

Products from well-known brands like Elanco, Bayer, and Virbac include Advantage II, Profender, and Comfortis. Additionally, the use of pets in the home has increased demand for urinary health supplements and hairball control products.

Fleas and ticks hold the most industry share for over-the-counter medications for pets, although allergies also have a sizable portion of the industry. In 2025, 40 to 45 percent of all pet medications sold over the counter will be for fleas and ticks.

This segment is primarily driven by the increasing incidence of vector-borne diseases (such as Lyme disease, anaplasmosis, and ehrlichiosis) transmitted by ticks. The developing focus of pet owners on preventive care is affecting the flea collars, oral chews, and spot-on industry.

Major flea and tick control companies like NexGard (Zoetis), Bravecto (Merck Animal Health), and Frontline Plus (Boehringer Ingelheim) make long-lasting, rapidly acting topical medications. These items remain some of the best-selling products in pet supply stores, veterinary clinics, and online marketplaces. Growing frustration with resistance to old-line flea drugs, like organophosphates, is driving innovation, too, such as isoxazoline-based oral chews and plant-based repellents.

Allergies are one of the prevalent segments of the industry, owing to increasing cases of skin irritation, environmental allergies, and food intolerances in pets. Allergic treatments believed to comprise 15%-20% of sales in 2025 flow through antihistamines, corticosteroid sprays, hypoallergenic shampoos, and omega-3 fatty acid supplements.

Some of these include Apoquel (Zoetis) to reduce itching, Cytopoint (also made by Zoetis) to decrease tires, and Zesty Paws to boost the immune response. Pet seasonal allergies, dermatitis, and dietary intolerances are being more recognized by pet owners, contributing growth opportunities in this segment as the trend changes to natural and hypoallergenic formulations.

As flea populations pose a risk of allergic reactions to pets as well, especially in the case of cats and dogs, easy-over-the-counter (OTC) solutions and veterinarians' products that are effective and accessible are likely to be preferred by pet parents, resulting in this industry being at an all-time rate in terms of growth.

The industry for pet medicine is growing at an accelerated pace, considering factors like rising pet ownership awareness toward preventive healthcare for pets and reasonable demand for OTC medications. Pet owners look forward to these affordable and effective options for addressing various ailments, increasing competition among established and emerging players.

Key players Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, and Bayer Animal Health (Elanco) are marketing products like flea and tick preventives, dewormers, pain relievers, and skin treatments. Startups and niche brands are expanding their portfolios into natural supplements, CBD-based pet wellness products, and AI-driven pet health monitoring solutions.

Industry evolution, with the growth of e-commerce, DTC sales, and increased scrutiny by regulators for product safety and efficacy, is a major force at play. Shifting to organic and chemical-free formulations and subscription-based models in the pet wellness space is also reshaping industry dynamics.

Strategic factors impacting competition entail product efficacy, regulatory compliance, distribution partnerships, and branding strategies. Players investing in innovative formulations, telehealth-integrated pet care solutions, and sustainable packaging will have a stronger footing in this industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Zoetis Inc. | 20% |

| Merck Animal Health | 17% |

| Boehringer Ingelheim | 15% |

| Elanco Animal Health | 10% |

| Bayer AG | 8% |

| Other Companies | 30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Zoetis Inc. | Offers a comprehensive range of OTC pet medications, including parasiticides and dermatology products. Recent activities include the launch of innovative pain management solutions for pets. |

| Merck Animal Health | Provides a variety of OTC products focusing on vaccines and anti-parasitic treatments. The company has been expanding its product line to include more comprehensive health solutions for pets. |

| Boehringer Ingelheim | Offers OTC medications targeting respiratory and digestive health in pets. Recent initiatives include partnerships to enhance pet healthcare accessibility. |

| Elanco Animal Health | Provides OTC products focusing on flea and tick treatments, as well as nutritional supplements. The company has been actively acquiring smaller firms to broaden its product portfolio. |

| Bayer AG | Offers a range of OTC pet medications, including flea, tick, and worm treatments. Recent activities involve research into advanced formulations for pet health products. |

Key Companies Insights

Zoetis Inc. (20%)

A pet health industry leader for human OTC products, Zoetis Inc., has devised a range of parasiticides and dermatology products. The company continues to make innovative offerings that resonate with the changing preferences of consumers.

Merck Animal Health (17%)

Merck Animal Health is into vaccines and anti-parasitic treatments, its main thrust in the OTC portfolio. The company puts a great premium on product quality and user satisfaction, thus keeping a steady flow in industry capture.

Boehringer Ingelheim (15%)

Boehringer Ingelheim's OTC products are primarily respiratory and digestive health medications for pets. Innovation by the company has, thus, appealed to pet owners keen on exploiting effective health solutions.

Elanco Animal Health (10%)

OTC products to treat fleas and ticks, as well as nutritional supplements, are among several products from Elanco Animal Health. Its attention to quality and growing product line resonates well with consumers who demand full-range pet healthcare options.

Bayer AG (8%)

OTC medicines for pets, such as flea, tick, and worm treatments, are also sold by Bayer AG. Continuing to focus on customer experience and product innovation has strengthened the company.

The industry is slated to reach USD 11.2 billion in 2025.

The industry is predicted to reach a size of USD 16.5 billion by 2035.

Ceva Santé Animale Co., Elanco Animal Health Inc., Boehringer Ingelheim International GmbH, Zoetis Inc., Merck & Co., Inc., Virbac SA Co., Bayer AG, IDEXX Laboratories Co., Covetrus Inc., Dechra Pharmaceuticals PLC, Vetoquinol SA, Phibro Animal Health Co., Kyoritsuseiyaku Co., Krka, d. d., Novo Mesto, Sequent Scientific Ltd., Heska Co., and Eco Animal Health Group are the key players in the industry.

China, slated to grow at 8.4% CAGR during the forecast period, is poised for the fastest growth.

Chewables & tablets are among the most widely used forms of pet OTC medication.

By pet type. the industry is segmented by pet type into dogs, cats, birds, fish and reptiles, small pets, and others.

By application, the industry includes fleas & ticks, allergies, pain relief & arthritis, de-wormers, and others.

By form, the industry is categorized into chewables & tablets, capsules & ointment, sprays, and others.

By sales channel, the industry is divided into pet specialty stores, veterinary clinics, drug & pharmacy stores, online retail, and others.

By region, the industry spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.