The global PET (Polyethylene Terephthalate) packaging industry is witnessing substantial growth due to increasing demand for lightweight, cost-effective, and recyclable packaging solutions across multiple industries, including food & beverage, pharmaceuticals, and personal care. Advances in PET recycling technology, sustainability initiatives, and increasing regulatory support for eco-friendly materials are reshaping the competitive landscape.

Market growth is driven by consumer preference for sustainable packaging, government regulations promoting circular economy practices, and innovations in lightweight, durable, and reusable PET packaging solutions. As cost-efficiency and quality become priorities, manufacturers are investing in advanced PET recycling, bio-based PET, and smart packaging solutions.

Market Leaders & Competitive Landscape

Explore FMI!

Book a free demo

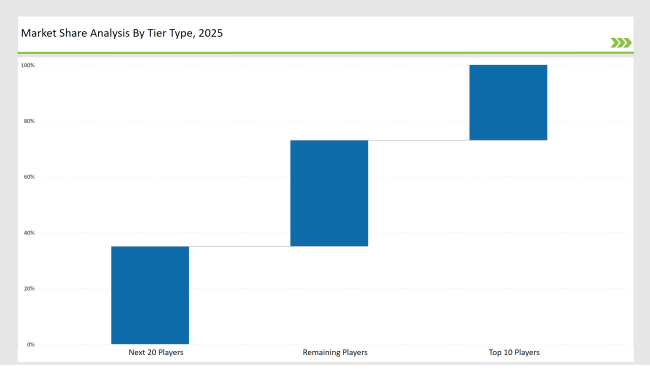

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Berry Global, ALPLA) | 12% |

| Rest of Top 5 (Indorama Ventures, Plastipak) | 9% |

| Next 5 of Top 10 | 6% |

The demand for high-quality PET packaging is increasing across multiple industries:

Manufacturers are focusing on innovative solutions to meet evolving market needs:

Year-on-Year Leaders

To stay competitive in the PET packaging industry, suppliers should focus on:

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Berry Global, ALPLA |

| Tier 2 | Indorama Ventures, Plastipak, Graham Packaging |

| Tier 3 | Nampak, Retal, Alpha Packaging |

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched fully recyclable PET packaging (March 2024) |

| Berry Global | Introduced lightweight PET bottle designs (July 2023) |

| ALPLA | Expanded rPET bottle production (October 2023) |

| Indorama Ventures | Developed advanced PET recycling technology (February 2024) |

| Plastipak | Innovated in refillable PET packaging (May 2024) |

The PET packaging industry is transitioning toward sustainability, efficiency, and material innovation. Key players are emphasizing:

The industry is expected to advance in:

Rising demand for lightweight, cost-effective, and sustainable packaging solutions.

Amcor, Berry Global, ALPLA, Indorama Ventures, and Plastipak.

Recycled PET (rPET), bio-based PET materials, and smart packaging solutions.

Asia-Pacific, North America, and Europe.

Companies are investing in bio-based PET, advanced recycling technologies, and eco-friendly production methods.

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.