The pet market is growing at a rapid pace due to increasing humanization of pets, growing disposable incomes, and expanding demand for premium pet products and services, leading to a rise in pet ownership worldwide. Pet owners are choosing health, nutritional, and well-being solutions leading to increased spends on pet foods, accessories, healthcare, and grooming.

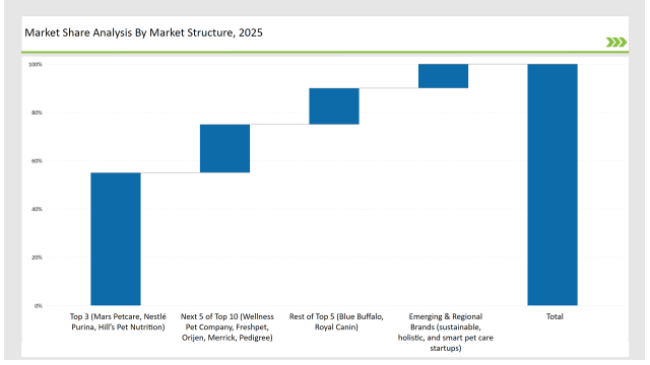

These market leaders continue to dominate Mars Petcare and Nestlé Purina, backed by Hill's Pet Nutrition along with an extremely wide range of products, pan-global distribution networks, and also strong brand capital, accounting for 55 percent of the global market share. The other 30% is comprised of regional pet brands and specialty pet product companies, while the rest 15% is emerging startups in sustainable pet care, smart pet technology, and DTC solutions.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Mars Petcare, Nestlé Purina, Hill’s Pet Nutrition) | 55% |

| Rest of Top 5 (Blue Buffalo, Royal Canin) | 15% |

| Next 5 of Top 10 (Wellness Pet Company, Freshpet, Orijen, Merrick, Pedigree) | 20% |

| Emerging & Regional Brands (sustainable, holistic, and smart pet care startups) | 10% |

The pet market in 2025 is moderately concentrated, with the top players accounting for 50% to 60% of the total market share. Leading companies such as Nestlé Purina, Mars Petcare, and Hill’s Pet Nutrition dominate the segment, while direct-to-consumer pet brands and holistic pet wellness solutions add competitive diversity.

This market structure reflects strong brand influence while allowing space for personalized pet care and premium nutrition offerings.

The pet market is sold through various sales channels. E-commerce and online pet specialty retailers take 55 percent share of the market because consumers are able to compare prices, have a high-volume selection, and utilize subscription-based delivery services.

Brick-and-mortar pet stores account for 25 percent share, and that share is attributed to the personal touch of customer service and onhand product availability. Veterinary clinics and pharmacies are 15% of the total, which is prescription-based pet healthcare and premium pet food. The rest is 5%, DTC brands and boutique pet shops that only sell exclusive high-end pet care solutions.

The pet market is categorized into pet food, pet healthcare, pet accessories, and pet grooming services. The largest is pet food at 45%, where premium and organic pet nutrition remain in vogue. Pet healthcare accounts for 25%, driven by increasing pet insurance adoption, veterinary visits, and preventive wellness solutions.

Pet accessories contribute 20%, covering toys, beds, leashes, and training products. Pet grooming services hold 10%, growing due to rising demand for pet wellness, hygiene, and luxury grooming experiences.

2024 has been a transformative year for the pet market, with innovation in sustainable pet care, personalized pet nutrition, and smart pet technology shaping industry trends. Key players include:

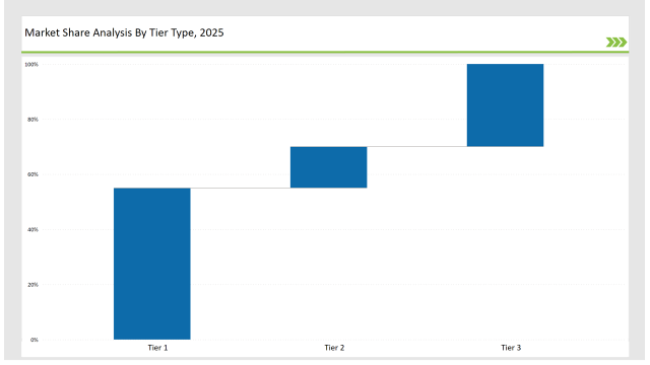

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Mars Petcare, Nestlé Purina, Hill’s Pet Nutrition |

| Market Share (%) | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Blue Buffalo, Royal Canin |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, smart pet care startups |

| Market Share (%) | 30% |

| Brand | Key Focus Areas |

|---|---|

| Mars Petcare | Organic & tailored pet nutrition |

| Nestlé Purina | Veterinary diets & science-backed pet food |

| Hill’s Pet Nutrition | Prescription pet diets for health conditions |

| Blue Buffalo | Grain-free, high-protein pet diets |

| Royal Canin | Breed-specific and advanced metabolism-based pet food |

| Emerging Brands | AI-powered pet tech, smart collars, and GPS pet monitoring |

The pet market is bound to grow at a steady rate due to the trend of humanization, the adoption of technology, and sustainable living. The premium experience in pets will continue to be shaped through smart solutions for pets, while organic and health-conscious segments will be pursued as new frontiers.

Pet health monitoring by AI, customized meal plans, and eco-friendly products will lead the future in pet care. As pet owners continue to prioritize the well-being of their furry companions, the industry will evolve into a more personalized, technology-driven, and sustainable market.

Leading players such as Mars Petcare, Nestlé Purina, and Hill’s Pet Nutrition collectively hold around 55% of the market.

Regional brands and specialty pet care companies contribute approximately 30% of the market by offering locally made, unique pet products.

Startups specializing in AI-powered pet care and sustainable pet products hold about 10% of the market.

Private labels from large pet retailers and e-commerce platforms hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Children Mattress Market Product Type, Ingredient Type, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Fabric Softener Market Analysis by Nature, Product Type, End Use, Sales Channel & Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.