The market for pet furniture is increasing drastically as the desire for stylish, functional, and comfortable products increases among pet owners. Pet humanization is taking over the furniture design sector; aesthetics, sustainability, and multi-functionality take precedence over style. Brands are now using ergonomic designs, eco-friendly materials, and smart technology to satisfy ever-changing needs by pet owners.

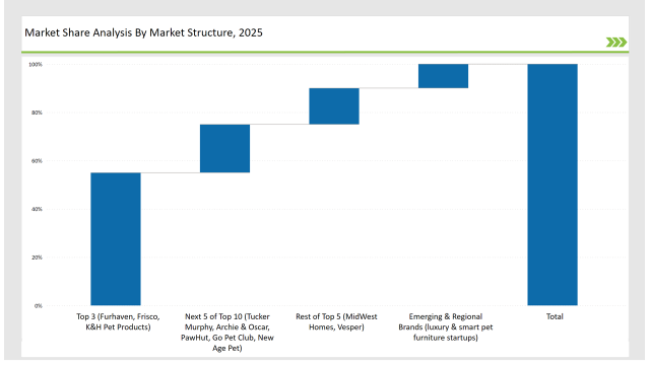

Leaders in the market include Furhaven, Frisco, and K&H Pet Products, which holds a majority of 55% of the market share through strong brand loyalty, wide range of products, and competitive pricing. Regional brands and niche pet furniture makers account for 30%, while emerging smart pet furniture and luxury brands account for the remaining 15%.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Furhaven, Frisco, K&H Pet Products) | 55% |

| Rest of Top 5 (MidWest Homes, Vesper) | 15% |

| Next 5 of Top 10 (Tucker Murphy, Archie & Oscar, PawHut, Go Pet Club, New Age Pet) | 20% |

| Emerging & Regional Brands (luxury & smart pet furniture startups) | 10% |

The pet furniture market in 2025 is moderately concentrated, with the top players accounting for 50% to 60% of the total market share. Leading brands such as Furhaven, Frisco, and K&H Pet Products dominate the segment, while handmade and customizable pet furniture add competitive diversity.

This market structure reflects strong brand influence while allowing space for aesthetic and functional pet lifestyle innovations.

The pet furniture market operates through multiple sales channels. E-commerce and online pet specialty retailers dominate with 60% of the market, as consumers prefer the convenience of browsing a variety of designs and home delivery. Brick-and-mortar pet stores contribute 25%, offering in-person shopping experiences and custom recommendations.

Specialty home décor retailers account for 10%, targeting pet owners looking for furniture that blends seamlessly with modern interiors. The remaining 5% includes direct-to-consumer (DTC) brands and niche luxury retailers, specializing in high-end, bespoke pet furniture.

Pet furniture market segments include pet beds, pet houses & condos, cat trees & scratching posts, and multifunctional pet furniture. The latter holds 40% of the market as it is primarily about comfort-driven products for the owners. Cat trees and scratching posts account for 30% of the total, catering to feline behaviors such as climbing, scratching, and lounging.

Pet houses and condos take up 20%, providing indoor and outdoor shelter solutions. Multifunctional pet furniture comprises 10%, which is in increasing demand since consumers are now looking for creative, space-saving designs that match human furniture.

For 2024, the pet furniture market has really changed with a focus on sustainability, smart technology, and ergonomic designs. Industry leaders include:

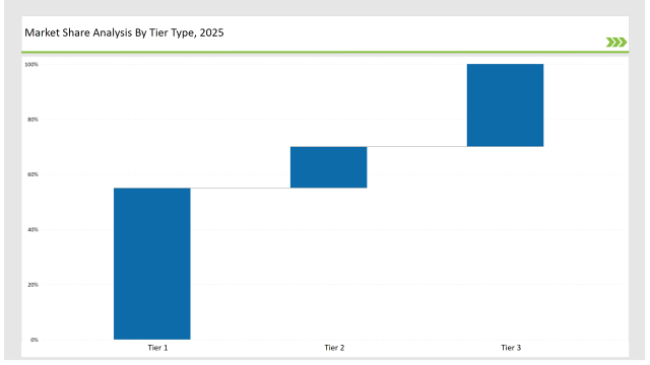

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Furhaven, Frisco, K&H Pet Products |

| Market Share (%) | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | MidWest Homes, Vesper |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, smart pet furniture startups |

| Market Share (%) | 30% |

| Brand | Key Focus Areas |

|---|---|

| Furhaven | Orthopedic, memory foam pet beds |

| Frisco | Modern, space-saving cat trees & scratching posts |

| K&H Pet Products | Heated & cooling eco-friendly pet furniture |

| MidWest Homes | Durable, chew-resistant pet enclosures |

| Vesper | Modular, stylish cat furniture for contemporary homes |

| Emerging Brands | AI-powered pet beds & luxury handcrafted pet furniture |

The pet furniture market is set to continue its growth trajectory based on sustainability, smart pet solutions, and ergonomic innovations. Brands will focus on integrating smart features, creating sustainable furniture, and offering luxury pet designs that fit the modern home aesthetic.

As pet owners continue to seek comfort and convenience for their furry friends, pet furniture will evolve beyond functionality to become an essential part of home décor. The future of the industry revolves around personalization, innovation, and enhanced pet well-being.

Leading players such as Furhaven, Frisco, and K&H Pet Products collectively hold around 55% of the market.

Regional pet furniture makers and specialty brands contribute approximately 30% of the market by offering unique, locally crafted designs.

Startups specializing in AI-powered pet furniture and high-end artisanal designs hold about 10% of the market.

Private labels from e-commerce retailers and specialty pet brands hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.