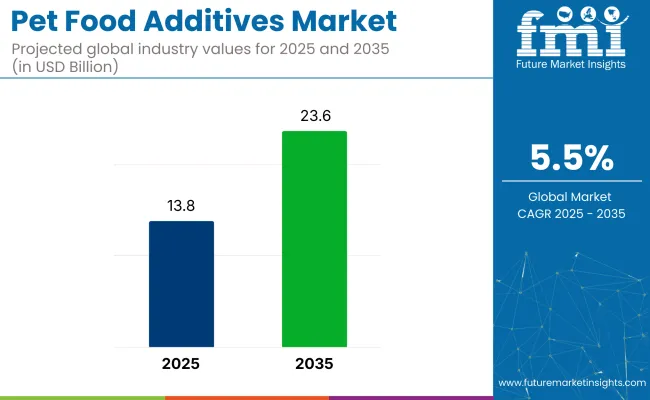

The global pet food additives market is valued at USD 13.8 billion in 2025 and is slated to reach USD 23.6 billion by 2035, which shows a CAGR of 5.5%.

| Metric | Value |

|---|---|

| 2025 Market Size | USD 13.8 billion |

| 2035 Market Size | USD 23.6 billion |

| CAGR (2025 to 2035) | 5.5% |

Key drivers include rising awareness about pet health, growing demand for natural and clean-label ingredients, and manufacturers’ focus on advanced distribution networks. Companies are expanding production capacities to meet the surge in premium, organic, and customized nutrition products for pets.

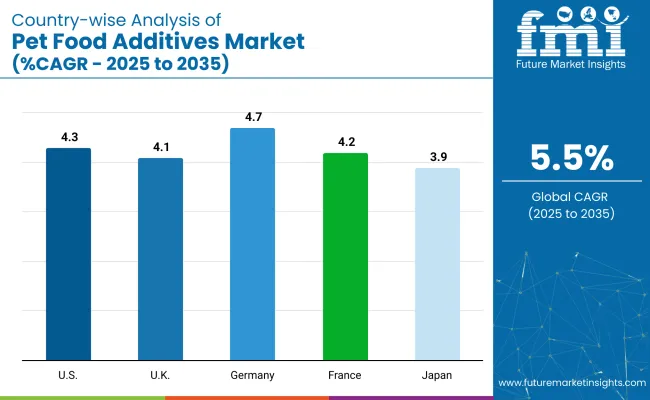

The USA will hold a CAGR of 4.3% due to its strong production capabilities and broad retail presence, while Germany will record the highest CAGR of 4.7% owing to growing demand for organic and high-protein pet products. France is projected to grow at a CAGR of 4.2% from 2025 to 2035, driven by rising demand for natural antioxidants and plant-based pet food additives.

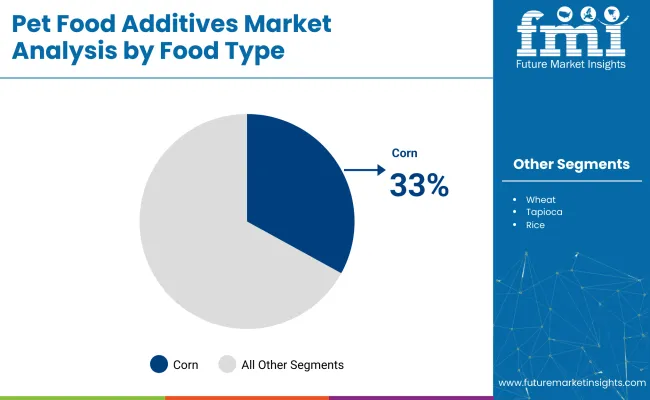

Corn will lead the food type segment with over 33% market share due to its high energy content and cost-effectiveness. Food processing additives will dominate the additive type segment with over 28% market share, driven by their role in improving texture, taste, and shelf life, helping manufacturers meet the demand for premium and functional pet food products.

The market accounts for a significant portion within its parent markets. It holds approximately 15-20% of the overall pet food market, driven by the need for enhanced nutrition, preservation, and flavoring. Within the animal feed additives market, pet food additives represent around 10-12% share, as livestock feed additives dominate this segment. In the pet care market, which includes grooming, healthcare, and accessories, pet food additives contribute roughly 5-7%. Compared to the broader food additives market, it accounts for nearly 3-4%. Its share within the animal nutrition market is estimated at 8-10%, reflecting specialized formulation demand.

The pet food additives market is segmented by pet type, food type, additive type, and region. By pet type, the market is categorized into cross linked starch, acetylated starch, oxidized starch, enzyme-treated starch, pre-gelatinized starch, hydrolyzed starch, cationic starch, phosphorylated starch, and others (including modified specialty starch blends and novel starch derivatives). By food type, the market is segmented into potato, wheat, corn, tapioca, and rice. By additive type, the market is classified into food processing, beverages processing, animal feed, cosmetic and personal care, papermaking, textile, pharmaceuticals, and others (including industrial adhesives, bio-plastics, and specialty chemical applications). Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

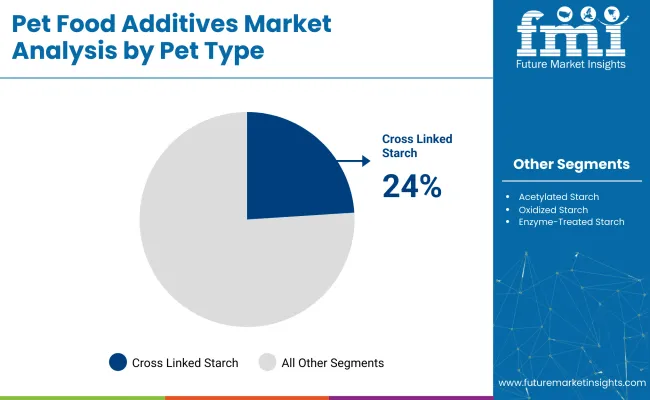

The pet food additives market by pet type is led by cross linked starch, which holds the largest share of 24.3% in 2025 due to its excellent thickening, stabilizing, and emulsifying properties that enhance texture and consistency in premium pet foods.

Corn dominates the market with a 33.7% share in 2025, owing to its high carbohydrate content, energy density, and cost-effectiveness, making it widely used in dry pet food and treats.

Food processing additives lead the additive type segment with a 28.5% share in 2025, driven by their role in enhancing texture, taste, shelf life, and nutrient stability in pet food.

The pet food additives market is experiencing steady growth, driven by increasing consumer awareness of pet health and nutrition, rising demand for clean-label and natural additives, and the growing adoption of specialized, high-performance formulations by the pet food manufacturing industry.

Recent Trends in the Pet Food Additives Market

Key Challenges in the Pet Food Additives Market

Among the top countries, Germany will record the highest CAGR at 4.7%, driven by strong demand for organic and high-protein pet additives. The USA follows with a 4.3% CAGR, supported by advanced production facilities and broad retail networks. France is projected at 4.2% CAGR, with rising demand for natural antioxidants and plant-based additives. The United Kingdom will grow at 4.1% CAGR, due to regulatory focus and clean-label trends. Japan shows the slowest growth among these at 3.9% CAGR, influenced by demand for senior pet nutrition additives and stringent product safety standards.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA pet food additives revenue is projected to grow at a CAGR of 4.3% from 2025 to 2035.

Sales of pet food additives market in the UK are expected to record a CAGR of 4.1% from 2025 to 2035.

Germany’s pet food additives market is projected to grow at a CAGR of 4.7% from 2025 to 2035, the fastest among European markets.

Pet food additives revenue in France is expected to grow at a CAGR of 4.2% from 2025 to 2035.

Japan’s pet food additives revenue is projected to grow at a CAGR of 3.9% from 2025 to 2035.

The pet food additives market is moderately consolidated, with leading global companies holding substantial shares while regional players cater to niche needs. Top companies compete through pricing strategies, continuous innovation in additive formulations, strategic partnerships with distributors, and expansion of production facilities to enhance market reach and supply chain efficiency.

Companies like dsm-firmenich, BASF, and Cargill focus on developing plant-based, clean-label, and functional additives to align with rising consumer health consciousness. Their strategies include launching novel natural preservative blends, investing in breed-specific nutritional premixes, and strengthening R&D capabilities. Meanwhile, regional firms such as MIAVIT Holding and TER Chemicals GmbH & Co. KG focus on specialty solutions and localized distribution networks to maintain competitiveness.

Recent Pet Food Additives Industry News

In January 2024, Darling Ingredients acquired the Polish rendering company Miropasz Group. This deal added three poultry rendering plants in southeastern Poland, expanding Darling’s feather meal production capacity by 250,000 metric tons of poultry byproducts annually (Source: Darling Ingredients)

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 13.8 billion |

| Projected Market Size (2035) | USD 23.6 billion |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in Metric Tons |

| By Pet Type | Cross Linked Starch, Acetylated Starch, Oxidized Starch, Enzyme-Treated Starch, Pre-gelatinized Starch, Hydrolyzed Starch, Cationic Starch, Phosphorylated Starch, and Others (Specialty Starch Blends, Resistant Starches, Dual-Modified Starches, Novel Starch Derivatives) |

| By Food Type | Potato, Wheat, Corn, Tapioca, Rice |

| By Additive Type | Food Processing, Beverages Processing, Animal Feed, Cosmetic and Personal Care, Papermaking, Textile, Pharmaceuticals, Others (Industrial Adhesives, Bio-Plastics, Specialty Chemical Applications, and Biodegradable Packaging Additives) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | dsm-firmenich, Brenntag, Cargill Incorporated, Adisseo, BASF, Bentoli, AFB International, Alltech, MIAVIT Holding, TER Chemicals GmbH & Co. KG, Gillco Ingredients, Turpaz Group |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The pet food additives market size in 2025 is USD 13.8 billion.

The market is projected to reach USD 23.6 billion in 2035.

The market is expected to grow at a CAGR of 5.5% from 2025 to 2035.

Cross linked starch leads the pet type segment with over 24% market share in 2025.

Germany is projected to record the highest CAGR of 4.7% during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pet Blood Pressure Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Pet Herbal Supplements Market Size and Share Forecast Outlook 2025 to 2035

Global Pet Wellness Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA