There are three main market structures of the global pet dietary supplement which are multinational corporations, regional leaders, and niche players. The multinational companies that constitute the highest market percentage of 45% are comprised of companies like Nestlé Purina, Mars Petcare, Virbac, and Vetoquinol due to their strong R&D capabilities as well as large networks of distribution.

Regional players, including Beaphar, Dechra Pharmaceuticals, and Tomlyn, a Vetoquinol subsidiary, command 30% market share through their specialized offerings in meeting the specific needs of their local markets.

About 25% is accumulated by niche players and startups such as Nordic Naturals, PetHonesty, and Ark Naturals, while in the organic, functional, and alternative formulation niche. High degrees of dominance have been illustrated by the leaders of this market, which are Nestlé Purina, Mars Petcare, Virbac, Vetoquinol, and Bayer Animal Health.

Explore FMI!

Book a free demo

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (Nestlé Purina, Mars Petcare, Virbac, Vetoquinol, Bayer Animal Health) | 45% |

| Regional Leaders (Beaphar, Dechra Pharmaceuticals, Tomlyn, Nutramax Laboratories) | 30% |

| Startups & Niche Brands (Nordic Naturals, PetHonesty, Ark Naturals, The Honest Kitchen, Zesty Paws) | 25% |

The market is moderately consolidated with multinational corporations at the forefront but smaller brands driving innovation in specialized segments.

The pet dietary supplements market provides products of diverse types with varieties to suit various needs for health and wellness. The largest share of 32% comes from the Probiotics segment, as an ever-growing number of people realize that gut health matters, too, for their pet. Multivitamins have a share in 26% of the market, which enables the aggregate development of the overall health of the pet.

Omega 3 fatty acids comprise 18% of the market since they are important in supporting healthy skin and coat, as well as cognitive function. Glucosamine is one supplement used to improve joint health and mobility, representing 16% of the market. There is 8% for the "Others" which are special or niche products in the pet dietary supplements.

The pet dietary supplement market caters to a diverse range of applications to address specific health and wellness needs of pets. Digestive Health leads the pack with 28% of the market share, as pet owners look to help their pets achieve gut health and overall digestive function. The Joint Health segment represents 25% of the market, since pet owners want their pets to stay mobile and to keep the functionality of the joints in them, especially as they grow older.

The Weight Management segment is also 20% of the market, as pet owners want to maintain a healthy weight for their pets. The Skin and Coat Health segment is 17% because of the pet owners' realization of the importance of maintaining their pets' skin and coat health. The Dental Care segment accounts for 7% because pet owners want to nurture their pets' oral health.

The year 2024 is reported to be a significant period in the life cycle of the global pet dietary supplement market from the perspectives of new innovations developed in products and strategic alliances combined with market proliferation.

In all this, the main players took many opportunities through such competitive strengths, formulating modern-day inventions alongside sustainable models to achieve higher stakes. For instance, major players had invested heavily in R&D while developing supplements to meet the increasingly high demand for organic and natural products.

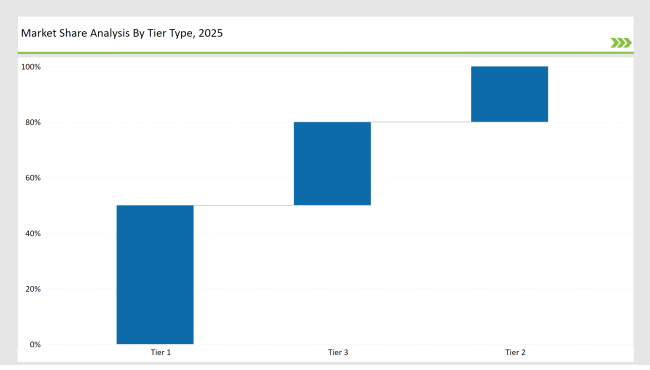

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Nestlé Purina, Mars Petcare, Vetoquinol, Virbac, Bayer Animal Health |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Meiji, Lotte, Beaphar, Dechra Pharmaceuticals |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Regional players, startups like Nordic Naturals, PetHonesty, Ark Naturals |

| Brand | Key Focus |

|---|---|

| Nestlé Purina | Developed breed-specific supplements to address unique nutritional needs of various dog breeds. |

| Mars Petcare | Introduced functional treat-based supplements combining health benefits with enjoyable flavors. |

| Vetoquinol | Expanded into emerging markets in Asia-Pacific through strategic acquisitions and local partnerships. |

| Bayer Animal Health | Launched CBD-infused calming supplements to cater to the rising demand for natural anxiety relief products. |

| Beaphar | Focused on sustainable ingredient sourcing, ensuring eco-friendly and ethically produced supplements. |

| Zesty Paws | Expanded product range to include supplements specifically designed for senior pets' health and mobility. |

| Nutramax Laboratories | Partnered with veterinary networks to co-develop clinically backed supplements for enhanced credibility. |

| The Honest Kitchen | Launched USDA-certified organic supplements, emphasizing transparency and high-quality natural ingredients. |

| Nordic Naturals | Developed new omega-rich formulas tailored for small breeds and specific health conditions. |

| Ark Naturals | Entered premium subscription-based sales, offering personalized supplement plans for pet owners. |

Probiotic formulations are to be dominated by the market as consciousness regarding pet gut health is increasing. There is an opportunity for manufacturers to gain through advanced probiotic strains and undertake clinical trials to establish efficiency. This is both for dogs and cats, especially in North America and Europe, where owners of the animals give top priority to pet health in terms of digestive health.

Direct-to-consumer models, especially subscription-based sales, will become a new trend as these offer convenience and personalization. Brands like The Honest Kitchen may benefit from this trend through personalized supplement packages and auto-renewal services, with assured constant income and loyalty from customers for the next ten years.

The demand for natural anxiety relief products will drive the expansion of CBD-infused supplements. Brands such as Bayer Animal Health can lead this segment by ensuring that they are compliant with local regulations and invest in the best quality sources of CBD. It will cater to the growing population of pet owners who seek holistic and non-pharmaceutical solutions for stress and anxiety in their pets.

Clinically-backed benefits to be made by supplements that are prescribed by veterinarians; the companies, such as Virbac and Vetoquinol, can expand their vet-exclusives product lines for chronic condition treatments and preventive health. In this way, pet owners who rely on veterinarians for guidance and recommendations about their pets' health needs will improve trust and adoption.

Nestlé Purina, Mars Petcare, Virbac, Vetoquinol, and Bayer Animal Health lead the market, collectively holding approximately 45% of the total market share. Their extensive product lines and global distribution networks position them as key players in the industry.

Startups and niche brands hold 25% of the market by focusing on organic, CBD-infused, and functional supplements. Brands like Nordic Naturals and PetHonesty differentiate themselves through innovative formulations and targeting specific health needs.

Regional leaders hold 30% of the market, with key players including Beaphar, Dechra Pharmaceuticals, and Tomlyn. These companies focus on localized product offerings and distribution strategies tailored to specific regional preferences.

Probiotic supplements, CBD-infused products, and joint health supplements are expected to drive growth, supported by increasing pet health awareness and the aging pet population.

Sustainable packaging and ethically sourced ingredients are becoming critical factors for consumers. Brands like Beaphar are leading the way by adopting eco-friendly packaging solutions, which attract environmentally conscious pet owners and enhance brand reputation.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.