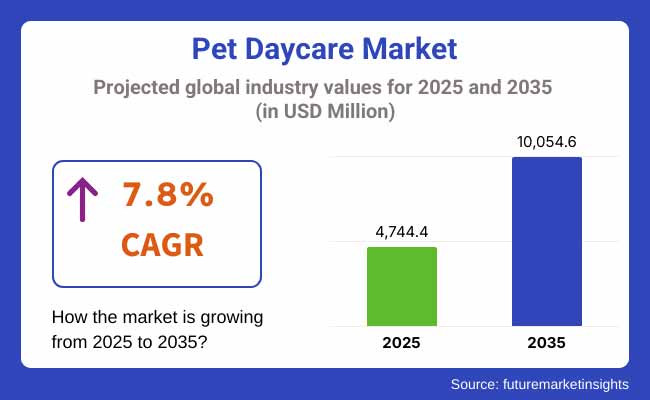

The pet daycare market is expected to witness steady growth between 2025 and 2035, driven by rising pet ownership, increasing demand for premium pet care services, and the growing trend of pet humanization. The market is projected to be valued at USD 4,744.4 million in 2025 and is anticipated to reach USD 10,054.6 million by 2035, reflecting a CAGR of 7.8% over the forecast period.

Pet daycare services give supervised care, socialization, training, and enrichment activities for pets whereas their house owners are away. The market is being driven by the rising demand for premium pet services, real-time pet monitoring solutions, and specialist care for senior pets and pets with special needs. Nonetheless, high service costs, regulatory challenges, and pet safety and hygiene concerns have impeded broader market adoption.

This market will be supplemented with smart collar advancements, AI technology based behaviour analysis and tele-veterinary integrations, all making for a more personalised, safe and health-monitored pet. Additionally, the emergence of eco-friendly pet daycare centers, subscription-based pet care plans, and luxury pet wellness retreats are contributing to the transformation of pet daycare services in the era ahead.

North America accounts for the largest market for pet daycare services, owing to high pet ownership rates, rising spending on pet wellness, and growing demand for professional pet care services. The premium pet daycare facilities, AI-led pet tracking, and mobile pet daycare services witnessed strong growth across the USA and Canada. Market growth is also driven by pet-friendly workplace policies and on-demand pet care apps.

Pet daycare adoption is shown to grow steadily in Europe due to growing disposable income, higher awareness regarding pet mental hygiene, and the increasing presence of pet-friendly public places.

For instance, Germany, the UK, France, and Italy are at the forefront in the fields of pet boarding luxury, pet spa services, and holistic pet wellness programs. Demand is further driven by the EU’s focus on pet welfare regulations and sustainable pet care solutions, that quickly pushes the need of environmentally friendly pet daycare centers.

The Asia-Pacific region is expected to grow at the highest CAGR, propelled by growing pet adoption rates, increased spending on pets, and increased demand for pet care services in China, Japan, India, and Australia due to urbanization.

China is influential in pet daycare innovations, and Japan and South Korea are leaders in robotic pet care assistants and AI-based pet interaction technologies. In India, the increasing popularity of home care pet services and mobile pet wellness programs are also aiding in market growth.

Challenges: High Operational Costs and Regulatory Compliance

Pet daycare services provide a higher level of care than traditional pets aiding in socialization and interaction with humans; however, high operational costs, a limited skilled workforce, and strict pet care regulations continue to be a major hurdle. Other factors that hinder market expansion include competition from unorganized pet-sitting services and the risk of disease transmission or infection from the group service.

Opportunities: AI-Powered Pet Monitoring and Luxury Pet Retreats

New growth opportunities stem from the rising adoption of AI-based pet behaviour monitoring, smart pet daycare centers with real-time tracking, and holistic retreat for pet wellness. Prospects for pet fitness monitoring, interactive pet play products and tele-veterinary services are expected to lead the long-term expansion of the market.

The future of pet care services is also changing with a growing focus on sustainability, evident with the emergence of organic pet food, lined eco-friendly play areas, and AI-assisted enrichment programs at pet daycare centers.

The trend towards premium pet daycare services, personalized care plans, and tech-integrated pet monitoring gained steam, particularly in urban centers, pet-friendly communities, and two-income households.

Customer trust and service quality were enhanced by advancements in AI-driven pet tracking, live video surveillance, and pet behaviour analysis. But though high operating costs, pet separation anxiety issues for owners, and strict pet safety rules were obstacles to widespread adoption.

Forecasting for 2025 to 2035, the market will see the rise of AI-enabled pet wellness registries, mechanical pet companions, and block chain-based pet service records. Smart wearables for pet health tracking, AI-assisted behavioural analysis for pet safety, and fully automated daycare facilities will improve service efficiency and cat and dog welfare.

As personalized pet activity plans, smart nutrition-based pet daycare services, and on-demand pet transportation solutions become more common, they will drive continued transformation in the industry.

Moreover, the emergence of sustainable pet daycare centers, AI-based pet-to-human communication devices, and automated pet entertainment systems will shift market trends, resulting in better pet health, safety, and convenience for pet owners.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with local pet care laws, vaccination requirements, and safety guidelines for boarding facilities. |

| Service Innovation | Use of basic boarding, playtime, and socialization services. |

| Industry Adoption | Growth in urban pet care facilities, premium pet hotels, and demand for trained pet sitters. |

| Smart & AI-Enabled Solutions | Early adoption of real-time pet surveillance, automated feeding, and digital pet tracking. |

| Market Competition | Dominated by local pet care businesses, luxury pet hotels, and franchise-based pet daycare chains. |

| Market Growth Drivers | Demand fuelled by increasing pet adoption, growing pet humanization trends, and busy pet owners needing reliable daycare services. |

| Sustainability and Environmental Impact | Early adoption of eco-friendly pet toys, biodegradable cleaning supplies, and green energy-powered daycare centers. |

| Integration of AI & Digitalization | Limited AI use in pet surveillance, appointment scheduling, and vaccination record management. |

| Advancements in Pet Daycare Infrastructure | Use of traditional pet enclosures, scheduled outdoor activities, and manual feeding routines. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven pet health compliance, block chain-backed pet records, and globally standardized pet care certification. |

| Service Innovation | Adoption of AI-powered personalized pet daycare programs, smart pet health tracking, and robotic pet assistants. |

| Industry Adoption | Expansion into fully automated pet daycare facilities, AI-integrated behavioural training centers, and hybrid daycare models with at-home smart pet monitoring. |

| Smart & AI-Enabled Solutions | Large-scale deployment of AI-powered pet behaviour analytics, smart pet play systems, and wearable tech for continuous pet wellness monitoring. |

| Market Competition | Increased competition from AI-integrated pet wellness startups, robotic pet assistant providers, and block chain-driven smart pet service platforms. |

| Market Growth Drivers | Growth driven by AI-assisted real-time pet health tracking, fully automated pet daycare facilities, and sustainable eco-friendly pet care centers. |

| Sustainability and Environmental Impact | Large-scale transition to carbon-neutral pet daycare operations, AI-driven resource efficiency, and biodegradable pet food packaging in daycare facilities. |

| Integration of AI & Digitalization | AI-powered real-time pet-to-human communication systems, block chain-backed digital pet ID tracking, and predictive analytics for pet behaviour and health. |

| Advancements in Pet Daycare Infrastructure | Evolution of self-cleaning pet play areas, AI-driven activity personalization, and robotic pet interaction assistants for mental and physical stimulation. |

The United States still dominates the market for pet daycare services, propelled by rising pet ownership, growing consumer expenditure on pet care, and the need for premium-level pet boarding and enrichment services. Demand for professional pet daycare centers is being driven by the rise of urban pet parenting and dual-income households.

Other trends that enhance on dealing with customers are smarter pet monitoring, recording videos in real-time along with custom care programs. Key industry trends are also being defined as automation is taking centre stage as more companies introduce an array of products including AI-driven scheduling, automated pet feeders, and interactive play solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.1% |

Growing pet adoption, a sustained interest in specialist daycare and a growing awareness of the importance of mental health and socialisation for pets have continued to drive the UK pet daycare market. Industry adoption is being fuelled by the proliferation of luxury pet boarding facilities and pet wellness programs.

Also, the growing presence of dog-friendly offices and daycare services with a subscription component are changing consumer behaviour. Market developments are also including the increasing shift towards eco-friendly and sustainable pet care products within daycare centers.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.6% |

Pet daycare markets in Germany, France, and the Netherlands are at the forefront, bolstered by robust pet welfare regulations, rising pet expenditure levels, and higher demand for comprehensive pet care services within the EU. The European Union’s emphasis on sustainable and cruelty-free pet care items is speeding the move toward organic pet food, biodegradable pet bedding and holistic pet wellness programs in daycare centers.

This innovation is further driven by the development of AI-powered pet behaviour tracking and interactive pet training programs. Additionally, the increasing trend of pet-friendly travel accommodations is further accelerating the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.9% |

Japan's pet daycare industry is growing, fuelled by trends towards greater pet humanization, demand for premium pet services, and investments in AI-powered pet wellness and entertainment technologies. With its expertise in deploying robotic pet care solutions, the country is pioneering innovations in automated pet monitoring and interactive engagement systems.

In urban settings, the growing availability of small-space pet daycare alternatives is also shaping service options. Moreover, the growth of senior pet care services and specialized daycare services for geriatric pets is also fuelling the growth of the pet care market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.5% |

The trends of pet-friendly lifestyle are becoming popular amongst South Korea's working citizens whose disposable income is allowing for the adoption of pets and is to be considered as the main factor driving the growth of the largest pet daycare market in South Korea. Increasing demand for high-quality pet nutrition, advanced pet grooming services, and AI-integrated pet monitoring systems are boosting market growth in the country.

Moreover, innovative smart pet daycare options, such as automated feeding systems, in-boarding pets with Track and Health monitoring, and customizable pet care packages are being adopted for better customer engagement. An added driver of industry adoption is the rise of pet wellness programs like hydrotherapy and behavioural training.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.2% |

Group Play Sessions Dominate the Market as Pet Owners Emphasize Socialization and Active Lifestyles

With the increasing awareness of pet socialization advantages, Group Play Sessions segment are the largest contributor of the Pet day care Market. Group play sessions set your pet up for success with structured activities so that your pet can interact with other animals, trainers and caretakers.

Market adoption has been driven by the rising popularity of supervised group play programs with breed-specific, temperament-based playgroups, and interactive agility courses. The market growth is driven by the growing proliferation of outdoor pet parks, with AI powered play tracking, features like swimming areas, obstacle courses, etc., boosting outdoor stimulation for pets, thus ensuring its physical and mental health.

The adoption was further propelled by real-time pet tracking, with Hoosain's GPS-enabled wearables, AI-driven motion analytics and mobile app inclusion, promising better transparency and ease of mindcare.

Advancements in AI-based pet behaviour analysis, interactive robotic companions, and digital pet well-being monitoring are boosting efficiency, security, and engagement, placing them on a massive projected market growth trajectory for group play sessions globally.

Grooming Services Gain Popularity as Pet Owners Prioritize Hygiene and Preventative Healthcare

The Grooming segment has witnessed robust growth due to increased awareness among pet owners regarding the importance of regular hygiene maintenance, skin care, and coat health. Modern pet spas provide specialized treatments, organic grooming products and even AI-assisted health screenings, unlike traditional grooming services.

The growing popularity of customized pet grooming related to breed-specific haircuts, hypoallergenic shampoos, aromatherapy treatments, etc., has further driven adoption. The continuous rise in addition to some luxury offerings such as hydrating spa treatments, infrared coat conditioners, and organic paw soaks which made market demand stronger and increased the chances of better convenience and health benefits for pets.

This improvement has been bolstered even more by the introduction of numerous innovations within AI-powered grooming diagnostics that offer automated skin and fur health analysis, allergy detection and real-time weight monitoring for pet wellness, ensuring that veterinarians can address any potential dermatological problems early on and keep on top of pet health in general.

Although it is beneficial in maintaining hygiene, improving the health of the fur and skin of the pet, and identifying diseases, the Grooming segment faces challenges such as getting a good groomer is expensive, pets are anxious when such activity is taken and the cost of labour is also high as several of the skilled groomers are required for the task.

Increased availability, affordability, and comfort for pets resulting from emerging innovations in such attachments as AI-powered self-grooming stations, automated pet drying systems, and aromatherapy-infused relaxation techniques are transforming the efficiency of the grooming process, facilitating a continuation of market growth for grooming services on a global scale.

Dog Daycare Services Lead Market Expansion as Demand for Canine Care Solutions Grows

Pets day care market Size has segmented the market into several categories based on the to provide an overview of the market to make the growth segments more manageable and easy to comprehend. Demand for breed-specific daycare services, which offer customized diet plans, fitness training, and cognitive enrichment programs, has increased demand for adoption, according to grants. Over 75% of pet daycare centers primarily offer services for dogs because of the high enrolment rates, according to studies.

Growing number of AI-enabled dog training programs integrated with voice-recognition commands, interactive behavioural therapy, and digital obedience tracking capable of tracking dogs through their devices have significantly increased the demand within pet industry, boosting the market trend of pet development and providing ease to the pet owners.

Real-time canine health monitoring and management systems, such as wearable biometric collars, GPS tracking, and mobile app health dashboards have aided adoption, providing greater transparency into pet wellness tracking as they are integrated into block chain systems.

While it has a leg up on behaviour training, socialization, and general well-being, the Dog Daycare category faces space, aggressive behaviour, and high operational cost challenges.

Despite some existing challenges, such as workforce shortages and limited real estate, innovations emerging in the smart kennel automation, virtual pet training consultations and AI pet matchmaking for playgroups sectors are enhancing efficiency, scalability and the pet experience, which are fuelling persistent market growth for dog daycare services globally.

Cat Daycare Services Gain Traction as Pet Owners Seek Specialized Feline Care Solutions

Kitties segment showing traction especially in urban areas where pet owners don’t find cat daycare solution. Unlike dog daycare centers, cat-oriented facilities prioritize peace and quiet, low-stress environments, individual attention, and play with staff.

Feline enrichment programs with climbing gyms, interactive laser play and A.I.-powered puzzle feeders have spurred the adoption boom, which has pushed up demand for the amenities. More than half of pet owners in cities are sending their felines to tailored cat daycare centres, studies show.

With the growing market demand due to increased availability of luxury cat boarding solutions equipped with climate-controlled suites, pheromone-infused relaxation zones, and AI-powered pet monitoring, and other pet services leading to enhanced feline comfort and well-being.

Smart cat health monitoring, including advanced litter box tracking, hydration sensors, and wellness reports on mobile apps, has also spurred adoption, ensuring early detection of potential health problems and heightened awareness among owners.

While it does provide benefits like a stress-free environment, tailored cat care, and tech-integrated monitoring solutions, the Cat Daycare segment encounters challenges of insufficient specialized facilities, elevated service costs, and difficulties faced by the pet adjusting.

But these innovations in cat care, including AI-driven feline behaviour analysis, interactive robotic playthings, and digital remote pet check-ins, are enhancing efficiency, affordability, and engagement of cat owners, and continue to drive market growth for cat day care services around the world.

The growing pet adoption rates, rising disposable income of pet owners and increasing awareness with respect to health care of pets are some of the factors utilising the pet daycare market. The market is on the rise, with more services in urban regions, luxury animal centers, and exclusive pet care sites. Trends that will continue to define the industry include grass roots tech-enabled pet monitoring, upscale pet wellness programs, and sustainable pet care.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Camp Bow Wow | 12-16% |

| Dogtopia | 10-14% |

| PetSmart Inc. | 8-12% |

| Rover.com | 6-10% |

| Fetch! Pet Care | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Camp Bow Wow | Develops full-service pet daycare facilities with boarding, grooming, and training services. |

| Dogtopia | Specializes in pet socialization programs and high-quality pet wellness services. |

| PetSmart Inc. | Offers in-store pet daycare services alongside pet grooming and veterinary care. |

| Rover.com | Focuses on tech-enabled pet care services, including daycare, dog walking, and home visits. |

| Fetch! Pet Care | Provides customized in-home pet care solutions, including daycare, training, and pet sitting. |

Key Company Insights

Camp Bow Wow (12-16%)

Camp Bow Wow leads in full-service pet daycare, integrating boarding, grooming, and behaviour training.

Dogtopia (10-14%)

Dogtopia specializes in structured pet socialization programs, enhancing pet wellness and daycare experiences.

PetSmart Inc. (8-12%)

PetSmart offers in-store pet daycare services alongside grooming and veterinary care solutions.

Rover.com (6-10%)

Rover.com pioneers in tech-enabled pet care services, providing a platform for daycare, walking, and sitting services.

Fetch! Pet Care (4-8%)

Fetch! Pet Care provides customized in-home daycare solutions, catering to pet owners seeking personalized services.

Other Key Players (45-55% Combined)

Several pet service providers contribute to the expanding Pet Daycare Market. These include:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 13: Global Market Attractiveness by Service Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Animal Type, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 28: North America Market Attractiveness by Service Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Animal Type, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Service Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Animal Type, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Animal Type, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Animal Type, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Service Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Animal Type, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Service Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Animal Type, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Service Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Animal Type, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The overall market size for the pet daycare market was USD 4,744.4 million in 2025.

The pet daycare market is expected to reach USD 10,054.6 million in 2035.

The demand for pet daycare services will be driven by increasing pet ownership, rising consumer spending on pet care services, growing demand for premium and specialized pet care facilities, and advancements in technology for pet monitoring and wellness tracking.

The top 5 countries driving the development of the pet daycare market are the USA, Canada, Germany, the UK, and Australia.

The Pet Grooming Services segment is expected to command a significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA