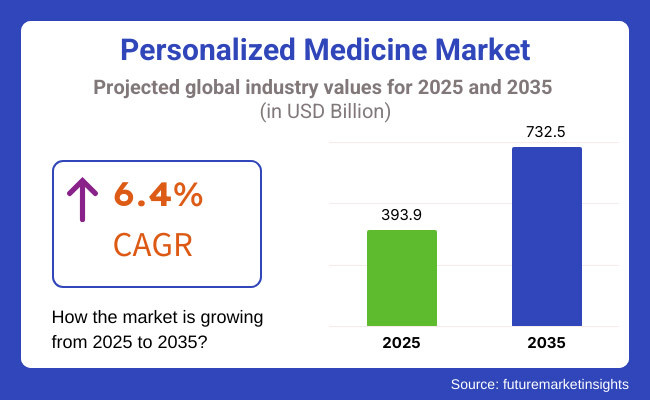

The personalized medicine market is expected to reach USD 393.9 Billion by 2025 and is expected to steadily grow at a CAGR of 6.4% to reach USD 732.5 Billion by 2035. In 2024, personalized medicine market have generated roughly USD 370.2 Billion in revenues.

Personalized medicine is a cutting edge of modern medicine that describes specific treatment and preventive strategies for an individual. Personalized medicine particularly works with genomic data, certainly better biomarkers, and the best kinds of diagnostics to identify the most effective therapies just for that patient to maximize treatment response while minimizing toxicity.

Advancements in genomics and biotechnology coupled with the reduction of the cost of genetic sequencing that lean towards the increased feasibility of personalized approaches significantly attribute to the growth of the market. Moreover, their growing focus on developing targeted cancer treatments and interventions for rare diseases further propel its growth.

Between 2020 and 2024, various historical drivers will have facilitated the overall adoption of personalized medicine. The COVID-19 pandemic emphasized the value of targeted treatments, increasingly demonstrating the need of speed of diagnoses, developing a much greater interest in the fields of genomics and biomarker testing.

During the entire period, the cost of genomic sequencing declined, bringing genetic profiling well within the reach of healthcare systems and patients. Furthermore, growing investment in precision medicine research especially in developed countries further anticipate the growth of the market.

Genetic profiling is becoming more cost-efficient with the evolution of genomic sequencing technology, bioinformatics, and molecular diagnostics. The regional research infrastructure and the broad-spectrum funding from government programs serves the incubation of innovation here.

Growing number of people suffering from chronic diseases such as cancer and heart disorders have increased the need for personalized treatment stratification. Moreover, the larger use of electronic health records (EHRs) combined with data analytics now facilitates the design of personalized therapies. Furthermore, growing application of companion diagnostics and new drugs for clinical application of personalized medicine in pharmaceutical companies of North America further propel the growth of the market.

The innovation with cross-border collaboration on research has been supported by the European Union and especially through Horizon Europe and European Alliance for Personalized Medicine (EAPM)-type projects.

They have increased the understanding that treatment should be targeted to a patient's own genetics in cancer, rare diseases, and increasingly chronic illnesses. The UK, French, and German countries have built national genomics initiatives that will promote the collection in enormous scales with the intent of enabling personalized strategies. Value-based care mind shifts in the region with the growing awareness of clinicians and patients alike have been catalyst for the greater push towards precision diagnostics and individualized treatment plans.

Investments made by governments in the genomic research, biobanking, and targeted oncology fields in in China, Japan, and South Korea, are majorly contributing to an increase in the market.

The region's fast-increasing middle-class population and the enhanced healthcare infrastructure of the region are some of the many demand drivers for personalized treatments and advanced diagnostics. Furthermore, Asian Pacific pharma companies kick-start the construction of their precision medicine pipelines, more possibly aided by an accelerated regulatory approval for the targeted therapies. Awareness levels on genetic tests and also availability of direct-to-consumer genetic tests are further fuels for demand for the region's personalized medicines.

Challenges

Integration and Secure Management of Diverse data, Hinders the Adoption of Personalized Medicine

Genomic data, EHRs, environmental data, and lifestyle information make up that pillar of personalized medicine and its designs for intervention among patients. At the same time, there are silos within national health systems when they are combined with different forms of data and separated ways of sharing data between hospitals, laboratories and research institutes.

This scenario of non-interoperability compromises research, intrudes upon clinicians' ability to form an overall image of a patient, and, at the same time, presents privacies and ethical challenges with regard to the collection and storage of such genetic data when such development is still new. One of the largest challenges is how to secure data and at the same time allow stakeholders to exchange it freely in order to usher in personalized medicine. Opportunity: New Extensions in Treatment for Oncology and Rare Diseases.

Opportunities

Growth investments towards Oncology and Rare Disease TreatmentsPoses new Opportunities in the Market

Cancer treatment today consists of tumor profiling and biomarker therapies designed for patients and would recognize those most efficacious and least toxic-treatment regimens, according to their genomic profile. The same occurs for rare conditions, mostly genetic in origin, which are now being revolutionized by gene therapy and targeted diagnostics.

Its benefit enables pharmaceutical companies to widen their pipelines of intelligent medicines with rapidly declining costs of genomic sequencing and tightly coupling companion diagnostics with new medicines. Such synergy allows for the opening of pathways to drug development, fast-tracking regulatory approvals, and optimal reimbursement policy for targeted therapies, which push forward acceptance and expansion in clinical and market settings of international markets.

Integration of Genomics into Mainstream Clinical Practice Surges the Growth of the Market

Advancement of next-generation sequencing (NGS) technologies hastens the collection of affordable genomic profiles to complete the integration of the genetic component in diagnosis, treatment choice, and disease prevention, particularly in oncology, where for targeted treatment, alongside whole-genome sequencing, cancer patients are being identified.

In addition, national genomics programs such as All of Us Research Program (USA) and Genomics England have stimulated building population-scale genomic data, creating both a strong impetus for future research and innovation. It is this continuing confluence of genomic science and clinical practice that will pave the future for the industry related to precision medicine in providing patients with personalized treatment alternatives that will be more efficient based on their individual genetic profiles.

Pharmaceutical Investment in Companion Diagnostics Anticipates the Growth of the Market

Companion diagnostics serve as instruments in establishing the patients best suited to respond to specific drugs by means of biomarkers or genetic mutations and are thus reducing trial and error in prescriptions while maximising chances of success. This co-development model thus eases the pathway for regulatory approval of the products since companion diagnostic validation is often a requirement by agencies like FDA and others for targeted therapeutics.

Such a trend greatly influences the pipeline of cancer drugs, as the number of medicines developed to specifically target mutations such as EGFR, ALK, and BRCA will grow with increasing adoption of approved diagnostics. The association between diagnostics and pharma would fuel further the development of precision drugs while at the same time fast-tracking clinical acceptance of personalized medicine across therapies.

Integration of Data Analytics in Personalized Treatment is an Ongoing Trend in the Market

Processing even huge sets of data with genomic information, the realities of life evidence, trials' outcomes, and lifestyle, integration of data analytics finds almost indistinguishable connections between genes and disease susceptibility and even disease development and treatment outcomes. Machine learning algorithms help forecasting the effects of specific genetic variants on drug efficacy or adverse effects, thus helping to develop the drug quickly.

Predictive analytics can be trained to devise personalized treatment plans that are unique to every patient based on his or her molecular and clinical profile. Special significance is this trend going to have in cancer treatment, as AI-based platforms increasingly help in bringing molecular characterization and precision therapies closer to the ideal end of identifying patients more swiftly and accurately, enhancing their clinical outcome as well as drug development efficiencies in the personalized medicine area.

Direct-to-Consumer Genetic Testing and Personalized Health Insights is an Emerging Trend in the Market

Companies that offer cheap at-home kits for genetic testing have brought genomic knowledge within the reach of Billions of consumers, and, in consequence, public awareness regarding the role of genetics in diseases and prevention is growing. The DTC tests now also provide personalized health reports, besides ancestry information, on disease risk, medication response (pharmacogenomics), and lifestyle advice based on genetic predispositions.

This empowerment brings health professionals to include genetic information into preventive-care practices and early intervention. The intersection of consumer health data with clinical genomics is driving a movement toward proactive, preventive medicine, redefining how people will interact with their healthcare journey in the age of personalized medicine.

A market for personalized medicine was rapidly developed during 2020 to 2024, owing to new developments in genomics and biomarker science along with greater adoption of companion diagnostics and precision cancer drugs. The COVID-19 pandemic saw genomic surveillance and biomass approaches for personalized treatment catapulted into another dimension of awareness.

Growth 2025 to 2035 will depend on AI-driven data analytics and gene-editing technologies along with direct-to-consumer genetic testing, while mounting research in rare diseases, regenerative medicine, and multi-omics will direct the future trajectory. Partnerships between pharma, tech, and diagnostics will act as the prime enablers of personalized, preventive, and precision medicine around the globe.

Shifts in the Personalized Medicine Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Enhancement of clinical validity, companion diagnostics, and data privacy. The regulatory agencies (FDA, EMA, PMDA) gave emphasis to genomic data protection and pharmacogenomics guidelines |

| Technological Advancements | Increased use of NGS, multi-omics, and AI-driven biomarker discovery. Developmental efforts in liquid biopsy and pharmacogenomics-guided therapies |

| Consumer Demand | Raising awareness of genetic testing and increased interest caused by COVID-19 in individualized risk profiling have driven the increased demand. Direct-to-consumer testing has gained momentum |

| Market Growth Drivers | Precision oncology, national genomics programs, and pharma-diagnostic partnerships have driven research in this area. Rare disease research also played a part |

| Sustainability | Initially geared towards equity of access and low-cost testing in the low-income regions |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter governance will apply to the use of AI, specific multi-omics integration, and real-world evidence. Paying attention to data ethics, consent, and equitable access will make it secure |

| Technological Advancements | Moving towards real-time molecular monitoring, applied more of AI-predictive modeling, and CRISPR for gene editing, personalized therapies |

| Consumer Demand | Emerging plans for prevention become personalized and easily built into digital health services to enable personal health management. |

| Market Growth Drivers | Growth is direct from multi-omics, AI diagnostics, and real-world data platforms. Cross-sector partnerships and low-cost solutions drive adoption |

| Sustainability | Concentrate on diagnostics that do not cost high amounts of money, health equality across countries, and low-carbon laboratory procedures to minimize environmental footprints |

Market Outlook

The real revolution in personalized medicine in America comes from strong market demands made by oncology and targeted drug development, as well as consumer-directed genetic testing. The prospects for growth are being fueled by large-scale biobanks and government support for companion diagnostics.

The future focus will be an increased concentration on predictive medicine by AI and that value-based consideration making personalized care part of value-based care will indicate directions to which the market will develop.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

The personalized medicine market of Germany gets really good boosts from great government support bases for genomic research, partnerships between big pharma companies and biotech start-ups, and having a well-developed healthcare infrastructure. Future growth will involve the level of integration between artificial intelligence and clinical decision support systems and the advancement of multi-omics diagnostics in healthcare systems.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

India's personalized medicine market base is expanded due to increase in chronic diseases, increasing number of genetic-testing start-up enterprises, and increasing level of health awareness. Low sequencing costs will bring precision diagnostics well within reach. Future expansion is dependent on public-private partnerships, regional genetic databases, and governmental initiatives that support precision healthcare across genetically diverse populations throughout the country.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.2% |

Market Outlook

The expansion of personalized medicine in China is now being driven by the tremendous, state-invested depth into precision oncology, national genomics initiatives, and a booming biotech cluster. The demand for innovation is driven by personalized cancer treatments.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.7% |

Market Outlook

Japan's personalized medicine progress is driven by strong government backing for genomic research, needs of an aging population, and pharmacogenomics innovation. Close collaboration between academia and industry drives breakthroughs.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

The Personalized Medicine Diagnostics segment dominates the market due to its critical role in identifying biomarkers

The personalized medicine diagnostics segment reigns supreme in the personalized medicine market because most of the biomarkers, genetic mutations, and patient-specific disease profiles that are identified through diagnostics are important in terms of personalizing treatment, particularly for oncology, rare diseases, and pharmacogenomics.

The proliferating use of next-generation sequencing (NGS), liquid biopsies, companion diagnostics, and multi-omics profiling has established such tools in drug development and clinical decision-making while regulatory requirements for companion diagnostics tied with targeted therapies support this supremacy. In addition, the switch toward early diagnosis of disease and preventive medicine guarantees long-term demand for diagnostic products in precision medicine platforms.

Advancements in Targeted Drug Development Surges Personalized Medicine Therapeutics Segment Growth

The Personalized Medicine Therapeutics area has had high growth mainly due to progress in targeted drug development, gene therapy, and immunotherapy. Pharmaceutical companies are increasingly applying precision oncology and gene editing therapies targeting rare diseases with individualized genetic knowledge. Developments in CAR-T therapies, RNA-based treatments, and patient-specific cancer vaccines have further expanded individualized therapeutic options.

In parallel, the increasing acceptance of companion diagnostics that help inform drug selection is also facilitating the adoption of targeted therapies. As healthcare systems move from volume- to value-based care and the regulatory environment accelerates precision medicine approvals, demand for streamlined, patient-centric therapies continues to rapidly grow in the global healthcare markets.

Hospitals Segment Dominates the Personalized Medicine Market due to High Patient Turnover

Hospital is made up of a broad portion of the personalized medicine markets as it is an inseparable part of the delivery of advanced diagnostics, genomic tests, and targeted therapies to the patients. Hospitals present a hub-of-choice facility for precision therapy, specifically in oncology, cardiology, and rare diseases, where genetic analysis is key in tailoring treatment regimes. Aside from developing genomics infrastructure, hospitals are embarking on multi-omics platforms to further strengthen their hold on this segment.

Specialized genomics centers hold a significant share due to their expertise in advanced genomic sequencing

Advances in genomic sequencing, bioinformatics, and multi-omics command significant stakes for specialized genomics centers in personalized medicine market. Their contributions include identifying actionable mutations, susceptibility to conditions, and essential biomarkers for diagnosis to pave the way for personalized treatment.

They provide services in academic research and the development of drugs but also in clinical diagnostics applied to complex diseases like cancer, rare diseases, and inherited disorders. As precision oncology programs, pharmacogenomics projects, and national genome sequencing programs expand, these centers will become even more involved in business as specialist testing and interpretation services are finding their way into precision medicine.

Predictive analytics, and multi-omics approaches to enhance diagnostic precision as well as generating specific targets for therapeutic interventions. With these, companies are mounting affiliations with biotechnology firms, hospitals, and genomics laboratories, which fortifies their footprint.

Approval from relevant authorities tends to favor companion diagnostics and targeted therapies. Innovative differentiation is also spurred by rapid sequencing technologies, individualized treatment algorithms, as well as digital health solutions. Competitive pressure from emerging markets also translates into demands for low-cost solutions with local genomic databases.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Illumina Inc. | 33.6% to 38.5% |

| Asuragen Inc. | 20.4% to 22.6% |

| Genentech, Inc. | 15.1% to 17.2% |

| Abbott Laboratories | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| Illumina Inc. | Illumina collaborates with pharmaceutical companies, research institutes, and healthcare delivery systems to make genomic profiling a part of clinical decision-making, thus enabling research in cancer, rare diseases, and pharmacogenomics |

| Asuragen Inc. | Asuragen is in the field of molecular diagnostics and companion diagnostics with competencies in RNA assays. It specializes in carrier screening, oncology diagnostics, and hereditary disease testing to achieve accurate patient stratification and personalized treatment planning toward the best outcome. |

| Genentech, Inc. | Genentech is a pioneer of targeted therapy and generates personalized therapy in partnership with diagnostics, particularly in oncology and immunology. Partnering with diagnostic firms, Genentech develops companion diagnostics that drive drug choice and optimize dosing. |

| Abbott Laboratories | Abbott provides individualized diagnostic solutions in infectious diseases, oncology, and cardiology. Its companion diagnostics directed targeted treatment choice, and Abbott is actively investing in liquid biopsy, biomarker discovery, and pharmacogenomics platforms to foster precision medicine adoption. |

Key Company Insights

Illumina Inc.

Illumina has become an incredibly effective promoter of next-generation sequence adaption in clinical and research environments. It is recognized for its emphasis on genome sequencing at low costs, and in partnership with biopharma, it sits pretty at the forefront of all cancer genomics, establishing its mandate in precision medicine.

Asuragen Inc.

Asuragen is a leader in molecular diagnostics, with its specialty in RNA-based tests and genetic assays. It fuels early detection, inherited risk stratification, and therapy guidance, especially in the context of oncology.

Genentech, Inc.

Genentech has taken the lead in the manufacture of targeted therapies that integrate diagnosis and therapy for personalized oncology. Companion diagnostics and biomarker-directed immunotherapy, therefore, place it into the fold of cutting-edge precision therapeutics.

Personalized Medicine Diagnostic (Genetic Testing, Direct-to-Consumers (DTC) Diagnostic, Others), Personalized Medicine Therapeutics (Pharmaceuticals, Genomic Medicines, Medical Devices), Personalized Medicines Laboratory Services (R & D of Drugs Services, Analytical Services, Clinical Trials Services, Others) and Others

Companion Diagnostics, Biomarker Identification, Pharmacogenomics, Drug Discovery, Health Information, Clinical Research and others

Cancer, Neurological Disorders, Cardiovascular Disorders, Infectious Diseases, Psychiatric Disorders, Autoimmune Disorders, Rare Diseases and Others

Hospitals, Diagnostic Centers, Research & Academic Institutes, Biotechnology and Biopharmaceutical Companies, Contract Research Organizations (CROs), Specialized Genomics Centers and Others.

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: North America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 6: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: Latin America Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 12: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 14: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Europe Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 16: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Asia Pacific Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 18: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Asia Pacific Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 20: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: MEA Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 22: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 24: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Figure 1: Global Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Billion) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ Billion) Analysis by Region, 2018 to 2033

Figure 4: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 11: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 12: Global Market Attractiveness by Region, 2023 to 2033

Figure 13: North America Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 14: North America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 15: North America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 16: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 20: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 21: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 22: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 23: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 24: North America Market Attractiveness by Country, 2023 to 2033

Figure 25: Latin America Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 26: Latin America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 27: Latin America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 28: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 29: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 30: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 32: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 33: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 34: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 35: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 36: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 37: Europe Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 38: Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 39: Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 40: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 41: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 42: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 43: Europe Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 44: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 45: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 46: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 47: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 48: Europe Market Attractiveness by Country, 2023 to 2033

Figure 49: Asia Pacific Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 50: Asia Pacific Market Value (US$ Billion) by Country, 2023 to 2033

Figure 51: Asia Pacific Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 52: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 53: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 54: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 55: Asia Pacific Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 56: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 57: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 58: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 59: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 60: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 61: MEA Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 62: MEA Market Value (US$ Billion) by Country, 2023 to 2033

Figure 63: MEA Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 64: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 65: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: MEA Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 68: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 69: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 72: MEA Market Attractiveness by Country, 2023 to 2033

The overall market size for personalized medicine market was USD 393.9 Billion in 2025.

The personalized medicine market is expected to reach USD 732.5 Billion in 2035.

Growing advancements in personalized medicine by integration of data analytics and genomic profiling anticipates the growth of the market.

The top key players that drives the development of personalized medicine market are Illumina Inc., Asuragen Inc., Genentech, Inc., Abbott Laboratories and Biogen International.

Personalized medicine diagnostics segment by product is expected to dominate the market during the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA