The Peristaltic Pumps Market is valued at USD 1.40 billion in 2025. As per FMI's analysis, the peristaltic pumps will grow at a CAGR of 3.8% and reach USD 2.03 billion by 2035. The increasing demand for accurate, contamination-free fluid transfer in critical applications supports this growth. Peristaltic pumps have advantages including low maintenance, high accuracy, and the ability to handle a wide range of viscosities, which makes these pumps a preferred option in various end-use industries.

In 2024, the peristaltic pumps landscape continued to witness robust growth in pharmaceuticals, food processing, and water and wastewater treatment businesses, among others. One key trend observed was the growing adoption of peristaltic pumps in biopharmaceutical applications, where precision and contamination-free fluid transfer are crucial.

Due to stringent industrial regulations along with increased investments in healthcare as well as the manufacturing sector, North America and Europe lead the segment at present. Nonetheless, rapid industrialization in Asia-Pacific is anticipated to create substantial opportunities in the near future.

One big challenge for the future growth of the peristaltic pumps industry is their high cost. These pumps are expensive because they need very precise engineering and are made from specialized materials. They also require advanced manufacturing methods to make sure they work correctly and are durable.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.40 billion |

| Industry Size (2035F) | USD 2.03 billion |

| CAGR (2025 to 2035) | 3.8% |

Explore FMI!

Book a free demo

The segment for peristaltic pumps is on a gradual growth path as demand increases in pharmaceuticals, water treatment, and food processing, where the need for accuracy and contamination-free fluid management is paramount.

Improved technology through automation and predictive maintenance using AI is making processes more efficient and lowering the cost of operation, all to the benefit of manufacturers and industries dependent upon sterile and accurate fluid transfer High upfront costs and limitations in high-pressure applications may hinder widespread adoption, particularly among cost-conscious purchasers in emerging sectors.

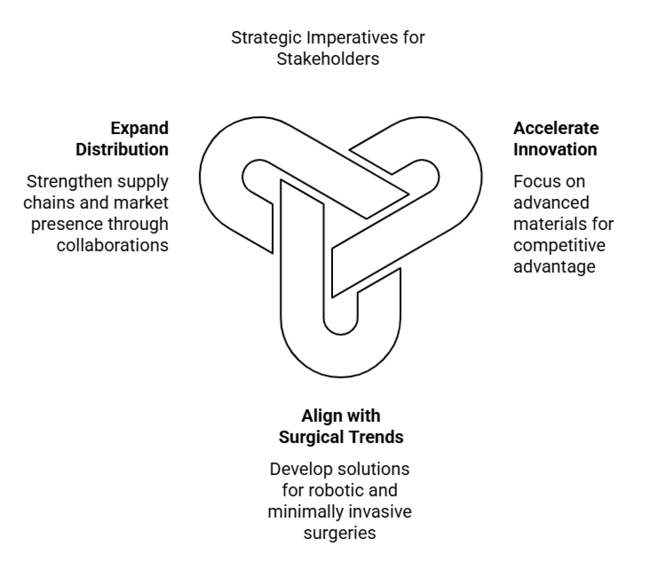

Invest in Smart Pump Technologies

Firms should accelerate R&D and the deployment of automated, AI-powered peristaltic pumps to improve efficiency, reduce downtime, and meet the growing demand for accuracy in pharmaceutical and industrial sectors.

Expand in High-Growth Regions

Businesses ought to bolster their presence in high-growth segments, most importantly in the Asia-Pacific, by tailoring product portfolios to comply with regulatory requirements in sectors and expanding local manufacturing or partnership arrangements.

Strengthen Supply Chain Resilience

Managers should diversify sources, streamline transportation, and consider vertical integration to mitigate supply chain disruptions and ensure regular deliveries to major end-user industries.

Accelerate Innovation in Smart Peristaltic Pumps

Executives should invest in R&D to develop advanced peristaltic pumps with automation, real-time monitoring, and AI-driven predictive maintenance to enhance operational efficiency and meet evolving industry demands.

Align with Sustainability and Regulatory Trends

Companies must focus on developing energy-efficient, eco-friendly pump solutions while ensuring compliance with stringent regulations in pharmaceuticals, water treatment, and food processing to remain competitive.

Expand Industry Reach Through Strategic Partnerships

Firms should strengthen distribution networks, form strategic alliances with regional suppliers, and explore M&A opportunities to enhance production capacity and gain a stronger foothold in high-growth sectors, particularly in Asia-Pacific.

| Priority | Immediate Action |

|---|---|

| Smart Pump Integration | Invest in R&D for AI-driven automation and predictive maintenance features. |

| Regulatory Compliance Readiness | Align product designs with evolving industry regulations, especially in pharmaceuticals and water treatment. |

| Supply Chain Resilience | Diversify supplier base and optimize logistics to mitigate potential disruptions. |

| Emerging Industry Expansion | Strengthen regional partnerships and distribution channels in Asia-Pacific and Latin America. |

| Sustainability & ESG Compliance | Develop energy-efficient, eco-friendly peristaltic pumps to meet sustainability goals and segment expectations. |

In order to remain competitive in the changing peristaltic pumps market, the company will need to maintain competitiveness in intelligent automation, green sustainability, and international growth. Improving efficiency through investment in AI-based predictive maintenance will foster long-term adherence and establish confidence in the industry under tighter regulatory requirements.

Doing so will generate new revenue channels by enhancing supply chain resilience in addition to international expansion in fast-growing markets. To stay competitive through 2035, firms should focus on innovation, strategic partnerships, and sustainability-driven differentiation.

Regional Variance:

ROI Perspectives:

Regional Variance:

Regional Differences:

Manufacturers:

North America: 58% reported skilled labor shortages in pump assembly.

Europe: 52% cited regulatory hurdles (e.g., CE certification).

Asia-Pacific: 61% struggled with fluctuating raw material prices.

Distributors:

End-Users:

Regional Focus:

High Consensus:

There is a high consensus that compliance, efficiency, and price sensitivity are key concerns worldwide.

Key Variances:

Strategic Insight:

| Country | Regulatory Impact on Peristaltic Pumps |

|---|---|

| United States | The Clean Water Act and EPA regulations drive demand for precision chemical dosing pumps in water treatment. The FDA and USP Class VI standards require pharmaceutical and food manufacturers to use hygienic peristaltic pumps. Energy efficiency standards promote the adoption of energy-efficient pump models. |

| United Kingdom | Compliance with the UK Environmental Permitting Regulations and MHRA (Medicines and Healthcare Products Regulatory Agency) guidelines impacts the adoption of peristaltic pumps in wastewater treatment and biopharmaceuticals. Brexit-related import/export tariffs affect supply chain dynamics. |

| France | Strict wastewater treatment laws and EU Food Safety Regulations mandate contamination-free pumps in food and beverage processing. France’s carbon neutrality goals drive demand for energy-efficient and recyclable pumping solutions. |

| Germany | As a leader in industrial automation, Germany enforces Industry 4.0 and VDMA standards, encouraging the use of IoT-enabled peristaltic pumps. The European Green Deal also supports sustainable pump designs for chemical and water treatment sectors. |

| Italy | Pharmaceutical and food safety compliance (EU GMP, HACCP) pushes demand for high-precision peristaltic pumps. Stringent wastewater regulations boost adoption in the chemical and industrial sectors. |

| South Korea | Government initiatives in semiconductor and biopharmaceutical industries promote high-purity peristaltic pumps. Environmental policies focusing on wastewater management also drive demand. |

| Japan | Japan’s strict pharmaceutical and food industry hygiene laws increase the need for sterile, contamination-free peristaltic pumps. Energy efficiency mandates encourage the development of low-power and durable pump systems. |

| China | China’s Environmental Protection Law enforces strict wastewater discharge regulations, increasing demand for chemical dosing peristaltic pumps. Government-led industrial modernization also boosts automation-friendly pump adoption. |

| Australia & New Zealand | Water conservation laws and mining industry safety standards push demand for rugged, reliable peristaltic pumps. The region’s focus on sustainability supports the shift to energy-efficient and recyclable pump designs. |

| India | Stringent pollution control laws and wastewater treatment regulations are expanding the use of peristaltic pumps in industrial and municipal applications. The Pharmaceutical and Food Safety Standards Authority of India (FSSAI) ensures strict compliance in sanitary pump applications. |

The USA peristaltic pumps landscape will witness a growth of 4.2% CAGR from 2025 to 2035, with the growing usage of these pumps in pharmaceuticals, water treatment, and food & beverage industries. The pharmaceutical industry continues to be a key driver of demand due to the requirement of contamination-free fluid handling during drug production.

Besides, EPA water regulations are also compelling municipal and industrial sewage treatment plants to adopt peristaltic pumps because these can manage viscous and abrasive fluids effectively. With heightened automation in manufacturing, peristaltic pumps coupled with IoT-based predictive maintenance solutions are finding popularity.

Top USA manufacturers are investing in smart pumps providing real-time monitoring and automatic control for maximizing efficiency. Additionally, the food and beverages industry, led by growing clean-label products and hygienic processing requirements, is another growth driver.

The peristaltic pumps sector in the UK is expected to register a CAGR of 3.6% between 2025 and 2035, backed by stringent environmental laws, growing pharma investments, and booming food & beverages industry. Stringent wastewater treatment processes are well-defined in the UK Water Industry Act, and industries are compelled to implement high-precision dosing pumps for this very reason.

Biopharmaceutical is another key sector, with the UK being one of the leading hubs for biologics research and development. Continued growth in peristaltic pump demand can be attributed to the need for sterile, contaminant-free transfer of fluids during production of drugs for cell and gene therapy. Additionally, the growth of specialty food manufacturing and craft breweries has driven the increased adoption of peristaltic pumps for hygienic processing.

The landscape for peristaltic pumps in France will expand at 3.7% CAGR from 2025 to 2035. This expansion will primarily be promoted by government funding for wastewater treatment plants, production of pharmaceuticals, and improvements in food manufacturing. France has some of the strictest water treatment and environmental regulations in Europe, driving the adoption of peristaltic pumps for accurate chemical dosing in urban and industrial environments. The pharmaceutical industry in France, supported by robust government grants, is expanding further, driven by growth in biologics and vaccine manufacture.

Hygienic, contamination-free pumping arrangements are in demand. In addition, the wine and dairy industries, with their need for accurate and contamination-free fluid transfer solutions, are increasingly adopting peristaltic pump technology. The government's stringent energy efficiency requirements, however, are challenging conventional pump manufacturers, compelling them to adopt smart, energy-efficient pumps.

Germany's peristaltic pumps sector will grow at 4.0% CAGR during 2025 to 2035, with the support of robust industrial appetite, tight environmental regulations, and the development of automation. The chemical and pharmaceutical sectors of the country are significant users of peristaltic pumps, demanding accurate dosing and contamination-free fluid transfer.

Germany's water treatment industry, as a response to EU environmental directives, is a key growth driver. Peristaltic pumps are finding more application in municipal wastewater treatment facilities, particularly in chemical dosing. Moreover, the automotive and manufacturing industries utilize these pumps for industrial fluid management, specifically in battery and hydrogen fuel cell manufacturing. Industry 4.0 and intelligent manufacturing drives in Germany have pushed the incorporation of AI-based pump monitoring systems faster.

Italy's peristaltic pumps industry is expected to grow at a CAGR of 3.5% during 2025 to 2035, led by the food & beverage industry, wastewater treatment programs, and pharmaceutical innovation. The nation's wine and dairy industries need hygienic, contamination-free fluid transfer solutions, which is why peristaltic pumps are being increasingly adopted. Efforts by the government of Italy towards promoting water conservation and recycling have contributed to higher adoption of peristaltic pumps for wastewater treatment.

The growth in demand for biopharmaceutical production and cosmetics production is also driving segment growth. The Italian landscape is challenged by economic volatility and high import reliance on raw material. Firms that offer energy-efficient and sustainable solutions are most likely to become competitive.

The South Korean peristaltic pumps landscape is estimated to grow with a CAGR of 3.9% during the forecast period of 2025 to 2035. The investments in the biopharmaceutical sector, semiconductor production, and water treatment plants are major drivers for growth.

The government initiatives toward smart manufacturing and industrial automation are driving the adoption of IoT-based pumps at a faster pace. Nevertheless, obstacles like high upfront capital expenditures and Chinese manufacturers' competition remain. Technological innovation and export-led demand, mainly in semiconductor use, will underpin future segment expansion.

The segment for Japan's peristaltic pumps will expand at a 2025 to 2035 CAGR of 3.4%, fueled by drug breakthroughs, semiconductor production, and precision engineering uses. Aging population in Japan has contributed to expanded investment in medical device and pharmaceutical manufacturing that demands contamination-free fluid handling.

Although Japan dominates high-precision manufacturing, the segment also experiences price pressures and gradual automation transition in smaller sectors. Smart pump technologies, portable industrial designs, and green initiatives will shape the future of Japan's peristaltic pump sector.

China's peristaltic pumps industry will expand at 4.5% CAGR, highest amongst large economies. The rise in demand is influenced by industrial automation, investment in water treatment and pharmaceuticals production. China promotes local manufacturing of precision and high-tech pumps. Nonetheless, regulatory complexities and increasing labor expenses pose obstacles. Many top players are investing in AI-enabled monitoring solutions and expanding exports to sustain growth.

India's peristaltic pumps landscape will grow at a CAGR of 4.3% between 2025 and 2035, owing to fast industrialization, water treatment infrastructure investment growth, pharmaceutical production growth, and expansion of the food processing industry. Peristaltic pumps are used widely for sterile fluid management, vaccine manufacture, and accurate chemical dosing.

With the government prioritizing local development of medical and industrial equipment, local manufacturers are redoubling their efforts to limit import dependency and manufacture cost-effective, high-precision pumps. India's food and beverage processing sectors are also embracing peristaltic pumps for edible oil refining, beverage production, and dairy processing. The textile and chemical sectors, which need strong and contamination-free pumping solutions, are also adding to industry growth.

The Australia & New Zealand (ANZ) peristaltic pumps landscape is anticipated to expand at a CAGR of 3.2% from 2025 to 2035, based on growing investment in water treatment facilities, mining, and growing food & dairy processing industries. The region's stringent environmental standards and emphasis on sustainability have accelerated the uptake of low-maintenance and efficient pumping solutions.

Governments in both nations are imposing strict water quality regulations, which are fueling demand for peristaltic pumps in chemical dosing and sludge handling applications in wastewater treatment plants. Australia's booming mining industry heavily relies on peristaltic pumps, especially for slurry transfer, chemical dosing, and mineral processing, where low maintenance and durability are essential.

The ANZ economy's dairy and food sectors, which are major contributors to the economy, are also turning to sanitary peristaltic pumps for contamination-free liquid handling in dairy processing, fruit juice extraction, and certain beverage applications where precise dosing is required.

The peristaltic pumps market is primarily divided into hose pumps and tube pumps, both expected to grow at a CAGR of 3.5% in 2025. Tube pumps are widely applied for low-pressure applications requiring precise and contamination-free fluid handling, hence ideally suitable for laboratory, medical, and pharmaceutical applications.

Hose pumps are applied for heavy-duty and high-pressure applications and are commonly employed in industrial processes such as chemical processing, mining, and wastewater treatment. The selection between the two segments is based on fluid viscosity, flow rate, pressure demands, and industry requirements.

Growing demand for automated and energy-saving pumping systems is fueling innovation in both segments, with manufacturers emphasizing longevity, ease of maintenance, and material compatibility to address changing industry demands.

The segment for peristaltic pumps by end-use industry includes pharmaceutical & medical, food & beverage, water & wastewater treatment, mining, chemical processing, and other industrial uses with 3.4% CAGR between 2025 to 2035. The pharmaceutical industry depends upon peristaltic pumps for the transfer of sterile liquids, bioprocessing, and accurate dosing, whereas the food & beverage industry applies them to handle hygienic fluids in dairy, beverage, and flavoring processes.

Peristaltic pumps have an indispensable role in wastewater treatment and water treatment facilities. They are required for operations such as chemical dosing, transporting sludge, and disinfecting water to meet environmental regulations. Besides this, they have a primary role in chemical processing plants and mining operations. Due to the capability of handling corrosive, abrasive, and viscous fluids, they are very valuable.

Dominant players in the peristaltic pumps segment are competing through a combination of price strategies, technology advancements, strategic alliances, and geographical diversification. Some producers focus on cost competitiveness to capture price-sensitive markets, while others aim for high-performance, high-priced pumps suitable for industries with a need for precision and conformance, for example, the pharmaceutical and water treatment industries. Innovation continues to be an area of interest for companies, with investments being made in intelligent peristaltic pumps.

Regional and industry trends influence growth strategies. Industry leaders are expanding production and enhancing distribution in areas such as the Asia-Pacific region and the Middle East, where demand for industrial automation and water treatment products is increasing. Firms are acquiring smaller companies and forming joint ventures to leverage technology expertise and develop new applications, including in biopharmaceuticals and green energy solutions.

Watson-Marlow (WMFTG)

Cole-Parmer

Verder Group

Flowrox

Wanner Engineering

Mergers & Acquisitions

Product Launches & Innovations

Strategic Partnerships

Regulatory & Market Changes

Expansion & Investment

Peristaltic pumps are widely used in pharmaceuticals, food & beverage, water treatment, mining, and chemical processing due to their contamination-free fluid transfer and low-maintenance design.

Compared to centrifugal or diaphragm pumps, peristaltic pumps work without seals or valves, lowering the risk of leakage and contamination; hence, they are used for accurate dosing and will also handle abrasive or viscous liquids.

Low maintenance, self-priming, accurate flow control, high tolerance for corrosive, shear sensitive or high viscosity fluid without damage are some of the benefits of peristaltic pumps.

Features like IoT incorporation, automated surveillance, and energy-conserving layouts are improving longevity, accuracy, and maintenance predictive abilities.

Important considerations include flow rate, pressure requirements, tubing material compatibility, application type, and maintenance needs to ensure optimal performance.

Tube Pumps and Hose Pumps

Pharmaceutical & Medical, Food & Beverage, Water & Wastewater Treatment Mining, Chemical Processing, and Others

North America, Latin America, Western Europe, Eastern Europe, Asia Pacific Excluding Japan (APEJ), Japan, and The Middle East & Africa (MEA)

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Turbidimeter Market Growth - Trends & Forecast 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Industrial Exhaust System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.