The period patch market is gaining fast-paced traction with every increasing number of women looking for non-invasive, non-pharmacological practices toward solution-based alleviation of menstrual pain. As period health becomes better known, convenience, comfort, and sustainability in pain management dominate the choices of consumers.

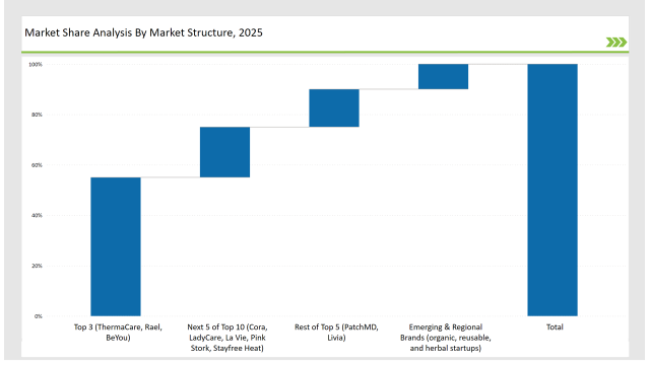

Self-heating, herbal-infused, and transdermal pain relief technologies are revolutionizing the market. The most prominent brands are ThermaCare, Rael, and BeYou, with innovative formulations, proven efficacy, and high consumer trust, and they hold 55% of the market share. Regional brands and emerging wellness startups account for 30%, while companies focused on organic, reusable, and plant-based period patches contribute the remaining 15%.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (ThermaCare, Rael, BeYou) | 55% |

| Rest of Top 5 (PatchMD, Livia) | 15% |

| Next 5 of Top 10 (Cora, LadyCare, La Vie, Pink Stork, Stayfree Heat) | 20% |

| Emerging & Regional Brands (organic, reusable, and herbal startups) | 10% |

The period patch market in 2025 is moderately concentrated, with the top players accounting for 50% to 60% of the total market share. Leading brands such as ThermaCare, Rael, and BeYou dominate the segment, while organic and technology-enhanced pain relief patches add competitive diversity.

This market structure reflects strong brand influence while allowing space for innovative menstrual pain management solutions and natural alternatives.

The period patch market is distributed across various sales channels. E-commerce and DTC platforms take the lead with 55% of the market, as customers value the discretion and ease of purchasing intimate health products online. Retail pharmacies and supermarkets account for 25%, making menstrual pain relief solutions available over the counter.

Subscription-based wellness brands comprise 15%, providing curated feminine health solutions. Specialty health and wellness stores comprise the remaining 5%, serving organic and eco-conscious consumers.

The period patch market is divided into three categories, namely self-heating patches, herbal and organic patches, and transdermal pain relief patches. Self-heating patches command the market share with 45% as it immediately and persistently gives comfort through increased blood flow. Herbal and organic patches constitute 30% of the market share.

It is surging due to chemical-free formulations from plants. Transdermal pain relief patches comprise 25%. It allows the slow and gradual release of ingredients such as menthol and magnesium, relieving pain over time.

2024 has been a game-changing year for the period patch market, with innovation in heat-based technology, plant-derived pain relief, and subscription-based menstrual wellness programs driving industry trends. Key players include:

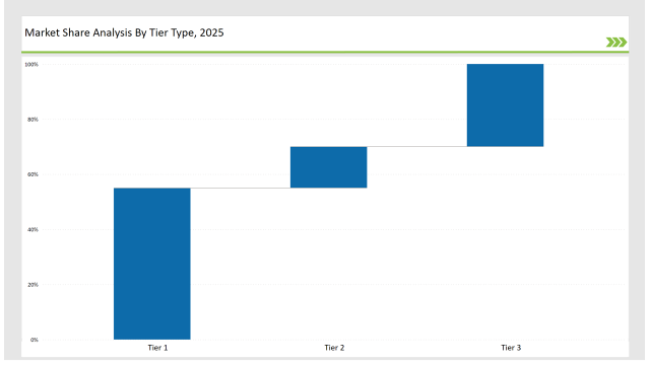

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | ThermaCare, Rael, BeYou |

| Market Share (%) | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | PatchMD, Livia |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, organic startups |

| Market Share (%) | 30% |

| Brand | Key Focus Areas |

|---|---|

| ThermaCare | Long-lasting heat patches for menstrual pain relief |

| Rael | Biodegradable, toxin-free organic period patches |

| BeYou | Essential oil-infused, hormone-free pain relief patches |

| PatchMD | Transdermal patch technology for targeted relief |

| Livia | Wearable pain relief devices integrated with period patches |

| Emerging Brands | Herbal and CBD-infused period patches for holistic relief |

The period patch market is poised for continued growth, driven by sustainability efforts, heat therapy innovation, and personalized wellness solutions. Brands will focus on biodegradable materials, AI-driven menstrual tracking, and integrated feminine health solutions to meet evolving consumer needs.

As awareness around menstrual pain management increases, period patches will become a mainstream alternative to traditional painkillers. The industry’s future revolves around accessibility, sustainability, and innovation in non-invasive, drug-free menstrual care.

Leading players such as ThermaCare, Rael, and BeYou collectively hold around 55% of the market.

Regional and specialty brands focusing on herbal and organic period patches contribute approximately 30% of the market.

Startups specializing in innovative period patches with heat retention and pain-relief formulas hold about 10% of the market.

Private labels from wellness retailers and online health brands hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Children Mattress Market Product Type, Ingredient Type, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Fabric Softener Market Analysis by Nature, Product Type, End Use, Sales Channel & Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.