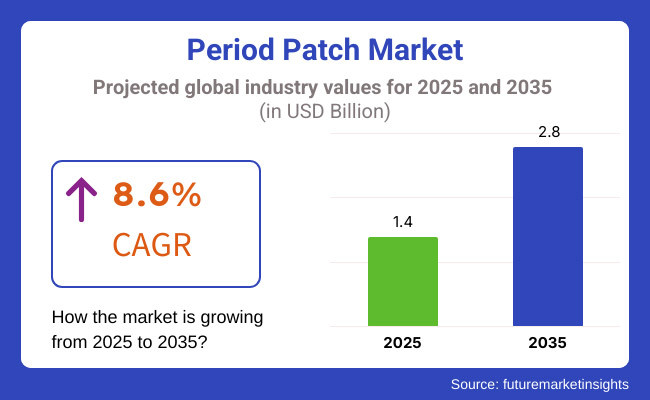

The period patch market is witnessing significant growth, driven by increasing awareness of non-invasive menstrual pain relief solutions and rising demand for alternative pain management methods. The market is projected to expand from USD 1.4 billion in 2025 to USD 2.8 billion by 2035, registering a CAGR of 8.6% during the forecast period.

With consumers seeking chemical-free, accessible, and effective pain relief options, the demand for heat patches, transdermal pain relief patches, and herbal-invested results are on the rise. Inventions in tone-heating technology, biodegradable accessories, and factory-grounded phrasings are reshaping the request geography.

While North America and Europe dominate the request, Asia-Pacific is rising as a high-growth region, driven by adding menstrual health mindfulness, growing disposable income, and rising relinquishment of heartiness-focused products.

Explore FMI!

Book a free demo

North America leads the period patch request with strong consumer mindfulness, high disposable income, and a wide vacuity of hearty products. The USA is a crucial request, with brands similar to ThermaCare, Rael, and Patchology launching tone-heating and herbal-invested period patches. The trend of clean, chemical-free heartiness products is driving demand for organic and factory-grounded pain relief patches, with consumers preferring paraben-free, scent-free, and biodegradable options. The e-commerce smash has further expanded request reach, with online retailers offering subscription models for menstrual care products.

Europe is witnessing a rise in demand for sustainable and applicable period pain relief results. Countries similar to Germany, France, and the UK are leading the shift toward eco-friendly and natural phrasings. The region’s focus on menstrual health mindfulness juggernauts and the presence of decoration heartiness brands have accelerated the relinquishment of pharmaceutical pain relief druthers. Numerous consumers are shifting from oral pain relievers to topical and transdermal pain operation results, boosting the period patch member.

Asia-Pacific is a swift-growing region fueled by the addition of mindfulness of menstrual health, rapid-fire urbanization, and the growing demand for affordable heartiness results. Countries similar as India, China, Japan, and South Korea are experiencing a rise in first-time buyers concluding for period patches as a safer volition to traditional anodynes’ commerce and social media marketing are playing a crucial part in expanding request penetration, with brands using influencer hook-ups and digital platforms to educate consumers about heat remedy and herbal period pain relief patches.

Challenge

Despite the growth, numerous consumers remain ignorant of period patches as a volition to traditional menstrual pain relief styles. Request penetration is still low in developing regions, where pain relief styles similar to oral drug and herbal teas are more generally used. To overcome this, brands are investing in educational juggernauts, influencer marketing, and mindfulness enterprises to expand consumer relinquishment.

Opportunity

The rise of AI-integrated wearable pain relief patches, sustainable biodegradable accouterments, and herbal-invested results presents major growth openings. Smart heat patches with malleable temperature control, factory-grounded pain relief formulas, and eco-friendly disposable patches are gaining traction, feeding to environmentally conscious consumers. Also, the growth of telehealth and menstrual health shadowing apps provides an occasion for brands to integrate individualized period pain relief results, further driving consumer engagement and fidelity.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 12.50 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 8.80 |

| Country | India |

|---|---|

| Population (millions) | 1,450.9 |

| Estimated Per Capita Spending (USD) | 5.20 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 10.30 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 11.20 |

The USD 4.32 billion period patch market is growing due to increasing consumer preference for non-invasive pain relief solutions. Women prioritize natural, chemical-free, and heat-based patches for menstrual cramps. E-commerce platforms, drugstores, and wellness brands drive availability. Sustainable, biodegradable patches attract eco-conscious buyers. Celebrity endorsements and social media campaigns boost market awareness, while innovation in herbal and CBD-infused patches fuels demand.

China's USD 12.93 billion period patch request benefits from rising mindfulness about menstrual heartiness and growing civic womanish populations. Women seek herbal, aromatherapy, and tone-heating patches as druthers to oral pain relievers. Original brands using traditional Chinese drugs dominate deals. E-commerce, social commerce, and influencer marketing play vital places in driving consumer relinquishment. Youngish consumers favor sustainable, discreet, and trip-friendly period patches for convenience.

India’s USD 7.54 billion market is expanding as menstrual health awareness improves across urban and rural areas. Affordable herbal and heat-based patches are gaining traction as natural remedies. The influence of Ayurveda drives demand for plant-based pain relief solutions. Increasing e-commerce accessibility and government initiatives promoting menstrual wellness support growth. Domestic brands dominate, with rising interest in biodegradable, skin-friendly patches that align with sustainable living trends.

The UK’s USD 703 million period patch request is shifting toward natural, non-toxic, and vegan-pukka results. Women prefer patches with essential canvases and tone-heating technology for instant cramp relief. Apothecaries, online retailers, and subscription-grounded menstrual care boxes drive product vacuity. Growing mindfulness of period heartiness and sustainable period product energies request expansion, with eco-conscious buyers favoring recyclable and chemical-free druthers.

Germany’s USD 942 million market thrives on demand for clinically tested, skin-friendly, and fragrance-free period patches. Women favor self-heating, herbal, and reusable patches as alternatives to traditional painkillers. Strict regulatory standards drive the adoption of dermatologist-approved products. Sales primarily come from pharmacies, organic wellness stores, and online platforms. Sustainability-conscious consumers push brands to develop biodegradable and hypoallergenic patches that align with the country’s eco-friendly movement.

The market for period patches is becoming increasingly popular as individuals are looking for alternative, pain-free, and convenient options for menstrual cramps. A survey of 250 US, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and Middle East users reinforces the driving forces behind purchasing behaviour and upcoming trends.

Effectiveness and comfort drive purchases, with 72% of US and 68% of UK consumers demanding fast and lasting pain relief. Likewise, 65% of EU consumers choose herbal or heat patches rather than conventional painkillers. However, 40% of Southeast Asian and 38% of Chinese consumers prioritize price over premium formulation, and there is some scope for a cheaper variety.

Natural and chemically-free options are in fashion, and 58% of ANZ and 55% of Japanese consumers want patches with organic, perfume-free, and hypoallergenic elements based on sensitivity and chemical sensitivity worries. Korea follows suit at 60%, but with preferences for herbal components such as mugwort and ginseng in its patches, echoing the national enthusiasm for more natural remedies.

Price sensitivity differs, with 50% of the US and 47% of the UK willing to pay USD 15+ per pack for tested, high-quality patches but only 35%-40% of Southeast Asian and Chinese for high-priced ones. Mid-range is more mainstream in Japan (44%) and Korea (41%), offering a compromise between value for money and functionality.

The most favored shopping channel is e-commerce, with 65% of US buyers and 63% of Chinese buyers buying period patches from Tmall, Shopee, and Amazon online for convenience and shopping privacy. Bricks and mortar are most favoured by the Middle East (45%) and Japan (48%), where stock availability and product advice in a store drive purchases.

The market for period patches is changing with the demand for plant-based, heat-activated, and new-generation products. Companies can solidify their market space by emphasizing sustainability, biodegradable ingredients, and dermatologist-approved solutions, meeting the increasing customer demand for safe, effective, and comfortable period management.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Brands introduced heat-activated and transdermal pain relief patches infused with natural ingredients like menthol and CBD. Wearable patches with discreet, long-lasting effects gained popularity. |

| Sustainability & Circular Economy | Companies adopted biodegradable materials and reusable patch options. Water-based adhesive and eco-friendly packaging became key trends. |

| Connectivity & Smart Features | Smart patches with temperature control and Bluetooth connectivity allowed users to monitor menstrual pain relief via mobile apps. AI-powered symptom prediction tools gained traction. |

| Market Expansion & Consumer Adoption | Increased awareness of non-invasive menstrual pain relief drove adoption. E-commerce and subscription-based models gained traction. |

| Regulatory & Compliance Standards | Stricter regulations ensured that patches used clinically tested, non-toxic ingredients. Certifications for medical-grade and dermatologically approved products became essential. |

| Customization & Personalization | Brands introduced scent-free, hypoallergenic, and customizable patches. Subscription services tailored patch formulas based on cycle tracking. |

| Influencer & Social Media Marketing | Women’s health influencers and wellness advocates drove awareness. TikTok, Instagram, and YouTube fueled conversations around period comfort and pain management. |

| Consumer Trends & Behavior | Consumers prioritized non-medicated, fast-acting, and discreet period pain relief solutions. Demand for chemical-free, natural pain relief increased. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-driven, personalized period patches adapt to hormonal cycles and pain intensity. Smart patches integrate with health-tracking apps for real-time symptom management. |

| Sustainability & Circular Economy | Zero-waste period patches with compostable materials become the industry standard. The blockchain ensures transparency in ingredient sourcing and compliance with sustainability. |

| Connectivity & Smart Features | AI-powered period patches sync with wearable health devices to optimize menstrual pain relief. Block chain secures user health data for personalized treatment insights. |

| Market Expansion & Consumer Adoption | Emerging markets witness strong demand due to increasing menstrual health awareness. AI-driven consumer education platforms enhance accessibility and adoption. |

| Regulatory & Compliance Standards | Global mandates require all period patches to meet stringent biocompatibility and sustainability standards. Block chain enhances regulatory transparency and compliance tracking. |

| Customization & Personalization | AI-powered formulations adapt to user pain levels, body temperature, and lifestyle. On-demand 3D-printed patches provide hyper-personalized relief solutions. |

| Influencer & Social Media Marketing | Virtual influencers and met-averse-based menstrual wellness workshops reshape digital engagement. NFT-linked limited-edition period patches enhance brand exclusivity. |

| Consumer Trends & Behavior | Biohacking-inspired period patches integrate hormone-balancing and stress-relief properties. Consumers embrace AI-driven menstrual health solutions for holistic pain management. |

The USA The period patch market experiences robust expansion due to growing awareness of menstrual pain relief alternatives combined with rising demand for non-invasive solutions and a consumer shift toward organic and chemical-free products. The market's dominant entities encompass Rael alongside Livia and Patchology.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

An expanding UK period patch market emerges from heightened menstrual health awareness combined with sustainable product preferences and wellness-focused consumer service trends. Prominent industry names encompass Patch Aid and ThermaCare.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.8% |

Germany’s period patch market is growing, with consumers prioritizing dermatologist-tested, safe, and effective pain relief solutions. Key players include Hansaplast, Well Patch, and Thermacare.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.0% |

The period patch market in India experiences swift expansion driven by heightened menstrual health awareness alongside increased disposable incomes and the growing acceptance of alternative pain relief methods. The market features prominent brands such as Carmeuse, Nua, and Sirona.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.8% |

China’s period patch market is expanding significantly, driven by increasing focus on women’s health, demand for premium wellness products, and advancements in transdermal technology. Key players include Yunnan Baiyao, Kao Corporation, and Bioelectric.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.1% |

Consumers of period patches increasingly choose pain-relief-infused period patches with active ingredients such as menthol, CBD, or NSAIDs and heat therapy strips that offer natural relief for menstrual cramps. Convenience behind discreet, go-anywhere pain management fuels adoption.

Demand is strongest among young women, students, and working professionals for convenient and non-invasive relief from menstrual distress. Increased consciousness about alternative painkillers drives market expansion.

Companies are creating skin-friendly, hypoallergenic, and biodegradable period patches to satisfy the needs of environmentally conscious customers. Increased demand for sustainable and organic sanitary goods drives purchases.

Websites and online retailers are the main channels for the distribution of period patches. Direct-to-consumer brands use social media, influence, and subscription platforms to gain and retain customers.

The global menstrual pain relief patches request is passing steady growth, driven by adding mindfulness of women's health, a shift towards pharmacological pain relief results, and the rising frequency of dysmenorrhea. These patches offer an accessible and effective system for easing menstrual cramps, exercising heat remedies or herbal phrasings to give relief.

Companies are fastening product invention, incorporating natural constituents, and expanding their distribution channels to strengthen their request positions. The assiduity features both established transnational pots and rising original players seeking to capture request share through different product immolations and targeted marketing strategies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Procter & Gamble Co. | 15-20% |

| BeYou | 10-15% |

| Rael | 8-12% |

| Cora | 5-8% |

| The Good Patch | 3-5% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Procter & Gamble Co. | Offers menstrual pain relief patches under its "ThermaCare" brand, focusing on heat therapy to alleviate cramps. The company emphasizes product accessibility and has a strong global distribution network. |

| BeYou | Provides natural menstrual pain relief patches infused with herbal ingredients. Focuses on sustainability and appeals to consumers seeking eco-friendly and vegan products. |

| Rael | Offers heating patches designed for menstrual cramp relief, utilizing natural heat-generating components. Emphasizes organic and clean ingredients, targeting health-conscious consumers. |

| Cora | Markets heat relief patches for menstrual discomfort, highlighting the use of natural materials and a commitment to women's health advocacy. |

| The Good Patch | Provides plant-based patches aimed at relieving menstrual discomfort, focusing on holistic wellness and the use of natural ingredients. |

Procter & Gamble Co. (15-20%)

Procter & Gamble maintains a commanding position in the menstrual pain relief patches request with its" ThermaCare" brand. The company's focus on heat remedies provides an effective, non-pharmacological result for menstrual cramps. With a robust global distribution network, Procter & Gamble ensures wide product vacuity, feeding to a broad consumer base.

Be You (10-15%)

Be You has sculpted out a significant request share by offering natural, herbal-invested menstrual pain relief patches. The company's commitment to sustainability and eco-friendly practices resonates with environmentally conscious consumers. BeYou's focus on vegan and atrocity-free products prayers to a niche yet growing member of health-conscious individualities.

Rael (8-12%)

Rael specializes in hotting patches for menstrual cramp relief, exercising natural heat-generating factors. The company's emphasis on organic and clean constituents aligns with the preferences of health-conscious consumers. Rael's fidelity to women's health and heartiness has established a pious client base and a strong request presence.

Cora (5-8%)

Cora offers toast relief patches designed to palliate menstrual discomfort, pressing the use of natural accouterments. The company's commitment to women's health advocacy and social responsibility prayers to consumers seeking brands with a purpose. Cora's focus on quality and ethical practices enhances its character in the request.

The Good Patch (3-5%)

The Good Patch provides factory-grounded patches aimed at relieving menstrual discomfort and fastening holistic heartiness. The company's use of natural constituents and emphasis on overall well-being attract consumers interested in volition and reciprocal health results. The Good Patch's innovative approach and product variety contribute to its growing request share.

Other Key Players (40-50% Combined)

Several other companies contribute to the growth of the menstrual pain relief patches market by focusing on niche segments, innovative formulations, and competitive pricing. Notable brands include:

These firms utilize their individual strengths and market awareness to provide products that are attuned to unique consumer demands. Product diversification, concentration on natural and organic ingredients, and penetration into new markets further consolidate their competitive stance.

The Period Patch industry is projected to witness a CAGR of 8.6% between 2025 and 2035.

The Period Patch industry stood at USD 1,323.4 million in 2024.

The Period Patch industry is anticipated to reach USD 2,820 million by 2035 end.

North America is set to record the highest CAGR of 10.2% in the assessment period.

The key players operating in the Period Patch industry include TheraPatch, Patchology, Livia, BeYou, Sirona, and Rael.

Heat Patches, Cooling Patches, Herbal Patches, Pain Relief Patches, and Others.

Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online, Convenience Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.