The pelletized activated carbon market is estimated to reach a valuation of USD 5.9 billion in 2025 and it is forecasted to grow around USD 10.2 billion by the year 2035, with a CAGR of 5.8%. This is increasing due to a rise in the demand for air filtration, water filtration, and industrial emission regulation.One of the main growth drivers is the world's drive towards clean air technology.

Governments and industries are making investments in emissions control systems in order to comply with more stringent regulations on such pollutants as volatile organic compounds (VOCs), sulfur dioxide, and nitrogen oxides. Pelletized activated carbon finds extensive application in industrial air treatment and flue gas treatment systems.

The chemical and pharmaceutical markets also play their role in driving demand. Pelletized carbon is used for solvent recovery, catalyst support, and odor control. Its stability against wear and thermal stability provide an advantage to its use in hostile operating environments, enhancing the lifecycle and performance of filtration systems.

Despite its benefits, the industry is confronted with price volatility of raw materials (e.g., coal, coconut shell, and wood) and competition from powdered and granular forms of activated carbon in specific applications. However, pelletized forms are superior in handling, regeneration efficiency, and dust control and remain competitive for most industrial applications.

Sustainability trends are also taking over the industry. Players in the industry are investing in recycled and bio-based sources of carbon as a way of reducing environmental footprints. State-of-the-art reactivation technology and closed-loop filtration technology are helping to extend product lifecycle and enhance cost-effectiveness.

Asia Pacific controls international consumption with China, India, and Southeast Asia, where water scarcity, urbanization, and industrialization are fueling demand. North America and Europe also have strong positions based on environmental regulations and uptake in high-performance air and gas purification systems.

Market Metrics

| Metrics | Value s |

|---|---|

| Industry Size (2025E) | USD 5.9 billion |

| Industry Value (2035F) | USD 10.2 billion |

| CAGR (2025 to 2035) | 5.8% |

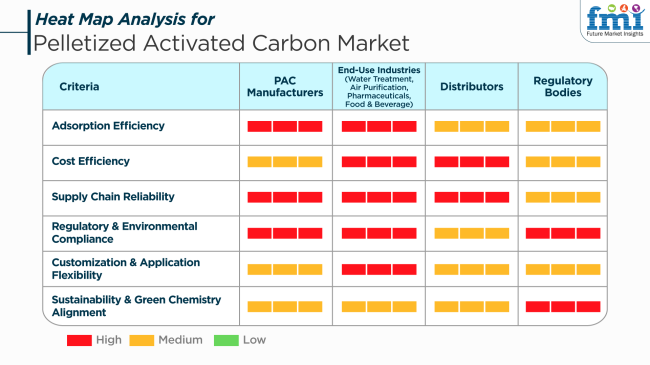

The industry is growing rapidly, with rising demand in various industries like water treatment, air filtration, pharmaceuticals, and food & beverage. PAC's distinct characteristics, such as high adsorption capacity, low dust level, and easy handling, make it a critical ingredient in many applications.

PAC manufacturers are more interested in producing reliable products of consistent quality to meet the challenging specifications of application industries. They adopt sustainable production processes and also look for secure supply chain guaranteeing availability in the growing worldwide industry.End-use industries such as water treatment, air filtration, pharmaceuticals, and food and beverages need cost-effective and proven PAC solutions that deliver maximum performance in a range of applications. They are looking for products with high efficacy, meeting environmental regulations, and enabling customization to fit their operational requirements.

Distributors are keen to emphasize the need to have a dependable supply chain that can support end-use industries. They concentrate on providing a diversified product mix addressing various applications along with timely delivery and competitive prices.

From 2020 to 2024, the industry witnessed uniform growth due to the rising environmental regulations and accelerating demand for water and air purification technologies. Firms involved in water treatment, air filtration, and chemical processing utilized more extensively pelletized activated carbon as it possesses fine adsorption and handling characteristics. The COVID-19 pandemic further increased the need for water and clean air, thereby driving high demand in domestic and industrial sectors.

Fluctuating raw material prices and supply chain disruptions were, however, industry growth limitations during this time. During 2025 to 2035, the industry will witness radical changes based on technology drivers, demographic changes, and changing industrial requirements. Growing needs for sustainable and renewable sources of energy will boost the need for pelletized activated carbon to be used for applications like energy storage and purification of gases.

Additionally, innovations in production methods are likely to improve efficiency and reduce costs, making pelletized activated carbon more widely available in industries. Increasing adoption of electric vehicles and regulatory emissions standards also tend to accelerate industry growth as pelletized activated carbon plays an influential role in emissions control as well as in air purification.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Maintained growth due to ecological laws and cleansing solution requirements. | Faster growth by virtue of technological innovations and applications of green energy. |

| Water and air purification, industrial processing uptake. | Growth in renewable energy, emission control, and energy storage technology requirements. |

| Enhancements in adsorption efficiency and handling capability. | Technological improvements in production technologies improving efficiency and cost. |

| Development in developed industrie s with mature industrial bases. | Penetration in emerging industrie s with rising environmental consciousness and industrial growth. |

| Enforcement of environmental regulations encouraging cleaner technologies. | Increased global emission standards and sustainability mandates driving demand. |

| Emphasize the improvement of adsorption characteristics for purification processes. | Creation of advanced products for energy storage and emission control. |

The industry is also sensitive to price fluctuations in raw materials, particularly coal, wood, and coconut shells. The industry in 2024 was approximately USD 3.11 billion, and price fluctuations had an impact on manufacturers' costs of production and profit margins.

Stringent environmental regulations pose severe threats to the company. Compliance with various regional standards necessitates constant watchfulness and adjustment. Noncompliance risks legal consequences and brand damage, affecting industry share and customer confidence.

Disruption of supply chains, such as transport delays or geopolitical tension, can slow raw material and finished goods delivery. Such disruptions can create production shutdowns and failures to meet customer needs, negatively impacting sales and long-term business relationships.

The industry is confronted with threats of rising competition and technological innovation. Firms are required to spend on research and development to come up with innovative products and improve product offerings over time. Lack of this will lead to becoming outdated and losing industry share to nimbler competitors.

Reliance on principal industries like water treatment, air purification, and pharmaceuticals makes decline in these industries lead to direct effects on demand for PAC. Spreading out the customer base to other industries can reduce this risk.

In conclusion, the PAC industry is exposed to risks of raw material price volatilities, regulatory issues, supply chain breakages, technology shifts, and industry-specific economic recessions. Pre-emptive measures for these drivers of growth and competitiveness are required to maintain growth and competitiveness in this fast-paced industry.

The coal segment is said to dominate the industry with 35% of the industry in 2025, followed by Wood, which is expected to cover 25%. It is widely produced from these raw materials to create pelletized activated carbon for air and water treatment, as well as other industrial processes.

This is because the lowest-cost and best-performing raw material in both air and water filtration are coal. It has a high adsorption capacity, which is beneficial in absorbing pollutants and impurities. It is generally applicable to large municipal and industrial operations, like water purification, waste treatment, and gas phase filtration. Coal-based activated carbon is one of the products in Calgon Carbon, a company of Cabot Corporation, which is an important player in the coal-based activated carbon industry.

The company specializes in supplying coal-based activated carbon to air and water treatment. Jacobi Carbons also takes a large share of the coal-based activated carbon industry, with a strong presence internationally, which provides a solution to various industries, including automotive, chemical, and mining. The importance of use in different sectors further cements the supremacy of coal in the activated carbon industry.

Wood holds the second position with 25% of the industry share. Wood-based activated carbons are preferred for uses requiring a higher degree of purity, such as for decaffeination in the food and beverage industry, and liquid filtering, such as alcoholic beverages. It's also preferred in household air purifiers for supposedly being "greener" as a renewable source.

Significant players in the manufacture of wood-based activated carbons are Kuraray and Carbon Activated Corporation, which mainly target applications such as drinking water filtration and air purification. Moreover, Haycarb, which manufactures activated carbon, has mentioned Wood as one using it as a raw material to further strengthen the industry share of Wood in the healthcare industry to treat some conditions.

Both coal and wood-based activated carbons play a vital role in fighting against increasing environmental issues; industries are now looking for an economic and ecological solution for pollution control and purification.

In 2025, the water treatment segment will lead the industry by occupying over 40% of the industry share. Following this, air purification and air treatment would capture 25% of the industry share.

The water treatment segment remains an important segment owing to the rising global demand for safe and clean drinking water, especially in regions plagued by water scarcity and pollution. Pelletized activated carbon finds widespread application in municipal water treatment plants to remove organic compounds, chlorine, and other impurities in water so that it meets the standards prescribed in the regulation for drinking purposes.

Industrial water treatment plants lastly employ activated carbon to treat wastewater before discharging it into natural water bodies, thereby minimizing environmental contamination. Calgon Carbon (a subsidiary of Cabot Corporation) and Jacobi Carbons are some of the significant suppliers for this segment, providing activated carbon solutions for large-scale water purification projects across a variety of industries.

Coming second with a 25% industry share is the Air Purification and Treatment segment. The removal of contaminants from the air, including volatile organic compounds (VOCs), odors, and gases, is a critical function of pelletized activated carbon. After that, it finds application in HVAC systems, air purifiers, and industrial gas filtration systems.

The increasing concern over indoor air quality and rising incidences of international air pollution regulations are stimulating demand for air purification of activated carbon-based products. Companies such as Kuraray, Haycarb, and Carbon Activated Corporation manufacture activated carbon for air treatment applications that service industry sectors engaged in improving the air quality of urban and industrial surroundings.

Environmental awareness and strict regulatory standards, coupled with increasing consumer preference for healthy living conditions, will shape the above segments and keep them a significant industry share in the upcoming years.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

| UK | 3.8% |

| France | 3.6% |

| Germany | 3.9% |

| Italy | 3.5% |

| South Korea | 4.1% |

| Japan | 3.3% |

| China | 5.9% |

| Australia | 3.6% |

| New Zealand | 3.0% |

The USA industry is anticipated to grow at a CAGR of 4.4% over the 2025 to 2035 period. Demand is driven by stringent air and water pollution regulations, especially for mercury emissions control, wastewater treatment, and VOC elimination in process industries. Increasing demand from food and beverages for purification and decolorization is also driving growth.

Major producers are investing in technology development to enhance pore structure and adsorption efficiency, with products for use in environmental clean-up and gas treatment. Local production capacities, supported by advances in carbonization and activation technology, are ensuring supply stability and fulfilling EPA and industrial requirements.

The UKindustry is anticipated to record a CAGR of 3.8% from 2025 to 2035. Industry dynamics are driven by regulation-led efforts towards reducing emissions, especially in manufacturing and energy production sectors. Water treatment applications in municipal systems are also driving demand for pelletized forms due to their ease of handling and low-pressure drop.

Suppliers are focusing on product regeneration ability and efficiency to aid circular economy goals. There is a growing demand for odor control in public buildings and HVAC-activated carbon filters. Air quality monitoring and sustainability programs with pairing are set to sustain industry growth in the UK

France is anticipated to grow at a CAGR of 3.6% in the industry over the forecast period. The increasing use of flue gas treatment, recovery of solvents, and purification of air in the industry drives the industry. The beverage and food processing sectors also utilize activated carbon to meet safety and sanitation regulations.

French chemical companies are improving production technology to enhance adsorption kinetics and product life. Emphasis on recycling and reactivation is also consistent with national policy for sustainable industrial processes. Automotive uses especially cabin air filters, are also emerging as a derivative growth driver for demand.

Germany's industry is expected to develop at a CAGR of 3.9% during the period 2025 to 2035. Demand is underpinned by strict environmental regulation of industrial emissions, waste incineration, and automotive manufacturing. Pelletized products are preferred for applications that require consistent flow rates and mechanical strength in severe operating conditions.

Major German producers are enhancing production efficiency and enhancing high-performance carbon grades for use in energy storage, air filtration, and chemical processing. Industry strength is provided by solid infrastructure and compatibility with high-tech environmental technology systems. Recycling and regeneration services are widely used, facilitating the long-term sustainability of the industry.

Italy is anticipated to record a CAGR of 3.5% in the industry during 2025 to 2035. Growing applications in the pharmaceutical, petrochemical, and water treatment sectors are also driving growth. Odor control and indoor air purification in commercial and residential buildings are also contributing to demand.

Italian producers and distributors are placing greater emphasis on quality assurance, particularly in the manufacture of activated carbon for drinking water networks and food purposes. Conforming to EU environmental directives is promoting the adoption of lower-emission production technologies and regeneration capabilities. Import alliances are key to product availability.

South Korea is expected to grow at a CAGR of 4.1% in the industry during the forecast period. Petrol-based industrial processes, semiconductor manufacturing processes, and electricity generation are significant drivers for demand. Uses in emission control systems and building air purification by pelletized forms are becoming commonplace.

South Korean companies are utilizing technological advancements to produce pelletized carbon with tailored pore structures and excellent heat resistance. Strong domestic demand for green technology and export growth in air quality solutions are propelling the development of the industry. Government support for green technology is also boosting R&D spending in the industry.

Japan's industry is forecast to grow at a CAGR of 3.3% from 2025 to 2035. Stringent environmental regulations, aging infrastructure, and water treatment equipment demand for advanced facilities fuel the growing industry. The fine chemicals and electronics sectors need high-purity activated carbon for premium applications.

Japanese makers are renowned for innovative precision engineering and carbon regeneration improvement. Increasing demand for commercial and residential building air filters is also present. The addition of activated carbon in energy storage devices and the next generation of filtration units is developing new high-value application areas.

China is forecasted to lead the industry with a CAGR of 5.9% in the period 2025 to 2035. Growth is fueled by industrialization, urbanization, and increasing environmental regulations. Demand is high in power generation, chemical processing, and municipal water treatment applications. The use of flue gas for gas purification and desulfurization is expanding at a rapid rate.

Large Chinese producers are ramping up production and enhancing quality to international standards. Government initiatives for clean air and water management are also enhancing demand, particularly in high-volume urban metropolises. Integration with waste management and recycling networks is also fueling continuous domestic consumption as well as overseas industries.

Australia's industry is expected to grow at a CAGR of 3.6% during the period from 2025 to 2035. It is propelled by applications in mining effluent treatment, industrial air purification, and drinking water filtration. The industry is supported by increasing concern for environmental responsibility and environmentally friendly waste management practices.

Australian companies are making investments in reprocessing and importation within their local plants in order to ensure the supply base. Utilization in infrastructure uses, such as odor management and ventilation systems for tunnels, is making industry entry easier. Alliance with local Asian-Pacific suppliers is enhancing access to goods and product quality.

New Zealand is also likely to grow at 3% CAGR in the industry during the period 2025 to 2035. Small is the size of the industry with significant applications for municipal wastewater treatment, cleaning up the environment, and smaller-scale industrial activity. Growing perception within the public domain regarding water and air purity is driving continued albeit slow-up.

Import routes and collaboration with Australian and Asian vendors maintain domestic demand. Shifting towards eco-friendly filtration technologies and regulatory upgrades of environmental monitoring is expected to support stable demand. Beekeeping and organic processing applications are emerging as niche applications for rural industries.

The industryis highly competitive. Key players are investing in advanced purification technologies, sustainable production methods, and strategic partnerships that would help them fortify their industry positions. The industry leaders leveraging such technological advancements in water treatment, air purification, and industrial emissions control to broaden their footprint include Calgon Carbon Corp, Ada Carbon Solutions, and Cabot Corporation.

However, the focus of these companies is on high-performance activated carbon solutions that are suitable for municipal water treatment plants, power-generation facilities, and automotive applications.

In comparison, medium-sized companies like Carbotech and Carbon Activated Corporation try to compete through cost-effective manufacturing, optimizing supply chains, and entering new regional industries. The customizable activated carbon solutions these firms provide for niche industries such as pharmaceuticals, food and beverage, and chemical processing have since established a strong foothold in the industry.

Strategic mergers, acquisitions, and partnerships continue to shape the competitive environment nowadays. Meadwestvaco Corporation and Carbon Resources LLC run high activities in extending and building their geographic distribution channels to the international level while augmenting their R&D capabilities to make adsorption efficiency and regeneration potential improvements.

Bio-based activated carbons are currently the trend employed in all the industry's leading-edge applications, bestowing a possible advantage to players focusing on developing more environmentally sound innovations in their products.

Increased competition has also started with Asian manufacturers, especially China and its counterpart, India, being used as major grounds for producing price-competitive products due to the high availability of cheap raw materials and manufacturing facilities.

However, patented product innovations and regulatory compliance to engineered world standards from North America and Europe would evidently keep their competitive edge high against Asian products. Thus, the European and North American players are superior in performance and applications for high-demand scenarios like air filtration and gas purification.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Calgon Carbon Corporation | 22-27% |

| Ada Carbon Solutions LLC | 15-20% |

| Cabot Corporation | 12-16% |

| Carbotech | 8-12% |

| Carbon Activated Corporation | 6-10% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Calgon Carbon Corporation | Specializes in high-performance pelletized carbon for air filtration, water treatment, and industrial applications. |

| Ada Carbon Solutions LLC | Focuses on activated carbon for mercury emission control in coal-fired power plants. |

| Cabot Corporation | Develops pelletized activated carbon solutions for automotive, energy storage, and environmental applications. |

| Carbotech | Provides customized activated carbon products for air purification, chemical processing, and gas separation. |

| Carbon Activated Corporation | Offers cost-effective filtration solutions for municipal and industrial water treatment systems. |

Key Company Insights

Calgon Carbon Corporation (22-27%)

The industry leader in high-quality pelletized activated carbon, focusing on advanced air purification and water treatment solutions with global regulatory approvals.

Ada Carbon Solutions LLC (15-20%)

Specializes in activated carbon for mercury capture, playing a crucial role in power plant emissions reduction and environmental compliance.

Cabot Corporation (12-16%)

Strengthens its industry presence with high-capacity activated carbon for automotive and energy storage applications, driving innovation in filtration and gas separation.

Carbotech (8-12%)

Expands its footprint through cost-effective, tailored activated carbon solutions for industrial purification and environmental applications.

Carbon Activated Corporation (6-10%)

Competes through regional expansion, bulk production capabilities, and a diverse product portfolio for industrial and commercial air filtration.

Other Key Players

The industry is segmented into coal, wood, coconut shell, lignite, bamboo, paddy husk, and others.

The industry is segmented into water treatment, air purification and treatment, industrial processes, mercury removal, and others.

The industry is segmented into automotive industry, food and beverages industry, pharmaceutical and medical industry, chemical industry, agriculture industry, and others.

The industry is segmented into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Japan, and Middle East and Africa.

The industry is estimated to reach USD 5.9 billion by 2025.

The industry is projected to grow to USD 10.2 billion by 2035.

China is expected to grow at a CAGR of 5.9.

The coal-based segment dominates the industry, owing to its superior adsorption capacity and cost-effectiveness across various end-use industries.

Key players in the industry include Calgon Carbon Corporation, Ada Carbon Solutions LLC, Cabot Corporation, Carbotech, Carbon Activated Corporation, MeadWestvaco Corporation, Carbon Resources LLC, Clarinex Group, Carbotech AC GmbH, and Siemens Water Technologies Corp.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Activated Cake Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Activated Bleaching Earth Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Activated Cake Emulsifier Suppliers

Activated Partial Thromboplastin Test Market

Activated Charcoal Supplements Market Trends - Sales & Industry Insights

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Bags Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Filter Market Growth - Trends & Forecast 2025 to 2035

Assessing Activated Carbon Market Share & Industry Trends

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Activated Tear Tape Market

Wood Activated Carbon Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Water Activated Tape Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Water Activated Tape Dispensers

Water-Activated Tape Market Trends & Industry Forecast 2024-2034

Food Grade Activated Carbon Market Report - Applications & Growth 2025 to 2035

Fluorescence-Activated Cell Sorting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA