The pediatric obesity management market is expected to acquire a market value of USD 3.46 billion in 2025. Over the projection period, the market will reach at USD 5.12 billion by 2035, reflecting a CAGR of 4% during the decade.

In 2024, the pediatric obesity management industry experienced major developments in the domains of drug treatment, technological innovation, and public health. Novo Nordisk's liraglutide was safe and effective in six-year-old children, lowering their body mass index by 7.4% over a one-year span. The firm submitted to the USA FDA and European Medicines Agency for approval in the age category.

Technological innovations saw Fitbit launch the Fitbit Ace LTE children's smartwatch, promoting activity and health monitoring among children. Public health figures indicated that 9.6% of children starting primary school in England were obese in 2023to 2024, prompting the NHS to establish 30 specialist clinics for children aged 2-18 years. Socioeconomic disparities were observed, with higher rates of obesity among disadvantaged communities.

Several key drivers in the industry include increasing awareness of childhood obesity and technological advancements, while the constraints are high treatment costs and limited access to health care services in certain regions.

The sector will expand with the inclusion of digital health solutions, personalized interventions, and community-based collaborative engagement strategies during the forecast period between 2025 and 2035. Ethical issues regarding pharmaceutical interventions in children and the need for long-term safety data, however, will affect adoption rates.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 3.46 billion |

| Industry Size (2035F) | USD 5.12 billion |

| CAGR (2025 to 2035) | 4% |

Explore FMI!

Book a free demo

The pediatric obesity treatment industry is positioned for stable expansion with growing obesity in children, growing awareness, and the progress of pharmaceutical and digital health technology.

Directly benefited are pharmaceutical companies that make pediatric weight-loss drugs, wearable technology companies that sell activity monitoring, and health professionals with specialty obesity centers. The excessive cost of treatment and limited equal access to treatment might, however, constrain extensive uptake, especially in poorer groups.

Expand Pediatric-Specific Treatment Offerings

Actionable Recommendation: Invest in R&D for pediatric-specific obesity medications and behavioral interventions, ensuring regulatory approval and long-term safety data to drive adoption.

Leverage Digital Health & AI for Personalized Care

Actionable Recommendation: Develop AI-driven, personalized obesity management programs integrating wearables, telehealth, and data analytics to align with the growing demand for tech-enabled healthcare solutions.

Strengthen Partnerships & Industry Access

Actionable Recommendation: Establish strategic partnerships with healthcare providers, insurers, and public health organizations to improve affordability and accessibility while exploring M&A opportunities to expand industry reach.

| Risk | Probability & Impact |

|---|---|

| Regulatory & Safety Challenges-Delays in approvals or unforeseen side effects in pediatric obesity drugs could hinder industry adoption. | Medium Probability, High Impact |

| Affordability & Access Barriers-High treatment costs and insurance limitations may restrict widespread adoption, especially in lower-income regions. | High Probability, High Impact |

| Industry Competition & Innovation Pace-Emerging competitors and rapid technological advancements may disrupt existing solutions and reduce industry share. | Medium Probability, Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Pediatric Drug Approvals & Safety Data | Monitor regulatory approvals and conduct long-term safety studies for pediatric obesity medications. |

| Digital Health Integration | Initiate partnerships with wearable tech and AI-driven platforms to enhance personalized obesity management. |

| Industry Access & Affordability | Develop pricing strategies and collaborate with insurers to improve coverage and reimbursement options. |

To stay ahead, the company needs to speed up the approval process for treatments specifically designed for children and ensure these are safe over the long term. They should use AI-powered health technology and partner with insurance companies and healthcare providers to increase accessibility and reach more people.

With more competitors and cost concerns, it’s important to focus on pricing models that can easily grow. They should also consider merging with other companies and expanding into underserved areas. This plan emphasizes the urgent need to align research, digital technology, and Industry strategies to lead in this fast-growing area.

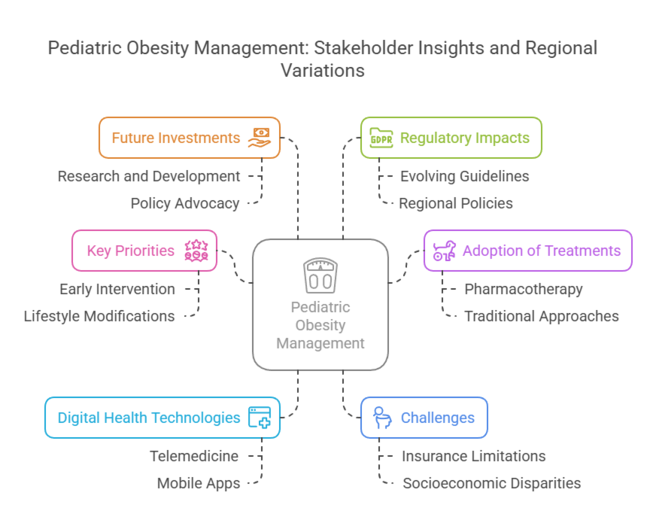

In Q4 2024, Future Market Insights conducted a comprehensive survey involving 450 stakeholders-including healthcare providers, pharmaceutical companies, policymakers, and patient advocacy groups-across the United States, Western Europe, Japan, and South Korea. The survey aimed to elucidate the dynamics of the pediatric obesity management Industry from diverse perspectives.

Regional Variations

Pharmacotherapy Utilization: Globally, 60% of healthcare providers reported prescribing weight management medications for pediatric patients, indicating a growing acceptance of pharmacological interventions.

Regional Insights

Telemedicine and Mobile Health Apps: Around 72% of stakeholders acknowledged the role of digital platforms in delivering counseling, monitoring progress, and providing educational resources to pediatric patients and their families.

Regional Adoption Rates

Insurance Coverage Limitations: A notable 68% of respondents identified inadequate insurance coverage for obesity treatments as a significant barrier to patient access.

Regional Disparities

Evolving Guidelines: About 75% of respondents acknowledged that changing regulatory frameworks significantly influence treatment approaches and necessitate continuous adaptation to ensure compliance.

Regional Observations

| Country | Policies, Regulations, and Mandatory Certifications |

|---|---|

| United States |

|

| United Kingdom |

|

| France |

|

| Chile |

Food Labeling and Advertising Law (2016): Mandates front-of-package warning labels on foods high in calories, sugar, sodium, or saturated fats; prohibits the sale of such foods in schools; and restricts advertising targeted at children under fourteen. |

| Thailand |

Control of Marketing of Infant and Young Child Food Act: Aligns with the International Code of Marketing of Breast-milk Substitutes, regulating the marketing of infant and young child foods to promote breastfeeding and reduce childhood obesity. |

| European Union |

EASO Certification in Obesity Management: The European Association for the Study of Obesity (EASO) offers certification recognizing expertise in obesity management, requiring adherence to specific training and clinical experience criteria. |

The pediatric obesity management sector is fueled by a high prevalence of childhood obesity, a strong healthcare infrastructure, and high-level government initiatives for prevention and control. Widespread programs include school-based interventions and public awareness campaigns. Moreover, the adoption of digital health technologies,coupled with advanced pharmacological treatments, will drive the growth of the industry.

FMI opines that the United States pediatric obesity management sales will grow at nearly 4.8% CAGR through 2025 to 2035.

The pediatric obesity management industry in the United Kingdom is paved by massive public health and government policies against childhood obesity. The focus on preventive care and the emergence of behavior therapy and wearable devices in the UK positively influence the growth of the industry.

FMI opines that the United Kingdom pediatric obesity management sales will grow at nearly 4.5% CAGR through 2025 to 2035.

The pediatric obesity management industry in France benefits from the significant investment the country makes in public health initiatives such as nutritional education and community fitness programs. The French healthcare system encourages the implementation of both traditional and cutting-edge therapeutic approaches.

FMI opines that France pediatric obesity management sales will grow at nearly 4.2% CAGR through 2025 to 2035.

The pediatric obesity management industry in Germany is anticipated to achieve a rate of 4.3% as compared to CAGR in the coming period. A preventive healthcare approach, advanced treatment alternatives, and high healthcare expenditure characterize the industry growth in the country. This growth is supported further by Germany'sadoptionof digital health solutions and behavioral therapies.

FMI opines that the Germany pediatric obesity management sales will grow at nearly 4.3% CAGR through 2025 to 2035.

The Pediatric Obesity Management industry in Italy is characterized by the government's efforts in the field of promoting healthy lifestyles, which are carried out through public campaigns and at schools, training the school staff. In Italy, the health care system allows access to several types of treatment, such as pharmacological and behavioral therapies.

FMI opines that the Italy pediatric obesity management sales will grow at nearly 3.8% CAGR through 2025 to 2035.

South Korea Pediatric Obesity Management industry, Reach, Trends and Insights is driven by factors such as rapid urbanization, transforming dietary habits, and greater awareness of health problems linked with obesity help explain this expansion. The rising governmental initiatives to promote the consumption of healthy food and regular physical activity to children also drive the industry's growth.

FMI opines that the South Korean pediatric obesity management sales will grow at nearly 4.6% CAGR through 2025 to 2035.

Japan's pediatric obesity management industry is supported by preventive healthcare and public awareness campaigns on childhood obesity. Concepts such as the Japanese diet free from additives and preservatives work synergistically with modern treatment to bolster the efficacy of obesity-management protocols.

FMI opines that the Japan pediatric obesity management sales will grow at nearly 3.7% CAGR through 2025 to 2035.

The pediatric obesity management industry in China is expected to make a rapid growth due to its economy, urbanization, and lifestyle changes have significantly contributed to the rising incidence of obesity among children. Industry growth is primarily driven by government initiatives towards educating the public on health and the promotion of physical activity among children.

FMI opines that China’s pediatric obesity management sales will grow at nearly 5.2% CAGR through 2025 to 2035.

The Australia & New Zealand Pediatric Obesity Management industry is projected to thrive during the period 2025 to 2035. Both countries initiated comprehensive public health campaigns, as well as school-based programs to tackle childhood obesity. Industry growth in this region is being driven by the availability of advanced treatment options and strong preventive care.

FMI opines that the Australia pediatric obesity management sales will grow at nearly 4.1% CAGR through 2025 to 2035.

Lorcaser in is anticipated to remain a strong player in the industry of pediatric obesity management as it works by regulating appetite via serotonin receptors. Lorcaserin will likely remain available for patients needing ongoing pharmacotherapy for weight management, particularly as evidence mounts about its efficacy and safety in pediatric cohorts. But regulatory scrutiny and safety concerns could stifle its widespread adoption.

Liraglutide is being increasingly adopted, in part due to its utility in both obesity and glucose regulation, which may make it a favorable choice for children with concomitant diabetes such as type 2 diabetes. Healthcare professionals will still favor liraglutide as it has a scientifically proven track record of inducing weight loss with metabolic stability.

Phentermine will continue to be used more broadly, especially for the short-term treatment of obesity in adolescents.

It will be particularly demanded in regions where healthcare access and affordability significantly shape treatment choice due to its cost-effectiveness and capacity to effectuate rapid weight loss. Its stimulant qualities and dependency potential will ultimately force stricter controls over prescription availability and closer patient management.

Setmelanotide will see a fairly rapid uptake, especially in the case of rare genetic obesity disorders. Increasing awareness and diagnosis of genetic obesity disorders will fuel growth in setmelanotide-based therapy.

With the advent of more clinical data and long-term follow up data available for healthcare systems to evaluate, setmelanotide is expected to establish itself as a component for the management of pediatric obesity alongside other biologics and lifestyle interventions for obesity management, for patients with more complex syndromic obesity etiologies, such as those caused by POMC or LEPR deficiencies.

The industry will also be supported by other classes of agents, such as some new peptide agent therapies and combination therapies.

The increasing pipeline of new anti-obesity medications will create competition and provide additional treatment options. This will lure pharmaceutical industries to invest significantly in research and development, leading to a better treatment armamentarium for childhood obesity.

The oral medications will dominate the pediatric obesity treatment industry on account of convenience and patient compliance. Parents and health care personnel will prefer oral formulations that would be particularly advantageous for children who could be averse to injections.

New extended-release formulations and combination therapies will also enhance opportunities for oral therapies to be effective tools in long-term weight management strategies. Oral drugs will continue to dominate the industry based on their affordability and easy accessibility, particularly in geographical areas with limited access to advanced healthcare systems.

Recombinant-based treatments (GLP-1 receptor agonists/other biologics) will dominate and undergo rapid growth through injection-based therapies. There will be a significant increase in the use of liraglutide and emerging injectable medicines as the impact of insulin and metabolic benefits becomes more evident.

These self-injection devices and patient-friendly delivery systems will increase adherence and acceptance amongpediatric patients. As more regulatory approvals for biologic therapies occur, this biopharmaceutical industry segment will be among the fastest-growing, especially among patients needing highly specialized obesity treatment regimens.

Hospital pharmacies will continue to be an important distribution channel for pediatricobesity management drugs. While some visits may require hospitalization, healthcare providers can depend on hospital pharmacies to supply prescription medication for critical cases as obesity-related complications strain health services.

Specialized pediatric obesity clinics within hospitals will also increase the need to distribute pharmaceutical products ona hospital basis.

Weight management medications are expected to be widely available at retail pharmacies, which will cater to parents and caregivers looking for easy access to prescriptions. Pharmacists will play a significant role in educating patients to make sure that prescribed therapies are used by patients. The growing retail pharmacy networks and collaborations with healthcare organizations will bolster their standing in the industry.

However, digitalization is allowing for instant deliveries of prescriptions, which will lead to expedited growth for online pharmacies. The ability to access obesity management drugs by ordering online will be attractive to caregivers over the long term as they manage treatment plans for their children.

Regulatory and governing bodies will work out the supervision and authenticity of transactions, promoting the establishment of online and secure e-commerce for obesity-based prescriptions.

The pediatric obesity management industry is quite fragmented, with several pharmaceutical companies and medical device manufacturers holding a strong position in the global industry. Leading players harness innovation, strategic collaborations, and industry penetration to enhance their dominance.

They are investing in R&D to bring innovative drugs to the industry, mergers and acquisitions to diversify their offerings, and partnerships to strengthen distribution channels.

In March 2025, Novo Nordisk reached a licensing agreement with Lexicon Pharmaceuticals for worldwide rights to the experimental obesity drug LX9851, worth up to USD 1 billion. It’s part of an effort to broaden Novo Nordisk’s obesity treatment portfolio.

The Apollo ESG System and Orbera365 System were introduced at the same time, with a goal to reach the growing industry of medical devices that induce weight loss in patients in India, in December 2024 by Boston Scientific. Such movements are indicative of a robust industry with companies on the prowl for growth initiatives.

Market Share Analysis

Rising obesity rates, increased awareness, government initiatives, and advancements in pharmacological treatments are fueling growth.

GLP-1 receptor agonists like Liraglutide are gaining popularity due to their proven efficacy in weight management.

Wearable devices, telemedicine, and AI-driven personalized treatment plans are enhancing patient monitoring and engagement.

Hospitals, retail, and online pharmacies ensure accessibility and adherence to prescribed treatments.

Yes, evolving guidelines and approvals for pediatric obesity drugs are shaping treatment options and accessibility.

Lorcaserin, Liraglutide, Phentermine, Setmelanotide, and Others

Oral and Injectable

Hospital Pharmacies, Retail Pharmacies and Online Pharmacies

North America, Latin America, Europe, East Asia, South Asia, Oceania and Middle East and Africa

Cardiogenic Shock Treatment Market Analysis & Forecast for 2025 to 2035

The Metered Dose Inhalers Market is Segmented by Type, and End User from 2025 to 2035

The Staphylococcus Aureus Testing Market Is Segmented by Test Type, Application and End User from 2025 To 2035

The Dyslexia Treatments Market Is Segmented by Drug Type and Distribution Channel from 2025 to 2035

The Spinal Fusion Market is segmented by Product, Procedure and End User from 2025 to 2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.