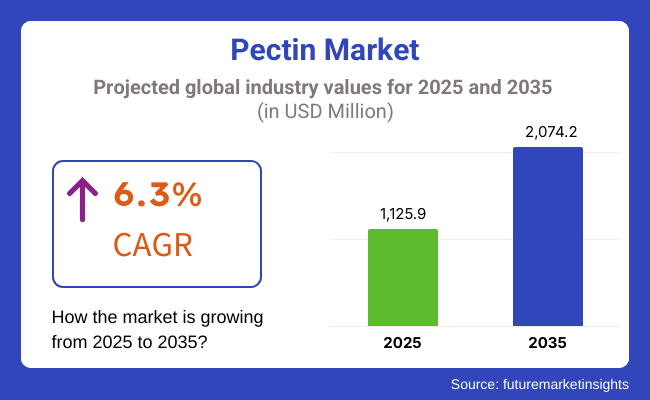

The global Pectin market is estimated to be worth USD 1,125.9 million in 2025 and is projected to reach a value of USD 2,074.2 million by 2035, expanding at a CAGR of 6.3% over the assessment period of 2025 to 2035.

Pectin is increasingly valued for its health benefits, particularly as a soluble fiber that supports digestive health and helps lower cholesterol levels. Its ability to form gels and thicken foods makes it a popular choice in functional foods and dietary supplements. As consumers become more health-conscious, the demand for products containing pectin is rising, as it offers a natural way to enhance nutritional value while promoting overall well-being.

The food and beverage industry in emerging markets, especially in Asia-Pacific and Latin America, is experiencing significant growth, driven by rising disposable incomes and changing consumer preferences. As more consumers seek convenient and processed food options, the demand for pectin as a natural ingredient in various products is increasing. This trend is further fueled by urbanization and a growing middle class, leading to greater investment in food innovation and product development.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global pectin market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year.

The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.3% (2024 to 2034) |

| H2 | 5.9% (2024 to 2034) |

| H1 | 6.4% (2025 to 2035) |

| H2 | 7.0% (2025 to 2035) |

The above table presents the expected CAGR for the global pectin demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 5.3%, followed by a slightly higher growth rate of 5.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 6.4% in the first half and remain relatively moderate at 7.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Increased Demand for Sugar Alternatives

The shift towards healthier eating habits has significantly increased the demand for reduced-sugar and sugar-free products. Consumers are becoming more aware of the health risks associated with high sugar intake, such as obesity and diabetes, prompting them to seek alternatives. Pectin, a natural polysaccharide derived from fruits, serves as an effective thickening agent in these formulations.

It allows manufacturers to create appealing textures and mouthfeel in products like jams, jellies, and desserts without relying on high sugar content. This capability not only enhances the sensory experience of the product but also aligns with the preferences of health-conscious consumers, making pectin an essential ingredient in the development of innovative, low-sugar food options.

Innovation in Food Preservation

With an increasing emphasis on food safety and extending shelf life, manufacturers are turning to pectin for its natural preservation properties. Pectin’s gelling and thickening abilities help maintain the texture and quality of various food products, making it a valuable ingredient in sauces, jams, and jellies. As consumers become more health-conscious, they are seeking products that not only taste good but also have a longer shelf life without artificial preservatives.

Pectin provides a natural solution, allowing manufacturers to enhance the stability and freshness of their products. This innovation in food preservation not only meets consumer demands for quality but also supports the growing trend towards clean label products, further driving the use of pectin in the food industry.

Rise of Plant-Based Diets

The rise of plant-based diets is reshaping consumer preferences, driven by health, ethical, and environmental considerations. As more individuals adopt vegetarian and vegan lifestyles, the demand for natural ingredients like pectin is surging. Pectin, derived from fruits, is an ideal choice for plant-based food products, including dairy alternatives, meat substitutes, and snacks. Its versatility allows it to be used as a thickener, stabilizer, and gelling agent, enhancing the texture and mouthfeel of plant-based offerings.

This trend is not only fostering innovation in product development but also encouraging manufacturers to explore new applications for pectin, making it a key ingredient in the growing market for plant-based foods that cater to health-conscious consumers.

Global Pectin sales increased at a CAGR of 5.3% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on pectin will rise at 6.3% CAGR.

Pectin is celebrated for its numerous health benefits, particularly as a soluble fiber that supports digestive health. It aids in regulating blood sugar levels and can help lower cholesterol, making it a valuable addition to a balanced diet.

As consumers become more health-conscious and seek out functional foods, the demand for natural ingredients that provide these benefits is rising. Pectin's ability to promote overall well-being positions it as an attractive option for those looking to enhance their dietary choices.

The clean label movement is gaining momentum as consumers increasingly prefer products with natural and easily recognizable ingredients. Pectin, derived from fruits, aligns perfectly with this trend, appealing to those who are cautious about artificial additives and preservatives.

This demand for transparency in food labeling drives manufacturers to incorporate pectin into their products, as it not only meets consumer expectations for natural ingredients but also enhances the overall quality and appeal of food offerings.

Tier 1 Companies: This tier comprises industry leaders with annual revenues exceeding USD 20 million, collectively holding a market share of approximately 40% to 50%. These companies are recognized for their high production capacity, extensive product portfolios, and robust global presence. They leverage advanced manufacturing technologies and have established strong relationships with key stakeholders across the supply chain.

Prominent players in Tier 1 include CP Kelco, DuPont, Cargill, and Tate & Lyle. These companies not only dominate the market but also drive innovation through research and development, ensuring they meet evolving consumer demands for natural and functional ingredients.

Tier 2 Companies: Tier 2 consists of mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies have a significant presence in specific regions and play a crucial role in influencing local markets. They are characterized by a strong understanding of consumer preferences and regulatory compliance, although they may lack the extensive technological capabilities and global reach of Tier 1 companies.

Notable Tier 2 players include Ingredion, Naturex, and Hawkins Watts Limited. These companies often focus on niche markets and specialized applications, allowing them to carve out a competitive advantage in their respective regions.

Tier 3 Companies: The third tier includes a majority of small-scale companies with revenues below USD 5 million. These firms primarily operate at a local level, catering to niche demands and specific consumer needs. They are often characterized by limited production capacity and geographical reach, making them more vulnerable to market fluctuations.

Tier 3 companies typically focus on fulfilling local marketplace demands and may lack the formal structure and resources of larger competitors. This segment is recognized as an unorganized field, where many players operate informally and may not have the same level of regulatory compliance or technological advancement.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 565.1 million |

| Germany | USD 104.1 million |

| China | USD 56.8 million |

| India | USD 24.3 million |

| Japan | USD 13.6 million |

The USA regulatory environment is becoming increasingly favorable towards natural ingredients, particularly dietary fibers like pectin. The Food and Drug Administration (FDA) acknowledges the health benefits associated with pectin, such as its role in digestive health and cholesterol management. This recognition provides manufacturers with the confidence to incorporate pectin into their products, knowing it complies with health guidelines and meets consumer demand for transparency and natural ingredients.

Additionally, regulatory support fosters innovation, encouraging food producers to explore new applications for pectin in functional foods and beverages, ultimately enhancing its market presence and appeal among health-conscious consumers.

The German food industry is at the forefront of innovation and research, particularly in the application of pectin. Companies are actively exploring new uses for pectin in functional beverages, health supplements, and other food products that cater to the growing consumer demand for health-oriented options.

This innovation is fueled by a desire for products that not only deliver great taste but also offer tangible health benefits, such as improved digestion and enhanced nutritional value. As manufacturers develop novel formulations that incorporate pectin, they are able to meet the evolving preferences of health-conscious consumers, thereby significantly boosting its market presence.

The emergence of clean label products in India reflects a significant shift in consumer preferences towards transparency and natural ingredients. Indian consumers are increasingly seeking foods that are free from artificial additives and preservatives, favoring products that highlight their wholesome, natural components. Pectin, derived from fruits, perfectly aligns with this clean label trend, as it is perceived as a safe and healthy ingredient.

In response, manufacturers are incorporating pectin into a variety of products, including jams, jellies, and dairy alternatives, to meet the demand for quality and authenticity. This alignment with consumer values is driving the growing demand for pectin in the Indian market.

| Segment | Value Share (2025) |

|---|---|

| Citrus Fruits (Source) | 28% |

Major citrus-producing countries like the United States, Brazil, and Spain ensure a consistent supply of raw materials, facilitating the extraction of high-quality pectin. This availability is crucial as manufacturers seek reliable sources to meet the growing global demand for pectin in various food applications. Additionally, the use of citrus peels, a byproduct of the juice industry, aligns with sustainability goals by transforming waste into a valuable ingredient.

This practice not only reduces environmental impact but also appeals to eco-conscious consumers and brands that prioritize sustainable sourcing. By leveraging these waste materials, manufacturers can enhance their product offerings while contributing to a circular economy.

The competition in the global pectin market is intensifying as companies focus on innovation, product diversification, and sustainability to maintain their competitive edge. Key players are investing in research and development to explore new applications for pectin, such as in functional foods and beverages. Additionally, manufacturers are emphasizing clean label products and sourcing practices that resonate with health-conscious consumers. Strategic partnerships and collaborations with food producers and research institutions are also being pursued to enhance product offerings and expand market reach.

For instance

The global Pectin industry is estimated at a value of USD 1,125.9 million in 2025.

Sales of Pectin increased at 5.3% CAGR between 2020 and 2024.

CP Kelco USA, Inc., Cargill, Inc., DuPont Inc., Herbstreith & Fox, Yantai Andre Pectin Co., Ltd., Naturex Group are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 24.5% over the forecast period.

North America holds 36.5% share of the global demand space for Pectin.

This segment is further categorized into High-methoxyl Pectin, Low-methoxyl Pectin (Amidated (LMA) and Non Amidated (LMC).

This segment is further categorized into Fermented Plant-based Products, Fermented Dairy Products, including Yoghurt, Jams, Jellies, Chews, Fruit Spreads, Sugar Confectionary, Fruit Roll Ups, Fruit Preparations, Bakery Fillings, Glazes, Sauces, Toppings, Ripples, Compotes, Juices, and Reduced-sugar Beverages.

This segment is further categorized into Citrus Fruits (Oranges, Tangerines/Mandarins, Grapefruit, Lemon and Lime), Pears, Apples, Plums, Banana and Others (Peach, Berries).

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.