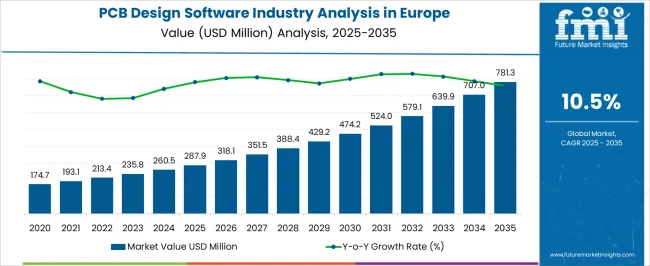

The PCB Design Software Industry Analysis in Europe is estimated to be valued at USD 287.9 million in 2025 and is projected to reach USD 781.3 million by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period.

The PCB design software industry in Europe is evolving rapidly, supported by the region’s strong electronics manufacturing base, increasing adoption of automation, and the rise of IoT-enabled devices. Growing demand for miniaturized and high-performance electronic components has intensified the need for advanced design tools that ensure accuracy, reliability, and speed in circuit development.

The industry benefits from technological innovation in 3D modeling, design automation, and simulation features that enhance product development cycles. The proliferation of electric vehicles, renewable energy systems, and industrial electronics is expanding design requirements across multiple sectors.

With growing R&D investments and digital transformation initiatives, Europe remains a hub for PCB design innovation, positioning the region for continued growth and competitiveness in the global electronic design ecosystem.

| Metric | Value |

|---|---|

| PCB Design Software Industry Analysis in Europe Estimated Value in (2025 E) | USD 287.9 million |

| PCB Design Software Industry Analysis in Europe Forecast Value in (2035 F) | USD 781.3 million |

| Forecast CAGR (2025 to 2035) | 10.5% |

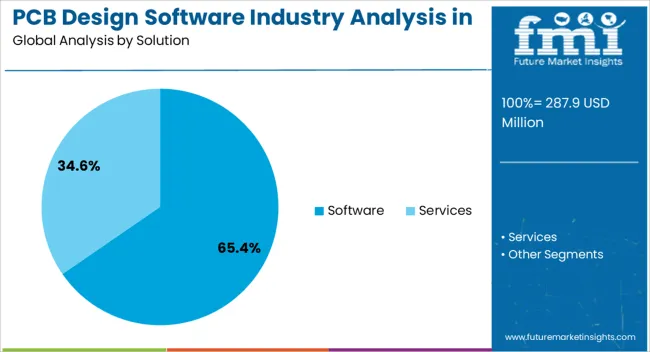

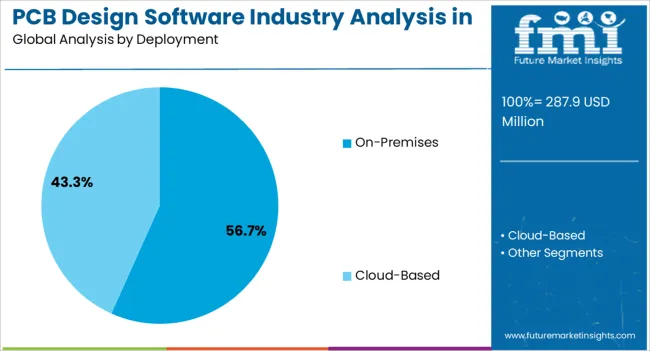

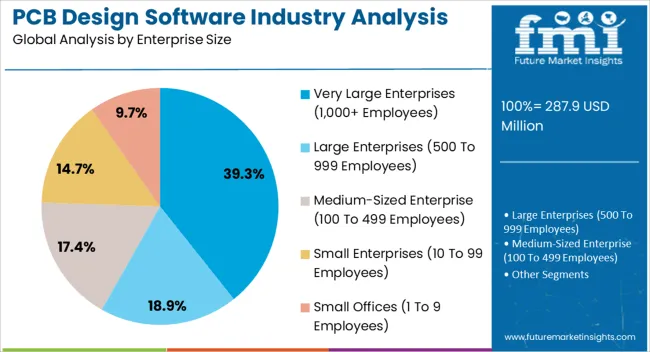

The market is segmented by Solution, Deployment, Enterprise Size, and Industry and region. By Solution, the market is divided into Software and Services. In terms of Deployment, the market is classified into On-Premises and Cloud-Based. Based on Enterprise Size, the market is segmented into Very Large Enterprises (1,000+ Employees), Large Enterprises (500 To 999 Employees), Medium-Sized Enterprise (100 To 499 Employees), Small Enterprises (10 To 99 Employees), and Small Offices (1 To 9 Employees).

By Industry, the market is divided into Electronics And Electrical, Telecommunications, Healthcare And Medical Devices, Automotive, Aerospace And Defense, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment leads the solution category with approximately 65.40% share, driven by the increasing demand for advanced electronic design automation tools that enhance productivity and design precision. These platforms integrate schematic capture, layout design, and signal integrity analysis into unified environments, streamlining complex workflows.

The segment’s growth is bolstered by the integration of cloud-based collaboration and AI-assisted optimization features, enabling faster prototyping and reduced design errors. With rising complexity in PCB architectures for automotive, aerospace, and consumer electronics applications, demand for sophisticated design software continues to expand.

The software segment is expected to maintain dominance as manufacturers prioritize digitalization and design efficiency.

The on-premises segment dominates the deployment category with approximately 56.70% share, reflecting the preference among large enterprises for data security, control, and system customization. On-premises solutions provide enhanced performance for complex, resource-intensive design tasks and ensure compliance with strict data protection regulations prevalent in Europe.

Enterprises with established IT infrastructure favor this model for long-term reliability and integration with existing engineering systems. Although cloud-based deployments are gaining attention, the on-premises segment remains prevalent among industries handling proprietary or defense-related designs.

With ongoing hardware advancements and cybersecurity priorities, this segment is expected to retain a strong presence in the PCB design software market.

The very large enterprises segment holds approximately 39.30% share in the enterprise size category, underscoring the concentration of demand among companies with extensive R&D and complex design operations. These organizations invest heavily in advanced PCB design platforms to support high-volume, precision-driven production.

The segment benefits from robust budgets, dedicated engineering teams, and the need for sophisticated simulation and validation tools. Large enterprises across automotive, aerospace, and telecommunications sectors are leading adopters, leveraging design software to accelerate innovation cycles and maintain competitive advantage.

As the complexity of electronic systems continues to increase, very large enterprises are expected to remain the primary revenue contributors in Europe’s PCB design software industry.

From 2020 to 2025, Europe’s PCB design software industry grew a CAGR of 9.4%, reaching an industry size of USD 287.90 million in 2025.

Europe’s PCB design software industry is expected to rise at a CAGR of 10.5% from 2025 to 2035.

The table presents the expected CAGR for Europe’s PCB design software industry over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the field is predicted to surge at a CAGR of 10.1%, followed by a slightly higher growth rate of 10.5% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to remain moderate to 10.5% in the first half and surge at 12.7% in the second half.

Semi-annual Insights

| Particular | Value CAGR |

|---|---|

| H1 | 10.1% (2025 to 2035) |

| H2 | 10.5% (2025 to 2035) |

| H1 | 10.5% (2025 to 2035) |

| H2 | 12.7% (2025 to 2035) |

The table below shows the estimated growth rates of the top four countries. France, the United Kingdom, and Germany are set to record high CAGRs of 12.0%, 10.4%, and 11.6% respectively, through 2035.

| Country | Value CAGR |

|---|---|

| Germany | 11.6% |

| Italy | 9.4% |

| United Kingdom | 10.4% |

| France | 12.0% |

Germany's PCB design software industry is expected to surge at a CAGR of 11.6% by 2035. This rising popularity is attributed to:

The PCB design software industry in the United Kingdom is anticipated to surge at 10.4% CAGR during the forecast period. Key factors influencing the industry include:

France's PCB design software industry is estimated to rise at a CAGR of 12.0%. Top factors supporting the industry’s expansion in the country include:

The section below shows the service segment leading in terms of solution. It is estimated to thrive at an 11.5% CAGR between 2025 and 2035. Based on industry, the electronics and electrical segment is anticipated to hold a dominant share through 2035. It is set to exhibit a significant CAGR during the forecast period.

| Solution | Value CAGR |

|---|---|

| Software | 8.6% |

| Services | 11.5% |

The service segment is expected to dominate the Europe PCB design software industry with a CAGR of 11.5% from 2025 to 2035. This segment captured a significant industry share in 2025 due to the high demand for loan software.

The industry for PCB design software in Europe is anticipated to be dominated by the electronics and electrical sectors. The segment held a significant industry share in 2025.

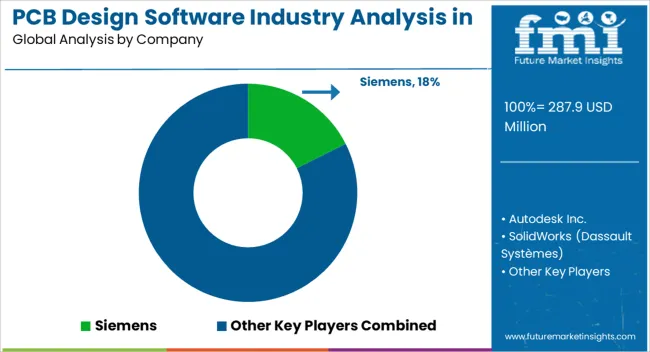

Europe’s PCB design software industry is competitive, with established players and start-ups vying for industry share. Key companies in the electronic design automation (EDA) sector offer comprehensive PCB design software tools, covering several functionalities such as schematic capture and layout design. Niche players also focus on specific aspects of PCB design or provide specialized solutions.

Key players invest in research & development, offering cutting-edge features and compatibility with technological advancements. They often engage in strategic partnerships and acquisitions to expand their product portfolios.

Start-ups introduce agile solutions, addressing industry challenges or emerging trends like artificial intelligence, machine learning, and cloud-based solutions. Leading companies adapt quickly to changing industry dynamics and provide tailored solutions to niche industries or specialized applications.

Open-source PCB design software solutions are gaining popularity, offering an alternative approach to traditional commercial software. The dynamic nature of the electronics industry and continuous technological advancements are prompting companies to remain responsive to emerging trends and customer demands.

Key Development:

In January 2025, Pulsonix signed an agreement with Accelerated Designs Inc. to provide Pulsonix users access to the Accelerated Designs Ultra Librarian for Pulsonix.

Key Player:

Dassault Systèmes SE, also known as 3DS, is a multinational software firm based in France that specializes in developing software for 3D product design, production, simulation, and related goods.

The global PCB design software industry analysis in europe is estimated to be valued at USD 287.9 million in 2025.

The market size for the PCB design software industry analysis in europe is projected to reach USD 781.3 million by 2035.

The PCB design software industry analysis in europe is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in PCB design software industry analysis in europe are software, _pcb layout software, _pcb schematic capture software, services, _pcb designing and engineering services, _consulting services and _support and maintenance services.

In terms of deployment, on-premises segment to command 56.7% share in the PCB design software industry analysis in europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PCB Connector Market Size and Share Forecast Outlook 2025 to 2035

PCB Vision Inspection Equipment for SMT Market Size and Share Forecast Outlook 2025 to 2035

PCB Design Software Market Analysis by Component, Deployment, Application, and Region Through 2035

Rigid-Flex PCB Market Size and Share Forecast Outlook 2025 to 2035

Multi-Axis PCB Drilling Machine Market Size and Share Forecast Outlook 2025 to 2035

Substrate-like PCB Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Designer Sneaker Market Forecast Outlook 2025 to 2035

Design Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Reference Designs Market Growth - Trends & Forecast 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Packaging Design And Simulation Technology

AI-powered Design Tools Market Insights - Growth & Forecast 2025 to 2035

Electronic Design Automation (EDA) Market

Second Hand Designer Shoes Market Trends – Growth & Forecast to 2035

SRAM and ROM Design IP Market Report - Growth & Industry Analysis 2025 to 2035

AI & AR-Powered Construction Design Apps for Seamless Planning

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA