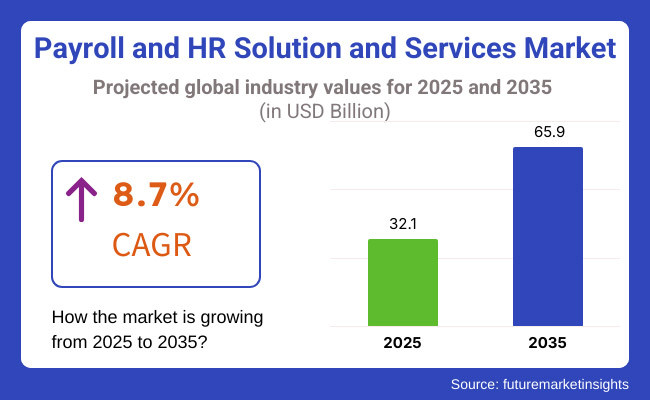

The payroll and HR solution and services market is projected to experience substantial growth by 2025, expanding from USD 32.1 billion to USD 65.9 billion by 2035 with a compound annual growth rate (CAGR) of 8.7%. Organizations are increasingly handing over payroll processing and HR functions to third-party vendors; thus, risk management has become a crucial element.

As businesses are turning to cloud-based payroll and HR solutions, the security and compliance concerns faced due to third-party integrations have become a major problem. Companies enjoy the advantage of automatic HR platforms being used to manage employee records, payroll taxes, and benefits that ensure data privacy and security.

The increasing probability of data breaches and cyber threats in payroll and HR systems is consequently increasing the demands for real-time risk monitoring and fraud detection solutions that are now being covered by organizations. Organizations are putting money into secure payroll platforms that offer continuous threat assessment and compliance tracking. The multi-factor authentication and blockchain technology feature that has been added is the reason behind this security measure, which lets payroll information stay safe from being penetrated by any cyber threats.

North America is the market it leads, mainly due to its strict labor laws, advanced payroll technologies, and high regulatory scrutiny. Globally, countries such as India and Australia are becoming popular centers for payroll and HR solutions due to the expansion of workforces, modification of job laws, and modernization of digital payroll. In the Asia-Pacific, companies are moving toward cloud-based payroll systems for the purpose of handling large workforces effectively, thus getting the payroll right on time and with accuracy.

The inclination towards cloud-based payroll and HR systems is a live example of Switch City, which has been the major market growth lever in recent years. Companies are progressively applying these techniques with the aim of streamlining the performance of their operations, cutting costs, and boosting data security. The cloud systems offer constructed-in scalability and flexibility, which allow businesses' culture to shift without big-cost beachfront infrastructure upgrades. For instance, a state agency converting payroll to the cloud lowered its work needs, operation costs, and processing time.

This movement incessantly made payroll operations smooth but, at the same time, halted the resources for a more strategic part. By 2030, the global cloud payroll and HR software market, which is taking the form of cloud-centric operation, is estimated to grow to over USD 61 billion following this route of development. The Federal Cloud Computing Strategy is a project pushed by the government that will strengthen the adoption of cloud computing in public sector payroll and HR systems by, among others, addressing issues of security, procurement, and workforce development.

Integrating payroll and HR solutions with existing business applications is pivotal for business processes to become more productive. This entails seamless connectivity, which allows the automatic exchange of data between systems, thus eradicating manual data entry, reducing errors, and making sure the data is always consistent among the platforms. The projects bring about real-time availability of critical information, which in turn accelerates informed decision-making and strategic planning.

Explore FMI!

Book a free demo

The fast growth of the global payroll and HR solutions and services industry can primarily be attributed to the digital transformation and the automation in workforce management that is happening at a very fast rate. Frontline enterprises have been focusing on automation, compliance, and system integration to help them streamline the complex payroll processes. Cost-effective and easily scalable solutions are the priorities of small and medium-sized enterprises (SMEs) as they look to digitize the HR and payroll processes along with cutting down on administrative tasks.

HR and payroll service suppliers concentrate on integrated, compliance-driven platforms to meet the varied needs of their clients, thus ensuring adherence to regulations in different countries. Self-service portals are preventive measures that allow employees to not only get a boost in the availability of payroll information but also take care of benefits and HR support on their own. One of the main changes happening in the pay and HR market is the switch to cloud solutions, AI human resource analytics, and mobile workforce management systems, which leads to better accuracy, flexibility, and security.

Contracts & Deals Analysis

| Company | Contract/Development Details |

|---|---|

| Edison Partners | Acquired payroll and HR software company Fingercheck for USD 115 million, aiming to expand services for "deskless" employees. |

| Paychex | Announced plans to acquire competitor Paycor HCM in a transaction valued at approximately USD 4.1 billion, aiming to enhance upmarket capabilities and AI-driven HR technologies. |

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Greater payroll processing complexity from changing tax regulations and labor laws. | Payroll compliance engines powered by AI manage compliance with changing labor laws across geographies. |

| Cloud-based HR systems and AI-based recruitment software adoption. | AI and blockchain-based employee identity verification and compensation optimization tools become standard. |

| Surge in demand for remote workforce management tools and digital time tracking solutions. | Fully autonomous workforce management platforms powered by AI and IoT ensure seamless remote and hybrid work environments. |

| HR solutions integrated AI-driven employee engagement analytics and mental health support programs. | Personalized AI-driven career coaching and predictive workforce analytics drive employee well-being and retention strategies. |

| Growing adoption of multi-factor authentication and secure payroll processing tools. | Blockchain-enabled payroll systems eliminate fraud risks, ensuring fully auditable transactions. |

| Rising adoption of automated HR and payroll software, digital workforce trends, and gig economy expansion. | Expansion driven by decentralized HR ecosystems, AI-powered workforce analytics, and the emergence of global digital payroll services. |

| Greater payroll processing complexity driven by changing tax legislation and workforce regulations. | AI-powered payroll compliance engines enable automation of compliance with dynamic labor laws across geographies. |

| Cloud-based HR platforms and AI-fueled recruitment tools gain adoption. | AI and blockchain-based employee identity verification and compensation optimization solutions become mainstream. |

The biggest potential threat in the payroll and HR solution market accounts for compliance with regulations. Payroll and HR services are invariably subject to the unique labor laws, tax regulations, and data protection policies of jurisdictions around the world. Legal and reputational consequences await violators, whether it's GDPR in European countries, FLSA in the USA, or labor laws elsewhere, such as in Asia. Regular regulatory updates and local compliance knowledge are the key requirements.

Payroll and HR systems deal with highly sensitive data that includes employees' salaries, benefits, and other personal details, meaning the threat of data security and privacy issues can stand out as a major risk factor. Identity theft, fraud, and legal liabilities can lead to cyber-attacks, data breaches, and ransomware assaults.

The software package from the AI-powered payroll and HR solutions should have the worker's acceptance of mechanization as one of the prerequisites. Many businesses, particularly in traditional industries, are demographically quite resistant to disconnecting from manual processes to plug into automated HR platforms out of fears of being replaced and being deprived of learning opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.6% |

| Germany | 8.6% |

| United Kingdom | 9.2% |

| Japan | 3.8% |

| Unites States | 7.5% |

The payroll and HR solution and services market in China is a department that is growing rapidly owing to factors like digital transformation, evolving labor laws, and a growing workforce. While companies are looking at cloud-based HR solutions, they are also ensuring that the solutions signed up for will help increase efficiency and compliance with complex tax and social security regulations. There are increasing Remote and Hybrid work models, which is also contributing to the demand for automated payroll systems. Also, integrating AI and big data makes HR decision-making even better. Driving the market growth is the influx of SMEs, foreign investments, and multinationals flocking to set up operations in India, precipitating the need for scalable and compliant HR solutions to manage payroll, benefits, and employee engagement. FMI anticipates China's industry to grow at a 9.6% CAGR during the forecast period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Rapid Digital Transformation | Cloud-based and AI-powered HR solutions are being used more and more. |

| Government Regulations & Compliance | The need for automated payroll solutions is being driven by stringent tax and labor legislation. |

The demand for payroll and HR solutions and services in Germany is being driven by stringent labor laws, rising digital transformation, and a streamlined workforce management process. Businesses use automated payroll processing to ensure compliance with complicated tax regulations and employment laws. Cloud-based human resource platforms, According to Salary Intel, are gaining popularity due to the growing trend of remote work coupled with a demand for real-time payroll processing. Moreover, the rise of the gig economy, the integration of AI in HR solutions, and data security issues under GDPR are driving the adoption of modern HR and payroll services across sectors. The German industry will expand at an 8.6% CAGR during the forecast period, according to FMI.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Tight Labor Regulations & Adherence | Businesses use automated payroll solutions to ensure compliance with complex employment rules |

| Cloud-Based Payroll and HR Solution Adoption | Cloud-based solutions are being used by businesses in order to improve scalability, efficiency, and real-time data access. |

The payroll and HR solution and services market in the UK is considerably growing owing to increasing regulatory complexity, digital transformation, and growing remote working. Businesses are adopting automated payroll systems to comply with changing tax laws and employment regulations. As companies search for more efficiency and higher employee engagement, AI and cloud-based HR platforms are a growing trend. A growing economy, data security concerns, and government initiatives focusing on the digitalization of payroll solutions further contribute to the demand for advanced HR and payroll services in the UK. The UK industry will grow at a 9.2% CAGR during the forecast period, according to FMI.

Growth Factors in UK

| Key Drivers | Details |

|---|---|

| Compliance & Regulatory Complexity | The need for automated payroll systems is driven by frequent changes to employment and tax legislation. |

| Cloud-Based Payroll and HR Solution Adoption | Businesses are switching to SaaS-based HR systems in order to increase productivity, scalability, and accessibility. |

The rapid digital transformation, challenging labor laws, and growing automation of HR processes can be identified as the main driving forces in the Payroll and HR Solution and Services Market in Japan. That is why the companies are moving towards the AI-based payroll solution to bring operational efficiency, decrease mistakes, and comply with strict protocol of employment rule. The growth of remote and hybrid working has driven demand for cloud-based HR platforms. Also, Japan's aging workforce and growing emphasis on workforce optimization is compelling businesses to adopt advanced payroll and workforce management systems in order to improve productivity and employee satisfaction. FMI anticipates Japan's industry to grow at a 3.8% CAGR during the study period.

Growth Factor in Japan

| Key Drivers | Details |

|---|---|

| Quick Digital Change | Payroll management systems powered by AI and the cloud are being used by businesses for accuracy and efficiency |

| Complicated Labor Laws and Adherence | Automated solutions are necessary to guarantee compliance with stringent employment requirements. |

AI can also be used in payroll systems to help minimize error while keeping costs down due to the complicated tax regulations and labor laws many employers are subject to. Demand for mobile-friendly HR platforms is growing in tandem as remote and hybrid work models become more prevalent. Moreover, the bifurcated gig economy, growing emphasis on employee experience, and data security trends are expected to be some of the prominent drivers for refinancing to advanced payroll and HR solutions in the USA The USA market is expected to expand at a 7.5% CAGR during the forecast period, according to FMI.

Growth Factor in USA

| Key Drivers | Details |

|---|---|

| Cloud-Based Payroll System Adoption | SaaS-based payroll and HR systems are becoming more popular among businesses due to their increased scalability and effectiveness. |

| Changing Labor Laws and Requirements for Compliance | The need for automated payroll solutions is fueled by complicated tax and employment laws. |

Digitalization has swept across the world, transforming payroll and human resources (HR) management, with cloud-powered tools emerging as an ever-present solution. Today, we process at a 80% lower cost because of the rise of cloud payroll systems in about 62% of companies during 2023. For small and medium-sized enterprises (SMEs) in particular, this shift is advantageous as they can leverage scalable, cloud-based platforms with a lower need for in-house IT infrastructure and better access to data from anywhere. It is anticipated that payroll and HR solution and services will expand at the fastest growth rate of at a CAGR 10.4% for 2025 to 2035 in this market under cloud based. These on-premise payroll and HR management use cases still represent a large segment of organizations where data control, flexibility, and compliance are the most important factors. Although cloud-based solutions are on the rise, a lot of enterprises, i.e. large companies with intricate HR processes in place, prefer on-premise systems as it gives them direct control over sensitive employee data as well as the ability to customize functionalities according to their business needs. The global payroll and HR solutions and services market was valued at around USD 31.0 billion in 2024, and on-premise deployment captures a considerable share of the market. The on-premise segment is projected to register a compound annual growth rate (CAGR) of 8.2% during the analysis period. Industries with stringent regulatory requirements and the need for increased data security measures often drive the preference for on-premise solutions. On-premise systems are also a common option for organizations operating in highly regulated industries like finance, healthcare, and government where compliance with local data protection regulations and minimizing data breach liability risk is critical.

Taking up a sizeable share of the payroll and HR solutions market, the Banking, Financial Services, and Insurance (BFSI) sector contributed around 21.48% of the market. This dominance is due to the integration of strict regulatory compliance requirements in the sector and the need for intricate management of payroll. HR payroll management software automates compliance tasks and with the help of HR payroll management software popular in the BFSI sector, the complexity of payroll processes is reduced and the risk of errors and penalties is also reduced. The BFSI segment is expected to take a significant 23.6% share in 2024 of the Payroll and HR Solution and Services market size. Firms, including Zellis and Dayforce, provide dedicated payroll and HR solutions to the specialized requirements of the BFSI sector and government organizations.

Payroll and Human Resources (HR) solutions market segmentation by vertical - the government sector is one of the major segments of the payroll and human resources (HR) solutions market as large workforces need to be efficiently managed and compliance to strict policies and regulations needs to be ensured. Government organizations perform detailed payroll processes, and the implementation of specialized HR payroll management software automates compliance tasks, reduces errors, and improves the overall performance system. It is automation like this that ensures timely and accurate salary payments, benefits management and regulatory reporting.

As governmental administrative requirements evolve and grow, countries around the world are transitioning to improved payroll and human resources solutions, making it easier and more transparent to run effectively. As an instance, worldwide market for payroll and HR solutions and services is projected to reach USD 50.4 billion by 2030, at a CAGR of 8.4% from 2024 to 2030. Dayforce provides complete payroll, HR, and workforce management solutions to government bodies to drive workforce productivity and efficiency. Their platform empowers public sector organizations to manage large workforces, navigate complex labor laws, and modernize people operations with technology. Competitive Outlook

The market for Payroll and HR Solutions & Services is fiercely competitive in nature, with forces at work encouraging massive cloud adoption, AI-powered automation, and rapidly changing regulatory compliance requirements. Businesses want solutions for payroll processing, workforce management and employee engagement that are scalable, secure, and integrated.

The market is dominated by big players offering end-to-end payroll automation, HR analytics, and global workforce management solutions. These big players are ADP, Workday, SAP SuccessFactors, Oracle HCM Cloud, and UKG (Ultimate Kronos Group). With an aim to gain enterprise-grade compliance automation, ADP and SAP SuccessFactors are on different tracks from those taken by workforce analytics and ERP integration via AI-fueled methods adopted by Workday and Oracle HCM Cloud.

The likes of Paychex, Ceridian, and Rippling are gaining space, focusing on cost-effective platforms that are cloud-native and suitable for small to mid-sized companies and mid-market players. The market continues to evolve with cross-border payroll solutions, predictive workforce analytics, and employee self-service platforms for hybrid and remote working models.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ADP | 18-22% |

| Workday | 12-16% |

| SAP SuccessFactors | 10-14% |

| Oracle HCM Cloud | 9-12% |

| UKG (Ultimate Kronos Group) | 7-11% |

| Other Companies (combined) | 25-35% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| ADP | Provides cloud-based payroll and HR solutions, integrating compliance management and workforce analytics. |

| Workday | Offers AI-driven Human Capital Management (HCM) solutions with real-time workforce insights and payroll processing. |

| SAP SuccessFactors | Delivers scalable HR and payroll solutions focusing on automation, compliance, and employee experience. |

| Oracle HCM Cloud | Provides comprehensive workforce solutions, including global payroll, AI-driven analytics, and talent management. |

| UKG (Ultimate Kronos Group) | Specializes in workforce management and payroll automation, prioritizing employee engagement and data security. |

ADP (18-22%)

A frontrunner in business with a powerful global focus, ADP is emphasizing the value of AI payroll automation and compliance solutions.

Workday (12-16%)

Proclaimed to be a unified HCM firm Workday also utilizes real-time data analytics to leverage its workforce planning and payroll operations.

SAP SuccessFactors (10-14%)

Cloud-based payroll integration is what they focus on, complemented with compliance and automation tools for businesses of all sizes.

Oracle HCM Cloud (9-12%)

Intense investment in predictive workforce analytics and worldwide payroll management using Artificial Intelligence and machine learning as a tool for the future.

UKG (Ultimate Kronos Group) (7-11%)

Workforce automation self-service remains as priority to ensure payroll and HR systems would work as seamless functionality.

Other Key Players (25-35% Combined)

In January 2025, Paychex announced that it intended to acquire competitor Paycor HCM in a transaction valued at around USD 4.1 billion. With this acquisition, Paychex expects to be better positioned to encompass an array of AI-enhanced HR technologies, thereby enhancing its longer-term growth prospects in the domain of payroll and HR solutions.

In December 2024, global HR platform Deel accomplished its fifth acquisition of the year by purchasing Assemble, a compensation management startup. This acquisition fosters Deel's product suite and proves the company's commitment to embedding new-age technologies into its solutions for the increasing appetite for holistic HR solutions.

The market is projected to witness a CAGR of 8.7% between 2025 and 2035.

The market is anticipated to reach USD 65.9 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 10.8% in the assessment period.

The key players operating in the industry include Intuit, Inc., Automatic Data Processing, Inc. (ADP), Jobvite, Inc., Sage Group plc, Kronos, Inc., SAP SE, Oracle Corporation, TriNet Group, Inc., Paychex, Inc., Paycom, Paycor, Inc., Paylocity, TMF Group B.V., Ultimate Software Group, Inc., and Ramco Systems Ltd.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.