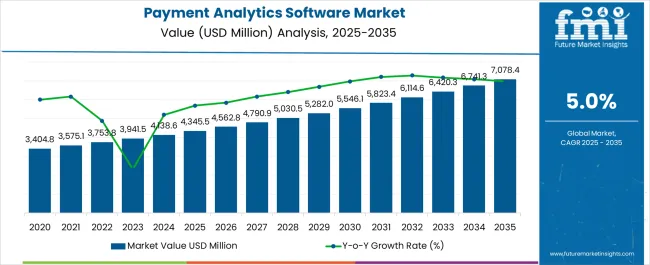

The Payment Analytics Software Market is estimated to be valued at USD 4345.5 million in 2025 and is projected to reach USD 7078.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Payment Analytics Software Market Estimated Value in (2025 E) | USD 4345.5 million |

| Payment Analytics Software Market Forecast Value in (2035 F) | USD 7078.4 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The payment analytics software market is experiencing strong growth driven by the rapid digitalization of financial transactions, expansion of e commerce, and the increasing need for real time insights into consumer behavior and transaction trends. Organizations are placing greater emphasis on fraud detection, payment optimization, and seamless user experiences, which has accelerated the integration of advanced analytics tools into financial systems.

The adoption of AI and machine learning algorithms has further enhanced predictive modeling, risk assessment, and customer profiling capabilities within payment analytics platforms. Regulatory frameworks aimed at strengthening financial transparency and compliance are also encouraging enterprises to deploy robust analytics solutions.

The outlook remains positive as businesses across industries prioritize intelligent payment processing systems that improve decision making, operational efficiency, and customer satisfaction.

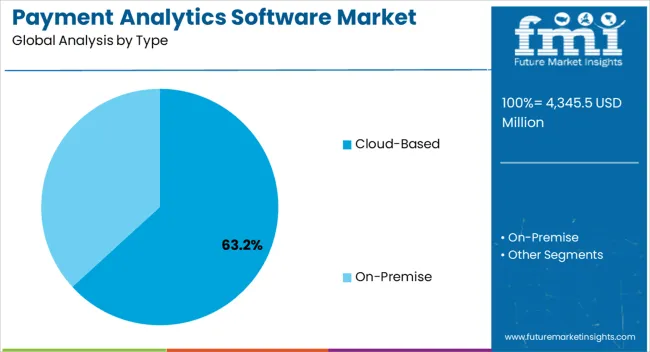

The cloud based segment is expected to hold 63.20% of the market by 2025 within the type category, positioning it as the leading segment. This growth is supported by its scalability, lower upfront infrastructure costs, and ease of integration with diverse financial platforms.

Cloud deployment enables real time data access, flexible resource management, and enhanced disaster recovery capabilities. Organizations have increasingly relied on cloud based solutions to manage global payment operations, given their capacity to deliver continuous updates, security enhancements, and seamless connectivity.

These advantages have consolidated the position of cloud based platforms as the most preferred model in payment analytics software adoption.

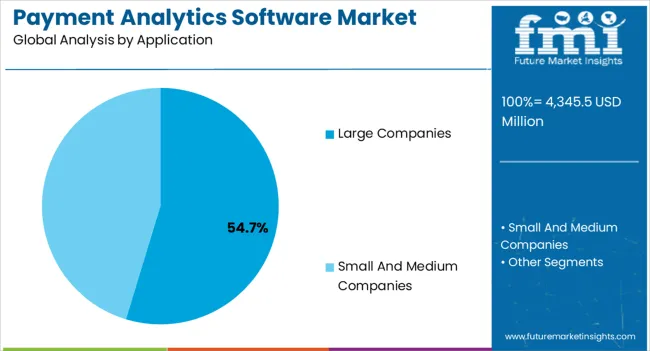

The large companies segment is projected to account for 54.70% of market revenue by 2025 within the application category, making it the dominant segment. This prominence is driven by the ability of large enterprises to invest heavily in advanced payment infrastructure and analytics platforms that enhance operational oversight and efficiency.

The volume and complexity of transactions managed by these organizations necessitate sophisticated tools capable of ensuring fraud detection, regulatory compliance, and optimized cash flow management. Additionally, large companies are increasingly focused on leveraging analytics to strengthen customer insights, loyalty programs, and global payment strategies.

This demand for advanced, scalable, and integrated solutions has established large companies as the primary drivers of growth within the payment analytics software market.

The growth in customer interaction touch points due to omnichannel and multichannel integration means businesses are attempting to use technology to cope while also enhancing customer service. Scalable technology is the need of the hour, as companies increase their investments in software and solutions.

According to a study, customer satisfaction rose 5%-10%, customer retention by over 10%, and operating costs witnessed a 15-20% decline after the adoption of advanced payment analytics.

Analyzing customer patterns is necessary for better Customer Relationship Management. Through a deeper understanding of consumer patterns, businesses understand their needs and preferences. A business monitors purchases to understand exactly how each of its products is performing over time across trend cycles and payment channels.

Using estimates of values each type of consumer brings, firms narrow down on which segments are driving revenue, and focus on targeting consumers in segments that lend the most value to their organizations.

Statistics show that nearly 70% of shopping carts end up abandoned. Payment analytics minimize the shopping cart abandonment rate by understanding what the problem is, by measuring the change in abandonment and sales across campaigns.

Analytics also help understand which transactions have higher chances of leading to transaction fraud, such as friendly fraud or false disputes, so companies know where to target their efforts.

Banks deal with very large amounts of payments for a significantly wide range of clients, ranging from businesses to individual consumers. Banks are looking to use data insights to convert these masses of data into insights in order to identify revenue streams. They require the automation of systems, since the volume of data they process is far too large to process manually.

The improvements in technology are expected to be the key driver for the market, since the sheer volume of payments data banks process on a daily basis is so high that its processing to gain insights has historically been a challenge. This helps banks identify which of their service offerings are efficient, which is outdated, and where new offerings are required.

The assigning of risk to customers is also improved by the use of analytics software. In traditional methods, customers are put into broad categories based on how high or low risk they are deemed to be based on data. However, analytics ensure access to far deeper insights into consumer behavior. Through it, banks create more individualized categories and assign the right agents and techniques as required.

| Countries | Market Share (2025) |

|---|---|

| United States | 16.5% |

| Germany | 5.4% |

| Japan | 4.3% |

| Australia | 2.7% |

Large companies dominated the payment analytics sector, with a share of 61.2% in 2025. Large companies are the top application for payment analytics, having witnessed a CAGR of 4.8% during 2020 to 2025, with a forecast CAGR of 4.6%.

While it does have several benefits, Payment Analytics requires a high amount of resources and sophisticated expertise. Furthermore, it is most beneficial to organizations that deal with large data flows and require automation to process the sheer volume of data generated on a daily level.

Europe is an emerging market for demand, with a 22.1% market share in 2025 and predicted market size of USD 1,300 million by 2035. In Europe, there has been a revision in the Payment Services Directive or PSD2, which places the weight of responsibility for fraud on payment providers. This means that payment analytics is now a need for any organization that does not want to bear the burden of any fraud.

The United States accounted for over 34% of the global market in 2024. The United States has a USD 4345.5 million absolute dollar opportunity between 2025 and 2035, and a forecast market size of USD 1,900 million by 2035 at a 4.5% CAGR.

More than 60% of the global market share for digital wallets was owned by the ownership section of United Kingdom IT businesses. Payment analytics software growth is anticipated to be fueled by rising expenditures made in digital wallet innovation by technology businesses to provide clients a safe and convenient way to perform financial transactions.

As the use of internet-enabled mobile devices increases and internet traffic increases, consumers are turning to their mobile devices to complete a variety of financial activities. Due to all these factors, the United Kingdom is expected to have a CAGR of 4.3% by 2035.

On-premise, deployment grows significantly in the Payment Analytics Software demand, with a historic CAGR of 11.4% and a forecast CAGR of 4.8% in 2025 to 2035. Due to the sensitive nature of payment data, businesses concerned about safety tend to prefer on-premise software. On-Premise software allows data to stay within an organization.

Cloud-based type dominated the market with a share of 65.5% in 2025. Organizations often prefer to keep their data on-premise due to concerns about storing their data in the cloud, which other organizations also access parallel. Cloud-based analytics, however, is the emerging trend due to its collaborative capacity, speed, and cost advantages.

There is a gradual shift to the cloud as security improvements of cloud-based systems increase, but organizations with sensitive information continue to prefer on-premise forms until the technology is more mature.

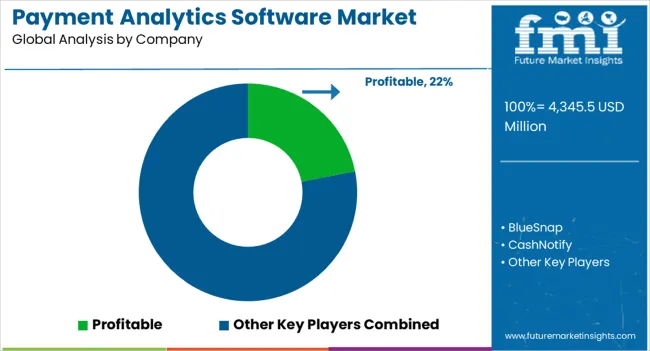

Rival Companies Compete & Invest in Research and Development to Stay Ahead in the Market

At present, Payment Analytics Software providers are focused on developments that make it cheaper to handle larger and larger amounts of data, as well as on the more insightful analysis of collected data.

Recent Developments:

The global payment analytics software market is estimated to be valued at USD 4,345.5 million in 2025.

The market size for the payment analytics software market is projected to reach USD 7,078.4 million by 2035.

The payment analytics software market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in payment analytics software market are cloud-based and on-premise.

In terms of application, large companies segment to command 54.7% share in the payment analytics software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Payment Bank Solutions Market Size and Share Forecast Outlook 2025 to 2035

Payment Processing Solutions Market Size and Share Forecast Outlook 2025 to 2035

ePayment System Market Analysis by Component, Deployment, Enterprise Size, Industry, and Region through 2025 to 2035

B2B Payments Platform Market

Mobile Payment Transaction Market Analysis – Growth, Applications & Outlook 2025 to 2035

Crypto Payment Gateways Market Insights - Trends & Growth 2025 to 2035

Mobile Payment Data Protection Market Trends – Growth & Demand 2024-2034

Mobile Payment Security Market Insights – Growth & Demand 2024-2034

Secure & Seamless Digital Payments – AI-Powered Payment Gateways

Mobile Payment Technologies Market

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Instant Payments Market Size and Share Forecast Outlook 2025 to 2035

The global QR code payment market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Biometric Payment Cards Market Size and Share Forecast Outlook 2025 to 2035

3D Secure Payment Authentication Market Insights by Components, Application, and Region - 2025 to 2035

Electronic Payment System For Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Payments Market Size and Share Forecast Outlook 2025 to 2035

In Vehicles Payment Market Size and Share Forecast Outlook 2025 to 2035

Contactless Payment Market

Contactless Payment Terminals Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA