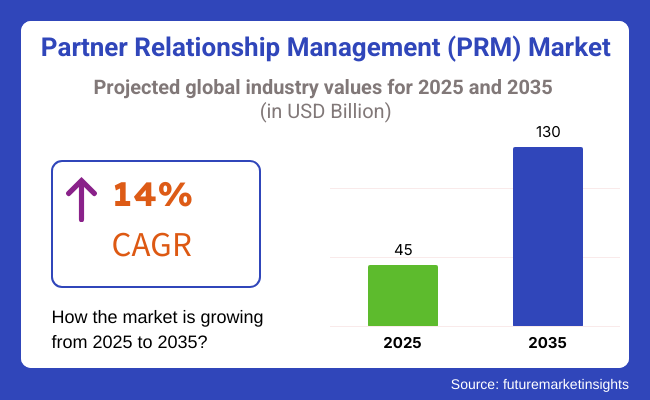

The market will reach USD 45 billion in 2025 and expand to USD 130 billion by 2035, reflecting a CAGR of 14.0% during the forecast period. Companies are increasingly leveraging AI-driven Partner Relationship Management (PRM) solutions, cloud-based PRM platforms, and real-time analytics tools to boost channel partner engagement and optimize business partnerships. Furthermore, investment in automated partner onboarding, data-driven performance monitoring, and partner ecosystem development will drive growth.

Companies apply Partner Relationship Management to unify partner communication, augment sales enablement, and provide central management of partner information in various sectors such as IT, telecom, manufacturing, and retail. The amalgamation of AI-based partner analytics, blockchain-based secured transactions, and IoT-driven partner monitoring will heighten real-time collaboration and decision-making.

Furthermore, the increasing adoption of automated deal registration, incentive management, and AI-powered partner segmentation is revolutionizing the PRM environment. Organizations are using PRM solutions to enhance partner lifecycle management, automate indirect sales processes, and generate revenue across various industries.

The partner relationship management (PRM) market is adapting very quickly as firms are looking for productive associations with distributors, resellers, and strategic partners. In the IT and telecom sectors, PRM solutions primarily center on the integration of CRM systems, analytics, and automation for the purpose of facilitating partner engagement.

Retail & e-commerce lend more weight to customization and scalability rather than basic features to cater to multi-tier distribution networks and loyalty programs. Healthcare establishments practice PRM for compliance tracking, partnership relations with medical suppliers, and collaboration with healthcare providers that stress the importance of data security and privacy.

The finance and banking sectors utilize PRM for risk assessment, compliance, and partner performance tracking, which are typically achieved through advanced analytics and reporting capabilities. In the domain of manufacturing, PRM is utilized mainly for the visibility of the supply chain, training of partners, and performance evaluation.

Across the sectors, PRM is normally taken up because of AI-driven automation, cloud-based platforms, and real-time analytics, which are the prerequisites for businesses, in the first place, to optimize their partnerships, improve their channel performance, and, in turn, increase profits.

| Company | Contract Value (USD Million) |

|---|---|

| Salesforce and Impartner | Approximately USD 500 - 550 |

| Oracle and Magentrix | Approximately USD 700 - 750 |

| Zift Solutions and Microsoft | Approximately USD 400 - 450 |

In March 2024, Salesforce and Impartner formed a strategic partnership valued at approximately USD 500 - 550 million to integrate advanced PRM solutions into Salesforce's platform, enhancing channel management capabilities for its users. In July 2024, Oracle acquired Magentrix for an estimated USD 700 - 750 million, aiming to expand its PRM offerings and provide comprehensive partner collaboration tools within its ecosystem.

Later, in October 2024, Zift Solutions and Microsoft entered into a partnership worth approximately USD 400 - 450 million to deliver integrated PRM solutions, facilitating seamless partner engagement and management for their mutual clients. These developments reflect a growing trend, with major technology companies investing in strategic partnerships and acquisitions to enhance their partner management capabilities and offer more integrated solutions to their clients.

Between 2020 and 2024, the PRM market expanded as companies deployed cloud-based systems to enable partner collaboration and sales productivity. AI and ML-powered PRM offerings increased predictive analytics, lead management automation, and partner personalized engagement.

The COVID-19 crisis expedited PRM adoption to remotely manage partners and virtually empower sales. While it was integration-prone with ERP and CRM systems, businesses invested in blockchain-secured solutions to offer stronger security for data and loyalty to partners.

Predictive analytics using AI, blockchain, and quantum-resistant data management by 2025 to 2035 will transform PRM. AI-driven platforms will onboard partners, handle compliance, and reward partners on their own. Blockchain will facilitate intelligent contracts for effortless tracking of commission and revenue shares.

Quantum computation will encrypt communications and transactions by partners. PRM based on the metaverse will provide digital partner training and sales simulations and AI-driven ESG analytics connecting partner networks and sustainability objectives.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| More stringent regulations (GDPR, CCPA) necessitated PRM solutions to provide secure data handling, consent-based tracking, and compliance auditing. | AI-powered, blockchain-protected PRM platforms provide real-time regulatory compliance, decentralized partner authentication, and automated, tamper-proof audit trails for transparent partner management. |

| AI-driven PRM technologies optimized partner segmentation, lead routing automation, and predictive analytics for measuring performance. | AI-born, self-adaptive PRM environments dynamically improve partner interactions, forecast sales potential, and deliver AI-driven automated partner lifecycle management. |

| Companies moved their operations to cloud-based PRM platforms for remote collaboration by partners, elastic access to data, and seamless integration with CRM and ERP systems. | AI-enhanced, decentralized PRM architectures provide real-time cloud-to-edge synchronization, AI-driven predictive insights, and automated performance optimization for seamless partner collaboration. |

| Firms incorporated PRM solutions on digital channels, such as social media, marketplaces, and automated marketing platforms. | Real-time omnichannel PRM solutions supported by AI enable AI-powered personalized partner communication, real-time engagement analytics, and AI-powered predictive content recommendations. |

| PRM platforms integrated AI-powered learning modules and gamified training programs to improve partner enablement. | AI-native, immersive PRM training platforms facilitate real-time, adaptive learning, AI-powered certification tracking, and interactive, gamified partner engagement models. |

| Firms utilized AI-enabled PRM analytics to improve revenue forecasting and fine-tune partner-driven revenue initiatives. | AI-enabled, intent-driven PRM systems offer real-time analysis of partner activity, AI-powered deal scoring, and prescriptive sales insight for hyper-personalized partner management. |

| AI-enabled security environments guaranteed end-to-end encrypted transactions of partner data, blocking illegal access and fraudulent activities. | AI-born, quantum-safe PRM solutions automatically detect data breaches, apply real-time security policies, and provide tamper-proof, AI-powered partner collaboration. |

| 5G-enabled PRM platforms improved real-time partner communication, virtual collaboration, and cloud-based data exchange. | AI-driven, 6G-powered PRM solutions enable ultra-high-speed, real-time partner collaboration, AI-driven workflow automation, and predictive relationship management for global companies. |

| Organizations optimized PRM infrastructure to reduce data processing power consumption and increase sustainability. | AI-driven, carbon-aware PRM solutions harness energy-efficient cloud computing, AI-driven resource management, and predictive workload balancing for green partner relationship management. |

| Organizations investigated blockchain-based PRM solutions for transparency in partner contracts and fraud prevention. | Decentralized PRM platforms with AI capabilities facilitate partner transactions via smart contracts, trustless agreement enforcement, and real-time verification of partner performance via AI. |

The partner relationship management market has been unveiling different trade sector challenges as logistics security, integration challenges, changing regulatory requirements as well as partner engagement issues. There is an overwhelming need for businesses to PRM solutions, such as delegating sales channels, adding communication, and trimming off ineffective partners; therefore, making the decision of whether to take risks is necessary for both growth and operational efficiency.

Data security and privacy threats remain one of the biggest challenges occurring in the data security and privacy risks. Partner relationship management platforms are web-based and for this reason are vulnerable to hacking even if they offer protection to thanks to traffic encryption.

A lack of robust cybersecurity measures is the primary factor for data breaches, system vulnerabilities, unauthorized access, and non-compliance with privacy regulations like GDPR and CCPA. Encryption, role-based access controls, and ongoing security audits are vital elements that organizations should activate.

Regulatory compliance is another reason why people are left in a daze. One of the major things that partner relationship management platforms have to do is abide by the requirements imposed by data protection laws, financial regulations, and other industry compliance rules. Failing to act according to the rules, be it intentionally or unintentionally, is what causes a business to seek the legal system in order to protect its reputation.

To address the issues, enterprises need to embrace secure, scalable, and user-friendly platforms built on AI-powered automation, compliance-ready frameworks, and seamless third-party integrations. Long-term success can be achieved through clear partner incentive programs, real-time monitoring of performance, and strategic partner engagement initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 11.2% |

| The UK | 10.9% |

| European Union | 11% |

| Japan | 10.8% |

| South Korea | 11.4% |

The USA Partner Relationship Management (PRM) market is increasing steadily, with companies adopting AI-driven platforms to facilitate collaboration, automate partner onboarding, and simplify sales performance. Companies develop cloud-based PRM platforms for real-time channel communication, business process automation, and enhanced partner interaction.

The need for data-driven decision-making, predictive analytics, and automated partner management drives growth. The manufacturing, technology, and retail sectors primarily use PRM solutions to optimize channel performance and accelerate revenue. Regulatory policies also compel companies to invest in compliant, scalable, and secure PRM platforms.

FMI is of the opinion that the USA market is slated to grow at 11.2% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| AI-based PRM adoption | Corporations use AI to automate and optimize partner interaction and selling strategies. |

| Cloud PRM solutions | Corporates use scalable, flexible, cloud-based PRM solutions to drive communication and productivity optimization. |

| Regulatory policies | Regulatory needs require expenditure on secure and standardized PRM systems. |

| Predictive analytics | Companies apply data analytics to forecast sales trends and make better choices. |

The UK PRM market is growing as businesses adopt AI-based platforms for partner collaboration automation, sales enablement, and performance management. Businesses prefer cloud-based PRM solutions with increased transparency, report automation, and improved partner retention.

The increased use of digital partner portals and AI-based engagement strategies propel the industry. Security and compliance-based regulatory needs further drive PRM adoption across industries, enabling businesses to offer secure and productive partner relationships.

FMI is of the opinion that the UK market is slated to grow at 10.9% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| AI-based PRM systems | Firms leverage AI to enhance collaboration and automate workflows. |

| Partner portals across the Internet | Companies utilize web-based portals for better communication and sales visibility. |

| Data security policies | Regulatory compliance in the UK compels corporations to invest in secure PRM technology. |

| Automated reporting | Companies use PRM technology for enhanced visibility and efficiency. |

The PRM market in the European Union is continuously expanding with the implementation of AI-based partner engagement, real-time analytics, and automated sales management capabilities.

Germany, France, and Italy lead the adoption of PRM in the technology, healthcare, and finance sectors. The European Union's strong data protection regulations compel companies to invest in GDPR-compliant PRM software. Increasing adoption of cloud computing and AI-driven partner analytics further encourages the implementation of PRM solutions across industries.

FMI is of the opinion that the European Union market is slated to grow at 11% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| AI-enabled engagement | Companies use AI-driven analytics to enhance partner performance. |

| Compliance with GDPR | Strict data protection laws drive investment in secure PRM solutions. |

| Emerging growth for cloud computing | Companies adopt cloud-based PRM for scalability and cost-efficiency. |

| Industry-wide adoption | PRM solutions have gained traction in the technology, finance, and healthcare sectors. |

Japan's PRM market is expanding as companies adopt AI-driven partner collaboration platforms, automated contract management systems, and performance monitoring solutions. Businesses invest in best-of-breed PRM products to increase channel revenues, improve partner education, and enhance customer communication.

Japan's business digitalization and efficiency-oriented strategies support the adoption of future-proof PRM products. Telecommunications, consumer electronics, and IT services industries drive growth through cloud-based PRM adoption, ensuring scalability and partner membership management.

FMI is of the opinion that the Japanese market is slated to grow at 10.8% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI-powered partner technologies | Companies employ AI collaboration tools for higher interaction. |

| Automation of contract management | Businesses adopt automated processes for compliance and efficiency. |

| Digitalization by government and companies | The government and corporations promote PRM adoption. |

| Investment in industries | IT, telecommunications, and electronics industries implement PRM applications. |

South Korea's PRM market is developing rapidly as companies embrace AI-based PRM solutions, real-time performance tracking, and cloud-partner collaboration platforms. Government support for digitalization fuels PRM adoption across industries.

Companies leverage predictive analytics, automated partner onboarding, and blockchain-based contract management to strengthen partner relationships and revenue streams. Additionally, increased 5G connectivity and real-time data analysis further drive expansion.

FMI is of the opinion that the South Korean market is slated to grow at 11.4% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| AI-based PRM adoption | Firms implement AI-driven platforms for greater efficiency. |

| Government policies | Government digitalization efforts encourage PRM investments. |

| Blockchain applications | Companies utilize blockchain to secure contracts. |

| 5G and real-time analytics | Enhanced connectivity boosts PRM capabilities. |

The integrated software segment is anticipated to hold a share of 63.5% of the overall share by 2025, as enterprises prefer comprehensive solutions to manage their partnerships in a single platform. PRMs are integrated, which means they have seamless integration with CRMs, automated onboarding processes for partners, efficient deal registration, and real-time tracking of partner performance, making them suitable for large enterprises with complex partner networks.

As companies expand their global collaborations, centralized AI-improved PRM platforms are becoming increasingly essential. The cloud-based integrated solutions are the most managed in the Unicore Collaboration Platform market, which includes Salesforce and Microsoft Dynamics 365, and need profit enablement.

Based on industry verticals, IT & Telecom, BFSI, and manufacturing emerged as the key segments, and there is a growing demand for integrated PRM platforms with increased adoption of AI-based analytics, automation, and API integrations.

In 2025, 36.5% of the total share will occupy standalone PRM software, with SMEs typically favoring lower-cost, domain-specific technologies. Standalone PRM software isn't integrated or all that powerful relative to integrated PRM platforms, targeting individual features like lead management, partner training, or incentive tracking, making this a decent option for companies with a low number of partners.

Standalone PRM tools are deployed by increasing numbers of industries, including retail, consumer goods, and healthcare, for everything ranging from channel management to partner loyalty programs to sales automation. Some of the key players in this segment are vendors such as Impartner, Zift Solutions, and Channeltivity, who provide scalable, customizable PRM solutions tailored to address different business needs.

The rise in complexities in channel partnerships, reseller networks, and cloud service providers is expected to enable IT & Telecom to have a 38% share by 2025. As tech companies grow their partner programs, they require AI-driven PRM solutions to automate deal management, partner enablement, and co-selling opportunities.

Given current trends toward subscription-strength services (cloud platforms), IoT and 5g deployments, etc., telecom companies are using the PRM platform to help them manage distributor relationships and optimize indirect sales. Key players leverage PRM solutions like those from Cisco, HP, and Dell to drive channel performance and enable real-time analytics and personalized partner experiences.

The retail industry will lead, capturing 25.6% of the PRM market by 2025, particularly because of the rise of e-commerce, omnichannel strategy, and distributor relationships. As the networks of suppliers, wholesalers, and resellers expand, the need to manage incentive programs, sales commissions, and partner marketing campaigns is skyrocketing the demand for PRM software among retailers.

Both retailers are using artificial intelligence (AI)-powered PRM solutions to get real-time insights into partner performance, optimize demand forecasting, and better engage their customers. To drive innovation, leading PRM players like SAP, Salesforce, Adobe Experience Cloud, etc., have catered to this segment by providing tightly integrated PRM tools to facilitate supplier collaboration, improve sales channel efficiency, etc.

The PRM industry is expected to gain momentum as enterprises focus more on digital collaboration, including channel sales optimization and partner ecosystem engagement. Increasing dependence on indirect sales and shifts toward cloud-based partner management solutions are the primary growth factors.

Key leaders like Salesforce, Microsoft, and Oracle, along with newer entrants like Impartner and Zift Solutions, dominate the competitive landscape with integrated PRM platforms, AI-powered analytics, and automated partner engagement tools. Some emerging startups and niche players are focusing their energies on building industry-specific partner enablement solutions, co-marketing automation, and personalized partner experiences. This is going to add more steam to the competition.

Industry evolution is driven by improved AI-driven partner insights, self-service partner portals, and predictive analytics for deal forecasting. A parallel trend emerging from these developments is the increasing demand for seamless integration with CRM, marketing automation, and ERP systems.

Strategic factors affecting the competitive arena include differentiation through AI-powered partner scoring, incentive automation, and real-time collaboration tools. Companies that provide scalable, customizable, and data-driven PRM solutions are gaining a competitive edge, ensuring continuous growth and transformation of the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Salesforce PRM | 20-25% |

| Oracle Partner Relationship Management | 15-20% |

| Microsoft Dynamics 365 PRM | 12-17% |

| Impartner PRM | 8-12% |

| Zift Solutions | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Salesforce PRM | Offers AI-based partner portals, deal registration automation as well as incentive management solutions. |

| Oracle Partner Relationship Management | The future of PRM solutions is cloud-based; in addition to partner analytics using insights from data, automated collaboration is another part of PRM. |

| Microsoft Dynamics 365 PRM | Focusing on automated engagement for partners, workflow automation alongside sales tracking in real-time. |

| Impartner PRM | Channel partner management, automation in partner onboarding and acceleration in deals are the key differentiators. |

| Zift Solutions | Offers PRM along with integration with marketing automation, sales enablement tools, and performance analytics. |

Key Company Insights

SalesforcePRM (20-25%)

This is a key leader utilizing AI technology for partner management, automated incentive programs, and real-time sales analytic optimization of the distribution channel.

Oracle Partner Relationship Management (15-20%)

Oracle draws insight for partner engagement from its cloud-based PRM solutions, data-driven insights, and AI-powered collaborative capabilities.

Microsoft Dynamics 365 PRM (12-17%)

Microsoft Dynamics 365 PRM specializes in automated partner workflows, enabling real-time partner sales tracking and AI-powered performance management applications.

Impartner PRM (8-12%)

Impartner PRM aids channel partner efficiency through automated onboarding, deal registration, and AI-enhanced sales enablement.

Zift Solutions (5-9%)

Zift Solutions provides integrated PRM solutions comprising marketing automation, sales enablement, and real-time partner analytics.

Other Key Players (20-30% Combined)

By type, the industry is segmented into integrated software and standalone software.

By deployment mode, the market is categorized into on-premises PRM software and cloud-based PRM software.

By enterprise size, the market covers small and midsized enterprises (SMEs) and large enterprises.

By industry, the market includes IT & telecom, retail, government, healthcare, BFSI, manufacturing, and others.

By region, the market spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

The industry is slated to reach USD 45 billion in 2025.

The industry is predicted to reach a size of USD 130 billion by 2035.

Some major key players include Salesforce PRM, Oracle Partner Relationship Management, Microsoft Dynamics 365 PRM, Impartner PRM, Zift Solutions, ChannelXperts, Magentrix, Allbound, and PartnerStack.

South Korea, with a projected CAGR of 11.4% from 2025 to 2035, is expected to witness the fastest growth in the industry.

Integrated software solutions are among the most widely used in the industry.

Table 1: Global Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 2: Global Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 3: Global Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 4: Global Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 5: Global Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 6: Global Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 7: Global Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 8: Global Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 9: Global Market Value (US$ Million) Analysis (2018 to 2022) By Region

Table 10: Global Market Value (US$ Million) Forecast (2023 to 2033) By Region

Table 11: North America Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 12: North America Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 13: North America Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 14: North America Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 15: North America Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 16: North America Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 17: North America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 18: North America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 19: North America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 20: North America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 21: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 22: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 23: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 24: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 25: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 26: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 27: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 28: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 29: Latin America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 30: Latin America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 31: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 32: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 33: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 34: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 35: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 36: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 37: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 38: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 39: Europe Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 40: Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 41: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 42: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 43: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 44: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 45: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 46: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 47: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 48: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 49: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 50: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 51: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 52: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 53: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 54: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 55: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 56: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 57: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 58: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 59: East Asia Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 60: East Asia Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 61: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 62: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 63: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 64: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 65: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 66: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 67: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 68: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 69: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 70: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) by Country

Figure 1: Global Market Size (US$ Million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 2: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 3: Global Market Value (US$ Million), 2018 to 2022

Figure 4: Global Market Value (US$ Million), 2023 to 2033

Figure 5: Global Market Value Share Analysis (2023 to 2033) By Type

Figure 6: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 7: Global Market Attractiveness By Type

Figure 8: Global Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 9: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 10: Global Market Attractiveness By Deployment Mode

Figure 11: Global Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 12: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 13: Global Market Attractiveness By Enterprise Size

Figure 14: Global Market Value Share Analysis (2023 to 2033) By Industry

Figure 15: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 16: Global Market Attractiveness By Industry

Figure 17: Global Market Value Share Analysis (2023 to 2033) By Region

Figure 18: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Region

Figure 19: Global Market Attractiveness By Region

Figure 20: North America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 21: Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 22: Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 23: East Asia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 24: South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 25: Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 26: North America Market Value (US$ Million), 2018 to 2022

Figure 27: North America Market Value (US$ Million), 2023 to 2033

Figure 28: North America Market Value Share Analysis (2023 to 2033) By Type

Figure 29: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 30: North America Market Attractiveness By Type

Figure 31: North America Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 32: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 33: North America Market Attractiveness By Deployment Mode

Figure 34: North America Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 35: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 36: North America Market Attractiveness By Enterprise Size

Figure 37: North America Market Value Share Analysis (2023 to 2033) By Industry

Figure 38: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 39: North America Market Attractiveness By Industry

Figure 40: North America Market Value Share Analysis (2023 to 2033) by Country

Figure 41: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 42: North America Market Attractiveness by Country

Figure 43: USA Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 44: Canada Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 45: Latin America Market Value (US$ Million), 2018 to 2022

Figure 46: Latin America Market Value (US$ Million), 2023 to 2033

Figure 47: Latin America Market Value Share Analysis (2023 to 2033) By Type

Figure 48: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 49: Latin America Market Attractiveness By Type

Figure 50: Latin America Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 51: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 52: Latin America Market Attractiveness By Deployment Mode

Figure 53: Latin America Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 54: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 55: Latin America Market Attractiveness By Enterprise Size

Figure 56: Latin America Market Value Share Analysis (2023 to 2033) By Industry

Figure 57: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 58: Latin America Market Attractiveness By Industry

Figure 59: Latin America Market Value Share Analysis (2023 to 2033) by Country

Figure 60: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 61: Latin America Market Attractiveness by Country

Figure 62: Brazil Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 63: Mexico Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 64: Rest of Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 65: Europe Market Value (US$ Million), 2018 to 2022

Figure 66: Europe Market Value (US$ Million), 2023 to 2033

Figure 67: Europe Market Value Share Analysis (2023 to 2033) By Type

Figure 68: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 69: Europe Market Attractiveness By Type

Figure 70: Europe Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 71: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 72: Europe Market Attractiveness By Deployment Mode

Figure 73: Europe Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 74: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 75: Europe Market Attractiveness By Enterprise Size

Figure 76: Europe Market Value Share Analysis (2023 to 2033) By Industry

Figure 77: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 78: Europe Market Attractiveness By Industry

Figure 79: Europe Market Value Share Analysis (2023 to 2033) by Country

Figure 80: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 81: Europe Market Attractiveness by Country

Figure 82: Germany Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 83: Italy Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 84: France Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 85: United Kingdom Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 86: Spain Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 87: BENELUX Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 88: Russia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 89: Rest of Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 90: South Asia & Pacific Market Value (US$ Million), 2018 to 2022

Figure 91: South Asia & Pacific Market Value (US$ Million), 2023 to 2033

Figure 92: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Type

Figure 93: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 94: South Asia & Pacific Market Attractiveness By Type

Figure 95: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 96: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 97: South Asia & Pacific Market Attractiveness By Deployment Mode

Figure 98: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 99: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 100: South Asia & Pacific Market Attractiveness By Enterprise Size

Figure 101: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Industry

Figure 102: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 103: South Asia & Pacific Market Attractiveness By Industry

Figure 104: South Asia & Pacific Market Value Share Analysis (2023 to 2033) by Country

Figure 105: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 106: South Asia & Pacific Market Attractiveness by Country

Figure 107: India Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 108: Indonesia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 109: Malaysia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 110: Singapore Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 111: Australia& New Zealand Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 112: Rest of South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 113: East Asia Market Value (US$ Million), 2018 to 2022

Figure 114: East Asia Market Value (US$ Million), 2023 to 2033

Figure 115: East Asia Market Value Share Analysis (2023 to 2033) By Type

Figure 116: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 117: East Asia Market Attractiveness By Type

Figure 118: East Asia Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 119: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 120: East Asia Market Attractiveness By Deployment Mode

Figure 121: East Asia Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 122: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 123: East Asia Market Attractiveness By Enterprise Size

Figure 124: East Asia Market Value Share Analysis (2023 to 2033) By Industry

Figure 125: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 126: East Asia Market Attractiveness By Industry

Figure 127: East Asia Market Value Share Analysis (2023 to 2033) by Country

Figure 128: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 129: East Asia Market Attractiveness by Country

Figure 130: China Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 131: Japan Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 132: South Korea Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 133: Middle East and Africa Market Value (US$ Million), 2018 to 2022

Figure 134: Middle East and Africa Market Value (US$ Million), 2023 to 2033

Figure 135: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Type

Figure 136: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 137: Middle East and Africa Market Attractiveness By Type

Figure 138: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 139: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 140: Middle East and Africa Market Attractiveness By Deployment Mode

Figure 141: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 142: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 143: Middle East and Africa Market Attractiveness By Enterprise Size

Figure 144: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Industry

Figure 145: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 146: Middle East and Africa Market Attractiveness By Industry

Figure 147: Middle East and Africa Market Value Share Analysis (2023 to 2033) by Country

Figure 148: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 149: Middle East and Africa Market Attractiveness by Country

Figure 150: GCC Countries Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 151: Turkey Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 152: South Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 153: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Partner Ecosystem Platform Software Market Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA