The parenteral packaging sector in the changing face of pharmaceuticals with regard to sterility, stability of the drug, and safety for patients through injectable drugs. This exploded the need for biologics, vaccines, and injectable drugs with increasing demand and then the demand for barrier materials, tamper-evident closures, and smart packaging technologies to ensure integrity. Recyclable and green packaging are increasingly motivated by regulatory adherence built into the requirements of its applicability to sustainability.

Investments are directed toward polymer and glass-based packaging and investment in state- of -the-art sterilization techniques and RFID-based tracking systems-designated improvements for delivering and protecting a drug and its supply chain. With the ever-increasing demand for biologics and personalized medicines, they are oriented towards prefillable syringes, two-chamber vials, and high-performance closures.

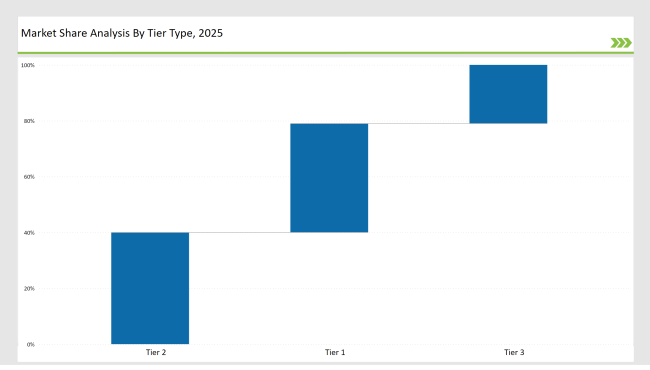

Tier 1 companies - Schott AG, Gerresheimer, and West Pharmaceutical Services - accounted for approximately 39% of the total market since those few companies dominate the pharmaceutical-grade packaging field and thus have established strong global distribution and parenteral drug delivery system initiatives.

Tier 2, such as Stevanato Group, SGD Pharma, and Becton Dickinson, secured 40% of the market with glass and polymer containers of superior quality, drug compatibility solutions, and highly advanced filling technologies.

Tier 3 consists of regional and niche players that are adept in customized parenteral packaging, eco-friendly materials, and specialty pharmaceutical solutions, making up 21% of the market. They emphasize localized manufacturing, innovative sterilization technologies, and specialty package formats.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Schott AG, Gerresheimer, West Pharmaceutical Services) | 20% |

| Rest of Top 5 (Stevanato Group, SGD Pharma) | 11% |

| Next 5 of Top 10 (Becton Dickinson, AptarGroup, Nipro Corporation, Berry Global, Catalent) | 8% |

The parenteral packaging industry serves multiple sectors where sterility, safety, and shelf-life extension are critical. Companies are developing advanced solutions to meet growing market demands.

Manufacturers are optimizing parenteral packaging with advanced sealing technologies, smart tracking, and sustainable materials.

Regulatory requirements and pharmaceutical innovation are transforming the parenteral packaging sector. Firms are adopting AI-based inspection, ultra-pure glass chemistry, and track-and-trace technologies to enhance safety and supply chain transparency. Enterprises are creating high-performance elastomer closures to maximize drug stability. Manufacturers are increasing polymer-based options to glass to minimize breakage and enhance sustainability. Furthermore, companies are adding smart labels with real-time temperature monitoring to guarantee proper storage conditions.

Technology suppliers should focus on automation, high-barrier materials, and anti-counterfeiting solutions to support the evolving parenteral packaging market. Partnering with pharmaceutical companies and biotech firms will drive adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Schott AG, Gerresheimer, West Pharmaceutical Services |

| Tier 2 | Stevanato Group, SGD Pharma, Becton Dickinson |

| Tier 3 | AptarGroup, Nipro Corporation, Berry Global, Catalent |

Leading manufacturers are advancing parenteral packaging technology with AI-driven inspection, tamper-evident closures, and sustainable materials.

| Manufacturer | Latest Developments |

|---|---|

| Schott AG | Launched ultra-pure glass vials for biologics in March 2024. |

| Gerresheimer | Developed lightweight polymer-based prefillable syringes in April 2024. |

| West Pharma | Expanded RFID-enabled tamper-evident closures in May 2024. |

| Stevanato Group | Released high-performance elastomer stoppers in June 2024. |

| SGD Pharma | Strengthened borosilicate glass vial production in July 2024. |

| Becton Dickinson | Introduced smart digital sensor-integrated packaging in August 2024. |

| AptarGroup | Pioneered single-dose parenteral packaging for specialty drugs in September 2024. |

The parenteral packaging market is evolving as companies invest in high-barrier materials, digital monitoring, and sustainability.

The sector will increasingly integrate AI-based quality control, RFID tracking, and sustainable materials. Ultra-pure glass will be fine-tuned by manufacturers for better drug compatibility. Companies will use polymer-based alternatives to make drugs safer and less prone to breakage. Companies will create anti-counterfeit smart labels for regulatory purposes. Digital monitoring will increase traceability of drugs in global supply chains. Companies will also optimize packaging design to achieve higher efficiency in automated pharmaceutical filling lines.

Leading players include Schott AG, Gerresheimer, West Pharmaceutical Services, Stevanato Group, SGD Pharma, Becton Dickinson, and AptarGroup.

The top 3 players collectively control 20% of the global market.

The market shows medium concentration, with top players holding 39%.

Key drivers include sterility, sustainability, smart packaging, and regulatory compliance.

Intelligent Packaging Market Growth & Industry Forecast 2025 to 2035

Kraft Packaging Market Trends - Growth & Forecast 2025 to 2035

Flexible Frozen Food Packaging Market Growth - Forecast 2025 to 2035

Flexible Thin Film Market Trends - Growth & Forecast 2025 to 2035

Hydrogel Market Demand & Technological Advances 2025-2035

Inflatable Bags Packaging Market from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.